by Calculated Risk on 8/03/2016 12:45:00 PM

Wednesday, August 03, 2016

Q2 2016 GDP Details on Residential and Commercial Real Estate

The BEA has released the underlying details for the Q2 advance GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 7.9% annual pace in Q1. However most of the decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $62.4 billion annual rate in Q1 to a $50.2 billion annual rate in Q2 - and is down from $106 billion in Q2 2015 (declined more than 50%).

Excluding petroleum, non-residential investment in structures increased at a 5.5% annual rate in Q2.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q2, and is up 22% year-over-year -increasing from a very low level - and is now above the lows for previous recessions (as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down slightly year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q2, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 19% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for three years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $242 billion (SAAR) (about 1.3% of GDP), and was down in Q2 compared to Q1, but is up 7.3% year-over-year.

Investment in home improvement was at a $220 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.1% of GDP), and is up 9.0% year-over-year.

ISM Non-Manufacturing Index decreased to 55.5% in July

by Calculated Risk on 8/03/2016 10:05:00 AM

The July ISM Non-manufacturing index was at 55.5%, down from 56.5% in June. The employment index decreased in June to 51.4%, down from 52.7% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:July 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 78th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.5 percent in July, 1 percentage point lower than the June reading of 56.5 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 59.3 percent, 0.2 percentage point lower than the June reading of 59.5 percent, reflecting growth for the 84th consecutive month, at a slightly slower rate in July. The New Orders Index registered 60.3 percent, 0.4 percentage point higher than the reading of 59.9 percent in June. The Employment Index decreased 1.3 percentage points in July to 51.4 percent from the June reading of 52.7 percent. The Prices Index decreased 3.6 percentage points from the June reading of 55.5 percent to 51.9 percent, indicating prices increased in July for the fourth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in July. The majority of the respondents’ comments reflect stability and continued growth for their respective companies and a positive outlook on the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly below the consensus forecast of 56.0, and suggests slower expansion in July than in June.

ADP: Private Employment increased 179,000 in July

by Calculated Risk on 8/03/2016 08:20:00 AM

Private sector employment increased by 179,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 165,000 private sector jobs added in the ADP report.

...

Goods-producing employment was down by 6,000 jobs in July, following June losses of 28,000. The construction industry lost 6,000 jobs, following June losses of 4,000 jobs. Meanwhile, manufacturing gained 4,000 jobs after losing 15,000 the previous month.

Service-providing employment rose by 185,000 jobs in July, fewer than June’s 203,000 jobs. The ADP National Employment Report indicates that professional/business services contributed 59,000 jobs, down from June’s 78,000. Trade/transportation/utilities increased by 27,000 jobs in July, down from 41,000 jobs added the previous month. Financial activities added 11,000 jobs, following last month’s gain of 9,000 jobs.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong, but is moderating as the economy approaches full employment. Businesses are having a more difficult time filling open job positions, which are near record highs. The nation’s biggest economic problem will soon be the lack of available workers.”

The BLS report for July will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in July.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 8/03/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 29, 2016.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier to the lowest level since February 2016 while the seasonally adjusted Government Purchase Index fell to the lowest level since November 2015. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.67 percent from 3.69 percent, with points decreasing to 0.30 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

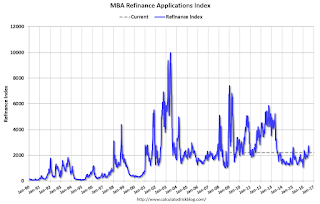

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "6 percent higher than the same week one year ago".

Tuesday, August 02, 2016

Wednesday: ADP Employment, ISM non-Mfg Index

by Calculated Risk on 8/02/2016 06:49:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 165,000 payroll jobs added in July, down from 172,000 added in June.

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for index to decrease to 56.0 from 56.5 in June.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Rise; Potential Volatility Ahead

Mortgage rates moved higher again today, after hitting the lowest levels in roughly 2 weeks last Friday. Like yesterday, today's increase was fairly minimal in the big picture, but successive days of weakness can add up. Unlike yesterday, most borrowers would now be seeing slightly higher costs on today's rate quotes compared to Friday's.Here is a table from Mortgage News Daily:

Here's the good news though: apart from the past 2 days, today's rates are the lowest in more than 2 weeks. After rising to a range of 3.5-3.625% last week, conventional 30yr fixed rates are now more likely to be quoted in a 3.375-3.5% range on top tier scenarios.

emphasis added

U.S. Light Vehicle Sales increase to 17.8 million annual rate in July

by Calculated Risk on 8/02/2016 04:11:00 PM

Based on a preliminary estimate from WardsAuto (ex-Jaguar and Porsche), light vehicle sales were at a 17.78 million SAAR in July.

That is up about 2% from July 2015, and up 6.5% from the 16.69 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 17.78 million SAAR from WardsAuto).

This was above the consensus forecast of 17.3 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales for 2016 - through the first seven months - are up almost 2% from the comparable period last year.

A solid month for auto sales.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/02/2016 01:00:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the CoreLogic (through June 2016) and NSA Case-Shiller National index since 1987 (through May 2016). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings are now declining.

The seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

CoreLogic: House Prices up 5.7% Year-over-year in June

by Calculated Risk on 8/02/2016 09:04:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 5.7 Percent Year Over Year in June 2016

Home prices nationwide, including distressed sales, increased year over year by 5.7 percent in June 2016 compared with June 2015 and increased month over month by 1.1 percent in June 2016 compared with May 2016, according to the CoreLogic HPI.

...

"Home prices continue to increase across the country, especially in the lower price ranges and in a number of metro areas," said Anand Nallathambi, President and CEO of CoreLogic. "We see prices continuing to increase at a healthy rate over the next year by as much as 5 percent.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in June (NSA), and is up 5.7% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The index is still 6.7% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years.

The year-over-year comparison has been positive for fifty three consecutive months.

Personal Income increased 0.2% in June, Spending increased 0.4%

by Calculated Risk on 8/02/2016 08:34:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income increased $29.3 billion (0.2 percent) in June according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $24.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $53.0 billion (0.4 percent).On inflation: The PCE price index increased 0.9 percent year-over-year partially due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.6 percent year-over-year in June (same as in May).

...

Real PCE increased 0.3 percent. ... The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

Monday, August 01, 2016

Tuesday: Personal Income & Outlays, July Auto Sales

by Calculated Risk on 8/01/2016 06:37:00 PM

Tuesday:

• At 8:30 AM ET: Personal Income and Outlays for June. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.3 million SAAR in July, from 16.6 million in June (Seasonally Adjusted Annual Rate).

From Jack Corgel at HotelNewsNow.com: Why oversupply won’t end the current cycle

A common question we hear at CBRE Hotels’ Americas Research is “When will the current up cycle end?” Some inquisitive types go so far as to ask, “How will it end?”Corgel argues there isn't overbuilding this time for several reasons (slow start to adding capacity, tighter lending standards, high construction costs, etc). I haven't thought about how this cycle will end (Hopefully not a major shock).

At the “end” of the past two up cycle phases, the peak rapidly dropped into a deep trough precipitated by tragic and disruptive shocks (i.e., 9/11, financial crisis) that made people hesitant to travel. In the absence of catastrophic events, hotel demand usually falls victim to the natural death of the up cycle. After all, as I have heard some exclaim, this current expansion phase has lasted more than 27 quarters—from Q3 2009 to Q2 2016—so it is likely that a recession is near given that certain past up cycles were either shorter—such as Q1 1975 to Q1 1980—or slightly longer than this recovery, like Q4 1982 to Q3 1990.

Another down cycle might occur as the result of overbuilding, spreading hotel demand thinly enough to cause financial distress and all the unpleasantness that goes along with it. But in this article, I provide three reasons why excessive supply growth is unlikely to produce financial distress in most hotel markets across the U.S. From my current vantage point, a Goldilocks supply scenario is likely to occur over the next few years in most cities: not too many and not too few hotel rooms will come on board.