by Calculated Risk on 4/13/2016 12:07:00 PM

Wednesday, April 13, 2016

Update: Framing Lumber Prices Up Year-over-year

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices have just turn up year-over-year for the first time since late 2014.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through February 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up about 1% from a year ago, and CME futures are up about 7% year-over-year.

Retail Sales decreased 0.3% in March

by Calculated Risk on 4/13/2016 08:42:00 AM

On a monthly basis, retail sales were down 0.3% from February to March (seasonally adjusted), and sales were up 1.7% from March 2015.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for March, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $446.9 billion, a decrease of 0.3 percent from the previous month, and 1.7 percent above March 2015. ... The January 2016 to February 2016 percent change was revised from down 0.1 percent to virtually unchanged.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.4% on a YoY basis.

Retail and Food service sales ex-gasoline increased by 3.4% on a YoY basis.The decrease in March was below expectations for the month, however retail sales for January and February were revised up.

MBA: "Mortgage Apps Jump 10% in Latest MBA Weekly Survey"

by Calculated Risk on 4/13/2016 07:00:00 AM

From the MBA: Mortgage Apps Jump 10% in Latest MBA Weekly Survey

Mortgage applications increased 10 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 8, 2016.

...

The Refinance Index increased 11 percent from the previous week to its highest level since February 2016. The seasonally adjusted Purchase Index increased 8 percent from one week earlier its highest level since October 2015. The unadjusted Purchase Index increased 9 percent compared with the previous week and was 24 percent higher than the same week one year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity is picking again with lower rates.

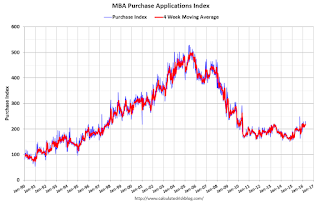

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 24% higher than a year ago.

Tuesday, April 12, 2016

Wednesday: Retail Sales, PPI, Beige Book

by Calculated Risk on 4/12/2016 06:01:00 PM

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for March will be released. The consensus is for retail sales to increase 0.1% in March. On a monthly basis, retail sales were down 0.1% from January to February (seasonally adjusted), and sales were up 3.1% from February 2015.

• Also at 8:30 AM, the Producer Price Index for March from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core PPI.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for February. The consensus is for a 0.1% decrease in inventories.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Treasury: Budget Deficit increased in Fiscal 2016 to Date compared to Fiscal 2015

by Calculated Risk on 4/12/2016 02:08:00 PM

The Treasury released the March Monthly Treasury Statement today. For fiscal year 2016 through March, the deficit was $461 billion compared to $439 billion for the same period in fiscal 2015 (the fiscal year ends in September).

In March, the Congressional Budget Office (CBO) released their new Updated Budget Projections: 2016 to 2026. The projected budget deficits were revised up recently.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

My guess is the actual deficit will be smaller in ficsal 2016 than the current CBO projection of 2.9% of GDP.

The decline in the deficit, as a percent of GDP, from almost 10% to 2.5% in 2015 was the fastest decline in the deficit since the demobilization following WWII (not shown on graph).

Note: In the year 2000 there were some projections that showed the entire debt could be paid off by now! But then along came some significant tax cuts, the Iraq war, two recessions, and other policy mistakes. Just a reminder that policy does matter.

The deficit is projected to remain stable for the next few years, before starting to slowly increase again.

CoreLogic: Foreclosure Inventory Declines 23.9% Year-over-year

by Calculated Risk on 4/12/2016 11:44:00 AM

CoreLogic released their National Foreclosure Report for February this morning.

CoreLogic reported that the national delinquency rate was at 3.2% in February, the lowest since November 2007.

From CoreLogic:

Approximately 434,000 homes in the United States were in some stage of foreclosure as of February 2016, compared to 571,000 in February 2015, a decrease of 23.9%. This was the 52nd consecutive month with a year-over-year decline. As of February 2016, the foreclosure inventory represented 1.2% of all homes with a mortgage, compared to 1.5% in February 2015.CoreLogic breaks down the foreclosure inventory by judicial vs non-judicial foreclosure states (see page 8 and 9 of the report). The judicial foreclosure states - that are still working through the backlog of foreclosures - have far more foreclosure inventory than the non-judicial foreclosure states.

NFIB: Small Business Optimism Index declined slightly in March

by Calculated Risk on 4/12/2016 09:06:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Drops to a New Two Year Low

The Index of Small Business Optimism fell 0.3 points from February, falling to 92.6. Statistically, no change. Four of the 10 Index components posted a gain, six posted small declines, the biggest gain was in Expected Business Conditions, a 4 point improvement to a still very negative number. ...

Reported job creation improved in March, with the average employment change per firm rising to an average gain in employment of 0.02 workers per firm, not much, but positive. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 92.6 in March.

Monday, April 11, 2016

"Mortgage Rates Holding Near 3-Year Lows"

by Calculated Risk on 4/11/2016 06:05:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Holding Near 3-Year Lows

Mortgage rates were little changed today, keeping them in line with the lowest levels in nearly 3 years. Specifically, there have only been 2-3 days with better rates since May 2013, depending on the lender. That puts the average lender at 3.625% in terms of conventional 30yr fixed rate quotes for top tier scenarios. Some of the more aggressive lenders continue to offer 3.5%. These rates are a mere quarter point higher than the all-time lows seen from late 2011 through early 2013.Here is a table from Mortgage News Daily:

emphasis added

Update: The California Budget Surplus

by Calculated Risk on 4/11/2016 02:59:00 PM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider (now at Bloomberg). One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved significantly since then. Here is the most recent update from California State Controller Betty Yee: CA Controller’s March Cash Report Shows Higher-Than-Expected Revenues

March state revenues surpassed estimates in Gov. Jerry Brown’s proposed 2016-17 budget by $218.6 million, with both the corporation tax and the retail sales and use tax beating expectations, State Controller Betty T. Yee reported today.California is doing much better.

Overall, total revenues of $7.40 billion outstripped projections in the proposed budget released in January by 3 percent. Corporation tax revenues of $1.71 billion were $47.5 million, or 2.9 percent, higher than expected. Sales tax revenues of $1.79 billion beat expectations by $36.0 million, or 2.0 percent. Only the personal income tax, which has normally surpassed projections in the past few years, came up short. Revenues of $3.49 billion were $31.2 million, or 0.9 percent, less than expected.

...

Compared to projections when this year’s budget was signed last summer, revenues for the first nine months of the fiscal year are $2.26 billion higher than expected, with both the corporation tax and the personal income tax exceeding estimates. Compared to the prior fiscal year, revenues to date are higher by $5.20 billion, or 7.1 percent.

emphasis added

Mortgage Rates and Ten Year Yield

by Calculated Risk on 4/11/2016 11:28:00 AM

With the ten year yield falling to 1.73%, there has been some discussion about whether mortgage rates will fall to new lows. Based on an historical relationship, 30-year rates should currently be around 3.7%.

As of Friday, Mortgage News Daily reported: "the average lender continuing to quote conventional 30yr fixed rates of 3.625% on top tier scenarios." Pretty close to expected.

The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

To reach new lows (on the Freddie Mac survey), mortgage rates would have to fall below the 3.35% lows in 2012.

For that to happen, based on the historical relationship, the Ten Year yield would have fall to under 1.5%.

So I don't expect new lows on mortgage rates unless the Ten Year yield falls further.