by Calculated Risk on 7/13/2016 07:00:00 AM

Wednesday, July 13, 2016

MBA: "Mortgage Applications Increase in Latest Weekly Survey "

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 8, 2016. This week’s results included an adjustment for the Fourth of July holiday.

... The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index was unchanged from one week earlier. The unadjusted Purchase Index decreased 20 percent compared with the previous week and was 5 percent lower than the same week one year ago. Last year, the Fourth of July fell on the prior week.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since May 2013, 3.60 percent, from 3.66 percent, with points increasing to 0.36 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased a little this year since rates have declined.

If refinance mortgage rates fell a little further, we might see a significant pickup in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "5 percent higher than the same week one year ago", although "Last year, the Fourth of July fell on the prior week".

Tuesday, July 12, 2016

Wednesday: Beige Book

by Calculated Risk on 7/12/2016 07:17:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

From Matthew Graham at Mortgage News Daily: Long-Term Rate Lows Fighting For Survival

Mortgage rates are on the move, heading noticeably higher after a more subtle increase yesterday. With that, this week now stands as the first major push back against the impressive run to near-record lows that's taken place since the UK voted to leave the European Union in late June. Whereas lenders had increasingly been quoting 3.25% on top tier 30yr fixed scenarios, most have moved back up to 3.375%. Some of the more conservatively-priced crowd is even higher.Here is a table from Mortgage News Daily:

emphasis added

When are people with Foreclosures and Short Sales eligible to borrow again?

by Calculated Risk on 7/12/2016 12:22:00 PM

Some information from mortgage broker Solyent Green is People:

For people with foreclosures or short sales on their record, the waiting period depends on if there are "Extenuating Circumstances" EC ( death in family, company relocation/shut down - about 5/10% of cases) or if the foreclosure or short sale was due to "Financial Mismanagement" FM (the majority of cases).

Jumbo loans, Foreclosure: 7 years (FM and EC)

Jumbo loans, Short Sale: 7 years FM, only 4 years EC

Fannie/Freddie, Foreclosure: 7 years FM, 3 years EC

Fannie/Freddie, Short Sale: 4 years FM, 2 years EC

FHA Foreclosure/Short Sale: 3 years (FM and EC)

A large number of the foreclosures were in 2009 and 2010, so those people will be eligible to borrow soon.

CR Note: Even though people are eligible to borrow, doesn't mean they will. They will have to saved enough for a downpayment, and many of these people are psychological scarred (and will wait longer to buy again).

Interesting: Soylent Green is People also offered this comment on mortgage rates: "It's possible to get a 30 fixed purchase at 3.125%, but refinance 30 fixed are priced at 3.625% to stave off pipeline runoff. That averages to 3.375ish, giving borrowers the wrong idea that they can refi at these super low rates."

BLS: Job Openings decreased in May

by Calculated Risk on 7/12/2016 10:13:00 AM

Note: Error corrected in graph for quits (HT Nancy).

From the BLS: Job Openings and Labor Turnover Summary

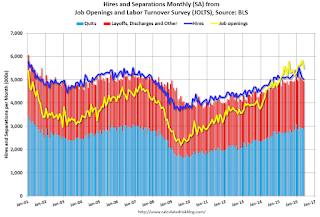

Job Openings decreased in May by 345,000 to 5.5 million. The prior 3-month average change in job openings was +80,000. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits was little changed in May at 2.9 million. The quits rate was 2.0 percent. Over the month, the number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in May to 5.500 million from 5.845 million in April.

The number of job openings (yellow) are up 2% year-over-year.

Quits are up 5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is decent report, although job openings are below the record high set in April 2016.

NFIB: Small Business Optimism Index increased Again in June

by Calculated Risk on 7/12/2016 07:41:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Sees Third Month of Modest Gains

The Index of Small Business Optimism rose seven-tenths of a point in June to 94.5 ... according to the National Federation of Independent Business’ (NFIB) monthly economic survey released today. ...

Fifty-six percent reported hiring or trying to hire (unchanged), but 48 percent reported few or no qualified applicants for the positions they were trying to fill. Fifteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem and the highest reading in this expansion. ... Twenty-nine percent of all owners reported job openings they could not fill in the current period, up 2 points, the highest reading in this expansion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 94.5 in June.

Monday, July 11, 2016

Tuesday: Job Openings

by Calculated Risk on 7/11/2016 07:46:00 PM

Tuesday:

• Early, NFIB Small Business Optimism Index for June.

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for May from the BLS.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for May. The consensus is for a 0.2% increase in inventories.

House Prices to National Average Wage Index

by Calculated Risk on 7/11/2016 01:17:00 PM

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there are always questions about which income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller and CoreLogic - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

For this graph I decided to look at house prices and the National Average Wage Index from Social Security.

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index is first divided by 1000).

This uses the annual average CoreLogic and the National Case-Shiller index since 1976.

As of 2015, house prices were somewhat above the median historical ratio - but far below the bubble peak. Prices have increased further in 2016, but house prices relative to incomes are still below the 1989 peak.

Going forward, I think it would be a positive if wages outpaced, or at least kept pace with house prices increases for a few years.

Notes: The national wage index for 2015 is estimated using the same increase as in 2014.

Phoenix Real Estate in June: Sales up 9%, Inventory up 7% YoY

by Calculated Risk on 7/11/2016 10:45:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up 6.5% year-over-year in June. This is the fourth consecutive months with a YoY increase in inventory, following fifteen consecutive months of YoY declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in June were up 8.6% year-over-year.

2) Cash Sales (frequently investors) were down to 20.9% of total sales.

3) Active inventory is now up 6.5% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

Now inventory is increasing a little again, and - if this trend continues in Phoenix - price increases will probably slow.

| June Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| June 2008 | 5,748 | --- | 1,093 | 19.0% | 53,8262 | --- |

| June 2009 | 9,325 | 62.2% | 3,443 | 36.9% | 38,358 | ---2 |

| June 2010 | 9,278 | -0.5% | 3,498 | 37.7% | 41,869 | 9.2% |

| June 2011 | 11,134 | 20.0% | 5,001 | 44.9% | 29,203 | -30.3% |

| June 2012 | 9,133 | -18.0% | 4,272 | 46.8% | 19,857 | -32.0% |

| June 2013 | 8,150 | -10.8% | 3,055 | 37.5% | 19,541 | -1.6% |

| June 2014 | 7,239 | -11.2% | 1,854 | 25.6% | 27,954 | 43.1% |

| June 2015 | 8,273 | 20.5% | 2,005 | 23.0% | 23,377 | -16.4% |

| June 2016 | 8,986 | 8.6% | 1,875 | 20.9% | 24,898 | 6.5% |

| 1 June 2008 does not include manufactured homes, ~100 more 2 June 2008 Inventory includes pending | ||||||

Black Knight: "425,000 Borrowers Out from Underwater on Mortgages" in Q1

by Calculated Risk on 7/11/2016 08:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for May today. According to BKFS, 4.25% of mortgages were delinquent in May, down from 4.91% in May 2015. BKFS also reported that 1.13% of mortgages were in the foreclosure process, down from 1.59% a year ago.

This gives a total of 5.38% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Tappable Equity Rose by $260 Billion in Q1 2016, 425,000 Borrowers Out from Underwater on Mortgages

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of May 2016. This month, the Mortgage Monitor leveraged data from the Black Knight Home Price Index to revisit the U.S. equity landscape in light of 48 consecutive months of annual home price appreciation (HPA). As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, the impact can be observed in terms of both levels of tappable equity available to borrowers as well as the continuing reduction in the number of borrowers who owe more than their homes are worth.

“As we approach the 10-year anniversary of the pre-crisis peak in U.S. housing prices, we’re just under 3 percent off that June 2006 peak nationally, and 23 states have already passed their 2006 peaks,” said Graboske. “The result is that equity levels are rising nationwide for the most part. In Q1 2016, 425,000 borrowers who had been underwater on their mortgages regained equity, bringing the national negative equity rate down to just 5.6 percent. That’s a far cry from the nearly 29 percent of borrowers who were underwater at the end of 2012, but still about five times as many as in 2004. The first quarter also saw tappable equity grow by $260 billion – a six percent increase in just the first three months of the year. There are now 38 million borrowers who have at least 20 percent equity in their homes, with an average of $116,000 in tappable equity per borrower. It seems borrowers are still being prudent when it comes to drawing upon that equity, though. Just $20 billion in equity was tapped via cash-out refinances in Q1 2016 -- roughly one-half of one percent of total available equity. Even so, cash-outs still accounted for some 42 percent of all refinance activity in Q1 2016.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This from Black Knight shows the number, and percent of borrowers, with negative equity since 2005.

From Black Knight:

• Home prices rose by two percent in Q1 2016, helping 425K borrowers to regain equity; 2.8 million borrowers remain underwater, nearly 5x as many as in 2004There is much more in the mortgage monitor.

• The national negative equity rate now stands at 5.6 percent, a 13 percent decrease from last year and down from a high of nearly 29 percent of all borrowers at the end of 2010

• Nevada has the highest negative equity rate at 12 percent, followed by Missouri and Rhode Island at 11 percent each, while Colorado and Texas have the lowest negative equity rates in the country at less than one percent

• Based on research published in the February 2016 Mortgage Monitor MM, at the current rate of recovery, negative equity will return to 2005 levels (~750K borrowers) in late 2018, though it will take over two years longer for the low end of markets across the country to recover than high end homes

Sunday, July 10, 2016

Sunday Night Futures

by Calculated Risk on 7/10/2016 09:54:00 PM

Weekend:

• Schedule for Week of July 10, 2016

• More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $45.01 per barrel and Brent at $46.41 per barrel. A year ago, WTI was at $53, and Brent was at $58 - so prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.23 per gallon (down about $0.50 per gallon from a year ago).