by Calculated Risk on 4/08/2016 09:08:00 AM

Friday, April 08, 2016

Philly Fed: State Coincident Indexes increased in 43 states in January

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2016. In the past month, the indexes increased in 43 states, decreased in five, and remained stable in two, for a one-month diffusion index of 76. Over the past three months, the indexes increased in 44 states, decreased in five, and remained stable in one, for a three-month diffusion index of 78.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January, 43 states had increasing activity.

Four states have seen declines over the last 6 months, in order they are Wyoming (worst), North Dakota, Alaska, and Louisiana - mostly due to the decline in oil prices.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.Source: Philly Fed.

Thursday, April 07, 2016

Merrill: "Fading the first quarter GDP fade"

by Calculated Risk on 4/07/2016 09:14:00 PM

The Atlanta Fed GDPNow estimate has fallen to just 0.4% annualized growth for Q1.

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2016 is 0.4 percent on April 5, down from 0.7 percent on April 1.From Merrill Lynch: Fading the first quarter fade

For the third year in a row, forecasters came into the first quarter looking for 2%-plus GDP growth, only to steadily revise estimates lower. [T]he Atlanta Fed’s GDPNow tracking [has declined] for 1Q in each year. They are far from alone: both we and the consensus have been doing the same thing. This weakness adds to market skepticism about a June Fed hike.CR note: No worries.

In both 2014 and 2015 we faded the weak 1Q data and argued that the recovery remained on track. Today, we see four reasons to reiterate that call. First, outside of the GDP adding up, the data look fine. Second, some of the weakness is likely due to lingering seasonal adjustment problems. Third, the fundamental backdrop points to moderate growth, not a big slowdown. Fourth, and perhaps most important, with potential growth slipping below 2%, and given the normal variation in the data, we should not be surprised to see near-zero quarters on an annual basis.

Hotels: Occupancy Rate Tracking just behind Record Year

by Calculated Risk on 4/07/2016 02:30:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 2 April

The U.S. hotel industry recorded positive year-over-year results in the three key performance metrics during the week of 27 March through 2 April 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate should mostly move sideways for the next couple of months, and then increase further during the Summer travel period.

In comparison with Easter week 2015, the industry’s occupancy rose 6.6% to 66.9%. Average daily rate for the week was up 5.0% to US$121.96. Revenue per available room increased 11.9% to US$81.61.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Phoenix Real Estate in March: Sales up 9%, Inventory up YoY

by Calculated Risk on 4/07/2016 11:21:00 AM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up year-over-year in March, following fifteen consecutive months of year-over-year declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in March were up 8.5% year-over-year.

2) Cash Sales (frequently investors) were down to 24.6% of total sales.

3) Active inventory is now up 3.6% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller. Inventory is something to watch in 2016!

| March Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Mar-08 | 4,303 | --- | 822 | 19.1% | 57,0811 | --- |

| Mar-09 | 7,636 | 77.5% | 2,994 | 39.2% | 49,743 | -12.9% |

| Mar-10 | 8,969 | 17.5% | 3,745 | 41.8% | 42,755 | -14.0% |

| Mar-11 | 9,927 | 10.7% | 4,946 | 49.8% | 37,632 | -12.0% |

| Mar-12 | 8,868 | -10.7% | 4,222 | 47.6% | 21,863 | -41.9% |

| Mar-13 | 8,146 | -8.1% | 3,384 | 41.5% | 20,729 | -5.2% |

| Mar-14 | 6,708 | -17.7% | 2,222 | 33.1% | 30,167 | 45.5% |

| Mar-15 | 7,884 | 17.5% | 2,172 | 27.5% | 26,623 | -11.7% |

| Mar-16 | 8,555 | 8.5% | 2,107 | 24.6% | 27,580 | 3.6% |

| 1 March 2008 probably included pending listings | ||||||

Weekly Initial Unemployment Claims decrease to 267,000

by Calculated Risk on 4/07/2016 08:35:00 AM

The DOL reported:

In the week ending April 2, the advance figure for seasonally adjusted initial claims was 267,000, a decrease of 9,000 from the previous week's unrevised level of 276,000. The 4-week moving average was 266,750, an increase of 3,500 from the previous week's unrevised average of 263,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 57 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

Note: The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 266,750.

This was below the consensus forecast of 272,000. The low level of the 4-week average suggests few layoffs.

Wednesday, April 06, 2016

Lawler: Yellen on Household Formations “Not Keeping Up;” What Is Her Data Source?

by Calculated Risk on 4/06/2016 05:30:00 PM

From housing economist Tom Lawler: Yellen on Household Formations “Not Keeping Up;” What Is Her Data Source?

In Federal Reserve Chair Yellen’s surprising “dovish” speech at the Economic Club of New York last week, she noted that a relatively slow pace of household formation was one of the “headwinds” that up to now had continued to restrain the U.S. economy. Here is a brief excerpt from her speech.

“Looking beyond the near term, I anticipate that growth will also be supported by a lessening of some of the headwinds that continue to restrain the U.S. economy, which include weak foreign activity, dollar appreciation, a pace of household formation that has not kept up with population and income growth and so has depressed homebuilding, and productivity growth that has been running at a slow pace by historical standards since the end of the recession.”I found the statement on the “lagging” pace of household formations somewhat fascinating, in that it is pretty widely known by competent housing economists and demographers that there currently are no good, reliable, or timely data on US household formations. Rather, there are multiple and often conflicting estimates of US household formations calculated based on different surveys conducted by the Census Bureau. In fact, there are even conflicting estimates of US household formations based on the SAME survey conducted by Census, but “controlled” to different benchmarks (in one case housing stock estimates, and in another case population estimates).

emphasis added

Since Chair Yellen was focusing on recent developments, I am assuming she was referring to household estimates from the Housing Vacancy Survey, which is a supplement to the Current Population Survey that (among other things) (1) produces estimate of the share of the housing stock that is occupied vs. vacant; and (2) which produces estimates of the number of occupied homes based on these occupancy share estimates and independent estimates of the housing stock from Census’ Population Division. Census released its report for the fourth quarter of 2015 in late January, and the estimates of the occupied housing stock (i.e. households) in that report did at face value suggest anemic growth in US households last year, after explosive growth in the latter part of 2014.

Here is a chart showing (1) quarterly changes in HVS-based household estimates (annualized, both not seasonally adjusted and seasonally adjusted (by me)), and (2) year-over-year changes in HVS-based household estimates.

Here is a chart showing (1) quarterly changes in HVS-based household estimates (annualized, both not seasonally adjusted and seasonally adjusted (by me)), and (2) year-over-year changes in HVS-based household estimates.As the chart suggests, HVS-based US household estimates are incredibly volatile, with most of the “noise” reflecting sizable (and unrealistic) quarterly fluctuations in estimates of the gross vacancy rate (as opposed to the housing stock). The chart also shows that HVS-based US household growth for the fourth quarter of 2014 was inconceivably high, reaching annualized growth of 5.6 million on an unadjusted basis and 4.7 million on a seasonally-adjusted basis. HVS-based household growth from Q4/2013 to Q4.2014 was 1.9 million, the highest YOY gain since the middle of 2005, while HVS-based household growth slowed to a paltry 462,000 from Q4/2014 to Q4/2015.

With respect to the acceleration in HVS-based household growth beginning in the second quarter of 2014, there were reasons unrelated to actual trends to expect an increase. Beginning in April 2014, a new sample based on the Master Address File compiled during Census 2010 was “phased in” to the HVS estimates, with the phase in period being 16 months. To the extent that the previous (and quite dated) sample was at least partly related to the HVS’ overestimate of the gross vacancy rate (as well as the homeownership rate), one would have expected the HVS estimates beginning in the second quarter to (1) show accelerated (and above “actual” household growth; and (2) shown “surprisingly large” declines in the homeownership rate. While the phase-in of the new sample can’t explain the volatility in the HVS estimates, it probably was at least partly behind the acceleration in household estimates Note that a similar but smaller acceleration in HVS based household estimates followed the phase-in of a new sample beginning from April 2004 to July 2005.

Less easy to understand, however, is why the HVS-based household estimates showed such anemic growth last year.

As noted before, the HVS-based household estimates are “controlled” to independent housing stock estimates, and in essence assume that (1) the HVS estimates for occupancy and vacancy shares are “correct,” and (2) the housing stock estimates are correct. Other household estimates from essentially the same survey (the HVS is a supplement to the CPS) but “controlled” to independent population estimates often show decidedly different household growth estimates. These estimates in essence assume that (1) household characteristics from the CPS/ASEC are “correct,” and (2) population estimates (total and by demographic characteristics) are correct. Unfortunately, such estimates are available only with a considerable lag (and only available for March of each year), and the last estimate available is for March 2015. In addition, the “time series” for CPS/ASEC household estimates are for the most part not adjusted to reflect updated estimates for population counts (total and demographic category, such as age). As such, these time series are of limited usefulness.

Even more disconcerting is that CPS-based household estimates by various characteristics (e.g., age of householder, tenure, etc.) are not at all consistent with decennial Census results, and have not been since 2000. It appears as if the implementation of the “Computer Assisted Information Collection” in 1994 is partly behind some of the “issues” of CPS-based household and housing tenure biases since then. (I’ll have more on this issue in a later report).

ACS estimates are a somewhat better “match” to decennial Census results, but such estimates are only available annually, and with a long lag. (The latest available estimates are for 2014).

Given both the huge volatility in, as well as the at times inconsistency of HVS-based household estimates relative to other household estimates, it is not clear how one should interpret last year’s slowdown in HVS-based household estimates.

Stated another way, the “household estimates conundrum” is alive and well, and quite frankly policymakers don’t currently have any reliable timely data on US households.

FOMC Minutes: Many participants argued "asymmetry made it prudent to wait for additional information"

by Calculated Risk on 4/06/2016 02:10:00 PM

There were different views - a couple of members expect to raise rates at the next meeting. However many participants argued for a cautious approach.

From the Fed: Minutes of the Federal Open Market Committee, March 15-16, 2016. Excerpts:

Participants generally agreed that the incoming information indicated that the U.S. economy had been resilient to recent global economic and financial developments, and that the domestic economic indicators that had become available in recent weeks had been mostly consistent with their expectations. Moreover, the sharp asset price movements that occurred earlier in the year had been reversed to a large extent, but longer-term interest rates and market participants' expectations for the future path of the federal funds rate remained lower. Taking these developments into account, participants generally judged that the medium-term outlook for domestic demand was not appreciably different than it had been when the Committee met in December. However, most participants, while recognizing the likely positive effects of recent policy actions abroad, saw foreign economic growth as likely to run at a somewhat slower pace than previously expected, a development that probably would further restrain growth in U.S. exports and tend to damp overall aggregate demand. Several participants also cited wider credit spreads as a factor that was likely to restrain growth in demand. Accordingly, many participants expressed the view that a somewhat lower path for the federal funds rate than they had projected in December now seemed most likely to be appropriate for achieving the Committee's dual mandate. Many participants also noted that a somewhat lower projected interest rate path was one reason for the relatively small revisions in their medium-term projections for economic activity, unemployment, and inflation.

Several participants also argued for proceeding cautiously in reducing policy accommodation because they saw the risks to the U.S. economy stemming from developments abroad as tilted to the downside or because they were concerned that longer-term inflation expectations might be slipping lower, skewing the risks to the outlook for inflation to the downside. Many participants noted that, with the target range for the federal funds rate only slightly above zero, the FOMC continued to have little room to ease monetary policy through conventional means if economic activity or inflation turned out to be materially weaker than anticipated, but could raise rates quickly if the economy appeared to be overheating or if inflation was to increase significantly more rapidly than anticipated. In their view, this asymmetry made it prudent to wait for additional information regarding the underlying strength of economic activity and prospects for inflation before taking another step to reduce policy accommodation.

For all of these reasons, most participants judged it appropriate to maintain the target range for the federal funds rate at 1/4 to 1/2 percent at this meeting while noting that global economic and financial developments continued to pose risks. These participants saw their judgment as consistent with the Committee's data-dependent approach to setting monetary policy; it was noted that, in this context, the relevant data include not only domestic economic releases, but also information about developments abroad and changes in financial conditions that bear on the economic outlook. A couple of participants, however, saw an increase in the target range to 1/2 to 3/4 percent as appropriate at this meeting, citing evidence that the economy was continuing to expand at a moderate rate despite developments abroad and earlier volatility in financial conditions, continued improvement in labor market conditions, the firming of inflation over recent months, and the apparent leveling-off of oil prices. In their judgment, increasing the target range for the federal funds rate too gradually in the near term risked having to raise it quickly later, which could cause economic and financial strains at that time.

Participants agreed that their ongoing assessments of the data and the implications for the outlook, rather than calendar dates, would determine the timing and pace of future adjustments to the stance of monetary policy. They expressed a range of views about the likelihood that incoming information would make an adjustment appropriate at the time of their next meeting. A number of participants judged that the headwinds restraining growth and holding down the neutral rate of interest were likely to subside only slowly. In light of this expectation and their assessment of the risks to the economic outlook, several expressed the view that a cautious approach to raising rates would be prudent or noted their concern that raising the target range as soon as April would signal a sense of urgency they did not think appropriate. In contrast, some other participants indicated that an increase in the target range at the Committee's next meeting might well be warranted if the incoming economic data remained consistent with their expectations for moderate growth in output, further strengthening of the labor market, and inflation rising to 2 percent over the medium term.

emphasis added

Las Vegas Real Estate in March: Sales Increased 4% YoY, Inventory Declines

by Calculated Risk on 4/06/2016 12:41:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada Home Prices and Sales Rise while Supply Stays Tight, GLVAR Reports

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in March was 3,488, up from a strong showing of 3,358 in March of 2015. Compared to the same month one year ago, 2.8 percent more homes and 8.3 percent more condos and townhomes sold in March.1) Overall sales were up 3.9% year-over-year.

...

By the end of March, GLVAR reported 7,214 single-family homes listed without any sort of offer. That’s down 0.6 percent from one year ago. For condos and townhomes, the 2,304 properties listed without offers in March represented a 5.8 percent decrease from one year ago.

GLVAR continued to report declines in distressed sales and a corresponding increase in traditional home sales, where lenders are not controlling the transaction. In March, 5.9 percent of all local sales were short sales – when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 8.3 percent of all sales one year ago. Another 7.1 percent of all March sales were bank-owned, down from 9.3 percent one year ago.

emphasis added

2) The percent of cash sales decreased year-over-year from 32.4% in Mar 2015 to 27.7% in Mar 2016. This has been trending down.

3) Non-contingent inventory for single-family homes was down 0.6% year-over-year. Inventory is important to watch - and inventory is still tight.

Reis: Mall Vacancy Rate unchanged in Q1 2016

by Calculated Risk on 4/06/2016 09:53:00 AM

Reis reported that the vacancy rate for regional malls was unchanged at 7.8% in Q1 2016 compared to Q4 2015, and down slightly year-over-year from 7.9% in Q1 2015. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was also unchanged at 10.0% in Q1 2016 compared to Q4, and down year-over-year from 10.1% in Q1 2015. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist and Director of Research Ryan Severino:

The national vacancy rate for neighborhood and community shopping centers was unchanged during the first quarter at 10.0%. Although the national vacancy rate technically did not decline, net absorption continues to exceed new construction, a heartening sign for a market that remains mired in a slow but steady recovery. The vacancy rate for malls also did not change, remaining at 7.8%. For neighborhood and community centers, the flat vacancy rate is just a blip, with more vacancy compression likely ahead. However, for regional malls, the vacancy compression cycle has largely ended.

While results from the first quarter have not shown any acceleration in the retail recovery, the overall economic environment remains conducive to further improvement. The labor market continues to generate more than 200,000 jobs per month on average, wages are slowly but surely inching higher, and retail sales continue to grow. Although the retail market clearly has no shortage of challenges - from e-commerce to new subtypes to experiential shopping - there is no reason to think that the recovery will not persist during the balance of 2016, even if the pace of the recovery does not accelerate much.

...

Asking and effective rents grew by 0.5% and 0.6% respectively during the first quarter. Quarterly rental growth rates for neighborhood and community centers have been virtually identical for the last six quarters. Consequently, the year-over-year growth rates have also changed very little in recent quarters, with asking and effective rents having grown by 2.1% and 2.2% respectively. Much like with new construction, the linchpin for rent growth is demand, or more specifically greater demand. Until net absorption rises to more robust levels, rent growth will remain stuck near current levels, more or less in line with core inflation. Nonetheless, rental growth is still the strongest it has been since 2007. Admittedly, that is not a high hurdle to clear, but slow progress is still progress.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Currently the vacancy rate is declining slowly and remains at an elevated level.

Mall vacancy data courtesy of Reis.

MBA: "Refinance Applications Drive Increase in Latest MBA Weekly Survey"

by Calculated Risk on 4/06/2016 07:00:00 AM

From the MBA: Refinance Applications Drive Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 1, 2016.

...

The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 11 percent higher than the same week one year ago.

emphasis added

Click on graph for larger image.

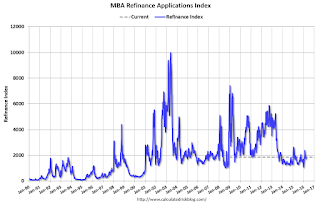

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity picked up earlier in 2016 as rates declined.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 11% higher than a year ago.