by Calculated Risk on 9/15/2016 09:23:00 AM

Thursday, September 15, 2016

Fed: Industrial Production decreased 0.4% in August

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.4 percent in August after rising 0.6 percent in July. Manufacturing output also declined 0.4 percent in August, reversing its increase in July; the level of the index in August is little changed from its level in March. Following two consecutive monthly increases, the index for utilities fell back 1.4 percent in August. Even so, the index was 1.7 percent above its year-earlier level, as hot temperatures this summer boosted the usage of air conditioning. The output of mining moved up 1.0 percent in August, its fourth consecutive monthly increase following an extended downturn; the index, however, was still about 9 percent below its year-ago level. At 104.4 percent of its 2012 average, total industrial production in August was 1.1 percent lower than its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in August to 75.5 percent, a rate that is 4.5 percentage points below its long-run (1972–2015) average.

emphasis added

Click on graph for larger image.

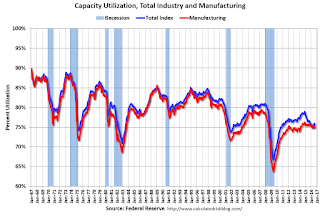

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 8.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.5% is 4.5% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.4% in August to 104.1. This is 19.4% above the recession low, and is at the pre-recession peak.

This was below expectations of a 0.2% decrease.

Retail Sales decreased 0.3% in August

by Calculated Risk on 9/15/2016 08:43:00 AM

On a monthly basis, retail sales decreased 0.3 percent from July to August (seasonally adjusted), and sales were up 1.9% from August 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for August, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $456.3 billion, a decrease of 0.3 percent from the previous month, and 1.9 percent above August 2015. ... The June 2016 to July 2016 percent change was revised from virtually unchanged to up 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.3% in August.

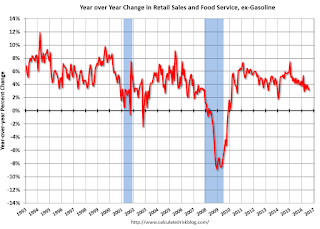

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.1% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.1% on a YoY basis.The decrease in August was below expectations of no change for the month.

Weekly Initial Unemployment Claims increased to 260,000

by Calculated Risk on 9/15/2016 08:33:00 AM

The DOL reported:

In the week ending September 10, the advance figure for seasonally adjusted initial claims was 260,000, an increase of 1,000 from the previous week's unrevised level of 259,000. The 4-week moving average was 260,750, a decrease of 500 from the previous week's unrevised average of 261,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 80 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 260,750.

This was lower than the consensus forecast of 265,000. The low level of claims suggests relatively few layoffs.

Wednesday, September 14, 2016

Thursday: Retail Sales, Industrial Production, Unemployment Claims and More

by Calculated Risk on 9/14/2016 06:45:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 259 thousand the previous week.

• Also at 8:30 AM, Retail sales for August will be released. The consensus is for no change in retail sales in August.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of -1.0, up from -4.2.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.7%.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.1% increase in inventories.

Review of FOMC Projections

by Calculated Risk on 9/14/2016 02:49:00 PM

Almost all analysts are expecting no change in Fed policy at the September FOMC meeting next week.

So the focus this month will probably be on the wording of the statement, any changes to the projections, and on the press conference.

Here are the June FOMC projections. Since the release of those projections, Q2 GDP was reported at a 1.1% annual rate, after increasing 0.8% in Q1.

Currently GDP is tracking around 3.3% annualized in Q3. It seems likely the FOMC will revise down GDP for 2016.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2016 | 2017 | 2018 | |

| Jun 2016 | 1.9 to 2.0 | 1.9 to 2.2 | 1.8 to 2.1 | |

| Mar 2016 | 2.1 to 2.3 | 2.0 to 2.3 | 1.8 to 2.1 | |

The unemployment rate was at 4.9% in August, so the unemployment rate projection for Q4 2016 will probably be mostly unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2016 | 2017 | 2018 | |

| Jun 2016 | 4.6 to 4.8 | 4.5 to 4.7 | 4.4 to 4.8 | |

| Mar 2016 | 4.6 to 4.8 | 4.5 to 4.7 | 4.5 to 5.0 | |

As of July, PCE inflation was up only 0.8% from July 2015.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2016 | 2017 | 2018 | |

| Jun 2016 | 1.3 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Mar 2016 | 1.0 to 1.6 | 1.7 to 2.0 | 1.9 to 2.0 | |

PCE core inflation was up 1.6% in July year-over-year.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2016 | 2017 | 2018 | |

| Jun 2016 | 1.6 to 1.8 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Mar 2016 | 1.4 to 1.7 | 1.7 to 2.0 | 1.9 to 2.0 | |

With the recent stabilization in oil prices, PCE inflation might pick up a little. But overall PCE core inflation is still below the FOMC target.

The FOMC will probably take no action at the meeting next week, and wait to see if employment gains continue - and inflation picks up.

Las Vegas: On Pace for Record Visitor Traffic and Convention Attendance in 2016

by Calculated Risk on 9/14/2016 10:07:00 AM

Another update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered to new record highs.

As of July, visitor traffic is running 1.7% above the record set in 2015 and on pace to be 10% above the pre-recession peak.

And convention attendance has returned too. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention attendance is up 14.4% from the same period in 2015, after being up 14.0% in 2015 compared to 2014.

At this pace, convention attendance will set a new record in 2016, and be close to 7% above the pre-recession peak set in 2006.

There were many housing related conventions during the housing bubble, so it has taken some time for convention attendance to recover. But attendance has really picked up over the last two years.

MBA: "Mortgage Applications Increase in Latest Weekly Survey"

by Calculated Risk on 9/14/2016 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 9, 2016. This week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index decreased 15 percent compared with the previous week and was 8 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.68 percent from 3.67 percent, with points increasing to 0.37 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

Based on the increase in mortgage rates over the last few days, I'd expect refinance activity to decline soon.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "8 percent higher than the same week one year ago".

Tuesday, September 13, 2016

Mortgage Rates "Pushing into Post-Brexit Highs"

by Calculated Risk on 9/13/2016 06:58:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still Pushing Into Post-Brexit Highs

Mortgage Rates were only slightly higher today, and in some cases were right in line with yesterday's. In fact, if you caught a lenders' rate sheet earlier this morning, chances are it was in better shape than yesterday. That stood to reason, considering bond markets (which drive mortgage rates) were also in slightly better shape to start. But bonds tanked in the afternoon (meaning prices fell, and yields rose), thus implying higher rates.Here is a table from Mortgage News Daily:

When bond markets move enough during the day, lenders often 'reprice' and send out updated rate sheets. That was indeed the case today, but the changes didn't leave us in significantly worse shape than yesterday. That's the positive way to look at it. The negative way is to observe that rates moved just a little bit more into the highest levels in more than 2 months (before Brexit).

During the best moments of the range over that time, conventional 30yr fixed rates on top tier scenarios have been as low as 3.25%. The most prevalent rate was 3.375%. While that's still available today for a few of the most aggressive lenders, you're more likely to see 3.5%-3.625%. Bottom line, the past few business days have solidified a shift higher of roughly an eighth of a percentage point.

emphasis added

House Prices to Median Household Income

by Calculated Risk on 9/13/2016 01:57:00 PM

The Census Bureau released the Income, Poverty and Health Insurance Coverage in the United States: 2015 this morning. The report showed a significant increase in the real median household income and a decline in poverty. For an overview, see from Nick Timiraos and Janet Adamy at the WSJ: U.S. Household Incomes Surged 5.2% in 2015, First Gain Since 2007 and from Jason Furman, Sandra Black, and Matt Fiedler at the CEA: Income, Poverty, and Health Insurance in the United States in 2015

One of the metrics to follow is a ratio of house prices to incomes. The following graphs use annual averages of house prices indexes - Case-Shiller and CoreLogic - and the nominal median household income (and the mean for the fourth fifth income) through 2015.

Note: Most reporting today is on the REAL median household income (adjusted for inflation over time). These graphs use nominal income since we are comparing to nominal house prices.

This graph shows the ratio of house price indexes divided by the Median Household Income through 2015 (the HPI is first multiplied by 1000).

This uses the annual average CoreLogic and the National Case-Shiller index since 1976.

As of 2015, house prices were above the median historical ratio - but far below the bubble peak.

The second graph is similar but uses the mean of the fourth fifth household income (if we separate households into fifths, this is the second highest income group).

Using this group, prices are well below the bubble peak.

Going forward, I think it would be a positive if incomes outpaced house prices, or at least kept pace with house prices increases for a few years.

NFIB: Small Business Optimism Index decreased Slightly in August

by Calculated Risk on 9/13/2016 10:07:00 AM

From the National Federation of Independent Business (NFIB): Political Climate as Negative Factor Hits Record High in Monthly NFIB Index of Small Business Optimism

The Index of Small Business Optimism declined two-tenths of a point in August to 94.4, with owners refusing to expand; expecting worse business conditions; and unable to fill open positions, according to the National Federation of Independent Business (NFIB).

Another major problem for small business owners is finding qualified workers to fill open positions. According to the survey, 15 percent said that finding qualified workers was their biggest problem. Thirty percent said they had job openings that they couldn’t fill. That’s the highest level since the recovery.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 94.4 in August.