by Calculated Risk on 11/18/2015 09:38:00 AM

Wednesday, November 18, 2015

AIA: "Architecture Billings Index on Solid Footing" in October

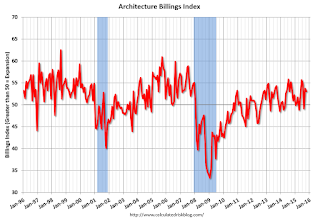

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index on Solid Footing

There has been increasing levels of demand for design services for nearly all construction project types for the majority of the year as revealed in the Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 53.1, down slightly from the mark of 53.7 in the previous month. This score still reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 58.5, down from a reading of 61.0 the previous month.

“Allowing for the possibility of occasional and minor backsliding, we expect healthy business conditions for the design and construction industry to persist moving into next year,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “One area of note is that the multi-family project sector has come around the last two months after trending down for the better part of the year.”

...

• Regional averages: South (56.2), West (54.4), Midwest (52.6), Northeast (49.2)

• Sector index breakdown: commercial / industrial (55.1), mixed practice (54.9), multi-family residential (52.5), institutional (51.4)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.1 in October, down from 53.7 in September. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for most of the year - suggesting a slowdown or less growth for apartments - but has now turned positive.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.

Housing Starts decreased to 1.060 Million Annual Rate in October

by Calculated Risk on 11/18/2015 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 1,060,000. This is 11.0 percent below the revised September estimate of 1,191,000 and is 1.8 percent below the October 2014 rate of 1,079,000.

Single-family housing starts in October were at a rate of 722,000; this is 2.4 percent below the revised September figure of 740,000. The October rate for units in buildings with five units or more was 327,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,150,000. This is 4.1 percent above the revised September rate of 1,105,000 and is 2.7 percent above the October 2014 estimate of 1,120,000.

Single-family authorizations in October were at a rate of 711,000; this is 2.4 percent above the revised September figure of 694,000. Authorizations of units in buildings with five units or more were at a rate of 405,000 in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in October. Multi-family starts are down year-over-year.

Most of the weakness in October was in the volatile multi-family sector.

Single-family starts (blue) decreased in October and are up year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),Total housing starts in October were below expectations, and starts for August and September were revised down slightly. I'll have more later ...

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey, Purchase Applications up 19% YoY

by Calculated Risk on 11/18/2015 07:01:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

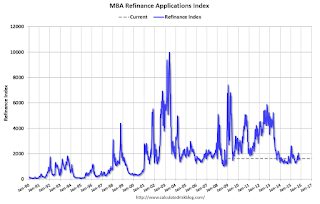

Mortgage applications increased 6.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 13, 2015. This week’s results included an adjustment for the Veterans Day holiday.

...

The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 12 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 19 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.18 percent, its highest level since July 2015, from 4.12 percent, with points remaining unchanged at 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 19% higher than a year ago.

Tuesday, November 17, 2015

Wednesday: Housing Starts, FOMC Minutes

by Calculated Risk on 11/17/2015 08:40:00 PM

Congress might shut down the government in December, from the WSJ: House Speaker Ryan Warns of Budget, Guantanamo Bay Confrontations With White House

Spending legislation needed to avoid a government shutdown in December must include Republican policy measures in order to pass Congress, House Speaker Paul Ryan (R., Wis.) said Tuesday.Shutting down the government is a bad idea.

Mr. Ryan didn’t rule out the possibility of a lapse in government funding when its current funding expires on Dec. 11, saying Republicans will force President Barack Obama to accept some conservative provisions, known as “riders” in the sweeping spending bill.

“There will have to be some riders in this for us to pass it through Congress,” Mr. Ryan said ...

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for October. Total housing starts increased to 1.206 million (SAAR) in September. Single family starts increased to 740 thousand SAAR in September. The consensus for 1.162 million, down from September.

• During the day, the AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

• At 2:00 PM, the Fed will release the FOMC Minutes for the Meeting of October 27-28, 2015

El Niño Update: Possibly "most powerful on record"

by Calculated Risk on 11/17/2015 04:31:00 PM

From the LA Times: El Niño could be the most powerful on record, scientists say

On the impact:

For the United States, El Niño can shift the winter track of storms that normally keeps the jungles of southern Mexico and Central America wet and moves them over California and the southern United States. The northern United States, like the Midwest and Northeast, typically see milder winters during El Niño.The South will probably be wetter than normal, and the north warmer. Typically growth picks up a little during an El Niño due to the milder winters in the midwest and northeast.

And on the data:

A key location of the Pacific Ocean is now hotter than recorded in at least 25 years, surpassing the temperatures during the record 1997 El Niño.

Some scientists say their measurements show that this year’s El Niño could be among the most powerful on record -- and even toppling the 1997 event from its pedestal.

“This thing is still growing and it’s definitely warmer than it was in 1997,” said Bill Patzert, climatologist with NASA’s Jet Propulsion Laboratory in La Cañada Flintridge. As far as the temperature readings go, "it’s now bypassed the previous champ of the modern satellite era -- the 1997 El Niño has just been toppled by 2015.”

Key Measures Show Inflation somewhat higher in October

by Calculated Risk on 11/17/2015 12:09:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in October. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.5% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for October here. Motor fuel was up a little in October following sharp declines in previous months.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.4% annualized rate) in October. The CPI less food and energy rose 0.2% (2.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy also rose 1.9%. Core PCE is for September and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.5% annualized, trimmed-mean CPI was at 2.5% annualized, and core CPI was at 2.5% annualized.

On a year-over-year basis, three of these measures suggest inflation remains below the Fed's target of 2% (median CPI is above 2%).

Inflation is still low, but appears to be moving up.

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q3

by Calculated Risk on 11/17/2015 10:28:00 AM

From the MBA: Mortgage Foreclosures and Delinquencies Continue to Drop

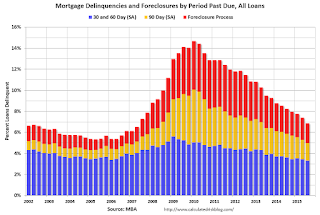

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.99 percent of all loans outstanding at the end of the third quarter of 2015. This was the lowest level since the first quarter of 2007. The delinquency rate decreased 31 basis points from the previous quarter, and 86 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 1.88 percent, down 21 basis points from the second quarter and 51 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the third quarter of 2007.

The percentage of loans on which foreclosure actions were started during the third quarter was 0.38 percent, a decrease of two basis points from the previous quarter, and down six basis points from one year ago. The foreclosure starts rate is at the lowest level since the second quarter of 2005.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 3.57 percent, a decrease of 38 basis points from last quarter, and a decrease of 108 basis points from last year. This was the lowest serious delinquency rate since the third quarter of 2007.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is about 85% of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and and is about 80% of the way back to normal.

So it has taken 5 1/2 years to reduce the backlog of seriously delinquent and in-foreclosure loans by over 80%, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal near the end of 2016. Most other mortgage measures are already back to normal, but the lenders are still working through the backlog of bubble legacy loans.

NAHB: Builder Confidence declines to 62 in November

by Calculated Risk on 11/17/2015 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 62 in November, down from 65 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Drops in November but Still Solid

Builder confidence in the market for newly constructed single-family homes slipped three points to 62 in November from an upwardly revised October reading on the NAHB/Wells Fargo Housing Market Index (HMI).

...

“The November report is pullback from an unusually high October, and is more in line with the consistent, modest growth that we have seen throughout the year,” said NAHB Chief Economist David Crowe. “A firming economy, continued job creation and affordable mortgage rates should keep housing on an upward trajectory as we approach 2016.”

...

Two of the three HMI components posted losses in November. The index measuring sales expectations in the next six months fell five points to 70, and the component gauging current sales conditions decreased three points to 67. Meanwhile, the index charting buyer traffic rose one point to 48.

Looking at the three-month moving averages for regional HMI scores, the West increased four points to 73 while the Northeast rose three points to 50. Meanwhile the Midwest and South held steady at 60 and 65, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 64, but still a strong reading.

Fed: Industrial Production decreased 0.2% in October

by Calculated Risk on 11/17/2015 09:26:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production declined 0.2 percent in October after decreasing the same amount in September. In October, the index for manufacturing moved up 0.4 percent, while the index for mining fell 1.5 percent and the index for utilities dropped 2.5 percent. For the third quarter as a whole, total industrial production is now estimated to have increased at an annual rate of 2.6 percent; a gain of 1.8 percent had been reported previously. At 107.2 percent of its 2012 average, total industrial production in October was 0.3 percent above its year-earlier level. Capacity utilization for the industrial sector declined 0.2 percentage point in October to 77.5 percent, a rate that is 2.6 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.6 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.5% is 2.6% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.2% in October to 107.2. This is 22.9% above the recession low, and 2.0% above the pre-recession peak.

This was below expectations of a 0.1% increase, however August and September were revised up.

CPI increased 0.2% in October

by Calculated Risk on 11/17/2015 08:35:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in October on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 0.2 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.2% increase for CPI, and also at the forecast of a 0.2% increase in core CPI.

The indexes for food, energy, and all items less food and energy all increased modestly in October. The food index, which increased 0.4 percent in September, rose 0.1 percent in October, with four of the six major grocery store food group indexes rising. The energy index, which declined in August and September, advanced 0.3 percent in October; major energy component indexes were mixed.

The index for all items less food and energy rose 0.2 percent in October, the same increase as in September. ... The index for all items less food and energy has risen 1.9 percent over the past 12 months; this is the same figure as the 12 months ending September.

emphasis added