by Calculated Risk on 10/30/2015 05:33:00 PM

Friday, October 30, 2015

Q3 2015 GDP Details on Residential and Commercial Real Estate

The BEA released the underlying details for the Q3 advance GDP report today.

Yesterday, the BEA reported that investment in non-residential structures decreased slightly in Q3.

The decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $88.6 billion annual rate in Q2 to a $75.0 billion annual rate in Q3. "Mining exploration, shafts, and wells" investment is down 49% year-over-year.

Excluding petroleum, non-residential investment in structures increased solidly in Q3.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q3, and is up 24% year-over-year -increasing from a very low level - and is still near the lows for previous recessions (as percent of GDP). .

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is up slightly year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q3, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 39% year-over-year.

Home improvement was the top category for twenty consecutive quarters following the housing bust ... but now investment in single family structures has been back on top for the last 7 quarters and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $211 billion (SAAR) (about 1.2% of GDP).

Investment in home improvement was at a $178 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (just under 1.0% of GDP).

These graphs show investment is generally increasing, but is still very low.

Restaurant Performance Index indicates slower expansion in September

by Calculated Risk on 10/30/2015 03:41:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index: Operators’ Sales Outlook at Two-Year Low

Although same-store sales and customer traffic remained positive in September, the National Restaurant Association’s Restaurant Performance Index (RPI) registered a modest decline. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.4 in September, down slightly from a level of 101.5 in August. Despite the decline, September represented the 31st consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

...

“The RPI's current situation indicators continued to illustrate growth in September, as both same-store sales and customer traffic remained positive,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “However, restaurant operators are more cautious about business conditions in the months ahead, as the proportion expecting a sales increase fell to a two-year low.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.4 in September, down from 101.5 in August. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. Even with this decline, the index is indicating expansion, and it appears restaurants are benefiting from lower gasoline prices.

Freddie Mac: Mortgage Serious Delinquency rate declined in September, Lowest since October 2008

by Calculated Risk on 10/30/2015 12:54:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in September to 1.41%, down from 1.45% in August. Freddie's rate is down from 1.96% in September 2014, and the rate in September was the lowest level since October 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for September soon.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.55 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until the second half of 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Chicago PMI increases Sharply, Final October Consumer Sentiment at 90.0

by Calculated Risk on 10/30/2015 10:00:00 AM

Chicago PMI: Oct Chicago Business Barometer Up 7.5 Points To 56.2

The Chicago Business Barometer increased 7.5 points to 56.2 in October from 48.7 in September, led by strong gains in both Production and New Orders.This was well above the consensus forecast of 49.2.

The sharp increase in the Barometer pushed it to the highest since January and marks a promising start to the fourth quarter, building on the small gain made in Q3.

...

Chief Economist of MNI Indicators Philip Uglow said, “The dissapointing September data look more like an aberration than the start of a trend, and the October results mark a good start to the final quarter of the year. Respondents were optimistic that orders will continue to pick-up, consistent with an acceleration in economic activity in Q4.“

emphasis added

Click on graph for larger image.

The final University of Michigan consumer sentiment index for October was at 90.0, down from the preliminary reading of 92.1, and up from 87.2 in September.

BEA: Personal Income increased 0.1% in September, Core PCE prices up 1.3% year-over-year

by Calculated Risk on 10/30/2015 08:32:00 AM

From the BEA, the Personal Income and Outlays report for September:

Personal income increased $18.6 billion, or 0.1 percent ... in September, according to the Bureau of Economic Analysis.On inflation: the PCE price index was up 0.2% year-over-year (the decline in oil prices pushed down the headline price index). However core PCE is only up 1.3% year-over-year - still way below the Fed's target.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in September, compared with an increase of 0.4 percent in August. ... The price index for PCE decreased 0.1 percent in September, compared with a decrease of less than 0.1 percent in August. The PCE price index, excluding food and energy, increased 0.1 percent in September, the same increase as in August.

The September price index for PCE increased 0.2 percent from September a year ago. The September PCE price index, excluding food and energy, increased 1.3 percent from September a year ago.

Thursday, October 29, 2015

Friday: Personal Income and Outlays, Employment Cost Index, Chicago PMI, Consumer Sentiment

by Calculated Risk on 10/29/2015 09:10:00 PM

Earlier today, the UCLA Ziman Center for Real Estate released some predictions for 2016:

[W]e are forecasting housing starts of 1.14 million units this year and 1.42 million units and 1.44 million units in 2016 and 2017, respectively. ...This housing start forecast for 2016 seems way too optimistic and I doubt the builders could ramp up that quickly. Also I doubt we will see 200 thousand jobs added per month through 2017; it takes less that 100 thousand jobs per month to hold the unemployment rate steady - and I've been expecting job growth to slow.

Our forecast is underpinned by continued growth in real GDP that will likely run at 3% in 2016, continued jobs gains in excess of 200,000 a month for most of the forecast period, relatively low mortgage rates at least through 2016 and household formations in excess of one million a year in 2016 and 2017.

Friday:

• At 8:30 AM ET, Personal Income and Outlays for September. The consensus is for a 0.2% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• Also at 8:30 AM, the Employment Cost Index for Q3. The consensus is for a 0.6% increase in Q3.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 49.2, up from 48.7 in September.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 92.5, up from the preliminary reading of 92.1.

Zillow Forecast: Expect September Year-over-year Change for Case-Shiller Index Similar to August

by Calculated Risk on 10/29/2015 06:10:00 PM

The Case-Shiller house price indexes for August were released Tuesday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: September Case-Shiller Forecast: Look for Continued Modest Growth in Pace of Appreciation

he August S&P Case-Shiller (SPCS) data published [Tuesday] showed home prices rising on a seasonally-adjusted monthly basis, with slight rises in the 10- and 20- city indices and almost half a percentage point rise in the national index.This suggests the year-over-year change for the September Case-Shiller National index will be about the same as in the August report.

We expect the September SPCS to show similar slight increases of 0.1 percent for the 10-City Index and 0.2 percent for the 20-City Index from August to September. The national index is expected to gain half of a percentage point over the same period (seasonally adjusted). We expect the 10- City and national indices to both grow 4.7 percent for the year ending in September, and the 20-City Index to grow 5.1 percent, the same rates of annual appreciation reported for August.

All SPCS forecasts are shown in the table below. These forecasts are based on today’s August SPCS data release and the September 2015 Zillow Home Value Index (ZHVI), released October 26. The SPCS Composite Home Price Indices for September will not be officially released until Tuesday, November 24.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| August Actual YoY | 4.7% | 4.7% | 5.1% | 5.1% | 4.7% | 4.7% |

| September Forecast YoY | 4.7% | 4.7% | 5.1% | 5.1% | 4.7% | 4.7% |

| September Forecast MoM | -0.1% | 0.1% | -0.1% | 0.2% | 0.0% | 0.5% |

Lawler: Builders say Labor Shortages Delaying Closings, Pushing Up Costs; and Some Other Observations

by Calculated Risk on 10/29/2015 03:04:00 PM

From housing economist Tom Lawler:

Several builders have released earnings and had earnings conference calls for the quarter ended September 30, 2015, and one of the key “themes” from builders was that resource “constraints,” specifically with respect to labor, slowed home closings last quarter, and in some cases contributed to weaker than expected net orders. PulteGroup, M/I Homes, Meritage Homes, and MDC Holdings all said, in one form or another, that labor “shortages” – laborers, land development, and various trades – had resulted both in accelerating labor costs and delays in land development and home construction. Most builders said that the main impact in terms of their operating results were lower-than-expected home closings last quarter, though one said that in some markets longer construction timelines appear to have led some buyers to forgo a home purchase.

Most builders noted that both land and labor costs had increased “significantly” of late, though costs of most materials were down. Several of the builders said that they were “able” to increase prices to match increases in overall construction costs in most markets, though at least one builder implied that price hikes in a few markets where costs had increased significantly may have led to fewer home orders.

While only one builder – Meritage -- gave specific numbers on the intra-quarterly patterrn of net home orders last quarter, the numbers were startling. According to a Meritage official, the YOY % change in the company’s net orders was +22% in July and +8% in August, but -15% in September. The official wasn’t sure what prompted the sharp slowdown in home orders in September, but he said he was pretty sure other builders say the same drop-off in sales in September. (Earlier this week Census reported that its preliminary estimate of new home sales fell sharply on a seasonally adjusted basis from August to September.) He also said that based on preliminary numbers it appeared as if net home orders would be up 10 to 15% YOY in October.

Commentary on first-time buyers has been mixed. PultgGroup showed a chart suggesting that 33% of its home deliveries last quarter were to “first-time buyers,” but in response to a question (about prices) an official said that PulteGroup was not so much focused on “entry-level” fist-time buyers but more on “affluent” first-time buyers purchasing homes in the $300,000-$400,000 range. M/I Homes said that it was “watching” for signs that the entry-level home buyer market was improving, and that it would be “ready to respond,” but that at present it had no new product plants designed for that market. Officials did note, however, that in the early part of last decade it sold a “substantial” number of sub-2,000 square-foot homes.

Meritage Homes, in contrast, said that it had seen an improvement in the demand from first-time buyers, and that it planned to increase its offerings of smaller, lower price homes over the next year.

On of the more striking aspects of the most recent “recovery” in single-family housing production has been the incredible low production levels of new single-family homes that are “affordable” to what used to be considered the “typical” first-time buyer.

While builders with a presence in Houston for the most part have downplayed the severity of the weakness in the Houston housing markets, Meritage officials gave some intra-quarterly color that suggested the market had deteriorated significantly over the past few months. Specifically, officials said that company’s sales cancellation rate have “spiked up,” and that sales has fallen “significantly,” over the past 60 days.

Flipping back to the “substantial” increase in labor costs at home builders, the BLS data on average hourly earnings for construction workers (including those involved in building single-family homes) does not show the sort of increases builders are reporting. One would assume, however, that they will soon.

Here is a summary of some selected stats from builders who have reported results for the quarter ended September 30, 2015.

| Net Orders | Settlements | Average Closing Price ($000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/15 | 9/14 | % Chg | 9/15 | 9/14 | % Chg | 9/15 | 9/14 | % Chg |

| PulteGroup | 4,092 | 3,779 | 8.3% | 4,356 | 4,646 | -6.2% | 336.0 | 334.0 | 0.6% |

| NVR | 3,258 | 2,936 | 11.0% | 3,607 | 3,236 | 11.5% | 380.4 | 366.2 | 3.9% |

| Meritage Homes | 1,567 | 1,500 | 4.5% | 1,712 | 1,522 | 12.5% | 387.0 | 358.0 | 8.1% |

| MDC Holdings | 1,109 | 1,081 | 2.6% | 1,080 | 1,093 | -1.2% | 421.1 | 370.6 | 13.6% |

| M/I Homes | 988 | 892 | 10.8% | 994 | 985 | 0.9% | 349.0 | 320.0 | 9.1% |

| Total | 11,014 | 10,188 | 8.1% | 11,749 | 11,482 | 2.3% | 366.0 | 348.5 | 5.0% |

Q3 GDP: Investment

by Calculated Risk on 10/29/2015 01:01:00 PM

The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline early last year was not a concern.

Residential investment (RI) increased at a 6.1% annual rate in Q3. Equipment investment increased at a 5.3% annual rate, and investment in non-residential structures decreased at a 4.0% annual rate. On a 3 quarter trailing average basis, RI (red) and equipment (green) are both positive, and nonresidential structures (blue) is slightly negative.

Note: Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery - and is now causing a slight decline. Other areas of nonresidential are now increasing significantly. I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward (except for energy and power), and for the economy to continue to grow at a steady pace.

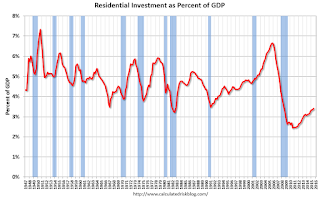

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP has been increasing, but is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

NAR: Pending Home Sales Index decreased 2.3% in September, up 3% year-over-year

by Calculated Risk on 10/29/2015 10:05:00 AM

From the NAR: Pending Home Sales Lose Further Steam in September

The Pending Home Sales Index, a forward–looking indicator based on contract signings, declined 2.3 percent to 106.8 in September from a slightly downwardly revised 109.3 in August but is still 3.0 percent above September 2014 (103.7). With last month's decline, the index is now at its second lowest level of the year (103.7 in January), but has still increased year–over–year for 13 straight months.This is well below expectations of a 1% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in October and November.

...

The PHSI in the Northeast fell 4.0 percent to 89.6 in September, but is still 3.9 percent above a year ago. In the Midwest the index declined 2.5 percent to 104.7 in September, but remains 4.3 percent above September 2014.

Pending home sales in the South decreased 2.6 percent to an index of 118.3 in September and are now 0.1 percent below last September. The index in the West inched back 0.2 percent in September to 104.4, but is still 6.6 percent above a year ago.

emphasis added