by Calculated Risk on 9/23/2015 12:10:00 PM

Wednesday, September 23, 2015

China: Buiter and Krugman Views

First, excerpts from Citi's Willem Buiter's: Is China Leading the World into Recession?

In the Global Economics team, however, we believe that a moderate global recession scenario has become the most likely global macroeconomic scenario for the next two years or so. That does not mean that a moderate recession as described in this paper, starting in the second half of 2016, has a likelihood of more than 50%. We do believe that a recession is the most likely outcome during the next few years, but it is important to distinguish between a moderate recession without a regional or global financial crisis and a deep or severe recession accompanied by a regional or global financial crisis.And excerps from Professor Krugman: Chinese Spillovers

...

In our view, the probability of some kind of recession, moderate or severe, is therefore 55%. A global recession of some kind is our modal forecast. A moderate recession is our modal forecast if we decompose recession outcomes into moderate and severe ones and assign separate probabilities to them.

In this publication, we analyse how, starting from where we are now, the world economy could slide into recession, defined as an extended period of excess capacity: the level of potential output exceeds the level of actual output, or the actual unemployment rate is above the natural rate or Nairu. The recession scenario is that of a recession of moderate depth and duration, without a major regional or global financial crisis. We conclude that if the global economy slides into a recession of moderate depth and duration during 2016 and stays there for most of 2017 before staging a recovery, it will most likely be dragged down by slow growth in a number of key emerging markets (EMs), and especially in China. We see such a scenario as increasingly likely. Indeed, we consider China to be at high and rapidly rising risk of a cyclical hard landing.

China is clearly in economic trouble. But how worried should we be about spillovers from China’s woes to the rest of the world economy? I have in general been telling people “not very”, although it’s a bigger issue for Japan and Korea. But Citi’s Willem Buiter suggests that it could be a quite big deal, leading to a global recession. And Willem is a very smart guy; read his “Alice in Euroland“, from 1998 (!), warning of the dangers of EMU’s “lender of last resort vacuum.” So could he be right?CR comment: China is a major concern, but I think a recession in the US in 2016 is very unlikely.

...

Overall, I’m not convinced of the Buiter thesis; China still seems to me not big enough to bring down the rest of the world. But I’m not rock-solid in that conviction, largely because we’ve seen so much contagion in the past. Stay tuned.

AIA: Architecture Billings Index indicated slight contraction in August

by Calculated Risk on 9/23/2015 09:04:00 AM

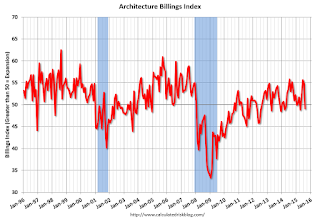

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Backslides Slightly

The Architecture Billings Index (ABI) slipped in August after showing mostly healthy business conditions so far this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 49.1, down from a mark of 54.7 in July. This score reflects a slight decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.8, down from a reading of 63.7 the previous month.

“Over the past several years, a period of sustained growth in billings has been followed by a temporary step backwards,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The fact that project inquiries and new design contracts continue to grow at a healthy pace suggests that this should not be a cause for concern throughout the design and construction industry.”.

...

• Regional averages: Midwest (56.1), South (53.8), West (50.2) Northeast (46.8)

• Sector index breakdown: institutional (53.7), mixed practice (52.8), commercial / industrial (49.7) multi-family residential (49.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.1 in August, down from 54.7 in July. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for the seventh consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Applications up 27% YoY

by Calculated Risk on 9/23/2015 07:04:00 AM

From the MBA: Rate Decreases Drive Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 13.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 18, 2015. The previous week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index increased 18 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier to its highest level since June 2015. The unadjusted Purchase Index increased 20 percent compared with the previous week and was 27 percent higher than the same week one year ago.

“We saw significant rate volatility last week surrounding the FOMC meeting, and rate declines toward the end of the week likely drove applications from both prospective home buyers and borrowers looking to refinance. The 30-year fixed rate remained unchanged over the week even though there was substantial intra-week fluctuation, but we saw rate decreases in other loan products like the 15-year fixed, 5/1 ARM, and 30-year jumbo,” said Mike Fratantoni, MBA’s Chief Economist.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) remained unchanged at 4.09 percent, with points increasing to 0.45 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 27% higher than a year ago.

Tuesday, September 22, 2015

"Mortgage Rates Back Into High 3's"

by Calculated Risk on 9/22/2015 08:41:00 PM

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the Day: The AIA's Architecture Billings Index for August (a leading indicator for commercial real estate).

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Into High 3's

Mortgage rates got back on track today after giving up a fair amount of last week's gains yesterday. Most lenders are very close to Friday afternoon's levels, which were among the best in over 4 months. ...

Most lenders continue to operate in a range of 3.875%-4.0% for conventional 30yr fixed rate quotes, though some of the more aggressive lenders are moving down to 3.75%.

Using Nomimal GDP to Mislead: A Bogus Reagan Wikipedia Sentence

by Calculated Risk on 9/22/2015 04:15:00 PM

Numbers are numbers. They aren't political, but sometimes people misuse numbers to mislead.

After hearing that Joe Biden might consider running for President, I looked up how old Ronald Reagan was when he was first took office (in January 1981). The first article that came up was on Wikipedia (Reagan was 69 when he took office and turned 70 a few weeks later - Biden is currently 72).

Sadly I noticed this misleading sentence in the Wikipedia article:

"[Reagan's] economic policies saw a reduction of inflation from 12.5% to 4.4%, and an average annual growth of GDP of 7.91%; while Reagan did enact cuts in domestic spending, military spending increased federal outlays overall, even after adjustment for inflation."There are several problems with this sentence.

First, it was mostly Fed Chairman Paul Volcker's monetary policies that reduced inflation from 11.8% year-over-year (SA, current base) in January 1981, when Reagan entered office, to 4.5% in January 1989, when Reagan left office. (not sure why the numbers are incorrect in the article). Note: Volcker left the Fed in 1987 and was replaced by Greenspan.

Second, and more important, a casual reader will see the "even after adjustment for inflation" after the semi-colon, and think the author is reporting real GDP growth. The 7.91% is annualized nominal GDP growth. (Actually 7.4% from Q1 1981 to Q1 1989, another error).

For comparison, annualized nominal GDP growth under President Carter was 12.0%! (Q1 1977 to Q1 1981). Of course there was more inflation under Carter.

Of course all analysts, economists and journalists report real GDP growth (inflation adjusted). If someone mentions nominal GDP growth, they make it very clear why they are discussing "nominal" growth.

Real GDP increased at an annualized rate of 3.4% from Q1 1981 to Q1 1989, under President Reagan, and at a 3.4% rate under President Carter from Q1 1977 to Q1 1981.

Maybe we should shift the timing, but here are the numbers I used (from the BEA):

| Nominal GDP1 | Real GDP2 | |

|---|---|---|

| Q1 1977 | $1,992.5 | $5,799.2 |

| Q1 1981 | $3,131.8 | $6,635.7 |

| Q1 1989 | $5,527.4 | $8,697.7 |

| Annualized Growth | Annualized Real Growth | |

| Carter (4 Years) | 12.0% | 3.4% |

| Reagan (8 Years) | 7.4% | 3.4% |

| 1[Billions of dollars] Seasonally adjusted at annual rates 2[Billions of chained (2009) dollars] Seasonally adjusted at annual rates | ||

Third, the second half of the sentence is wrong too. While Reagan did enact SOME cuts in domestic spending, domestic spending increased faster than inflation under Reagan. Discretionary domestic spending increased under Reagan too, but less than inflation (probably the point the author was trying to make).

The bottom line: The entire sentence should be removed from the Wikipedia article.

Note: To compare GDP across periods, not only do we need to adjust for inflation, but we should also adjust for changes in the labor force. See: Demographics and GDP: 2% is the new 4%

Chemical Activity Barometer "Signals Slowdown of Economic Activity"

by Calculated Risk on 9/22/2015 12:41:00 PM

Here is an indicator that I'm following that appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Cools; Signals Slowdown of Economic Activity

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), dropped 0.4 percent in September, following a revised 0.2 percent decline in August. The pattern shows a marked deceleration, even reversal, over second quarter activity. Data is measured on a three-month moving average (3MMA). Accounting for adjustments, the CAB remains up 1.2 percent over this time last year, also a deceleration of annual growth. In September 2014, the CAB logged a 4.1 percent annual gain over September 2013. It is unlikely that growth will pick up through early 2016. ...

Applying the CAB back to 1919, it has been shown to provide a lead of two to 14 months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. ...

“Business activity cooled off in September,” said ACC Chief Economist Kevin Swift. “Chemical, other equity, and product prices all continued to suffer, signaling a likely slowdown in broader economic activity,” he added. “One bright spot continues to be plastic resins, particularly those used in light vehicles. Sales of light vehicles are on track to record a banner year, the best since 2000,” he said. Light vehicles are a key end use market for chemistry, containing nearly $3,500 of chemistry per vehicle.

Also at play is the ongoing decline in U.S. exports. According to Swift, global trade is lagging behind both global industrial production and broader economic activity with deflationary forces at play. With this month’s data, the CAB is signaling slower gains in U.S. business activity into early 2016.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

And this suggests a slowdown in growth for industrial production.

Richmond Fed: "Manufacturing Sector Activity Generally Softened" in September

by Calculated Risk on 9/22/2015 10:03:00 AM

From the Richmond Fed: Manufacturing Sector Activity Generally Softened; Average Wages Grew Moderately

Fifth District manufacturing activity slowed in September, according to the most recent survey by the Federal Reserve Bank of Richmond. Order backlogs and new orders decreased, while shipments declined. Average wages continued to increase at a moderate pace this month, however manufacturing employment grew mildly.This was another weak regional manufacturing report.

Overall, manufacturing conditions weakened in September. The composite index for manufacturing decreased to a reading of −5, following last month's reading of 0. The index for shipments remained negative, only gaining one point to end at −3. Additionally, the volume of new orders decreased this month. At an index of −12, the September indicator lost 13 points from last month's reading of 1. Manufacturing employment increased mildly this month. The indicator added two points, ending at a reading of 3.

emphasis added

FHFA House Price Index Up 0.6 Percent in July, Up 5.8 Percent YoY

by Calculated Risk on 9/22/2015 09:08:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more).

From the FHFA: FHFA House Price Index Up 0.6 Percent in July

U.S. house prices rose in July, up 0.6 percent on a seasonally adjusted basis from the previous month, according to the Federal Housing Finance Agency (FHFA) monthly House Price Index (HPI). The previously reported 0.2 percent change in June remains unchanged.

The FHFA HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From July 2014 to July 2015, house prices were up 5.8 percent. The U.S. index is 1.1 percent below its March 2007 peak and is roughly the same as the November 2006 index level.

Click on graph for larger image.

Click on graph for larger image.This graph from the FHFA shows the FHFA purchase only index since 1991. The index is almost back to the March 2007 peak in nominal terms, but is well below the peak in real terms (adjusted for inflation).

Most of the other indexes are also showing the year-over-year change in the 5% range. For example, Case-Shiller was up 4.5% in June, and CoreLogic was up 6.9% in July.

Note: The July Case-Shiller index will be released next Tuesday, September 29th.

Monday, September 21, 2015

Lawler on Lennar: Net Home Orders Up by “Decent” Amount Last Quarter, Houston Weak

by Calculated Risk on 9/21/2015 07:36:00 PM

Tuesday:

• At 9:00 AM ET, FHFA House Price Index for July 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

• 10:00 AM, Richmond Fed Survey of Manufacturing Activity for September.

From housing economist Tom Lawler: Lennar: Net Home Orders Up by “Decent” Amount Last Quarter, Though Weakness in Houston Limits Overall Gain

Lennar Corporation reported that net home orders in the quarter ended August 31, 2015 totaled 6,495, up 10.3% from the comparable quarter of 2014. Regionally the “soft spot” in home orders was in Houston, where net orders (606) were down 12.0% from a year ago. Home deliveries last quarter totaled 6,318, up 15.8% from the comparable quarter of 2014, at an average sales price of $350,000, up 5.1% from a year earlier. The company’s order backlog at the end of August was 8,250, up 13.2% from last August, at an average order price of $366,000, up7.6% from a year ago.

On the conference call officials mentioned labor “shortages” in some areas and noted that labor costs were up about 10% over the last year. They also noted that land costs in many of its markets were up by well more than that. Officials said that the company’s “first-time buyer” share had increased from about 25% a year ago to 30%, and that the company was focusing a little more on less expensive homes, via a combination of higher density (and more attached homes), fewer amenities, and smaller size.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in August

by Calculated Risk on 9/21/2015 05:13:00 PM

Economist Tom Lawler sent me an updated table below of short sales, foreclosures and cash buyers for selected cities in August.

On distressed: Total "distressed" share is down in most of these markets. Distressed sales are up in the Mid-Atlantic due to an increase in foreclosures.

Short sales are down in all of these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jul- 2015 | Aug- 2014 | Aug- 2015 | Aug- 2014 | Aug- 2015 | Aug- 2014 | Aug- 2015 | Aug- 2014 | |

| Las Vegas | 6.2% | 11.5% | 7.0% | 8.9% | 13.2% | 20.4% | 28.2% | 32.1% |

| Phoenix | 2.7% | 3.9% | 4.3% | 6.2% | 7.0% | 10.1% | 22.6% | 25.2% |

| Sacramento | 4.3% | 6.4% | 3.8% | 5.4% | 8.0% | 11.8% | 18.8% | 20.2% |

| Minneapolis | 1.7% | 2.5% | 6.0% | 8.1% | 7.6% | 10.6% | ||

| Mid-Atlantic | 3.2% | 4.1% | 10.5% | 8.9% | 13.7% | 13.0% | 16.5% | 17.5% |

| Orlando | 3.6% | 7.2% | 21.0% | 25.7% | 24.6% | 32.9% | 35.5% | 42.2% |

| Florida SF | 3.6% | 6.0% | 16.6% | 21.2% | 20.2% | 27.3% | 33.6% | 38.6% |

| Florida C/TH | 2.3% | 4.3% | 15.3% | 19.1% | 17.6% | 23.3% | 59.7% | 64.5% |

| Bay Area CA* | 2.3% | 2.6% | 2.2% | 2.6% | 4.5% | 5.2% | 21.3% | 22.5% |

| So. California* | 3.2% | 4.2% | 3.9% | 4.3% | 7.1% | 8.5% | 21.8% | 24.9% |

| Rhode Island | 9.9% | 12.5% | ||||||

| Chicago (city) | 15.0% | 17.2% | ||||||

| Hampton Roads | 14.6% | 18.6% | ||||||

| Spokane | 10.1% | 11.1% | ||||||

| Northeast Florida | 26.2% | 32.5% | ||||||

| Toledo | 30.3% | 32.2% | ||||||

| Wichita | 22.4% | 25.7% | ||||||

| Tucson | 25.8% | 26.0% | ||||||

| Peoria | 17.3% | 21.3% | ||||||

| Georgia*** | 21.9% | 26.8% | ||||||

| Omaha | 16.9% | 18.3% | ||||||

| Pensacola | 30.6% | 32.7% | ||||||

| Richmond VA | 9.3% | 9.5% | 16.0% | 17.9% | ||||

| Memphis | 11.8% | 11.1% | ||||||

| Springfield IL** | 5.9% | 6.8% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||