by Calculated Risk on 7/06/2016 02:31:00 PM

Wednesday, July 06, 2016

FOMC Minutes: Concerns about slowing Labor Market, Brexit

From the Fed: Minutes of the Federal Open Market Committee, June 14-15, 2016. Excerpts:

Almost all participants judged that the surprisingly weak May employment report increased their uncertainty about the outlook for the labor market. Even so, many remarked that they were reluctant to change their outlook materially based on one economic data release. Participants generally expected to see a resumption of monthly gains in payroll employment that would be sufficient to promote continued strengthening of the labor market. However, some noted that with labor market conditions at or near those consistent with maximum employment, it would be reasonable to anticipate that gains in payroll employment would soon moderate from the pace seen over the past few years.

...

Global financial conditions had improved since earlier in the year, and recent data on net exports suggested that the drag on domestic economic activity from the external sector had abated somewhat. Still, participants generally agreed that global economic and financial developments should continue to be monitored closely. Some participants indicated that prospects for economic activity in many foreign economies appeared to be subdued, that global inflation and interest rates remained very low by historical standards, and that recurring bouts of global financial market instability remained a risk. Most participants noted that the upcoming British referendum on membership in the European Union could generate financial market turbulence that could adversely affect domestic economic performance. Some also noted that continued uncertainty regarding the outlook for China's foreign exchange policy and the relatively high levels of debt in China and some other EMEs represented appreciable risks to global financial stability and economic performance.

In light of participants' updates to their economic projections, they discussed their current assessments of the appropriate trajectory of monetary policy over the medium term. Most still expected that the appropriate target range for the federal funds rate associated with their projections of further progress toward the Committee's statutory objectives would rise gradually in coming years. However, some noted that their forecasts were now consistent with a shallower path than they had expected at the time of the March meeting. Many participants commented that the level of the federal funds rate consistent with maintaining trend economic growth--the so-called neutral rate--appeared to be lower currently or was likely to be lower in the longer run than they had estimated earlier. While recognizing that the longer-run neutral rate was highly uncertain, many judged that it would likely remain low relative to historical standards, held down by factors such as slow productivity growth and demographic trends. Several noted that in the prevailing circumstances of considerable uncertainty about the neutral federal funds rate, the Committee could better gauge the effects of increases in the federal funds rate on the economy if it proceeded gradually in adjusting policy.

emphasis added

Reis: Apartment Vacancy Rate unchanged in Q2 at 4.5%

by Calculated Risk on 7/06/2016 01:01:00 PM

Reis reported that the apartment vacancy rate was at 4.5% in Q2 2016 to 4.5%, unchanged from Q1, and up from 4.2% in Q2 2015. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.2% in 2014 and early 2015.

A few comments from Reis Senior Economist and Director of Research Ryan Severino:

The national vacancy rate was unchanged at 4.5% during the second quarter. However, this was merely due to rounding as demand simply cannot keep pace with the volume of new construction hitting the market. Given the trend over time for increased construction volume and limited demand, vacancy should increase steadily over time. This increase in vacancy is heavily concentrated in the newer properties that are coming online which are having a more difficult time securing tenants, either from the pool of new renters or from the pool of renters in other buildings. The vacancy rate for newly completed properties has been increasing dramatically over the last 12 to 18 months. This is a far cry from just a couple of years ago when the majority of new properties were arriving on the market stabilized or fully occupied.

...

Asking and effective rents both grew by 0.9% during the second quarter. This is a rebound from the significant pullback that occurred in quarterly growth rates during the first quarter, though that was likely due to seasonal effects. However, the rising vacancy rate is clearly taking the wind out of landlords' sails, especially for the new completed properties. Concessions are slowly creeping back into the market and newly completed properties are struggling to hit pro forma rents. As vacancy continues to inch higher, it will put continued downward pressure on rent growth.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. Now that completions are catching up with starts, the vacancy rate has started to increase.

This suggests rent growth - and multi-family starts - will slow.

Apartment vacancy data courtesy of Reis.

ISM Non-Manufacturing Index increased to 56.5% in June

by Calculated Risk on 7/06/2016 10:05:00 AM

The June ISM Non-manufacturing index was at 56.5%, up from 52.9% in May. The employment index increased in June to 52.7%, up from 49.7% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:June 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 77th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.5 percent in June, 3.6 percentage points higher than the May reading of 52.9 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 59.5 percent, 4.4 percentage points higher than the May reading of 55.1 percent, reflecting growth for the 83rd consecutive month, at a faster rate in June. The New Orders Index registered 59.9 percent, 5.7 percentage points higher than the reading of 54.2 percent in May. The Employment Index grew 3 percentage points in June after one month of contraction to 52.7 percent from the May reading of 49.7 percent. The Prices Index decreased 0.1 percentage point from the May reading of 55.6 percent to 55.5 percent, indicating prices increased in June for the third consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in June. Respondents’ comments are mostly positive about business conditions and the economy. Overall, the report reflects a strong rebound from the 'cooling-off' of the previous month for the non-manufacturing sector."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.3, and suggests faster expansion in June than in May.

Trade Deficit at $41.1 Billion in May

by Calculated Risk on 7/06/2016 08:41:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.1 billion in May, up $3.8 billion from $37.4 billion in April, revised. May exports were $182.4 billion, $0.3 billion less than April exports. May imports were $223.5 billion, $3.4 billion more than April imports.The trade deficit was larger than the consensus forecast of $40.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through May 2016.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in May.

Exports are 10% above the pre-recession peak and down 4% compared to May 2015; imports are 4% below the pre-recession peak, and down 3% compared to May 2015.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $34.19 in May, up from $29.48 in April, and down from $50.76 in May 2015. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined a little since early 2012.

The trade deficit with China decreased to $29.0 billion in May, from $30.3 billion in May 2015. The deficit with China is a substantial portion of the overall deficit.

MBA: "Mortgage Applications Surge in Latest Weekly Survey"

by Calculated Risk on 7/06/2016 07:00:00 AM

From the MBA: Mortgage Applications Surge in Latest MBA Weekly Survey

Mortgage applications increased 14.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 1, 2016.

... The Refinance Index increased 21 percent from the previous week to the highest level since January 2015. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 23 percent higher than the same week one year ago.

“Interest rates continued to drop last week as markets assessed the impact of Brexit, downgrading the likelihood of additional rate hikes by the Fed, and mortgage rates for 30-year conforming loans dropped to their lowest level in over 3 years,” said Mike Fratantoni, MBA’s Chief Economist. “In response, refinance application volume jumped almost 21 percent last week to its highest level since January 2015.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since May 2013, 3.66 percent, from 3.75 percent, with points decreasing to 0.32 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased a little this year since rates have declined.

With rates falling again this week (below the MBA reported rates for the week ending July 1st), there will probably be a further increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "23 percent higher than the same week one year ago".

Tuesday, July 05, 2016

Mortgage Rates at Record Lows

by Calculated Risk on 7/05/2016 07:07:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Early, Reis Q2 2016 Apartment Survey of rents and vacancy rates.

• At 8:30 AM,Trade Balance report for May from the Census Bureau. The consensus is for the U.S. trade deficit to be at $40.0 billion in May from $37.4 billion in April.

• At 10:00 AM, the ISM non-Manufacturing Index for June. The consensus is for index to increase to 53.3 from 52.9 in May.

• At 2:00 PM, FOMC Minutes for the Meeting of June 14-15, 2016

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back to 3.25% in Some Cases

Mortgage rates dropped noticeably today, bringing quite a few lenders down to 3.25% in terms of conventional 30yr fixed quotes on top tier scenarios. For all intents and purposes, these rates are "all-time lows," even though there were several occasions in late 2012 where some lenders offered lower rates. It just depends on what sort of time-frame you want to put on the previous instances of all-time lows. If we're talking about rates that were available for a few days here and there, then we're not quite back to those yet. If we're talking about the lowest stably-held rate for most top-tier quotes, we're back!Here is a table from Mortgage News Daily:

emphasis added

7

The Verizon Strike and the June Employment Report

by Calculated Risk on 7/05/2016 02:53:00 PM

A large number of Verizon workers went on strike on April 13th, and returned to work on June 1st.

What will be the impact on the June employment report?

These workers were on strike during the reference period in May and were not be counted as employed in May. Since the strike is over, they will be counted as employed in the June 2016 report.

According to the BLS report on Strikes occurring during CES survey reference period, 35,100 Verizon workers were on strike in May.

The BLS reported a loss of 37,200 thousand workers in May in the Information Super Sector under the Telecommunications Industry.

If the employment report shows a gain of 35,000 to 37,000 telecommunications workers (SA), then it will be reasonable to subtract those from the headline employment number to look at the underlying trend.

As an example, if the BLS reports 160,000 jobs added in June, and 35,000 telecommunication jobs gained in June, the underlying trend would be 125,000.

Reis: Office Vacancy Rate declined in Q2 to 16.0%

by Calculated Risk on 7/05/2016 11:36:00 AM

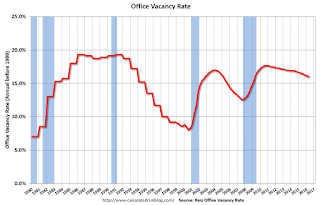

Reis released their Q2 2016 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.0% in Q2, from 16.1% in Q1. This is down from 16.5% in Q2 2015, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

For the eighth consecutive quarter, the national vacancy rate declined, falling by 10 basis points to 16.0%. As anticipated, the improvements in the space market are ongoing, but are very slight on a quarter-to-quarter basis. ...

Both asking and effective rents grew by 0.6% during the second quarter, the twenty-second consecutive quarter of asking and effective rent growth. These figures represent a modest decline versus the first quarter when asking and effective rents grew by 0.9% and 1.0% respectively. The 12-month changes for asking and effective rent growth both also slowed slightly versus the figures from the first quarter. Rent growth during the second quarter was likely hampered by the relatively weak demand and somewhat poor performance from the labor market.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.0% in Q2.

Office vacancy data courtesy of Reis.

CoreLogic: House Prices up 5.9% Year-over-year in May

by Calculated Risk on 7/05/2016 09:14:00 AM

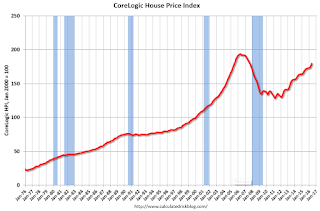

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 5.9 Percent Year Over Year in May 2016

Home prices nationwide, including distressed sales, increased year over year by 5.9 percent in May 2016 compared with May 2015 and increased month over month by 1.3 percent in May 2016 compared with April 2016, according to the CoreLogic HPI.

...

“Housing remained an oasis of stability in May with home prices rising year over year between 5 percent and 6 percent for 22 consecutive months,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The consistently solid growth in home prices has been driven by the highest resale activity in nine years and a still-tight housing inventory.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.3% in May (NSA), and is up 5.9% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The index is still 7.2% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last year.

The year-over-year comparison has been positive for fifty two consecutive months.

Monday, July 04, 2016

Ouch: Open-ended UK Property Fund suspends trading

by Calculated Risk on 7/04/2016 07:59:00 PM

From FT Alphaville: If you voted for Brexit and like open-ended UK property funds, we have some bad news

From Standard Life Investments as it suspends trading in its £2.9bn UK real estate fund (one of the UK’s largest) because of post-referendum redemption requests:Weekend:

Updating with actual press release:

STANDARD LIFE INVESTMENTS UK REAL ESTATE FUND

Due to exceptional market circumstances, Standard Life Investments has taken the decision to suspend all trading in the Standard Life Investments UK Real Estate Fund (and its associated Feeder Funds) from 12:00 noon on 4July 2016.

The decision was taken following an increase in redemption requests as a result of uncertainty for the UK commercial real estate market following the EU referendum result. ....

• Schedule for Week of July 3, 2016

• Q2 Review: Ten Economic Questions for 2016

Tuesday:

• Early, Reis Q2 2016 Office Survey of rents and vacancy rates.

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is a 1.0% decrease in orders.

Oil prices were up over the last week with WTI futures at $48.65 per barrel and Brent at $50.10 per barrel. A year ago, WTI was at $57, and Brent was at $59 - so prices are down 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.26 per gallon (down about $0.50 per gallon from a year ago).