by Calculated Risk on 4/14/2016 01:44:00 PM

Thursday, April 14, 2016

LA area Port Traffic Decreased Sharply YoY in March due to Labor Slowdown last Year

Note: There were some large swings in LA area port traffic early last year due to labor issues that were settled in late February 2015. Port traffic slowed in January and February last year, and then surged in March 2015 as the waiting ships were unloaded (the trade deficit increased in March too). This has impacted the YoY changes for the first few months of 2016.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 3.1% compared to the rolling 12 months ending in February. Outbound traffic was up 0.4% compared to 12 months ending in February.

The downturn in exports over the last year was probably due to the slowdown in China and the stronger dollar.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down sharply year-over-year in March, but last year imports surged after the labor issues were resolved. So the year-over-year data was negatively impacted.

Key Measures Show Inflation close to 2% in March

by Calculated Risk on 4/14/2016 11:14:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in March. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.5% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for March here. Motor fuel was up 29% annualized in March following several months of large declines.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.1% annualized rate) in March. The CPI less food and energy rose 0.1% (0.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy also rose 2.2%. Core PCE is for February and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.0% annualized, trimmed-mean CPI was at 1.5% annualized, and core CPI was at 0.8% annualized.

On a year-over-year basis, three of these measures are at or above 2%.

Using these measures, inflation has been moving up, and most are close to the Fed's target (Core PCE is still below).

Weekly Initial Unemployment Claims decrease to 253,000

by Calculated Risk on 4/14/2016 08:34:00 AM

The DOL reported:

In the week ending April 9, the advance figure for seasonally adjusted initial claims was 253,000, a decrease of 13,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 267,000 to 266,000. The 4-week moving average was 265,000, a decrease of 1,500 from the previous week's revised average. The previous week's average was revised down by 250 from 266,750 to 266,500.The previous week was revised down to 266,000.

There were no special factors impacting this week's initial claims. This marks 58 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

Note: The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 265,000.

This was well below the consensus forecast of 270,000. The low level of the 4-week average suggests few layoffs.

Wednesday, April 13, 2016

Thursday: CPI, Unemployment Claims

by Calculated Risk on 4/13/2016 06:55:00 PM

In the CPI report tomorrow, one thing I'll be checking is CPI-W.

CPI-W is the index that is used to calculate Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

Since the highest Q3 average was in 2014 (Q3 2014), at 234.242, we will have to compare to 2014, not Q3 2015, to see if there will be an adjustment this next year (the Cost-Of-Living Adjustment was unchanged in 2015).

So far, through February, CPI-W is down slightly year-over-year. With rising oil and gasoline prices, there might be an increase this year (it is really early).

Thursday:

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

• Also at 8:30 AM, the Consumer Price Index for March from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

Fed's Beige Book: Economic activity expanded in the "modest to moderate range" in most Districts

by Calculated Risk on 4/13/2016 02:04:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Chicago and based on information collected on or before April 7, 2016."

Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand in late February and March, though the pace of growth varied across Districts. Most Districts said that economic growth was in the modest to moderate range and that contacts expected growth would remain in that range going forward. Consumer spending increased modestly in most Districts and reports on tourism were mostly positive. Labor market conditions continued to strengthen and business spending generally expanded across most Districts. Demand for nonfinancial services grew moderately overall. Manufacturing activity increased in most Districts. Construction and real estate activity also expanded. Credit conditions improved, on net, in most Districts. Low prices weighed on energy and mining output as well as prospects for agricultural producers. Overall, prices increased modestly across the majority of Districts, and input cost pressures continued to ease.And on real estate:

Construction and real estate activity generally expanded in late February and March, and contacts across Districts maintained a positive outlook for the rest of the year. Residential real estate activity strengthened, on balance, with robust growth in San Francisco, Cleveland, and Boston, but more mixed reports from Dallas, Kansas City, and Atlanta. Several Districts credited a mild winter for stronger home sales, and the pace of home price increases picked up in a number of Districts. Multi-family construction remained strong in most Districts. Chicago, Cleveland, and St. Louis also noted some improvement in demand for single-family home construction, and a contact in San Francisco reported backlogs of more than six months for new single-family units. Commercial real estate activity generally increased, with leasing activity and rents rising in many Districts: particularly strong leasing was noted in retailing in Chicago and in the industrial sector in Dallas. Vacancy rates either moved lower or were unchanged in most Districts. Most Districts reporting on nonresidential construction said that demand increased. Contacts in Boston said the education, health care, hospitality, retail, and office sectors all contributed to its recent construction boom. Nonresidential contractors in Cleveland cited broad-based demand, with particular strength in education and healthcare projects, where several builders expressed concern about their capacity to take on additional projects. In contrast, Chicago noted continued weak demand for industrial construction, and Philadelphia reported fewer starts of new nonresidential projects.Decent Real Estate growth in most districts ...

emphasis added

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 4/13/2016 12:07:00 PM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices have just turn up year-over-year for the first time since late 2014.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through February 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up about 1% from a year ago, and CME futures are up about 7% year-over-year.

Retail Sales decreased 0.3% in March

by Calculated Risk on 4/13/2016 08:42:00 AM

On a monthly basis, retail sales were down 0.3% from February to March (seasonally adjusted), and sales were up 1.7% from March 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for March, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $446.9 billion, a decrease of 0.3 percent from the previous month, and 1.7 percent above March 2015. ... The January 2016 to February 2016 percent change was revised from down 0.1 percent to virtually unchanged.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.4% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.4% on a YoY basis.The decrease in March was below expectations for the month, however retail sales for January and February were revised up.

MBA: "Mortgage Apps Jump 10% in Latest MBA Weekly Survey"

by Calculated Risk on 4/13/2016 07:00:00 AM

From the MBA: Mortgage Apps Jump 10% in Latest MBA Weekly Survey

Mortgage applications increased 10 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 8, 2016.

...

The Refinance Index increased 11 percent from the previous week to its highest level since February 2016. The seasonally adjusted Purchase Index increased 8 percent from one week earlier its highest level since October 2015. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 24 percent higher than the same week one year ago.

emphasis added

Click on graph for larger image.

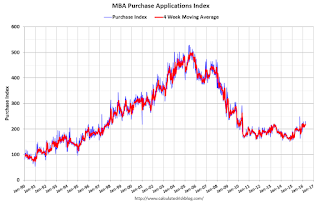

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity is picking again with lower rates.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 24% higher than a year ago.

Tuesday, April 12, 2016

Wednesday: Retail Sales, PPI, Beige Book

by Calculated Risk on 4/12/2016 06:01:00 PM

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for March will be released. The consensus is for retail sales to increase 0.1% in March. On a monthly basis, retail sales were down 0.1% from January to February (seasonally adjusted), and sales were up 3.1% from February 2015.

• Also at 8:30 AM, the Producer Price Index for March from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.1% decrease in inventories.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Treasury: Budget Deficit increased in Fiscal 2016 to Date compared to Fiscal 2015

by Calculated Risk on 4/12/2016 02:08:00 PM

The Treasury released the March Monthly Treasury Statement today. For fiscal year 2016 through March, the deficit was $461 billion compared to $439 billion for the same period in fiscal 2015 (the fiscal year ends in September).

In March, the Congressional Budget Office (CBO) released their new Updated Budget Projections: 2016 to 2026. The projected budget deficits were revised up recently.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

My guess is the actual deficit will be smaller in ficsal 2016 than the current CBO projection of 2.9% of GDP.

The decline in the deficit, as a percent of GDP, from almost 10% to 2.5% in 2015 was the fastest decline in the deficit since the demobilization following WWII (not shown on graph).

Note: In the year 2000 there were some projections that showed the entire debt could be paid off by now! But then along came some significant tax cuts, the Iraq war, two recessions, and other policy mistakes. Just a reminder that policy does matter.

The deficit is projected to remain stable for the next few years, before starting to slowly increase again.