by Calculated Risk on 9/24/2015 10:19:00 AM

Thursday, September 24, 2015

New Home Sales increased to 552,000 Annual Rate in August

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 552 thousand.

The previous three months were revised down by a total of 8 thousand (SA).

"Sales of new single-family houses in August 2015 were at a seasonally adjusted annual rate of 552,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.7 percent above the revised July rate of 522,000 and is 21.6 percent above the August 2014 estimate of 454,000"

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales since the bottom, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in August to 4.7 months.

The months of supply decreased in August to 4.7 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of August was 216,000. This represents a supply of 4.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

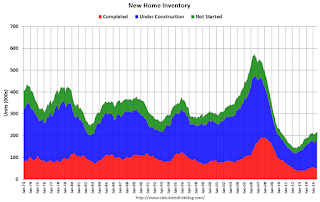

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2015 (red column), 46 thousand new homes were sold (NSA). Last year 36 thousand homes were sold in August. This is the highest for August since 2007.

The all time high for August was 110 thousand in 2005, and the all time low for August was 23 thousand in 2010.

This was well above expectations of 516,000 sales in August, and new home sales are on pace for solid growth in 2015. I'll have more later today.

Weekly Initial Unemployment Claims increased to 267,000

by Calculated Risk on 9/24/2015 08:33:00 AM

The DOL reported:

In the week ending September 19, the advance figure for seasonally adjusted initial claims was 267,000, an increase of 3,000 from the previous week's unrevised level of 264,000. The 4-week moving average was 271,750, a decrease of 750 from the previous week's unrevised average of 272,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 271,750.

This was below the consensus forecast of 275,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, September 23, 2015

Thursday: Yellen Speech, New Home Sales, Unemployment Claims, Durable Goods and More

by Calculated Risk on 9/23/2015 06:11:00 PM

Dr. Yellen's speech tomorrow could give hints on how close the Fed is to the first rate hike. There has been "some further improvement" in the labor market, but inflation is still below the Fed's target. Yellen's speech on Thursday is title "Inflation Dynamics and Monetary Policy"; she addresses the key topic!

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, up from 264 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.2% decrease in durable goods orders.

• Also at 8:30 AM, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 10:00 AM, New Home Sales for August from the Census Bureau. The consensus is for an increase in sales to 515 thousand Seasonally Adjusted Annual Rate (SAAR) in August from 507 thousand in July.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

• At 5:00 PM, Speech by Fed Chair Janet Yellen, "Inflation Dynamics and Monetary Policy", At the University of Massachusetts Amherst, Amherst, Massachusetts

Philly Fed: State Coincident Indexes increased in 41 states in August

by Calculated Risk on 9/23/2015 03:12:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for August 2015. In the past month, the indexes increased in 41 states, decreased in five, and remained stable in four, for a one-month diffusion index of 72. Over the past three months, the indexes increased in 44 states, decreased in five, and remained stable in one, for a three-month diffusion index of 78.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In August, 43 states had increasing activity (including minor increases).

The worst performing states over the last 6 months are West Virginia (coal), North Dakota (oil), Alaska (oil), Oklahoma (oil), New Mexico, and Kansas (self inflicted policy errors).

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green now. Note: Blue added for Red/Green issues.

China: Buiter and Krugman Views

by Calculated Risk on 9/23/2015 12:10:00 PM

First, excerpts from Citi's Willem Buiter's: Is China Leading the World into Recession?

In the Global Economics team, however, we believe that a moderate global recession scenario has become the most likely global macroeconomic scenario for the next two years or so. That does not mean that a moderate recession as described in this paper, starting in the second half of 2016, has a likelihood of more than 50%. We do believe that a recession is the most likely outcome during the next few years, but it is important to distinguish between a moderate recession without a regional or global financial crisis and a deep or severe recession accompanied by a regional or global financial crisis.And excerps from Professor Krugman: Chinese Spillovers

...

In our view, the probability of some kind of recession, moderate or severe, is therefore 55%. A global recession of some kind is our modal forecast. A moderate recession is our modal forecast if we decompose recession outcomes into moderate and severe ones and assign separate probabilities to them.

In this publication, we analyse how, starting from where we are now, the world economy could slide into recession, defined as an extended period of excess capacity: the level of potential output exceeds the level of actual output, or the actual unemployment rate is above the natural rate or Nairu. The recession scenario is that of a recession of moderate depth and duration, without a major regional or global financial crisis. We conclude that if the global economy slides into a recession of moderate depth and duration during 2016 and stays there for most of 2017 before staging a recovery, it will most likely be dragged down by slow growth in a number of key emerging markets (EMs), and especially in China. We see such a scenario as increasingly likely. Indeed, we consider China to be at high and rapidly rising risk of a cyclical hard landing.

China is clearly in economic trouble. But how worried should we be about spillovers from China’s woes to the rest of the world economy? I have in general been telling people “not very”, although it’s a bigger issue for Japan and Korea. But Citi’s Willem Buiter suggests that it could be a quite big deal, leading to a global recession. And Willem is a very smart guy; read his “Alice in Euroland“, from 1998 (!), warning of the dangers of EMU’s “lender of last resort vacuum.” So could he be right?CR comment: China is a major concern, but I think a recession in the US in 2016 is very unlikely.

...

Overall, I’m not convinced of the Buiter thesis; China still seems to me not big enough to bring down the rest of the world. But I’m not rock-solid in that conviction, largely because we’ve seen so much contagion in the past. Stay tuned.

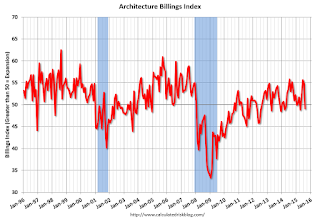

AIA: Architecture Billings Index indicated slight contraction in August

by Calculated Risk on 9/23/2015 09:04:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Backslides Slightly

The Architecture Billings Index (ABI) slipped in August after showing mostly healthy business conditions so far this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 49.1, down from a mark of 54.7 in July. This score reflects a slight decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.8, down from a reading of 63.7 the previous month.

“Over the past several years, a period of sustained growth in billings has been followed by a temporary step backwards,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The fact that project inquiries and new design contracts continue to grow at a healthy pace suggests that this should not be a cause for concern throughout the design and construction industry.”.

...

• Regional averages: Midwest (56.1), South (53.8), West (50.2) Northeast (46.8)

• Sector index breakdown: institutional (53.7), mixed practice (52.8), commercial / industrial (49.7) multi-family residential (49.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.1 in August, down from 54.7 in July. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for the seventh consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Applications up 27% YoY

by Calculated Risk on 9/23/2015 07:04:00 AM

From the MBA: Rate Decreases Drive Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 13.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 18, 2015. The previous week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index increased 18 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier to its highest level since June 2015. The unadjusted Purchase Index increased 20 percent compared with the previous week and was 27 percent higher than the same week one year ago.

“We saw significant rate volatility last week surrounding the FOMC meeting, and rate declines toward the end of the week likely drove applications from both prospective home buyers and borrowers looking to refinance. The 30-year fixed rate remained unchanged over the week even though there was substantial intra-week fluctuation, but we saw rate decreases in other loan products like the 15-year fixed, 5/1 ARM, and 30-year jumbo,” said Mike Fratantoni, MBA’s Chief Economist.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.09 percent, with points increasing to 0.45 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 27% higher than a year ago.

Tuesday, September 22, 2015

"Mortgage Rates Back Into High 3's"

by Calculated Risk on 9/22/2015 08:41:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the Day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Into High 3's

Mortgage rates got back on track today after giving up a fair amount of last week's gains yesterday. Most lenders are very close to Friday afternoon's levels, which were among the best in over 4 months. ...

Most lenders continue to operate in a range of 3.875%-4.0% for conventional 30yr fixed rate quotes, though some of the more aggressive lenders are moving down to 3.75%.

Using Nomimal GDP to Mislead: A Bogus Reagan Wikipedia Sentence

by Calculated Risk on 9/22/2015 04:15:00 PM

Numbers are numbers. They aren't political, but sometimes people misuse numbers to mislead.

After hearing that Joe Biden might consider running for President, I looked up how old Ronald Reagan was when he was first took office (in January 1981). The first article that came up was on Wikipedia (Reagan was 69 when he took office and turned 70 a few weeks later - Biden is currently 72).

Sadly I noticed this misleading sentence in the Wikipedia article:

"[Reagan's] economic policies saw a reduction of inflation from 12.5% to 4.4%, and an average annual growth of GDP of 7.91%; while Reagan did enact cuts in domestic spending, military spending increased federal outlays overall, even after adjustment for inflation."There are several problems with this sentence.

First, it was mostly Fed Chairman Paul Volcker's monetary policies that reduced inflation from 11.8% year-over-year (SA, current base) in January 1981, when Reagan entered office, to 4.5% in January 1989, when Reagan left office. (not sure why the numbers are incorrect in the article). Note: Volcker left the Fed in 1987 and was replaced by Greenspan.

Second, and more important, a casual reader will see the "even after adjustment for inflation" after the semi-colon, and think the author is reporting real GDP growth. The 7.91% is annualized nominal GDP growth. (Actually 7.4% from Q1 1981 to Q1 1989, another error).

For comparison, annualized nominal GDP growth under President Carter was 12.0%! (Q1 1977 to Q1 1981). Of course there was more inflation under Carter.

Of course all analysts, economists and journalists report real GDP growth (inflation adjusted). If someone mentions nominal GDP growth, they make it very clear why they are discussing "nominal" growth.

Real GDP increased at an annualized rate of 3.4% from Q1 1981 to Q1 1989, under President Reagan, and at a 3.4% rate under President Carter from Q1 1977 to Q1 1981.

Maybe we should shift the timing, but here are the numbers I used (from the BEA):

| Nominal GDP1 | Real GDP2 | |

|---|---|---|

| Q1 1977 | $1,992.5 | $5,799.2 |

| Q1 1981 | $3,131.8 | $6,635.7 |

| Q1 1989 | $5,527.4 | $8,697.7 |

| Annualized Growth | Annualized Real Growth | |

| Carter (4 Years) | 12.0% | 3.4% |

| Reagan (8 Years) | 7.4% | 3.4% |

| 1[Billions of dollars] Seasonally adjusted at annual rates 2[Billions of chained (2009) dollars] Seasonally adjusted at annual rates | ||

Third, the second half of the sentence is wrong too. While Reagan did enact SOME cuts in domestic spending, domestic spending increased faster than inflation under Reagan. Discretionary domestic spending increased under Reagan too, but less than inflation (probably the point the author was trying to make).

The bottom line: The entire sentence should be removed from the Wikipedia article.

Note: To compare GDP across periods, not only do we need to adjust for inflation, but we should also adjust for changes in the labor force. See: Demographics and GDP: 2% is the new 4%

Chemical Activity Barometer "Signals Slowdown of Economic Activity"

by Calculated Risk on 9/22/2015 12:41:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Cools; Signals Slowdown of Economic Activity

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), dropped 0.4 percent in September, following a revised 0.2 percent decline in August. The pattern shows a marked deceleration, even reversal, over second quarter activity. Data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 1.2 percent over this time last year, also a deceleration of annual growth. In September 2014, the CAB logged a 4.1 percent annual gain over September 2013. It is unlikely that growth will pick up through early 2016. ...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. ...

“Business activity cooled off in September,” said ACC Chief Economist Kevin Swift. “Chemical, other equity, and product prices all continued to suffer, signaling a likely slowdown in broader economic activity,” he added. “One bright spot continues to be plastic resins, particularly those used in light vehicles. Sales of light vehicles are on track to record a banner year, the best since 2000,” he said. Light vehicles are a key end use market for chemistry, containing nearly $3,500 of chemistry per vehicle.

Also at play is the ongoing decline in U.S. exports. According to Swift, global trade is lagging behind both global industrial production and broader economic activity with deflationary forces at play. With this month’s data, the CAB is signaling slower gains in U.S. business activity into early 2016.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests a slowdown in growth for industrial production.