by Calculated Risk on 1/11/2016 07:53:00 PM

Monday, January 11, 2016

Tuesday: Job Openings

Tuesday:

• At 5:30 AM ET, Panel Discussion with Vice Chairman Stanley Fischer, Monetary Policy, Financial Stability, and the Zero Lower Bound, At the Banque de France and Bank for International Settlements Farewell Symposium for Christian Noyer, Paris, France

• At 9:00 AM, NFIB Small Business Optimism Index for November.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS. Job openings decreased in October to 5.383 million from 5.534 million in September. The number of job openings were up 11% year-over-year, and Quits were up slightly year-over-year.

Some interesting information from Jody Kahn and Devyn Bachman at John Burns Real Estate Consulting 23,263 New Home Sales Last Year at Top 50 Masterplans, a 14% Increase over 2014

In 2015, the top 50 masterplans listed in the table below sold nearly 23,300 homes, representing:I expect sales in Houston to slow in 2016 (see: Lawler: "Yes, Houston will have a problem next year" , and Houston has been a major contributor to New Home sales - this is a reason I'm less optimistic than most housing analysts on new home sales this year.

• A 14% increase over 2014

• Roughly 4.7% of all new home sales nationally

• The highest sales volume in the 6 years we have been compiling our list

...

Texas continues to lead the country. The state boasts 17 of the top 50 best-selling master-planned communities, including 9 in Houston, the most of any metro area, 6 in Dallas, and one each in Austin and San Antonio. California contributed 11 top sellers, Florida had 7 communities, Las Vegas contributed 4, and Denver had 3. After getting shut out in 2014, 3 Phoenix communities joined the list ...

emphasis added

Question #1 for 2016: How much will the economy grow in 2016?

by Calculated Risk on 1/11/2016 02:19:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'm adding some thoughts, and a few predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

1) Economic growth: Heading into 2016, most analysts are once again pretty sanguine. Even with weak growth in the first quarter, 2015 was a decent year (GDP growth will be around 2.5% in 2015). Right now analysts are expecting growth of 2.6% in 2016, although a few analysts are projecting a recession. How much will the economy grow in 2016?

First, there are several analysts predicting a recession in 2016, see: The Endless Parade of Recession Calls. No one has a perfect crystal ball, but I'm not even on recession watch right now. In 2007, when I correctly predicted a recession, I was watching the impact of the housing bust on the economy - and that recession call seemed obvious (although it was out of the consensus). A recession in 2016 seems very unlikely.

Second, here is a table of the annual change in real GDP since 2007. Economic activity has mostly been in the 2% range since 2010. Given current demographics, that is about what we'd expect: See: 2% is the new 4%. It is possible with some boost related to lower oil prices (something that is hard to see in the data, but is certainly happening in some sectors), and some boost from government spending in 2016 - and maybe some help from the weather in Q1 - perhaps we will finally see growth at 3% this year.

| Annual Real GDP Growth | ||

|---|---|---|

| Year | GDP | |

| 2005 | 3.3% | |

| 2006 | 2.7% | |

| 2007 | 1.8% | |

| 2008 | -0.3% | |

| 2009 | -2.8% | |

| 2010 | 2.5% | |

| 2011 | 1.6% | |

| 2012 | 2.2% | |

| 2013 | 1.5% | |

| 2014 | 2.4% | |

| 20151 | 2.5% | |

| 1 2015 estimate. | ||

The good news is that all of the positives that led to the pickup in activity since 2013 are still present - the housing recovery is ongoing, state and local government austerity is over (and now Federal austerity is over), household balance sheets are in much better shape and household deleveraging is over, and commercial real estate (CRE) investment (ex-energy) and public construction will both probably make further positive contributions in 2016.

In addition, the sharp decline in oil prices should be a net positive for the US economy in 2016. And, hopefully, the negative impact from the strong dollar will fade in 2016.

The most likely growth rate is in the mid-2% range again, however a 3 handle is possible if PCE picks up a little more (ex-gasoline).

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Question #2 for 2016: How many payroll jobs will be added in 2016?

by Calculated Risk on 1/11/2016 11:29:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'm adding some thoughts, and a few predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

2) Employment:2) Employment: Through November, the economy has added 2,308,000 jobs this year, or 210,000 per month. As expected, this was down from the 260 thousand per month in 2014. Will job creation in 2016 be as strong as in 2015? Or will job creation be even stronger, like in 2014? Or will job creation slow further in 2016?

For review, here is a table of the annual change in total nonfarm, private and public sector payrolls jobs since 1997. For total and private employment gains, 2015 was the second best year since the '90s (only trailing the previous year, 2014).

| Change in Payroll Jobs per Year (000s) | |||

|---|---|---|---|

| Total, Nonfarm | Private | Public | |

| 1997 | 3,408 | 3,213 | 195 |

| 1998 | 3,047 | 2,734 | 313 |

| 1999 | 3,177 | 2,716 | 461 |

| 2000 | 1,945 | 1,681 | 264 |

| 2001 | -1,735 | -2,286 | 551 |

| 2002 | -507 | -740 | 233 |

| 2003 | 105 | 147 | -42 |

| 2004 | 2,032 | 1,885 | 147 |

| 2005 | 2,506 | 2,320 | 186 |

| 2006 | 2,087 | 1,878 | 209 |

| 2007 | 1,139 | 851 | 288 |

| 2008 | -3,577 | -3,757 | 180 |

| 2009 | -5,088 | -5,014 | -74 |

| 2010 | 1,066 | 1,282 | -216 |

| 2011 | 2,080 | 2,396 | -316 |

| 2012 | 2,257 | 2,315 | -58 |

| 2013 | 2,388 | 2,452 | -64 |

| 2014 | 3,116 | 3,042 | 74 |

| 2015 | 2,650 | 2,551 | 99 |

The good news is the economy still has solid momentum heading into the new year. The further decline in oil prices will give a boost to many sectors, construction activity (non-energy related) should continue to increase, and the pace of public hiring will probably increase further in 2016.

Also the drag on manufacturing due to the strong dollar will probably lessen in 2016.

There are also some negatives. The decline in oil prices will lead to further layoffs in the energy sector and have a ripple effect in some communities (like Houston). And the lower unemployment rate will mean some companies will have difficulty finding qualified candidates.

Note: Too many people compare to the '80s and '90s, without thinking about changing demographics. The prime working age population (25 to 54 years old) was growing 2.2% per year in the '80s, and 1.3% per year in the '90s. The prime working age population has actually declined slightly this decade. Note: The prime working age population is now growing slowly again, and growth will pick up the '20s.

In 2015, public employment added to total employment for the second consecutive year, but still at a fairly low level. Public hiring will probably pick up to 150,000+ in 2016.

The second table shows the change in construction and manufacturing payrolls starting in 2006.

| Construction Jobs (000s) | Manufacturing (000s) | |

|---|---|---|

| 2006 | 152 | -178 |

| 2007 | -195 | -269 |

| 2008 | -789 | -896 |

| 2009 | -1,047 | -1,375 |

| 2010 | -187 | 120 |

| 2011 | 145 | 204 |

| 2012 | 112 | 162 |

| 2013 | 213 | 125 |

| 2014 | 338 | 215 |

| 2015 | 263 | 30 |

Energy related construction hiring will decline in 2015, but I expect other areas of construction to be solid. For manufacturing, growth in the auto sector will probably slow this year, but the drag on manufacturing employment from the strong dollar should be less in 2016.

As I mentioned above, in addition to layoffs in the energy sector, exporters will have a difficult year - but probably not the severe contraction as in 2015, and more companies will have difficulty finding qualified candidates. Even with some boost from lower oil prices - and some additional public hiring, I expect total jobs added to be lower in 2016 than in 2015.

So my forecast is for gains of around 200,000 payroll jobs per month in 2016. Lower than in 2015, but another solid year for employment gains given current demographics.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Black Knight November Mortgage Monitor: First Time Foreclosure Starts Lowest on Record

by Calculated Risk on 1/11/2016 09:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for November today. According to BKFS, 4.92% of mortgages were delinquent in November, up from 4.77% in October. BKFS reported that 1.38% of mortgages were in the foreclosure process.

This gives a total of 6.30% delinquent or in foreclosure.

Press Release: Black Knight’s November Mortgage Monitor: Refinanceable Population Shrinks While Tappable Equity Rises; HELOC Originations Continue to Climb

Today, the Data & Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of November 2015. This month, Black Knight revisited the population of refinanceable borrowers and found that approximately 5.2 million borrowers could likely both qualify for and benefit from refinancing at today’s interest rates. However, as Black Knight Data & Analytics Senior Vice President Ben Graboske explained, this population is diminishing, and as mortgage interest rates rise, it will only continue to shrink further.

“Looking at current interest rates on existing 30-year mortgages and applying a set of broad-based underwriting criteria, we found that there are still approximately 5.2 million borrowers that make good candidates for traditional refinancing,” said Graboske. “Of course, that’s down from over 7 million as recently as April 2015, when interest rates were below 3.7 percent. If rates go up 50 basis points from where they are now, 2.1 million borrowers will fall out of the running; a 100-basis-point increase would eliminate another million, leaving only 2 million potential refinance candidates, the lowest population of refinance candidates in recent history. That said, of those that could likely qualify for and benefit from refinancing today, some 2.4 million are looking at potentially saving $200 or more on their monthly mortgage payments post-refinancing. Again, this is a very rate-sensitive population: after a 50-basis-point rise in rates, a million borrowers would lose out on those savings.

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the first time foreclosure starts since 2005.

From Black Knight:

Looking more closely at November’s foreclosure starts, we see that the month’s 31,000 first time foreclosure starts were the lowest in over 10 yearsThere is much more in the mortgage monitor.

In fact, the lowest number of foreclosure starts seen in 2005 (when Black Knight began tracking this data) was 37,700 in January – so not only are we back to pre-crisis levels, but November was 18 percent below the lowest level of first time foreclosure starts in all of 2005

Likewise, repeat foreclosures were at their lowest level since April of 2008

Sunday, January 10, 2016

Sunday Night Futures: Brent Oil Price Lowest Since 2004

by Calculated Risk on 1/10/2016 08:02:00 PM

Brent oil prices are now the lowest since June 2004 according to the EIA. WTI prices are the lowest since December 2008 (WTI fell to $30.28 per barrel on December 23, 2008).

From the USA Today: Gas prices could drop toward $1 a gallon

As oil prices fall, and refinery capacity stays strong, the price of gas could reach $1 a gallon in some areas, a level last reached in 1999. As a matter of fact, the entire states of Alabama, Arkansas, Missouri, Oklahoma and South Caroline have gas prices that average at or below $1.75.Weekend:

• Schedule for Week of January 11, 2016

• Question #3 for 2016: What will the unemployment rate be in December 2016?

Monday:

• At 10:00 AM ET, the Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 15 and DOW futures are down 125 (fair value).

Oil prices were down sharply over the last week with WTI futures at $32.45 per barrel (lowest since December 2008) and Brent at $32.92 per barrel (lowest since June 2004). A year ago, WTI was at $48, and Brent was also at $48 - so prices are down over 30% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.97 per gallon (down about $0.20 per gallon from a year ago). Gasoline prices should decline over the next few weeks based on the sharp decline in oil prices.

Question #3 for 2016: What will the unemployment rate be in December 2016?

by Calculated Risk on 1/10/2016 11:09:00 AM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

3) Unemployment Rate: The unemployment rate was at 5.0% in November, down 0.8 percentage points year-over-year. [CR Note: The unemployment rate was also at 5.0% in December]. Currently the FOMC is forecasting the unemployment rate will be in the 4.6% to 4.8% range in Q4 2016. What will the unemployment rate be in December 2016?

Forecasting the unemployment rate includes forecasts for economic and payroll growth, and also for changes in the participation rate. Note: The participation rate is the percent of the working age population (16 and over) that is in the labor force.

On participation: We can be pretty certain that the participation rate will decline over the next couple of decades based on demographic trends. In 2015, I expected the participation rate to stabilize as the labor market improved. Last year I wrote:

My guess is based on the participation rate staying relatively steady in 2015 - before declining again over the next decade.And the participation rate declined only slightly last year from 62.7% in December 2014, to 62.6% in December 2015. The long term down trend was offset by some people returning to the labor force in 2015.

For 2016, I expect more of the same - probably another small decline in the participation rate.

Here is a table of the participation rate and unemployment rate since 2008.

| Unemployment and Participation Rate for December each Year | |||

|---|---|---|---|

| December of | Participation Rate | Change in Participation Rate (percentage points) | Unemployment Rate |

| 2008 | 65.8% | 7.3% | |

| 2009 | 64.6% | -1.2 | 9.9% |

| 2010 | 64.3% | -0.3 | 9.3% |

| 2011 | 64.0% | -0.3 | 8.5% |

| 2012 | 63.7% | -0.3 | 7.9% |

| 2013 | 62.9% | -0.8 | 6.7% |

| 2014 | 62.7% | -0.2 | 5.6% |

| 2015 | 62.6% | -0.1 | 5.0% |

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline to around 4.5% by December 2016. My guess is based on the participation rate declining slightly in 2016 and for decent job growth in 2016 (however less in 2016 than in 2015).

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Saturday, January 09, 2016

Schedule for Week of January 11, 2016

by Calculated Risk on 1/09/2016 08:09:00 AM

The key economic report this week is December retail sales on Friday.

For manufacturing, December Industrial Production, and the January NY Fed manufacturing survey will be released on Friday.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

5:30 AM ET: Panel Discussion with Vice Chairman Stanley Fischer, Monetary Policy, Financial Stability, and the Zero Lower Bound, At the Banque de France and Bank for International Settlements Farewell Symposium for Christian Noyer, Paris, France

9:00 AM ET: NFIB Small Business Optimism Index for November.

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS.

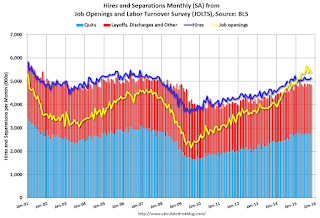

10:00 AM: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Job openings decreased in October to 5.383 million from 5.534 million in September.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up slightly year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

2:00 PM: The Monthly Treasury Budget Statement for December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, down from 277 thousand the previous week.

8:30 AM: The Producer Price Index for December from the BLS. The consensus is for a 0.2% decrease in prices, and a 0.1% increase in core PPI.

8:30 AM ET: Retail sales for December will be released. The consensus is for retail sales to be unchanged in December,

8:30 AM ET: Retail sales for December will be released. The consensus is for retail sales to be unchanged in December,This graph shows retail sales since 1992 through November 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were up 0.2% from October to November (seasonally adjusted), and sales were up 1.4% from November 2014.

8:30 AM: NY Fed Empire State Manufacturing Survey for January. The consensus is for a reading of -4.0, up from -4.6.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 76.8%.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 93.0, up from 92.6 in December.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.1% increase in inventories.

Friday, January 08, 2016

Merrill: Warm Weather "added nearly 100,000 jobs in December"

by Calculated Risk on 1/08/2016 08:01:00 PM

A few excerpts from a research note by Merrill Lynch economists Michelle Meyer and Alexander Lin: Melting snowmen

After two brutal winters, we have been enjoying an unprecedented warm winter start. The average temperature in December was 38.6 degrees, versus the previous record of 37.7 and the historical average of 33.2. If we create a national aggregate for temperature which is weighted by state population instead of area, we see an even bigger divergence from the norm in December. The appeal of using population weights is that it will put more emphasis on the temperature in the areas which have a greater economic contribution.

Another proxy for gauging the weather in the winter is to show heating degree days, which measures the demand for energy to heat houses or businesses ... the deviation from the norm for heating degree days in December and this past month was literally off the charts.

...

In a research note released February last year, Chicago Fed economists Justin Bloesch and François Gouri provide an insightful methodology for examining the impact of weather on economic indicators. Using daily data from the more than 1,200 weather stations that make up the US Historical Climatology Network, they constructed temperature and snowfall indices based on deviations from historical levels. ... They test the impact of this deviation on economic indicators – both in winter months and in April, May and June, to understand the potential payback. There is strong evidence of a weather impact on nonfarm payrolls as well as claims, housing starts, and permits. Focusing on payrolls, they estimated that a 1 standard deviation increase in temperature resulted in a 0.04% boost to nonfarm payroll growth during the current month, which would translate into roughly 60,000 additional jobs at today’s levels. Similarly, a 1 standard deviation decline in snowfall would result in a 0.03% bump to job growth, or 45,000 additional jobs.

Plugging in the December temperature and snowfall data to the output of the model from Bloesch and Gouri, we find that the weather can explain about 97,000 of job growth. This would imply that without the weather distortion, the economy would have added 195,000 jobs. While we don’t want to give a false sense of precision, this seems like a reasonable approximation. Before the sharp acceleration the past three months, job growth was trending at around 200,000 a month.

emphasis added

Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

by Calculated Risk on 1/08/2016 03:48:00 PM

Earlier I posted some questions for next year: Ten Economic Questions for 2016. I'll try to add some thoughts, and maybe some predictions for each question.

Here is a review of the Ten Economic Questions for 2015.

4) Inflation: The inflation rate has increased a little recently, and some key measures are now close to the the Fed's 2% target. Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

Although there are different measure for inflation (including some private measures) they all show that inflation is now close to the Fed's 2% inflation target - except Core PCE.

Note: I follow several measures of inflation, median CPI and trimmed-mean CPI from the Cleveland Fed. Core PCE prices (monthly from the BEA) and core CPI (from the BLS).

On a year-over-year basis in November, the median CPI rose 2.5%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy also rose 2.0%. Core PCE is for October and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.4% annualized, and core CPI was at 2.2% annualized..

Due to some remaining slack in the labor market (example: elevated level of part time workers for economic reasons), I expect these measures of inflation will be close to the Fed's target in 2016.

So currently I think core inflation (year-over-year) will increase further in 2016, but too much inflation will not be a serious concern in 2016.

Here are the Ten Economic Questions for 2016 and a few predictions:

• Question #1 for 2016: How much will the economy grow in 2016?

• Question #2 for 2016: How many payroll jobs will be added in 2016?

• Question #3 for 2016: What will the unemployment rate be in December 2016?

• Question #4 for 2016: Will the core inflation rate rise in 2016? Will too much inflation be a concern in 2016?

• Question #5 for 2016: Will the Fed raise rates in 2016, and if so, by how much?

• Question #6 for 2016: Will real wages increase in 2016?

• Question #7 for 2016: What about oil prices in 2016?

• Question #8 for 2016: How much will Residential Investment increase?

• Question #9 for 2016: What will happen with house prices in 2016?

• Question #10 for 2016: How much will housing inventory increase in 2016?

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 1/08/2016 12:41:00 PM

By request, here is another update of an earlier post through the December employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,073 |

| GW Bush 1 | -844 |

| GW Bush 2 | 381 |

| Obama 1 | 2,018 |

| Obama 2 | 7,8251 |

| 135 months into 2nd term: 10,731 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 844,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 463,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 2,018,000 more private sector jobs at the end of Mr. Obama's first term. Thirty five months into Mr. Obama's second term, there are now 9,843,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 578,000 jobs). These job losses had mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -702 |

| Obama 2 | 1241 |

| 135 months into 2nd term, 170 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming down turn due to the bursting of the housing bubble - and I predicted a recession in 2007).

For the public sector, the cutbacks are clearly. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Below is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fourth best for total job creation.

Note: Only 124 thousand public sector jobs have been added during the first thirty five months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is less than 8% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,073 | 1,242 | 11,315 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 7,825 | 124 | 7,949 | |

| Pace2 | 10,731 | 170 | 10,901 | |

| 135 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 235 | 279 | ||

| #2 | 173 | 259 | ||

| #3 | 118 | 219 | ||