by Calculated Risk on 9/13/2016 08:19:00 AM

Tuesday, September 13, 2016

Hilsenrath: Fed "Inclined to Stand Pat"

A few excerpts from an article by Jon Hilsenrath at the WSJ: Divided Federal Reserve Is Inclined to Stand Pat

Federal Reserve officials, lacking a strong consensus for action a week before their next policy meeting, are leaning toward waiting until late in the year before raising short-term interest rates.And from Goldman Sachs chief economist Jan Hatzius: Lack of a Clear Signal from the FOMC Lowers Odds of a September Hike

...

Officials release updated projections next week, and those could come down as officials coalesce around a view that rates will rise at an exceptionally gradual pace in the months ahead. Two rate increases in 2016 look especially unlikely.

At the same time, the Fed could present a more optimistic view about risks to the economic outlook. Early in the year, officials worried that a range of issues could derail growth and hiring. That included market turbulence tied to worries about China’s economy and to Britain’s decision to leave the European Union. Those worries have dissipated.

After flagging their worries for several months about risks to the economic outlook, officials could revert to calling these risks “balanced,” meaning the central bankers have become more open to raising rates later this year, as long as the economy doesn’t stumble in the weeks ahead.

A series of speeches by Fed officials concluded today with remarks by Governor Brainard. A common theme was the absence of a clear signal that the FOMC is likely to hike in September. The lack of a signal is meaningful because if action were likely, the committee would normally make an effort to nudge the market toward anticipating a hike.Goldman sees a 65% change of a rate hike by December.

Monday, September 12, 2016

Why Do Business Channels Ask former Executives about Economic Policy?

by Calculated Risk on 9/12/2016 08:46:00 PM

A short rant - I always find this irritating.

If I interviewed Jack Welch (former GE CEO), I'd ask about company finance, marketing, manufacturing, product development, hiring and training and more. That would be a wonderful learning experience.

But I wouldn't ask if he could solve a three dimensional differential equation in real time on TV!

However business channel talking heads always ask about the economy and economic policy. Welch would give a more coherent answer if you asked about 3-D differential equation than economics: he would probably just say "I don't know". That should be his answer to economic questions.

Today's example is former Home Depot CEO Bernie Marcus. I'd enjoy asking Mr. Marcus about subjects he knows - how he financed the growth of Home Depot, marketing, customer service, and hiring and training. That would be fascinating.

I wouldn't ask Mr. Marcus about differential equations or economic policy.

I think CNBC and Fox News are doing a disservice to their viewers and to the interviewee. They have business experts on their shows and then ask them about topics they know nothing about. Frustrating.

WTI Oil Prices Mostly Unchanged Year-over-year, Little Drag on Inflation

by Calculated Risk on 9/12/2016 04:22:00 PM

Fed Governor Lael Brainard mentioned oil prices earlier today:

The stabilization of the dollar and oil prices should lead inflation to move back toward our target in coming quarters.

Click on graph for larger image

Click on graph for larger imageThis graph shows the year-over-year change in WTI based on data from the EIA. Currently WTI is down about 1% year-over-year.

Five times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

WTI oil prices are mostly unchanged year-over-year.

The second graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI is at $46.05 per barrel today, and Brent is at $48.15.

According to Bloomberg, WTI is at $46.05 per barrel today, and Brent is at $48.15.Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Unless prices fall sharply again like happened at the end of 2015, oil (and gasoline prices) will be up year-over-year soon and no longer a drag on inflation.

Fed Governor Lael Brainard: "Asymmetry in risk ... counsels prudence in the removal of policy accommodation"

by Calculated Risk on 9/12/2016 01:19:00 PM

Live Stream for Speech by Fed Governor Lael Brainard: The Economic Outlook and Monetary Policy Implications

From Fed Governor Lael Brainard: The "New Normal" and What It Means for Monetary Policy

In today's new normal, the costs to the economy of greater-than-expected strength in demand are likely to be lower than the costs of significant unexpected weakness. In the case of unexpected strength, we have well-tried and tested tools and ample policy space in which to react. Moreover, because of Phillips curve flattening, the possibility of remaining labor market slack, the likely substantial response of the exchange rate and its depressing effect on inflation, the low neutral rate, and the fact that inflation expectations are well anchored to the upside, the response of inflation to unexpected strength in demand will likely be modest and gradual, requiring a correspondingly moderate policy response and implying relatively slight costs to the economy. In the face of an adverse shock, however, our conventional policy toolkit is more limited, and thus the risk of being unable to adequately respond to unexpected weakness is greater. The experience of the Japanese and euro-area economies suggest that prolonged weakness in demand is very difficult to correct, leading to economic costs that can be considerable.Those expecting Brainard to signal a rate increase were incorrect.

This asymmetry in risk management in today's new normal counsels prudence in the removal of policy accommodation. I believe this approach has served us well in recent months, helping to support continued gains in employment and progress on inflation. I look forward to assessing the evolution of the data in the months ahead for signs of further progress toward our goals, bearing in mind these considerations.

emphasis added

Update: U.S. Heavy Truck Sales Slump Continues

by Calculated Risk on 9/12/2016 08:56:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the August 2016 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 479 thousand SAAR in June 2015.

Heavy truck sales have since declined - probably mostly due to the weakness in the oil sector - and were at 331 thousand SAAR in August.

Even with the recent oil related decline, heavy truck sales are only about 10% below the average (and median) of the last 20 years.

Click on graph for larger image.

Sunday, September 11, 2016

Sunday Night Futures

by Calculated Risk on 9/11/2016 07:37:00 PM

Weekend:

• Schedule for Week of Sept 11, 2016

Monday:

• At 1:15 PM ET: Speech by Fed Governor Lael Brainard, The Economic Outlook and Monetary Policy Implications, At the Chicago Council on Global Affairs: Global Economic Series, Chicago, Illinois. Watch live here.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 7 and DOW futures are down 55 (fair value).

Oil prices were up over the last week with WTI futures at $45.37 per barrel and Brent at $47.60 per barrel. A year ago, WTI was at $45, and Brent was at $47 - so prices are mostly unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.17 per gallon (down almost $0.30 per gallon from a year ago).

Sacramento Housing in August: Sales up 8%, Active Inventory down 2% YoY

by Calculated Risk on 9/11/2016 09:07:00 AM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In August, total sales were up 8.4% from August 2015, and conventional equity sales were up 8.8% compared to the same month last year.

In August, 5.7% of all resales were distressed sales. This was up from 4.9% last month, and down from 7.8% in August 2015.

The percentage of REOs was at 3.0% in August, and the percentage of short sales was 2.7%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 1.8% year-over-year (YoY) in August. This was the sixteenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 13.8% of all sales (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Saturday, September 10, 2016

Schedule for Week of Sept 11, 2016

by Calculated Risk on 9/10/2016 08:09:00 AM

The key economic reports this week are August Retail Sales and the August Consumer Price Index (CPI).

For manufacturing, August industrial production, and the September New York Fed manufacturing surveys, will be released this week.

1:15 PM: Speech by Fed Governor Lael Brainard, The Economic Outlook and Monetary Policy Implications, At the Chicago Council on Global Affairs: Global Economic Series, Chicago, Illinois. Watch live here.

9:00 AM ET: NFIB Small Business Optimism Index for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 259 thousand the previous week.

8:30 AM ET: Retail sales for August will be released. The consensus is for no change in retail sales in August.

8:30 AM ET: Retail sales for August will be released. The consensus is for no change in retail sales in August.This graph shows retail sales since 1992 through July 2016.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of -1.0, up from -4.2.

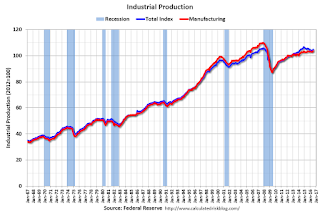

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.7%.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.1% increase in inventories.

8:30 AM: The Consumer Price Index for August from the BLS. The consensus is for 0.1% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 90.8, up from 89.8 in July.

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Friday, September 09, 2016

Leading Index for Commercial Real Estate shows gain in August

by Calculated Risk on 9/09/2016 07:18:00 PM

Note: This index is a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data & Analytics: Dodge Momentum Index Continues Ascent in August

The Dodge Momentum Index grew 1.3% in August to 134.9 (2000=100), from its revised July reading of 133.2. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The move higher in August was the result of a 1.7% increase from July for institutional planning as well as a 1.0% gain for commercial planning. August is the fifth consecutive month that the Momentum Index has increased, marking the longest such streak since the end of 2012 into 2013. The Momentum Index is currently 16% above the same month a year ago, reflecting this growth by major sector – institutional planning up 22% and commercial planning up 11%. That both sectors are showing such improvement suggests that developers are shrugging off sluggish economic data and the uncertainty surrounding the November elections, and moving ahead with plans for new projects.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 134.9 in August, up from 133.2 in July.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further increases in CRE spending over the next year.

When are people with Foreclosures and Short Sales eligible to borrow again?

by Calculated Risk on 9/09/2016 03:58:00 PM

CR Note: I'm asked this question frequently, so here is a repost ...

Some information from mortgage broker Solyent Green is People:

For people with foreclosures or short sales on their record, the waiting period depends on if there are "Extenuating Circumstances" EC ( death in family, company relocation/shut down - about 5/10% of cases) or if the foreclosure or short sale was due to "Financial Mismanagement" FM (the majority of cases).

Jumbo loans, Foreclosure: 7 years (FM and EC)

Jumbo loans, Short Sale: 7 years FM, only 4 years EC

Fannie/Freddie, Foreclosure: 7 years FM, 3 years EC

Fannie/Freddie, Short Sale: 4 years FM, 2 years EC

FHA Foreclosure/Short Sale: 3 years (FM and EC)

A large number of the foreclosures were in 2009 and 2010, so those people will be eligible to borrow soon.

CR Note: Even though people are eligible to borrow, doesn't mean they will. They will have to saved enough for a downpayment, and many of these people are psychological scarred (and will wait longer to buy again).