by Calculated Risk on 1/13/2016 02:03:00 PM

Wednesday, January 13, 2016

Fed's Beige Book: "Economic activity expanded"

Fed's Beige Book "Prepared at the Federal Reserve Bank of Philadelphia and based on information collected on or before January 4, 2016."

Reports from the twelve Federal Reserve Districts indicated that economic activity has expanded in nine of the Districts since the previous Beige Book report and contacts in Boston were described as upbeat. Meanwhile, New York and Kansas City described economic activity in their Districts as essentially flat. Atlanta and San Francisco characterized the growth in their Districts as moderate; Philadelphia, Cleveland, Richmond, Chicago, St. Louis, Minneapolis, and Dallas described their Districts' growth as modest. Contacts' outlooks for future growth remained mostly positive in Boston, Philadelphia, Atlanta, Chicago, Kansas City, and Dallas.And on real estate:

Residential real estate activity as measured in sales was generally positive in New York, Cleveland, Chicago, and St. Louis. Richmond experienced steady sales with pockets of strength, and Kansas City reported declines. Prices rose slightly to modestly overall in all reporting Districts, and inventories remained low in Boston, Richmond, and Minneapolis, and some parts of the New York District; however, New York City's rental vacancy rate increased. Though Boston contacts expected the market to perform well in 2016, contacts in Cleveland and Kansas City expressed concerns that higher interest rates may slow activity. Residential construction activity was described as modest or moderate in most Districts but was more subdued in New York, Atlanta, and Dallas overall. Multifamily construction continued to be strong in New York, Richmond, Minneapolis, and San Francisco and showed improvement in Chicago.Real Estate growth was modest to moderate ...

Most reporting Districts characterized nonresidential real estate activity as modest to moderate; Boston and New York indicated little change. Rental rates rose in more than half of the reporting Districts, and vacancy rates were mixed. Most Districts reported modest or moderate growth in commercial construction, and the Dallas District noted high levels of industrial construction in Dallas-Fort Worth. Contacts in the Atlanta District expect construction activity to increase slightly, while contacts in the Philadelphia, St. Louis, Minneapolis, and Richmond Districts expect overall commercial real estate activity to continue to strengthen at least modestly.

emphasis added

Is Oil "Cheap"?

by Calculated Risk on 1/13/2016 10:46:00 AM

One year ago today, I wrote Is Oil "Cheap"? Some people were arguing oil was "cheap" with Brent futures at $46 per barrel.

I pointed out that oil prices had still increased more than other key items since 1990 and 2000.

Below is an update to that table I posted comparing the change in headline CPI, Brent oil prices, Food, and Case-Shiller house prices since 1990 and 2000.

Things have changed now with Brent futures under $32 per barrel.

CPI is up 87% since 1990, but Brent is only up 51%.

Since 2000, CPI is up 41% and Brent is up 25%.

| Change Since | 1990 | 2000 |

|---|---|---|

| CPI | 87% | 41% |

| Brent Oil | 51% | 25% |

| Food | 91% | 50% |

| Case-Shiller House Prices | 127% | 74% |

So, compared to 1990 and 2000 prices, maybe oil is now "cheap".

Note: This is another way of saying that in real terms - inflation adjusted - oil prices are now below prices in 1990 and 2000.

MBA: Mortgage Applications Increased in Latest Weekly Survey, Purchase Applications up 19% YoY

by Calculated Risk on 1/13/2016 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 21.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 8, 2016. The previous week’s results included an adjustment for the New Year’s holiday.

...

The Refinance Index increased 24 percent from the previous week. The seasonally adjusted Purchase Index increased 18 percent from one week earlier. The unadjusted Purchase Index increased 74 percent compared with the previous week and was 19 percent higher than the same week one year ago

...

“MBA’s purchase mortgage application index reached its second highest level since May 2010 on a seasonally adjusted basis last week, second only to the week prior to the implementation of the Know Before You Owe rules,” said Lynn Fisher, MBA’s Vice President of Research and Economics.

“Bolstered by strong fourth quarter growth in jobs and continuing low rates, the results are similar to levels we saw in early December, suggesting that the purchase market’s strong finish to 2015 may be continuing. While refinances also increased on a holiday-adjusted basis, refinance activity was down 38 percent relative to a year ago when rates dove below 4 percent,” Fisher continued.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.12 percent from 4.20 percent, with points decreasing to 0.38 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity will probably stay low in 2016, and will probably be lower than in 2014 and 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 19% higher than a year ago.

Tuesday, January 12, 2016

Phoenix Real Estate in December: Sales up 4%, Inventory down 8%

by Calculated Risk on 1/12/2016 08:34:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

• At 2:00 PM, The Monthly Treasury Budget Statement for December.

On Phoenix:

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

For the thirteen consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from the prior year.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in December were up 4.3% year-over-year.

2) Cash Sales (frequently investors) were down to 23.9% of total sales.

3) Active inventory is now down 8.0% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

With falling inventory, prices increased a little faster in 2015 (something to watch if inventory continues to decline). Prices are already up 4.6% through October according the Case-Shiller (about double the pace for 2014).

| December Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Dec-08 | 5,524 | --- | 1,665 | 30.1% | 53,7921 | --- |

| Dec-09 | 7,661 | 38.7% | 3,008 | 39.3% | 39,709 | -26.2%1 |

| Dec-10 | 8,401 | 9.7% | 3,939 | 46.9% | 42,463 | 6.9% |

| Dec-11 | 7,843 | -6.6% | 3,635 | 46.3% | 24,712 | -41.8% |

| Dec-12 | 7,071 | -9.8% | 3,211 | 45.4% | 21,095 | -14.6% |

| Dec-13 | 5,930 | -16.1% | 2,053 | 34.6% | 25,511 | 20.9% |

| Dec-14 | 6,475 | 9.2% | 1,893 | 29.2% | 25,052 | -1.8% |

| Dec-15 | 6,756 | 4.3% | 1,617 | 23.9% | 23,053 | -8.0% |

| 1 December 2008 probably includes pending listings | ||||||

An update on oil prices

by Calculated Risk on 1/12/2016 02:54:00 PM

From the WSJ: U.S. Oil Prices Sink Below $30 a Barrel, First Time Since ’03

Oil tumbled below $30 a barrel on Tuesday, underscoring the global economy’s difficulty with absorbing a relentless flood of crude supplies.

...

The benchmark U.S. oil contract has dropped from $40 a barrel to $30 in just one month, and the pace of the selloff has rattled stock, bond and currency markets from Moscow to Riyadh to New York. Oil is down more than 70% since last trading in the triple digits, back in June 2014.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added). According to Bloomberg, WTI is at $30.20 per barrel today, and Brent is at $30.60

Prices really collapsed at the end of 2014 - and then rebounded a little - and have collapsed again. There are many factors pushing down oil prices - more global supply (even as some shale producers cut back), global economic weakness (slowing demand), strong dollar, and warm weather in the US (less heating demand) to mention a few.

U.S. Heavy Truck Sales

by Calculated Risk on 1/12/2016 12:55:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the December 2015 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009 on a seasonally adjusted annual rate basis (SAAR). Since then sales increased more than 2 1/2 times, and hit 492 thousand SAAR in November 2015 - even with weakness in the oil sector.

Heavy truck sales declined in December to 440 thousand SAAR.

The level in November 2015 was the highest level since December 2006 (9 years ago). Sales have been above 400 thousand SAAR for 18 consecutive months, are now above the average (and median) of the last 20 years.

Click on graph for larger image.

BLS: Jobs Openings increased in November

by Calculated Risk on 1/12/2016 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

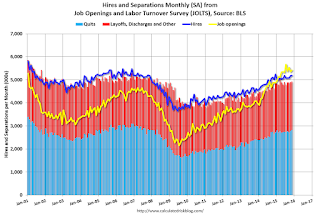

The number of job openings was little changed at 5.4 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.2 million and 4.9 million, respectively. Within separations, the quits rate was 2.0 percent, and the layoffs and discharges rate was 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.8 million quits in November, little changed from October. The number of quits has held between 2.7 million and 2.8 million for the past 15 months. The quits rate in November was 2.0 percent.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in November to 5.431 million from 5.349 million in October.

The number of job openings (yellow) are up 11% year-over-year compared to November 2014.

Quits are up 6% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is a solid report. Job openings are close to the record high set in July, and Quits are up 6% year-over-year.

NFIB: Small Business Optimism Index increased slightly in December

by Calculated Risk on 1/12/2016 09:23:00 AM

From the National Federation of Independent Business (NFIB): NFIB Survey Remains Flat, With Small Business Owners Divided on Sales Outlook, Business Conditions

The overall Index gained a modest 0.4 points in December. It now stands at 95.2, which is well below the 42-year average of 98. ...

Reported job creation faded a bit in December, with the average employment gain per firm falling to -0.07 workers from .01 in November, basically flat for the last few months. Fifty-five percent reported hiring or trying to hire (unchanged), but 48 percent reported few or no qualified applicants for the positions they were trying to fill. ... Twenty-eight percent of all owners reported job openings they could not fill in the current period, up 1 point and at the highest level for this expansion. This is a solid reading historically and indicates no significant change in the unemployment rate. A seasonally adjusted net 15 percent plan to create new jobs, up 4 points, a nice gain, possibly driven by the surge in expected real sales gains.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.2 in December.

Hiring plans are solid.

Monday, January 11, 2016

Tuesday: Job Openings

by Calculated Risk on 1/11/2016 07:53:00 PM

Tuesday:

• At 5:30 AM ET, Panel Discussion with Vice Chairman Stanley Fischer, Monetary Policy, Financial Stability, and the Zero Lower Bound, At the Banque de France and Bank for International Settlements Farewell Symposium for Christian Noyer, Paris, France

• At 9:00 AM, NFIB Small Business Optimism Index for November.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS. Job openings decreased in October to 5.383 million from 5.534 million in September. The number of job openings were up 11% year-over-year, and Quits were up slightly year-over-year.

Some interesting information from Jody Kahn and Devyn Bachman at John Burns Real Estate Consulting 23,263 New Home Sales Last Year at Top 50 Masterplans, a 14% Increase over 2014

In 2015, the top 50 masterplans listed in the table below sold nearly 23,300 homes, representing:I expect sales in Houston to slow in 2016 (see: Lawler: "Yes, Houston will have a problem next year" , and Houston has been a major contributor to New Home sales - this is a reason I'm less optimistic than most housing analysts on new home sales this year.

• A 14% increase over 2014

• Roughly 4.7% of all new home sales nationally

• The highest sales volume in the 6 years we have been compiling our list

...

Texas continues to lead the country. The state boasts 17 of the top 50 best-selling master-planned communities, including 9 in Houston, the most of any metro area, 6 in Dallas, and one each in Austin and San Antonio. California contributed 11 top sellers, Florida had 7 communities, Las Vegas contributed 4, and Denver had 3. After getting shut out in 2014, 3 Phoenix communities joined the list ...

emphasis added

Question #1 for 2016: How much will the economy grow in 2016?

by Calculated Risk on 1/11/2016 02:19:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'm adding some thoughts, and a few predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

1) Economic growth: Heading into 2016, most analysts are once again pretty sanguine. Even with weak growth in the first quarter, 2015 was a decent year (GDP growth will be around 2.5% in 2015). Right now analysts are expecting growth of 2.6% in 2016, although a few analysts are projecting a recession. How much will the economy grow in 2016?

First, there are several analysts predicting a recession in 2016, see: The Endless Parade of Recession Calls. No one has a perfect crystal ball, but I'm not even on recession watch right now. In 2007, when I correctly predicted a recession, I was watching the impact of the housing bust on the economy - and that recession call seemed obvious (although it was out of the consensus). A recession in 2016 seems very unlikely.

Second, here is a table of the annual change in real GDP since 2007. Economic activity has mostly been in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%. It is possible with some boost related to lower oil prices (something that is hard to see in the data, but is certainly happening in some sectors), and some boost from government spending in 2016 - and maybe some help from the weather in Q1 - perhaps we will finally see growth at 3% this year.

| Annual Real GDP Growth | ||

|---|---|---|

| Year | GDP | |

| 2005 | 3.3% | |

| 2006 | 2.7% | |

| 2007 | 1.8% | |

| 2008 | -0.3% | |

| 2009 | -2.8% | |

| 2010 | 2.5% | |

| 2011 | 1.6% | |

| 2012 | 2.2% | |

| 2013 | 1.5% | |

| 2014 | 2.4% | |

| 20151 | 2.5% | |

| 1 2015 estimate. | ||

The good news is that all of the positives that led to the pickup in activity since 2013 are still present - the housing recovery is ongoing, state and local government austerity is over (and now Federal austerity is over), household balance sheets are in much better shape and household deleveraging is over, and commercial real estate (CRE) investment (ex-energy) and public construction will both probably make further positive contributions in 2016.

In addition, the sharp decline in oil prices should be a net positive for the US economy in 2016. And, hopefully, the negative impact from the strong dollar will fade in 2016.

The most likely growth rate is in the mid-2% range again, however a 3 handle is possible if PCE picks up a little more (ex-gasoline).

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?