by Calculated Risk on 12/03/2015 02:11:00 PM

Thursday, December 03, 2015

Preview: Employment Report for November

On Friday at 8:30 AM ET, the BLS will release the employment report for November. The consensus, according to Bloomberg, is for an increase of 190,000 non-farm payroll jobs in November (with a range of estimates between 160,000 to 219,000), and for the unemployment rate to be unchanged at 5.0%.

The BLS reported 271,000 jobs added in October.

Here is a summary of recent data:

• The ADP employment report showed an increase of 217,000 private sector payroll jobs in November. This was above expectations of 183,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index increased in November to 51.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 10,000 in November. The ADP report indicated a 6,000 increase for manufacturing jobs.

The ISM non-manufacturing employment index decreased in November to 55.0%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 205,000 in September.

Combined, the ISM indexes suggests employment gains of 195,000. This suggests employment growth close to expectations.

• Initial weekly unemployment claims averaged close to 270,000 in November, up from 260,000 in October. For the BLS reference week (includes the 12th of the month), initial claims were at 272,000, up from 259,000 during the reference week in October.

The increase during the reference suggests a slightly higher level of layoffs in November - but still very low.

• The final November University of Michigan consumer sentiment index increased to 91.3 from the October reading of 90.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• Trim Tabs reported that the U.S. economy added 168,000 jobs in November, down from their estimate of 178,000 jobs in October. Note: "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding."

• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. Based on these indicators, it appears job gains should be around 200 thousand in November.

Goldman: November Employment Preview

by Calculated Risk on 12/03/2015 12:10:00 PM

A few excerpts from a piece by Goldman Sachs economist David Mericle:

We expect a 200k gain in nonfarm payroll employment in November, in line with consensus expectations. ... Labor market data were mixed in November. ADP employment growth surprised on the upside and the employment components of manufacturing surveys were somewhat stronger on balance, but the Conference Board’s measure of reported job availability declined, jobless claims rose slightly, and the ISM non-manufacturing index’s employment component declined. While a gain of 200k would be a bit softer than the recent average, it would still be well above our estimate of the “breakeven” rate of 85k per month.

We expect the unemployment rate to remain unchanged at 5.0% in November on a rounded basis following a decline last month to 5.036%. However, we see some risk that the unemployment rate will round up to 5.1% given the high unrounded level and the possibility of a slight rebound in participation, which appears a bit low after unexpectedly sharp declines earlier this year. ...

Finally, we expect average hourly earnings for all workers to rise 0.2% in November following a larger-than-expected 0.4% gain in October, implying a two-tenths decline in the year-on-year rate to 2.3%. ... Our wage tracker—which also now includes the Atlanta Fed wage measure—stands at 2.6%. Apart from a technical blip in late 2012, this is the highest reading of the recovery, although it is still somewhat below our 3-3.5% estimate of the full-employment equilibrium rate.

ISM Non-Manufacturing Index Decreased to 55.9% in November

by Calculated Risk on 12/03/2015 10:06:00 AM

The November ISM Non-manufacturing index was at 55.9%, down from 59.1% in October. The employment index decreased in November to 55.0%, down from 59.2% in October. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 70th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.9 percent in November, 3.2 percentage points lower than the October reading of 59.1 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 58.2 percent, which is 4.8 percentage points lower than the October reading of 63 percent, reflecting growth for the 76th consecutive month at a slower rate. The New Orders Index registered 57.5 percent, 4.5 percentage points lower than the reading of 62 percent in October. The Employment Index decreased 4.2 percentage points to 55 percent from the October reading of 59.2 percent and indicates growth for the 21st consecutive month. The Prices Index increased 1.2 percentage points from the October reading of 49.1 percent to 50.3 percent, indicating prices increased in November after two consecutive months of decreasing. According to the NMI®, 12 non-manufacturing industries reported growth in November. After a strong month of growth in October, the non-manufacturing sector’s rate of growth slowed in November. Most respondents are still positive about business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 58.2 and suggests slower expansion in November than in October. Still a solid report.

Weekly Initial Unemployment Claims at 269,000

by Calculated Risk on 12/03/2015 08:34:00 AM

The DOL reported:

In the week ending November 28, the advance figure for seasonally adjusted initial claims was 269,000, an increase of 9,000 from the previous week's unrevised level of 260,000. The 4-week moving average was 269,250, a decrease of 1,750 from the previous week's unrevised average of 271,000.The previous week was unrevised at 260,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 269,250.

This was at the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, December 02, 2015

Thursday: Yellen, ISM Non-Mfg, Unemployment Claims

by Calculated Risk on 12/02/2015 09:50:00 PM

From the WSJ: Yellen Signals Fed on Track to Raise Rates in December

Federal Reserve Chairwoman Janet Yellen signaled she’s ready to raise short-term interest rates this month barring a surprise that shakes her confidence in the economy.Thursday:

She also suggested she sees dissension within her ranks, which could complicate her moves toward ending seven years of near-zero rates.

“I don’t need unanimity. I think we have to tolerate some dissent,” Ms. Yellen said Wednesday, in answer to a question after delivering a speech on the economic outlook. “I wouldn’t try to stifle dissents, and I would even expect some at critical junctures.”

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 260 thousand the previous week.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is a 1.4% increase in orders.

• Also at 10:00 AM, the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 58.2 from 59.1 in October.

• Also at 10:00 AM, Testimony by Fed Chair Janet Yellen, Economic Outlook, Before the Joint Economic Committee, U.S. Senate, Washington, D.C.

• At 1:10 PM, Speech by Fed Vice Chairman Stanley Fischer, Financial Stability and Shadow Banks, At the Federal Reserve Bank of Cleveland Financial Stability Conference, Washington, D.C.

Fed's Beige Book: "Economic activity increased at a modest pace"

by Calculated Risk on 12/02/2015 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Richmond and based on information collected before November 20, 2015. "

The twelve Federal Reserve District reports indicate that economic activity increased at a modest pace in most regions of the country since the previous Beige Book report. Economic growth was modest in the Districts of Cleveland, Richmond, Atlanta, Chicago, St. Louis, Dallas and San Francisco. In the Minneapolis District the economy grew moderately, while in the Kansas City District growth was steady on balance with mixed conditions across sectors. In the New York District economic conditions leveled off since the previous report, and in the Philadelphia District aggregate business activity continued to grow at a modest pace. In the Boston District, growth was somewhat slower despite reports of revenue increases.And on real estate:

Housing markets grew at a moderate pace on balance, and home prices also increased modestly since the previous Beige Book. ... Residential construction grew at a modest to moderate pace since the previous report. The Cleveland and Chicago Districts reported moderate growth, while New York, Philadelphia, St. Louis, and Kansas City Districts reported modest growth in residential construction. In the New York and Atlanta Districts, residential construction was noted as steady.Real Estate growth was modest to moderate ...

Commercial construction strengthened modestly in most Districts since the previous report. ... Commercial leasing activity generally grew at a moderate pace.

emphasis added

Yellen: Expect Continued Growth, Further Reductions in Labor Slack, Inflation to Rise to 2 Percent

by Calculated Risk on 12/02/2015 12:02:00 PM

From Fed Chair Janet Yellen: The Economic Outlook and Monetary Policy

Let me now turn to where I see the economy is likely headed over the next several years. To summarize, I anticipate continued economic growth at a moderate pace that will be sufficient to generate additional increases in employment, further reductions in the remaining margins of labor market slack, and a rise in inflation to our 2 percent objective. I expect that the fundamental factors supporting domestic spending that I have enumerated today will continue to do so, while the drag from some of the factors that have been weighing on economic growth should begin to lessen next year. Although the economic outlook, as always, is uncertain, I currently see the risks to the outlook for economic activity and the labor market as very close to balanced.Yellen is prepared to raise rates this month.

Turning to the factors that have been holding down growth, as I already noted, the higher foreign exchange value of the dollar, as well as weak growth in some foreign economies, has restrained the demand for U.S. exports over the past year. In addition, lower crude oil prices have reduced activity in the domestic oil sector. I anticipate that the drag on U.S. economic growth from these factors will diminish in the next couple of years as the global economy improves and the adjustment to prior declines in oil prices is completed.

Although developments in foreign economies still pose risks to U.S. economic growth that we are monitoring, these downside risks from abroad have lessened since late summer. Among emerging market economies, recent data support the view that the slowdown in the Chinese economy, which has received considerable attention, will likely continue to be modest and gradual. China has taken actions to stimulate its economy this year and could do more if necessary. A number of other emerging market economies have eased monetary and fiscal policy this year, and economic activity in these economies has improved of late. Accommodative monetary policy is also supporting economic growth in the advanced economies. A pickup in demand in many advanced economies and a stabilization in commodity prices should, in turn, boost the growth prospects of emerging market economies.

A final positive development for the outlook that I will mention relates to fiscal policy. This year the effect of federal fiscal policy on real GDP growth has been roughly neutral, in contrast to earlier years in which the expiration of stimulus programs and fiscal policy actions to reduce the federal budget deficit created significant drags on growth. Also, the budget situation for many state and local governments has improved as the economic expansion has increased the revenues of these governments, allowing them to increase their hiring and spending after a number of years of cuts in the wake of the Great Recession. Looking ahead, I anticipate that total real government purchases of goods and services should have a modest positive effect on economic growth over the next few years.

Regarding U.S. inflation, I anticipate that the drag from the large declines in prices for crude oil and imports over the past year and a half will diminish next year. With less downward pressure on inflation from these factors and some upward pressure from a further tightening in U.S. labor and product markets, I expect inflation to move up to the FOMC's 2 percent objective over the next few years. Of course, inflation expectations play an important role in the inflation process, and my forecast of a return to our 2 percent objective over the medium term relies on a judgment that longer-term inflation expectations remain reasonably well anchored. In this regard, recent measures from the Survey of Professional Forecasters, the Blue Chip Economic Indicators, and the Survey of Primary Dealers have continued to be generally stable. The measure of longer-term inflation expectations from the University of Michigan Surveys of Consumers, in contrast, has lately edged below its typical range in recent years. However, this measure often seems to respond modestly, though temporarily, to large changes in actual inflation, and the very low readings on headline inflation over the past year may help explain some of the recent decline in the Michigan measure.6 Market-based measures of inflation compensation have moved up some in recent weeks after declining to historically low levels earlier in the fall. While the low level of these measures appears to reflect, at least in part, changes in risk and liquidity premiums, we will continue to monitor this development closely. Convincing evidence that longer-term inflation expectations have moved lower would be a concern because declines in consumer and business expectations about inflation could put downward pressure on actual inflation, making the attainment of our 2 percent inflation goal more difficult.

emphasis added

ADP: Private Employment increased 217,000 in November

by Calculated Risk on 12/02/2015 08:20:00 AM

Private sector employment increased by 217,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 183,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 13,000 jobs in November, down from 22,000 the previous month. The construction industry added 16,000 jobs after gaining over 30,000 in each of the two previous months. Meanwhile, manufacturing rebounded from two straight months of shedding jobs to add 6,000 in November.

Service-providing employment rose by 204,000 jobs in November, a strong increase from an upwardly revised 174,000 in October. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong and steady. The current pace of job creation is twice that needed to absorb growth in the working age population. The economy is fast approaching full employment and will be there no later than next summer.”

The BLS report for November will be released Friday, and the consensus is for 190,000 non-farm payroll jobs added in November.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey, Purchase Applications up 30% YoY

by Calculated Risk on 12/02/2015 07:02:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 27, 2015. This week’s results included an adjustment for the Thanksgiving holiday.

...

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index decreased 28 percent compared with the previous week and was 30 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.12 percent from 4.14 percent, with points increasing to 0.50 from 0.49 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

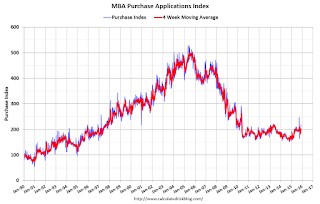

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 30% higher than a year ago.

Tuesday, December 01, 2015

Wednesday: Yellen Speech, ADP Employment, Beige Book

by Calculated Risk on 12/01/2015 08:16:00 PM

An excerpt from Tim Duy at Fed Watch: The Final Countdown

Bottom Line: Just how data-dependent is the Fed when it comes to December? Not much, I think. They are likely just looking for evidence that basic labor market trends remain intact to justify pulling the pin on higher rates. Absent any sharp financial disruptions or disastrous data, it looks like we are on the final countdown to the first rate hike of this cycle. Beyond that, they will proceed very cautiously; this is especially the case if they don’t see evidence of still-declining slack in the form of rising wages and inflation. And if the economy turns choppy as the drivers of recent growth loose their momentum, policy will turn choppy as well. Indeed, in such an environment, future rate hikes would likely comes in fits and starts. Thus while 100bp of tightening is a reasonable baseline for next year, the path is not likely to be a smooth 25bp every other meeting. That will likely pose some interesting communications challenges for the Fed.Wednesday:

emphasis added

• At 10:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 183,000 payroll jobs added in November, up from 182,000 in October.

• At 12:25 PM, Speech by Fed Chair Janet Yellen, Economic Outlook, At the Economic Club of Washington, Washington, D.C.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.