by Calculated Risk on 6/15/2016 07:01:00 AM

Wednesday, June 15, 2016

MBA: "Mortgage Applications Decrease in Latest MBA Weekly Survey"

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 10, 2016. The previous week’s results included an adjustment for the Memorial Day holiday.

...

The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index increased 17 percent compared with the previous week and was 16 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since January 2015, 3.79 percent, from 3.83 percent, with points decreasing to 0.32 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity increased a little this year since rates have declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "16 percent higher than the same week one year ago".

Tuesday, June 14, 2016

Wednesday: FOMC Statement, Industrial Production, PPI, Empire State Mfg

by Calculated Risk on 6/14/2016 08:21:00 PM

From Tim Duy at Bloomberg: Not June, Not Likely July, More Likely September

The best-laid plans can come undone by the tiniest of things.Wednesday:

In this case a slip in the data—a low print on nonfarm payrolls that may prove no more than a statistical bump—put a June interest rate hike out of reach for the Federal Reserve and probably a July one as well. That leaves September in focus as the next chance for the U.S. central bank to tighten policy—if the data hold.

...

The FOMC statement will be followed by a press conference. There Yellen will steer a middle ground between optimism and pessimism. Keeping a July hike in play will be her primary objective. With even her believing the economy is near full employment, the Fed will not yet give up on the story that an economic bounce in the second quarter will be sufficient to justify a rate hike in July.

Bottom Line: The optimistic tale spun by Yellen tells us that the Fed is ready and willing to hike rates. But that pesky little detail of a consistent data narrative to justify such a move continues to elude policymakers. The lack of supportive data has stripped them of a chance to hike rates in June, and also leaves July as an unlikely candidate. Turn your eyes to September.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for May from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

• Also at 8:30 AM, the New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -3.5, up from -9.0.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.1% decrease in Industrial Production, and for Capacity Utilization to decrease to 75.2%.

• At 2:00 PM, FOMC Meeting Announcement. No change to the Fed Funds rate is expected at this meeting.

• Also at 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Off Topic: #NothingCanBeDone

by Calculated Risk on 6/14/2016 06:20:00 PM

Last year I wrote a post bemoaning the defeatist attitude of so many policymakers Defeatists Policies #NothingCanBeDone

The main topic was economics, but I also mentioned guns ...

And we also hear "nothing can be done" about the ongoing mass shooting in the U.S., even though most Americans support stricter background checks, longer waiting periods, and restricting certain types of weapons. Reagan supported gun control, but not this Congress. Something can be done - and will be done eventually. Hopefully "Before some ol' fool come around here, Wanna shoot either you or me".Something can be done. And it SHOULD be done today.

U.S. Population Distribution by Age, 1900 through 2060

by Calculated Risk on 6/14/2016 12:23:00 PM

By request, here is a repeat of animations of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Note: For distribution, here are the same graphs using a slider (the user can look at individual slides).

There are many interesting points - the Depression baby bust, the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40. Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

The first graph is by distribution (updates every 2 seconds).

The second graph is by age. Population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

NFIB: Small Business Optimism Index increased in May

by Calculated Risk on 6/14/2016 10:15:00 AM

Earlier from the National Federation of Independent Business (NFIB): Small Business Optimism Rises Modestly in May

The Index of Small Business Optimism rose two tenths of a point in May to 93.8 ... according to the National Federation of Independent Business’ (NFIB) monthly economic survey released today. ...

Fifty-six percent reported hiring or trying to hire (up 3 points), but 48 percent reported few or no qualified applicants for the positions they were trying to fill. Hiring activity increased substantially, but apparently the “failure rate” also rose as more owners found it hard to identify qualified applicants. ... Twenty-seven percent of all owners reported job openings they could not fill in the current period, down 2 points, but historically strong.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 93.8 in May.

Retail Sales increased 0.5% in May

by Calculated Risk on 6/14/2016 08:38:00 AM

On a monthly basis, retail sales were up 0.5% from April to May (seasonally adjusted), and sales were up 2.5% from May 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for May, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $455.6 billion, an increase of 0.5 percent from the previous month, and 2.5 percent above May 2015. ... The March 2016 to April 2016 percent change was unrevised at up 1.3 percent (±0.2%).

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.3%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.6% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.6% on a YoY basis.The increase in May was above expectations for the month, and retail sales for March and April were revised up. A solid report.

Monday, June 13, 2016

Tuesday: Retail Sales, Small Business Survey

by Calculated Risk on 6/13/2016 10:53:00 PM

Tuesday:

• At 8:30 AM ET, Retail sales for May will be released. The consensus is for retail sales to increase 0.3% in May.

• At 9:00 AM ET,NFIB Small Business Optimism Index for May.

• At 10:00 AM ET, Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.2% increase in inventories.

From Matthew Graham at Mortgage News Daily: Yep, Mortgage Rates Are Still Super Low!

Mortgage rates haven't moved too much recently, and no one is complaining. While each of the past 5 days has only seen a modest drop in rates, they were already operating near 3-year lows. They officially hit new 3-year lows late last week, meaning today's modest improvement only takes us deeper into that territory.

...

It gets better. Three-year lows also happen to be pretty close to all-time lows. In terms of the average conventional 30yr fixed rate on a top tier scenario, we're talking about the difference between 3.5% today and 3.25% in late 2012. Those all-time lows were only available for a few weeks back then, and it was 3.375% that was the most commonly-quoted rate "all-time low" from there on out. So that's an eighth of a point between now and then--roughly $12/month on a $200k loan.

emphasis added

Update: Real Estate Agent Boom and Bust

by Calculated Risk on 6/13/2016 01:42:00 PM

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

The graph shows the number of real estate licensees in California.

The number of agents peaked at the end of 2007 (housing activity peaked in 2005, and prices in 2006).

The number of salesperson's licenses is off 31.9% from the peak, and is starting to increase again (up 2.6% from low). The number of salesperson's licenses has fallen to May 2004 levels.

Brokers' licenses are off 11.8% from the peak and have only fallen to April 2006 levels, but are still slowly declining (down 1% year-over-year).

It appears we are starting to see a pickup in Real Estate licensees in California, although the number of Brokers is still declining.

Will the Rebound in Oil Prices Rescue the Houston Housing Market?

by Calculated Risk on 6/13/2016 10:56:00 AM

I don't have an answer right now, but I'll be watching inventory for clues.

The Houston Association of Realtors (HAR) hasn't released data for May yet.

However, in April, active listing were up 17% year-over-year compared to April 2015. The current level isn't unusually high for the Houston market (inventory was over 50,000 in 2010), but inventory has increased significantly since oil prices started falling.

This graph shows the number of active listings in Houston since January 2013.

Note: inventory in late 2014 was at historic lows in Houston - it is the trend that is concerning, not the current level.

If inventory stops increasing (year-over-year), then the housing market will probably be OK (and the rebound in oil prices would be a factor).

Right now it is too early to tell.

Sacramento Housing in May: Sales up 3.5%, Active Inventory down 18% YoY

by Calculated Risk on 6/13/2016 08:11:00 AM

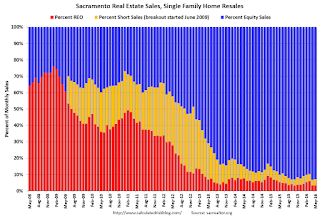

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In May, total sales were up 3.5% from May 2015, and conventional equity sales were up 4.9% compared to the same month last year.

In May, 7.0% of all resales were distressed sales. This was up from 6.5% last month, and down from 9.7% in May 2015.

The percentage of REOs was at 3.3% in May, and the percentage of short sales was 3.7%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 17.8% year-over-year (YoY) in May. This was the thirteenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 14.7% of all sales (frequently investors).

Summary: This data suggests a more normal market with fewer distressed sales, more equity sales, and less investor buying - but limited inventory.