by Calculated Risk on 6/28/2016 04:23:00 PM

Tuesday, June 28, 2016

Fannie Mae: Mortgage Serious Delinquency rate declined in May

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in May to 1.38%, down from 1.40% in April. The serious delinquency rate is down from 1.70% in May 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This is the lowest rate since June 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.32 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2017.

.

Earlier from Richmond Fed: Manufacturing Activity Declined in June

by Calculated Risk on 6/28/2016 02:51:00 PM

Earlier from the Richmond Fed: Manufacturing Sector Activity Declined; New Orders Decreased, Firms Continued to Increase Wages

Fifth District manufacturing activity weakened in June, according to the most recent survey by the Federal Reserve Bank of Richmond. New orders and shipments declined this month, while backlogs decreased further compared to last month. Manufacturing employment softened, while firms continued to increase wages.This was the last of the regional Fed surveys for June.

...

Overall, manufacturing conditions weakened in June. The composite index for manufacturing dropped to a reading of −7. ...

Manufacturing hiring softened in June. The index leveled off to a reading of −1, compared to last month's reading of 4. The average workweek index dropped 10 points this month to end −4. Average wage growth remained on pace with last month; that index slipped only one point to end at a reading of 14.

emphasis added

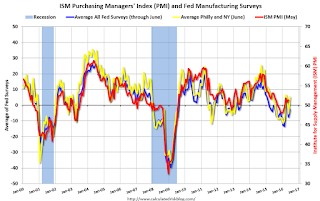

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

It seems likely the ISM manufacturing index will show expansion in June. The consensus is for the ISM to be at 51.5, up from 51.3 in May.

Real Prices and Price-to-Rent Ratio in April

by Calculated Risk on 6/28/2016 11:58:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.0% year-over-year in April

The year-over-year increase in prices is mostly moving sideways now around 5%. In April, the index was up 5.0% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 3.0% below the bubble peak. However, in real terms, the National index is still about 17.1% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to November 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to June 2005.

Real House Prices

In real terms, the National index is back to January 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to November 2003.

In real terms, house prices are back to late 2003 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to June 2003 levels, and the CoreLogic index is back to April 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.0% year-over-year in April

by Calculated Risk on 6/28/2016 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for April ("April" is a 3 month average of February, March and April prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Continue Gains in April According to the S&P/Case-Shiller Home Price Indices

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, reported a 5.0% annual gain in April, down from 5.1% the previous month. The 10-City Composite posted a 4.7% annual increase, down from 4.8% in March. The 20-City Composite reported a yearover-year gain of 5.4%, down from 5.5% from the prior month.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 1.0% in April. The 10-City Composite recorded a 1.0% month-over-month increase, while the 20-City Composite posted a 1.1% increase in April. After seasonal adjustment, the National Index recorded a 0.1% month-overmonth increase, the 10-City Composite posted a 0.3% increase, and the 20-City Composite reported a 0.5% month-over-month increase. After seasonal adjustment, 15 cities saw prices rise, two cities were unchanged, and three cities experienced negative monthly prices changes.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.6% from the peak, and up 0.3% in April (SA).

The Composite 20 index is off 9.0% from the peak, and up 0.5% (SA) in April.

The National index is off 3.0% from the peak, and up 0.1% (SA) in April. The National index is up 31.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to April 2015.

The Composite 20 SA is up 5.4% year-over-year..

The National index SA is up 5.0% year-over-year.

Note: According to the data, prices increased in 16 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Q1 GDP Revised Up to 1.1% Annual Rate

by Calculated Risk on 6/28/2016 08:35:00 AM

From the BEA: Gross Domestic Product: First Quarter 2016 (Third Estimate)

Real gross domestic product -- the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 1.1 percent in the first quarter of 2016, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2015, real GDP increased 1.4 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised down from 1.9% to 1.5%. Residential investment was revised down from 17.1% to 15.6%. This was close to the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 0.8 percent. With the third estimate for the first quarter, the general picture of economic growth remains the same; exports increased more than previously estimated ...

emphasis added

Monday, June 27, 2016

Tuesday: GDP, Case-Shiller House Prices

by Calculated Risk on 6/27/2016 05:42:00 PM

NOTE: Fed Chair Yellen was scheduled to participate in a "Policy Panel" at the ECB Forum on Central Banking in Portugal on Wednesday. She has cancelled. Mark Carney, Governor of the Bank of England and Chairman of the G20's Financial Stability Board, has also cancelled.

Tuesday:

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2016 (Third estimate). The consensus is that real GDP increased 1.0% annualized in Q1, revised up from a 0.8% increase.

• At 9:00 AM, S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices. The consensus is for a 5.5% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 5.1% year-over-year in April.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for June. This is the last of the regional Fed surveys for June.

From Tim Duy: Fed Once Again Overtaken By Events

With global financial markets reeling in the wake of Brexit - Britain's unforced error as a political gamble went too far - the Fed is back on the sidelines. A July hike was already out of the question before Brexit, while September was never more than tenuous, depending on the data falling in place just right. Now September has moved from tenuous to "what are you thinking?" ...

...

Bottom Line. The Fed will stand down for the moment; where they go down the road depends upon the depth and length of current disruption. I think at this point it goes without saying that if you hear a Fed speaker talking about July being on the table or confidently warning about two or three rate hikes this year, you should ignore them. Perhaps we can have that conversation later with regards to the December meeting, but certainly not now. ...

ATA Trucking Index increased in May

by Calculated Risk on 6/27/2016 03:35:00 PM

From the ATA: ATA Truck Tonnage Index Increased 2.7% in May

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.7% in May, following a revised 1.7% drop during April. In May, the index equaled 139 (2000=100), up from 135.3 in April. The all-time high was 144 in February.

Compared with May 2015, the SA index jumped 5.7%, which was up from April’s 2.4% year-over-year gain.

...

“Following two consecutive decreases totaling 6 percent, May was a nice increase in truck tonnage,” said ATA Chief Economist Bob Costello. “Better consumer spending in April and May certainly helped, but economic growth remains mixed and I’d expect the recent choppy pattern in tonnage to continue for the next quarter or two.

“We recently received good news on the inventory cycle, with the total business inventory-to-sales ratio declining for the first time in nearly a year. While one month doesn’t make a trend, this was good news for the trucking industry,” he said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 5.7% year-over-year.

U.S. Demographics: Ten most common ages in 2010, 2015, 2020, and 2030

by Calculated Risk on 6/27/2016 01:34:00 PM

The Census Bureau has released the population estimates for 2015.

Using that data, on Sunday I posted a table ranking the largest 5-year cohorts in 2010, 2015, 2020, and 2030: Largest 5-year Population Cohorts are now "20 to 24" and "25 to 29"

Using the same data, Jed Kolko tweeted the ten most common ages in the U.S. (seven of ten are in the twenties).

Here is a table showing the ten most common ages in 2010, 2015, 2020, and 2030 (projections are from the Census Bureau).

Note the younger baby boom generation dominated in 2010. By 2015 the millennials are taking over. And by 2020, the boomers are off the list.

My view is this is positive for both housing and the economy, especially in the 2020s.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2015 | 2020 | 2030 | |

| 1 | 50 | 25 | 29 | 39 |

| 2 | 49 | 26 | 30 | 40 |

| 3 | 20 | 24 | 28 | 38 |

| 4 | 19 | 23 | 27 | 37 |

| 5 | 47 | 27 | 31 | 36 |

| 6 | 46 | 56 | 26 | 35 |

| 7 | 48 | 55 | 32 | 41 |

| 8 | 51 | 22 | 25 | 30 |

| 9 | 18 | 52 | 35 | 34 |

| 10 | 52 | 28 | 34 | 33 |

Dallas Fed: Regional Manufacturing Activity declined again in June

by Calculated Risk on 6/27/2016 10:36:00 AM

From the Dallas Fed: Texas Manufacturing Activity Declines Again

Texas factory activity declined again in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, posted a second consecutive negative reading but rose from -13.1 to -7.0, suggesting the pace of contraction eased somewhat from May.Still grim in the Dallas region. The impact of lower oil prices is still impacting manufacturing.

Other measures of current manufacturing activity also reflected continued declines this month. The new orders index held steady at -14.2, while the growth rate of orders index fell four points to -18.6. The capacity utilization and shipments indexes remained negative for a second month but edged up, coming in at -9.3 and -8.6, respectively.

Perceptions of broader business conditions stayed pessimistic in June. The general business activity index has been negative since January 2015 and came in at -18.3 this month, up slightly from its May reading.

Labor market measures indicated a sixth month of contraction in a row in June. The employment index fell to -11.5, its lowest reading since November 2009. The decline in the index was largely due to a falloff in the share of firms adding to headcounts....

emphasis added

Black Knight: House Price Index up 1.0% in April, Up 5.4% year-over-year

by Calculated Risk on 6/27/2016 08:01:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: April Transactions -- U.S. Home Prices Up 1.0 Percent for the Month; Up 5.4 Percent Year-Over-Year

• U.S. home prices were up 1.0 percent for the month, and have gained 5.4 percent from one year agoThe year-over-year increase in the index has been about the same for the last year.

• At $260K, the U.S. HPI is up over 30 percent from the market’s bottom and is now just 2.9 percent off its June 2006 peak

• 14 of the nation's 40 largest metropolitan areas hit new peaks in April:

◦Austin, TX ($299K)

◦Boston, MA ($419K)

◦Charlotte, NC ($207K)

◦Dallas, TX ($230K)

◦Denver, CO ($351K)

◦Houston, TX ($225K)

◦Kansas City, MO ($180K)

◦Nashville, TN ($231K)

◦Pittsburgh, PA ($190K)

◦Portland, OR ($346K)

◦San Antonio, TX ($200K)

◦San Francisco, CA ($765K)

◦San Jose, CA ($921K)

◦Seattle, WA ($401K)