by Calculated Risk on 5/12/2016 06:51:00 PM

Thursday, May 12, 2016

Off-Topic: A Comment on Litmus Test Moments

Some off-topic rambling ...

A few times in life there are public moments (and private ones too) that really make a difference. As example, for economic forecasters, calling the housing bubble and bust is now a litmus test.

Some people, like Larry Kudlow, failed the test. See Kudlow's June 2005 article: Why the Housing Bears Are Wrong Again

[A]ll the bubbleheads who expect housing-price crashes in Las Vegas or Naples, Florida, to bring down the consumer, the rest of the economy, and the entire stock market [have been dead wrong].I was on the other side (apparently a "bubblehead" according to Kudlow), see my post in 2005: Housing: Speculation is the Key and many other housing related posts in 2005 and 2006. Note: For bonus points, I also called the bottom for house prices. Of course there are also the people who called the bubble, but have been wrong on just about everything else. Oh well.

None of this has happened.

Another litmus test was whether someone supported the Iraq war (especially now among Democrats). Most people are busy with their lives, and rely on the media to vet the arguments for war. But politicians and the media should have been paying close attention (I opposed the Iraq war, and was shouted down and called names like "Saddam lover" for questioning the veracity of the information).

Now we know most of the media failed the American public in 2002 and early 2003, with some exceptions like Walter Pincus at the Washington Post. Ms. Clinton has been criticized for supporting the Iraq invasion, as did Donald Trump (he claims otherwise now - but that claim is false). Opposing the invasion helped President Obama in 2008 - it was a litmus test for many voters.

I believe we are seeing a Litmus Test moment right now, especially for Republicans. I believe, in a few years, whether someone supported Trump or not will make a difference in how people are perceived. This will make or break some political careers.

For the most part, I avoid politics on this blog (although I do analyze some policies). But I think this is one of those key moments, so for the record: I am still a registered Republican, and #ImWithHer

Friday:

• At 8:30 AM ET, Retail sales for April will be released. The consensus is for retail sales to increase 0.9% in April.

• At 8:30 AM, the Producer Price Index for April from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.2% increase in inventories.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 89.7, up from 89.0 in April.

MBA: "Foreclosures Continue to Decrease, Delinquencies Flat" in Q1

by Calculated Risk on 5/12/2016 02:14:00 PM

From the MBA: Foreclosures Continue to Decrease, Delinquencies Flat

The delinquency rate for mortgage loans on one-to-four-unit residential properties remained unchanged from the previous quarter at a seasonally adjusted rate of 4.77 percent of all loans outstanding at the end of the first quarter of 2016. This was the lowest level since the third quarter of 2006. The delinquency rate was 77 basis points lower than one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the first quarter was 0.35 percent, a decrease of one basis point from the previous quarter, and down 10 basis points from one year ago. This foreclosure starts rate was at the lowest level since the second quarter of 2000.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 1.74 percent, down three basis points from the previous quarter and 48 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the third quarter of 2007.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 3.29 percent, a decrease of 15 basis points from previous quarter, and a decrease of 95 basis points from last year. This was the lowest serious delinquency rate since the third quarter of 2007.

Marina Walsh, MBA’s Vice President of Industry Analysis, offered the following commentary on the survey:

"The delinquency rate of 4.77 percent has returned to typical pre-recession levels and is lower than the historical average of 5.4 percent for the time period from 1979 to the first quarter of 2016.emphasis added

"The rate at which new foreclosures were initiated in the first quarter was 0.35 percent, the lowest in 16 years, and 10 basis points below the historical average of 0.45 percent. A total of 28 states and Washington, DC either saw decreases or no change in the foreclosure starts rate this quarter, while the remaining 22 states experienced increases in the foreclosure starts rate. Only two of these 22 states have strictly non-judicial processes in place.

"Continuing a consistent downward trend that began in the second quarter of 2012, the foreclosure inventory rate fell again in the first quarter of 2016 to 1.74 percent, a decrease of three basis points from the previous quarter. Of the 50 states and Washington, DC, 44 states either had no change or saw declines in the foreclosure inventory rate.

"While the overall foreclosure inventory rate for the first quarter was considerably lower than the peak of 4.64 percent at the worst of the crisis, it was still above the average of 1.5 percent for the time period between 1979 and the first quarter of 2016. The good news is that foreclosure inventory rates continued to decline in both judicial and non-judicial states this quarter. However, about two-thirds of the twenty states with foreclosure inventory rates above the national average were judicial states."

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent ticked up a little in Q1, but is still below the normal historical level.

The 90 day bucket declined further in Q1, but remains a little elevated.

The percent of loans in the foreclosure process continues to decline, and is still above the historical average.

The 90 day bucket and foreclosure inventory are still elevated, but should be close to normal at the end of 2016 or in early 2017. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

Hotels: Occupancy Rate Tracking just behind Record Year

by Calculated Risk on 5/12/2016 10:40:00 AM

First on hotel profits from HotelNewsNow.com: STR: US hotel profit margin surpasses 2007 peak

Total industrywide house profit reached almost US$73 billion, a year-over-year increase of 9.4% on a per-available-room basis. On an absolute nominal basis, the house profit represents an all-time high, and the house profit margin for 2015 exceeds the previous industry peak reached in 2007.And on occupancy from HotelNewsNow.com: STR: US hotel results for week ending 7 May

...

In real terms, the industry’s total revenue in 2015 surpassed the levels realized at the previous peak of 2007, but remained below the peak in 2000. Similarly, the house profit realized in 2015 was the second-best profit level since 1990, behind only the peak of US$15,248 per-available-room in 2000.

he U.S. hotel industry recorded mixed results in the three key performance metrics during the week of 1-7 May 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should mostly move sideways for the next couple of months, and then increase further during the Summer travel period.

In year-over-year comparisons, the industry’s occupancy decreased 1.6% to 65.8%. However, average daily rate for the week was up 2.1% to US$123.43, and revenue per available room increased 0.4% to US$81.19.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims increase to 294,000

by Calculated Risk on 5/12/2016 08:34:00 AM

The DOL reported:

In the week ending May 7, the advance figure for seasonally adjusted initial claims was 294,000, an increase of 20,000 from the previous week's unrevised level of 274,000. This is the highest level for initial claims since February 28, 2015 when it was 310,000. The 4-week moving average was 268,250, an increase of 10,250 from the previous week's unrevised average of 258,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 62 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 268,250.

This was above the consensus forecast and is the highest level for weekly claims since February 2015. The low level of claims suggests relatively few layoffs.

Wednesday, May 11, 2016

Two Years Ago: Housing Doom and Gloom

by Calculated Risk on 5/11/2016 05:49:00 PM

Two years ago, there were numerous "doom and gloom" stories about housing. I responded with What's Right with Housing? written on May 6, 2014. I wrote:

The first mistake these writers make is they are asking the wrong question. Of course housing is lagging the recovery because of the residual effects of the housing bust and financial crisis (this lag was predicted on this blog and elsewhere for years - it should not be a surprise).What has happened since?

The correct question is: What's right with housing? And there is plenty.

...

Housing is a slow moving market - and the recovery will not be smooth or fast with all the residual problems. But overall housing is clearly improving and the outlook remains positive for the next few years.

Housing starts are up 13% from March 2014 to March 2016.

New home sales are up 25% over the two years.

Existing home sales are up 13%.

House prices are up 9.7% (Case-Shiller National Index February 2014 to February 2016).

Some day I'll be bearish again on housing. But not in 2014 - and not now.

Q1 2016 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 5/11/2016 01:58:00 PM

The BEA has released the underlying details for the Q1 advance GDP report.

In April the BEA reported that investment in non-residential structures decreased at a 10.7% annual pace in Q1.

The decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $64.6 billion annual rate in Q4 to a $38.7 billion annual rate in Q1. "Mining exploration, shafts, and wells" investment is down 68% year-over-year.

OUCH!

Excluding petroleum, non-residential investment in structures increased at a 10.2% annual rate in Q1. That is solid growth.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q1, and is up 28% year-over-year -increasing from a very low level - and is now above the lows for previous recessions (as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is unchanged year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q1, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 32% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for the three years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $234 billion (SAAR) (about 1.3% of GDP), and is up 10.4% year-over-year.

Investment in home improvement was at a $195 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.1% of GDP), and is up 11.8% year-over-year.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 5/11/2016 10:32:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices are now up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through April 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up about 8% from a year ago, and CME futures are up about 20% year-over-year.

MBA: "Mortgage Applications Slightly Increase in Latest MBA Weekly Survey"

by Calculated Risk on 5/11/2016 07:00:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 6, 2016.

...

The Refinance Index increased 0.5 percent from the previous week. The seasonally adjusted Purchase Index increased 0.4 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 14 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.85 percent from 3.83 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity increased a little this year when rates declined.

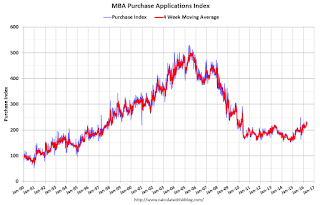

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 14% higher than a year ago.

Tuesday, May 10, 2016

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 5/10/2016 01:44:00 PM

Yesterday I posted a graph of the unemployment rate by level of education.

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

With the help of Tim Duy, Economics Professor at the University of Oregon, and Josh Lehner, at the Oregon Office of Economic Analysis, here is some data on the U.S. labor force by educational attainment since 1992.

Currently, approximately 53 million people in the U.S. labor force have a Bachelor's degree or higher. This is 39% of the labor force, up from 26% in 1992.

This is the only category trending up. "Some college" has been steady, and "high school" and "less than high school" have been trending down.

Based on currently trends, probably more than half the labor force will have at least a bachelor's degree within two decades.

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, this might push down the overall unemployment rate over time.

Also, I'd guess there will be less labor turnover, and fewer weekly claims (just a guess).

More education is one of the reasons I'm optimistic about the future (see: The Future's So Bright ...)

BLS: Jobs Openings increased in March

by Calculated Risk on 5/10/2016 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

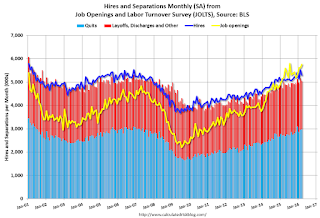

The number of job openings was little changed at 5.8 million on the last business day of March, the U.S. Bureau of Labor Statistics reported today. Hires edged down to 5.3 million while separations were little changed at 5.0 million. Within separations, the quits rate was 2.1 percent, and the layoffs and discharges rate was 1.2 percent....The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits was little changed in March at 3.0 million.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in March to 5.757 million from 5.608 million in February.

The number of job openings (yellow) are up 11% year-over-year compared to March 2015.

Quits are up 9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another strong report, and job openings are just below the record high set in July 2015.