by Calculated Risk on 8/20/2016 08:15:00 AM

Saturday, August 20, 2016

Schedule for Week of Aug 21, 2016

The key economic reports this week are July New and Existing Home Sales.

Also the second estimate of Q2 GDP will be released.

Fed Chair Janet Yellen is scheduled to speak at the Jackson Hole annual economic symposium.

For manufacturing, the August Richmond and Kansas City manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

10:00 AM ET: New Home Sales for July from the Census Bureau.

10:00 AM ET: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the June sales rate.

The consensus is for an decrease in sales to 580 thousand Seasonally Adjusted Annual Rate (SAAR) in July from 592 thousand in June.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for June 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.3% month-to-month increase for this index.

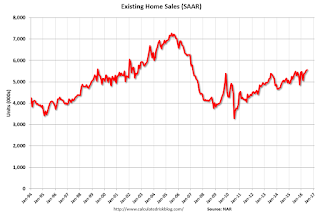

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.52 million SAAR, down from 5.57 million in June.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.52 million SAAR, down from 5.57 million in June.Housing economist Tom Lawler expects the NAR to report sales of 5.41 million SAAR in July, down 2.9% from June’s preliminary pace.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 262 thousand the previous week.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.7% increase in durable goods orders.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for August.

8:30 AM ET: Gross Domestic Product, 2nd quarter 2016 (Second estimate). The consensus is that real GDP increased 1.1% annualized in Q2, down from 1.2% in the advance estimate.

10:00 AM: University of Michigan's Consumer sentiment index (final for August). The consensus is for a reading of 90.5, up from the preliminary reading 90.4.

11:00 AM: Fed Chair Janet Yellen will speak at the annual economic symposium in Jackson Hole, Wyoming. The symposium topic is “Designing Resilient Monetary Policy Frameworks for the Future”.

Friday, August 19, 2016

2007: Tanta Changed the Blogging World

by Calculated Risk on 8/19/2016 04:11:00 PM

Note: I'm flying to Boston today to attend a wedding this weekend. There will be a few posts on Tanta today.

Every finance and economics blogger owes Tanta a debt of gratitude. Before Tanta wrote the following essay, newspapers would "borrow" ideas and subjects from bloggers, and never mention the source. In March 2007 - with a powerful essay - she changed the way the main street media treated bloggers.

In the week following publication of this piece, Tanta or myself were mentioned in just about every major newspaper in the US!

Sadly the media has trouble distinguishing between informed commentary and nonsense (like Zero Right) ... but at least bloggers now get mentioned.

From March 2007: Media Inquiries Policy

Calculated Risk is a hobby blog, created and maintained by a retired executive, with occasional assistance from a former bank officer and mortgage lending specialist who is currently on extended medical leave. Both of these people get endless questions, answers, hat tips, links, analysis, and overall inspiration from a very diverse group of commenters, regulars and occasional de-lurkers, all of whom are beloved except some of them.

CR regularly gets emails and comments from paid reporters who wish to know if CR or Tanta would like to be interviewed, or would simply like to answer one or several questions that the reporter has about economic or housing or mortgage issues. Because, so far, the answer has always been something on the order of “no,” we would like to explain to you why this is the case.

...

Dear reporters, we quote your stuff periodically, giving credit both to the reporter and the publication, under fair use terms. We have no objection to your returning the favor. If you have an editor who will not allow that, and you think that the problem can be solved by getting one of us to drop our online personas, give you our real names, and say the same thing to you over the phone, so that you can get your editor to accept it as something other than just blogging, which everybody knows is untrustworthy ranting by anonymous nuts, you are making a faulty assumption about the relationship among us, our birthdays, and yesterday. Neither CR nor Tanta wishes to play into a set of assumptions that render what we say on the blog as unworthy of coverage by the Big Media, but what we might say on the phone to Intrepid Reporter as good dirt and straight skinny.

From 2007 and 2008: The Compleat UberNerd

by Calculated Risk on 8/19/2016 11:15:00 AM

Note: I'm flying to Boston today to attend a wedding this weekend. There will be a few posts on Tanta today.

In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk.

From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices. In 2006, Tanta was diagnosed with late stage cancer, and she took an extended medical leave while undergoing treatment. While on medical leave she wrote for this blog, and her writings received widespread attention and acclaim.

If you want to understand the mortgage industry, read Tanta's posts (here is The Compleat UberNerd and a Compendium of Tanta's Posts).

As an example, here is a brief excerpt from Foreclosure Sales and REO For UberNerds

The following is not an exhaustive discussion of all of the issues involved in foreclosures and REO. It’s a start at unpacking some of the concepts and definitions. We have been seeing, and are going to continue to see, a lot of information presented on foreclosure sales, REO sales, and their impacts on existing home transaction volumes and prices in various market areas. As always with “UberNerd” posts, this is long and excruciating. Proceed with typical motivation as you may consider your own best interest in an open market in blog postings.And an excerpts from Mortgage Servicing for UberNerds

StillLearning asked in the comments about mortgage servicing, and since y’all are nerds, not dummies, here’s my highly-selective occasionally-oversimplified summary for you that skips the boring parts like how your check gets out of the “lockbox” and that stuff. We can discuss extra-credit issues like “excess servicing” and “subservicing” and “SFAS 144 meets MSR” and “negative convexity” and other kinds of inside baseball in the comments. There is a lot that can be said about loan servicing, but let’s start with the basics:Also see In Memoriam: Doris "Tanta" Dungey for photos, links to obituaries in the NY Times, Washington Post and much more.

Servicers have two major types of servicing portfolio: loans they service for themselves and loans they service for other investors. In accounting terms, the “compensation” is the same, meaning that even if you are the noteholder, you pay yourself to service the loans in the same way that an outside investor would pay you, and it shows on the books that way. The differences in compensation stem from the basic fact that one is generally more motivated to do a good job servicing (particularly collecting and efficiently liquidating REO) for one’s own investment than for someone else’s.

December 2006: Tanta joined CR!

by Calculated Risk on 8/19/2016 08:05:00 AM

Note: I'm flying to Boston today to attend a wedding this weekend. There will be a few posts on Tanta today.

In December 2006, my friend Doris "Tanta" Dungey started writing for Calculated Risk.

When some people say that here are few women bloggers in finance and economics, I remind them that Tanta was the best of all of us!

From December 2006, until she passed away from ovarian cancer on Nov 30, 2008, Tanta was my co-blogger. Tanta worked as a mortgage banker for 20 years, and we started chatting in early 2005 about the housing bubble and the changes in lending practices. In 2006, Tanta was diagnosed with late stage cancer, and she took an extended medical leave while undergoing treatment. While on medical leave she wrote for this blog, and her writings received widespread attention and acclaim.

Here are excerpts from her first two posts:

From December 2006: Let Slip the Dogs of Hell

I still haven’t gotten over the fact that there’s a “capital management” group out there having named itself “Cerberus”. Those of you who were not asleep in Miss Buttkicker’s Intro to Western Civ will recognize Cerberus; the rest of you may have picked up the mythological fix from its reprise as “Fluffy” in the first Harry Potter novel. Wherever you get your culture, Cerberus is the three-headed dog who guards the gates of Hell. It takes three heads to do that, of course, because it’s never clear, in theology or finance, whether the idea is to keep the righteous from falling into the pit or the demons from escaping out of it (the third head is busy meeting with the regulators). Cerberus is relevant not just because it supplies me with today’s metaphor, but because it was the Biggest Dog of three (including Citigroup and Aozora, a Japanese bank) who in April bought a 51% stake in GMAC’s mega-mortgage operation, GM having, of course, once been renowned as one of the Big Three Automakers until it became one of the Big Three Financing Outfits With A Sideline In Cars. I tried to find a link for you to Aozora Bank’s announcement of the purchase, but the only press release I could find for that day involved the loss of customer data. They must have been so busy letting GMAC into the underworld that the dog head keeping the deposit tickets from getting out got distracted.And from December 2006: On Hybrids, Teasers, and Other Mortgage Guidance Problems

...

Now, I’m just a Little Mortgage Weenie, not a Big Finance Dog, but bear with me while I ask some stupid questions. Like: how do the Big Dogs maintain “diverse and flexible production channels” (i.e., little mortgage banker Puppies to sell you correspondent business and little broker Puppies to sell you wholesale business) when “market share currently held by top-tier players” expands to two-thirds (meaning less diverse off-load strategies for the Little Puppies in the “production channels,” putting them at further pipeline/counterparty risk unless they become Bigger Puppies, which makes them competitors instead of “channels,”), while at the same time watching some of the Little Puppies (in whom the Big Dogs have a major equity stake) crawl under the porch to die? I know Citi doesn’t seem to have noticed that the “increased regulatory scrutiny” is not just of “products” but of “wholesale operational/management controls,” but I did.

First of all, a “hybrid ARM” is called a “hybrid” because it is, basically, a cross between a fixed rate and adjustable rate mortgage. Before the early 90s, an “ARM” basically meant a one-year ARM. The initial interest rate was set for one year, and the rate adjusted every year. The only real variations on this theme involved shortening the adjustment frequency: you could get an ARM that adjusted every six months instead of one year.CR Note: If you want to understand the mortgage industry, read Tanta's posts (here is The Compleat UberNerd and a Compendium of Tanta's Posts).

Around the early 90s, the “hybrid ARM” was introduced. It had an initial period in which the rate was “fixed” that didn’t match the subsequent adjustment frequency: this is the classic 3/1, 5/1, 7/1, and even 10/1 ARM. The whole idea of the hybrid ARM was to provide a kind of medium-range risk/reward tradeoff for borrowers and lenders.

Also see In Memoriam: Doris "Tanta" Dungey for photos, links to obituaries in the NY Times, Washington Post and much more.

Thursday, August 18, 2016

Friday: Travel Day

by Calculated Risk on 8/18/2016 09:36:00 PM

I'm off to Boston for the weekend and then to New York for a few days. Posting will be intermittent. Best wishes to all!

Here is an update on mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Lower

Mortgage Rates continued avoiding drama today, moving moderately lower as bond markets held on to gains that followed yesterday's Fed Minutes. As we discussed yesterday, the Fed didn't say anything earth-shattering, but some investors were prepared for more clues about rate hikes in the near term. When those clues didn't show up, rates were able to come back down just slightly.Here is a table from Mortgage News Daily:

Rates first improved in the secondary markets and Treasuries. When markets move in the afternoon--especially if that movement is just barely enough for a lender to consider changing rates--lenders will often wait until the following morning to make the adjustment. This was the case today as most lenders were in better territory right from the start. The improvement isn't enough to change actual interest rates, which remain in a range of 3.375-3.5% on conventional 30yr fixed quotes. But today's closing costs would be slightly lower compared to yesterday's.

emphasis added

LA area Port Traffic Mostly Unchanged in July

by Calculated Risk on 8/18/2016 02:43:00 PM

Special note: Now that the expansion to the Panama Canal has been completed, some of the traffic that used the ports of Los Angeles and Long Beach will eventually go through the canal. This could impact TEUs on the West Coast in the future.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was unchanged compared to the rolling 12 months ending in June. Outbound traffic was down 0.2% compared to 12 months ending in June.

The downturn in exports over the last year was probably due to the slowdown in China and the stronger dollar.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general exports are moving sideways and imports are gradually increasing.

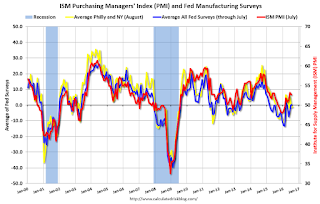

Earlier: Philly Fed Manufacturing Survey showed Weak Growth in August

by Calculated Risk on 8/18/2016 12:51:00 PM

From the Philly Fed: August 2016 Manufacturing Business Outlook Survey

Firms responding to the Manufacturing Business Outlook Survey suggest that growth was positive but tenuous this month. The diffusion index for current general activity moved from a negative reading to a marginally positive reading, while the indicators for new orders and employment suggested continued general weakness in business conditions.This was at the consensus forecast of a reading of 2.0 for August.

...

The index for current manufacturing activity in the region rose 5 points to only 2.0 in August ... The survey’s indicators of employment weakened considerably. The employment index fell 18 points to -20.0, which is its largest negative reading for the current year.

...

The survey’s index of future manufacturing activity rose 12 points to 45.8 in August, strongly indicating that the current weakness is expected to be temporary. This index is at its highest reading since January 2015

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through August. The ISM and total Fed surveys are through July.

The average of the Empire State and Philly Fed surveys was slightly negative again in August (yellow). This suggests the ISM survey will probably indicate sluggish expansion this month.

Zillow: Negative Equity Rate declined in Q2 2016

by Calculated Risk on 8/18/2016 09:53:00 AM

From Zillow: Q2 2016 Negative Equity Report: Why Cities and Suburbs are only Sometimes Impacted Similarly

According to the Q2 Zillow Negative Equity Report, the overall U.S. negative equity rate as of the end of Q2 2016 – the share of homeowners that were underwater, owing more to their lenders than their home was worth – was 12.1 percent. That’s down from 12.7 percent in the first quarter and 14.4 percent at the same time a year ago (figure 1). When examining the negative equity rate in urban and suburban areas, we found that 13.7 percent of homeowners in urban areas and 11.2 percent of homeowners in suburban communities were underwater at the end of Q2.The following graph from Zillow shows a time series for negative equity.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Despite steady improvement in the overall negative equity rate, pockets with relatively high shares of underwater homeowners remain, especially in the Midwest. Of the 35 largest metro areas covered by Zillow, the overall negative equity rate in Q2 was highest in Las Vegas (19.5 percent), Chicago (19 percent) and Baltimore (16.7 percent). Five of the 10 largest metros with the highest rates of negative equity are in the middle of the country (Chicago, Cleveland, Indianapolis, Kansas City, St. Louis). Meanwhile, the West Coast is home to the largest three metros with the lowest levels of negative equity (San Jose, San Francisco and Portland).

Weekly Initial Unemployment Claims decreased to 262,000

by Calculated Risk on 8/18/2016 08:33:00 AM

The DOL reported:

In the week ending August 13, the advance figure for seasonally adjusted initial claims was 262,000, a decrease of 4,000 from the previous week's unrevised level of 266,000. The 4-week moving average was 265,250, an increase of 2,500 from the previous week's unrevised average of 262,750.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 76 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 265,250.

This was close to the consensus forecast of 265,000. The low level of claims suggests relatively few layoffs.

Wednesday, August 17, 2016

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 8/17/2016 08:24:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, down from 266 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for August. The consensus is for a reading of 2.0, up from -2.9.

Something to think about on hotels from HotelNewsNow.com: California building boom leads to worries over supply

An extended period of strong hotel development has led to some supply concerns across California, but some markets are expected to remain strong as they enjoy favorable fundamentals and conditions that will keep supply growth to a minimum.

...

Flattening RevPAR growth “is coming at a time when a lot of product is coming online,” [Atlas President Alan Reay] said. “I won’t say we’re at the tipping point because some say we’re getting to where we should be because we didn’t do new construction for a few years.”

...

“There are pockets with a tremendous amount of supply coming in,” Reay said. “In downtown (Los Angeles) and north San Diego County, you definitely want to be cautious. If you’re not already out of the early planning stages, you need to be mindful of (new supply). And I think lenders will look at that more carefully.”