by Calculated Risk on 9/16/2015 06:18:00 PM

Wednesday, September 16, 2015

Thursday: FOMC Announcement, Housing Starts, Unemployment Claims and More

The focus tomorrow will be on the FOMC announcement, but there is some important data that will be released too ... such as August housing starts and the preliminary annual employment bench mark revision (that is usually very close to final revision).

Thursday:

• At 8:30 AM ET, Housing Starts for August. Total housing starts increased to 1.206 million (SAAR) in July. Single family starts increased to 782 thousand SAAR in July. The consensus for 1.168, down from July.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for 275 thousand initial claims, unchanged from 275 thousand the previous week.

• At 10:00 AM, the Philly Fed manufacturing survey for September. The consensus is for a reading of 6.3, down from 8.3.

• Also at 10:00 AM, the 2015 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS:

"Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The final benchmark revision will be issued with the publication of the January 2016 Employment Situation news release in February."• 2:00 PM: FOMC Meeting Announcement. The FOMC might raise the Fed Funds rate at this meeting.

• 2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• 2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

Key Measures Show Low Inflation in August

by Calculated Risk on 9/16/2015 02:31:00 PM

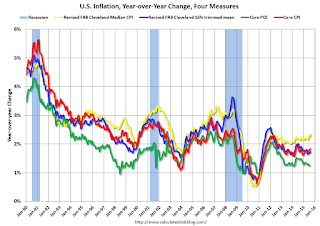

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in August. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for August here. Motor fuel was down sharply in August.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.1% (-0.8% annualized rate) in August. The CPI less food and energy rose 0.1% (0.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.8%. Core PCE is for July and increased 1.2% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.2% annualized, and core CPI was at 0.9% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is above 2%).

Inflation is still low.

August Update: Early Look at Cost-Of-Living Adjustments indicates NO increase in 2016

by Calculated Risk on 9/16/2015 11:21:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) decreased 0.3 percent over the last 12 months to an index level of 233.366 (1982-84=100). For the month, the index declined 0.2 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

Since the highest Q3 average was last year (Q3 2014), at 234.242, we only have to compare to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

By law, COLA can't be negative, so if the average for CPI-W is down year-over-year, COLA is set to zero (no adjustment).

CPI-W was down 0.3% year-over-year in August. We still need the data for September too, but it looks like COLA will be zero this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA, the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Method for determining the base

The formula for determining the OASDI contribution and benefit base is set by law. The formula is applicable only if a cost-of-living increase becomes effective for December of the year in which a determination of the base would ordinarily be made. ...This is based on a one year lag. The National Average Wage Index is not available for 2014 yet, but wages probably increased again in 2014. If wages increased the same as last year, then the contribution base next year would be increased to around $120,000 from the current $118,500. However, if COLA is zero, the contribution base will remain at $118,500.

This is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September). Based on data for July and August, it appears COLA will be zero.

NAHB: Builder Confidence at 62 in September, Highest in almost 10 Years

by Calculated Risk on 9/16/2015 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 62 in September, up from 61 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Continues to Rise

Builder confidence in the market for newly constructed single-family homes continued its steady rise in September with a one point increase to a level of 62 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). It is the highest reading since November 2005.

...

"NAHB is projecting about 1.1 million total housing starts this year,” said NAHB Chief Economist David Crowe. “Today's report is consistent with our forecast, and barring any unexpected jolts, we expect housing to keep moving forward at a steady, modest rate through the end of the year.”

...

Two of the three HMI components posted gains in September. The index measuring buyer traffic increased two points to 47, and the component gauging current sales conditions rose one point to 67. Meanwhile, the index charting sales expectations in the next six months dropped from 70 to 68.

Looking at the three-month moving averages for regional HMI scores, the West and Midwest each rose one point to 64 and 59, respectively. The South posted a one-point gain to 64 and the Northeast dropped one point to 46.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast of 61.

CPI decreased 0.1% in August

by Calculated Risk on 9/16/2015 08:34:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) decreased 0.1 percent in August on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 0.2 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.1% decrease for CPI, and below the forecast of a 0.2% increase in core CPI.

The gasoline index declined sharply in August and was the main cause of the seasonally adjusted all items decrease. ...

The index for all items less food and energy increased 0.1 percent in August, the same increase as in July. ... The 12-month change in the index for all items less food and energy also remained the same, at 1.8 percent for the 12 months ending August.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 9/16/2015 07:04:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 11, 2015. The week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index decreased 9 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 16 percent compared with the previous week and was 5 percent higher than the same week one year ago. The Labor Day holiday shifted from the first week in September last year to the second week this year.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.09 percent from 4.10 percent, with points increasing to 0.42 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015 (after the increase earlier this year).

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 5% higher than a year ago - but that is probably too low due to the shift in timing of Labor Day. Last week, the MBA reported the index was up 41% YoY. Next week will be a better YoY comparison.

Tuesday, September 15, 2015

Wednesday: CPI, Homebuilder Survey

by Calculated Risk on 9/15/2015 08:50:00 PM

From Tim Duy at Bloomberg: Why the Fed Is Likely to Stand Pat This Week

Bottom Line: The Federal Reserve is looking for a time with minimal downside risks to raise interest rates. The wavering global economy is likely creating enough downside risk to defer that first hike to a later meeting. But the Fed still wants to begin normalizing policy, and it will signal that it remains committed to a rate hike this year. Regardless of the global situation and the inflation picture, I suspect it will feel increasingly compelled to do just that as the unemployment rate drifts below 5 percent.Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Consumer Price Index for August from the BLS. The consensus is for a 0.1% decrease in CPI, and a 0.2% increase in core CPI.

• At 10:00 AM, the September NAHB homebuilder survey. The consensus is for a reading of 61, unchanged from August. Any number above 50 indicates that more builders view sales conditions as good than poor.

Lawler: Early Read on Existing Home Sales in August

by Calculated Risk on 9/15/2015 04:27:00 PM

From housing economist Tom Lawler:

Based on publicly-released realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.54 million, down 0.9% from July’s preliminary pace (which I believe should be revised upward; see below), but up 10.8% from last July’s seasonally adjusted pace.

Local realtor/MLS reports also suggest that the NAR’s estimate of the inventory of existing home sales at the end of August should be down about 0.9% from July, and down about 4.7% from last August. Finally, local realtor/MLS data would suggest that the NAR’s estimate of the median existing SF home sales price in August was up by about from last August.

Post-Mortem on July’s Existing Home Sales Report: NAR’s Estimate of Sales in the South Seems Low

Last month the NAR estimated that US existing home sales ran at a seasonally adjusted annual rate of 5.59 million in July – far above the “consensus” forecast but just slightly below my forecast based on realtor/MLS reports available prior to the EHS report. Based on more complete realtor/MLS reports for July, it appears to me that the NAR’s estimate for existing home sales in the South for July was too low. The NAR estimated that existing home sales on an unadjusted basis totaled 220,000 in the South in July, up 10% from the previous July’s pace. State and local realtor/MLS reports for that region, however, strongly suggest that the YOY sales gain in the South was several percentage points higher. To be sure, state realtor reports cover a significantly wider geographic area than does the NAR’s sample used to generate regional sales estimates (the NAR sample mainly includes just metro areas), and it is possible that the NAR’s estimate won’t be revised upward even though sales in the region clearly saw faster YOY growth than the NAR’s estimates suggest. But my “best guess” is that the NAR’s existing home sales estimate for July should be revised upward.

CR Note: The NAR release for August is scheduled for Monday, Sept. 21, 2015.

WSJ: "For the Fed, Markets May Be Flashing a Wait Sign"

by Calculated Risk on 9/15/2015 03:23:00 PM

First a quote that is probably correct ...

"I suspect way more economists than traders think the Fed will go this week. While way more traders than economists think the Fed should." Joseph Weisenthal

This is an important point from Greg Ip at the WSJ: For the Fed, Markets May Be Flashing a Wait Sign

The Federal Reserve owes no allegiance to the stock market. Its responsibility is to the actual economy—employment, output, inflation.The Fed isn't directly concerned about market volatility. However they would be concerned if the volatility signals economic weakness.

But sometimes, markets send the Fed important signals about the actual economy, and this may be one of those times.

As Fed policy makers ponder Wednesday and Thursday whether and when to raise rates, an important factor in their decision will be whether to wait to see if the recent turmoil in stocks, bonds and currencies points to unanticipated troubles in the global economy.

CoreLogic: "CoreLogic Reports 759,000 US Properties Regained Equity in the Second Quarter of 2015"

by Calculated Risk on 9/15/2015 10:58:00 AM

From CoreLogic: CoreLogic Reports 759,000 US Properties Regained Equity in the Second Quarter of 2015

CoreLogic ... today released a new analysis showing 759,000 properties regained equity in the second quarter of 2015, bringing the total number of mortgaged residential properties with equity at the end of Q2 2015 to approximately 45.9 million, or 91 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by $691 billion in Q2 2015. The total number of mortgaged residential properties with negative equity is now at 4.4 million, or 8.7 percent of all mortgaged properties. This compares to 5.1 million homes, or 10.2 percent, that had negative equity in Q1 2015, a quarter-over-quarter decrease of 1.5 percentage points. Compared with 5.4 million homes, or 10.9 percent, reported for Q2 2014, the number of underwater homes has decreased year over year by 1.1 million, or 19.4 percent.

... Of the more than 50 million residential properties with a mortgage, approximately 9 million, or 17.8 percent, have less than 20 percent equity (referred to as “under-equitied”), and 1.1 million, or 2.3 percent, have less than 5 percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near-negative equity are considered at risk of moving into negative equity if home prices fall. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged residential properties in negative equity at 20.6 percent, followed by Florida (18.5 percent), Arizona (15.4 percent), Rhode Island (13.8 percent) and Illinois (13.1 percent). Combined, these five states accounted for 31.7 percent of negative equity in the U.S."

Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago.

The second graph shows the distribution of home equity in Q2 2015 compared to Q1 2015. In Q2, 3.3% of residential properties have 25% or more negative equity, down from 3.8% in Q1 2015.

The second graph shows the distribution of home equity in Q2 2015 compared to Q1 2015. In Q2, 3.3% of residential properties have 25% or more negative equity, down from 3.8% in Q1 2015.In Q2 2014, there were 5.4 million properties with negative equity - now there are 4.4 million. A significant change.