by Calculated Risk on 8/09/2015 10:55:00 PM

Sunday, August 09, 2015

Sunday Night Futures

From the WSJ: Oil Futures Signal Weak Prices Could Last Years

Benchmark U.S. oil futures for September delivery are nearing the six-year low hit in March. But contracts for delivery in later years have taken an even bigger hit, with prices for 2016 and 2017 already trading below their March lows.This would be good news for consumers (bad news for producers).

That indicates that investors, traders and oil companies see the global glut of crude oil persisting beyond this year.

Weekend:

• Schedule for Week of August 9, 2015

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 4 and DOW futures are up 20 (fair value).

Oil prices were down over the last week with WTI futures at $43.65 per barrel and Brent at $48.34 per barrel. A year ago, WTI was at $97, and Brent was at $104 - so prices are down over 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.60 per gallon (down about $0.85 per gallon from a year ago). Gasoline prices should follow oil prices down.

Update: Framing Lumber Prices down Year-over-year

by Calculated Risk on 8/09/2015 10:36:00 AM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices are down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts.

Overall the decline in prices is probably due to more supply, and less demand from China.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through July 2015 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down about 14% from a year ago, and CME futures are down around 24% year-over-year.

Saturday, August 08, 2015

Schedule for Week of August 9, 2015

by Calculated Risk on 8/08/2015 08:11:00 AM

The key economic report this week is July Retail sales on Thursday.

For manufacturing, the July Industrial Production and Capacity Utilization report will be released this week.

For prices, PPI will be released on Friday.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

9:00 AM: NFIB Small Business Optimism Index for July.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for June from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in May to 5.363 million from 5.334 million in April.

The number of job openings (yellow) were up 16% year-over-year, and Quits were up 8% year-over-year.

2:00 PM ET: The Monthly Treasury Budget Statement for July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to be unchanged at 270 thousand.

8:30 AM ET: Retail sales for July will be released.

8:30 AM ET: Retail sales for July will be released.This graph shows retail sales since 1992 through June 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were down 0.3% from May to June (seasonally adjusted), and sales were up 1.4% from June 2014.

The consensus is for retail sales to increase 0.5% in July, and to increase 0.4% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.3% increase in inventories.

11:00 AM: the New York Fed will Release the Q2 2015 Household Debt and Credit Report

8:30 AM ET: The Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.1%.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 93.5, up from 93.1 in July.

Friday, August 07, 2015

Mortgage News Daily: Mortgage Rates at 4%

by Calculated Risk on 8/07/2015 09:19:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Surprisingly Calm After Jobs Report

Most lenders continue to quote conventional 30yr fixed rates of 4.0% on top tier scenarios, but with slightly lower closing costs today. The more aggressive lenders are increasingly able to quote 3.875% after these sorts of moves, though others are still stuck at 4.125% unless bond markets improve a bit further.Here is a table from Mortgage News Daily:

As of today, rates have improved for 3 straight weeks. ...

emphasis added

Merrill: Employment Report and a September Fed Rate Hike

by Calculated Risk on 8/07/2015 06:05:00 PM

An excerpt from a research piece by Merrill Lynch economist Micheal Hanson:

After the July employment report largely matched expectations, we anticipate that the FOMC should see enough cumulative progress to start the hiking cycle at the September meeting — the chance that liftoff occurs then continues to creep up, in our view. That said, there are still another five weeks until that meeting. With data dependence as the focus of the Fed, unexpected shocks or a broad-based slowdown in the data could still lead the Committee to delay hiking. The bigger question for some Fed officials and market participants is low inflation. We expect continued labor market gains to leave the FOMC “reasonably confident” on the inflation outlook come September — something they should communicate in upcoming speeches.It seems more and more likely that the Fed will hike in September.

emphasis added

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 8/07/2015 01:03:00 PM

By request, here is another update of an earlier post through the July employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,073 |

| GW Bush 1 | -844 |

| GW Bush 2 | 381 |

| Obama 1 | 2,018 |

| Obama 2 | 6,7321 |

| 130 months into 2nd term: 10,771 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 844,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 463,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 2,018,000 more private sector jobs at the end of Mr. Obama's first term. Thirty months into Mr. Obama's second term, there are now 8,750,000 more private sector jobs than when he initially took office.

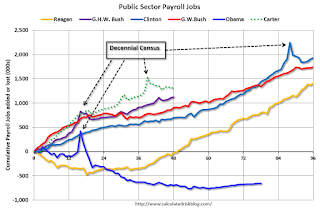

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 656,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -702 |

| Obama 2 | 461 |

| 130 months into 2nd term, 74 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

For the public sector, the cutbacks are clearly over at the state and local levels, and it appears cutbacks at the Federal level might also be over. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Here is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the third best for total job creation.

Note: Only 46 thousand public sector jobs have been added during the first thirty months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is about 5% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,073 | 1,242 | 11,315 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 6,732 | 46 | 6,778 | |

| Pace2 | 10,771 | 74 | 10,845 | |

| 130 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 231 | 267 | ||

| #2 | 186 | 252 | ||

| #3 | 146 | 223 | ||

July Employment Report Comments and more Graphs

by Calculated Risk on 8/07/2015 09:52:00 AM

Earlier: July Employment Report: 215,000 Jobs, 5.3% Unemployment Rate

This was a solid employment report with 215,000 jobs added, and employment gains for May and June were revised up slightly.

There was even a little wage growth, from the BLS: "In July, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $24.99. Over the year, average hourly earnings have risen by 2.1 percent." Weekly hours increased slightly in July.

A few more numbers: Total employment increased 215,000 from June to July and is now 3.7 million above the previous peak. Total employment is up 12.4 million from the employment recession low.

Private payroll employment increased 210,000 from June to July, and private employment is now 4.2 million above the previous peak. Private employment is up 13.0 million from the recession low.

In July, the year-over-year change was just over 2.9 million jobs.

Note: The unemployment rate at 5.3%, and still little real wage growth - and a higher than normal level of people working part time for economic reasons - indicates slack in the labor market. My view, partially based on demographics, is that the unemployment rate can fall below 5% without a significant pickup in inflation.

Overall this was a solid report.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate declined in July to 80.7%, and the 25 to 54 employment population ratio declined to 77.1%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased 2.1% YoY - and although the series is noisy - it does appear wage growth is trending up a little. Wages will probably pick up a little more this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in July at 6.3 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in July to 6.32 million from 6.51 million in June. This is the lowest level since Sept 2008 and suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 10.4% in July (lowest level since June 2008).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.18 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 2.12 million in June.

This is trending down, but is still high.

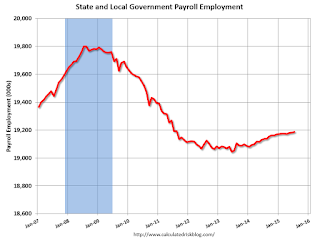

State and Local Government

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. (Note: Scale doesn't start at zero to better show the change.) In July 2015, state and local governments added five thousand jobs. State and local government employment is now up 145,000 from the bottom, but still 613,000 below the peak.

State and local employment is now generally increasing - slowly. And Federal government layoffs appear to have ended (Federal payrolls were unchanged in July, and Federal employment is up 3,000 year-to-date).

Overall this was a solid employment report for July and indicates further improvement in the labor market.

July Employment Report: 215,000 Jobs, 5.3% Unemployment Rate

by Calculated Risk on 8/07/2015 08:44:00 AM

From the BLS:

Total nonfarm payroll employment increased by 215,000 in July, and the unemployment rate was unchanged at 5.3 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in retail trade, health care, professional and technical services, and financial activities.

...

The change in total nonfarm payroll employment for May was revised from +254,000 to +260,000, and the change for June was revised from +223,000 to +231,000. With these revisions, employment gains in May and June combined were 14,000 higher than previously reported.

...

In July, average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $24.99. Over the year, average hourly earnings have risen by 2.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 215 thousand in July (private payrolls increased 210 thousand).

Payrolls for May and June were revised up by a combined 14 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In July, the year-over-year change was over 2.9 million jobs.

That is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was unchanged in July at 62.6%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in July at 5.3%.

This was slightly above expectations of 212,000 jobs, and revisions were up, and some wage growth ... a solid report.

I'll have much more later ...

Thursday, August 06, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 8/06/2015 06:37:00 PM

From Goldman Sachs:

We forecast nonfarm payroll growth of 225k in July, in line with consensus expectations. Many labor market indicators were softer in July, but some important service sector indicators, such as ISM nonmanufacturing employment, were significantly stronger. On balance, we expect job growth roughly consistent with the 223k increase in June. We expect the unemployment rate to hold steady at 5.3%. Participation should at least partially rebound following an unexpected dip in June that likely reflected calendar effects. Finally, average hourly earnings are likely to rise 0.2% month-over-month in July.From Merrill Lynch:

We expect a solid 215,000 gain in payrolls and a 0.3% rise in average hourly earnings. The unemployment rate should hold steady at 5.3%.From Nomura:

[W]e forecast a 225k increase in private payrolls, with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 230k workers. ... We forecast that average hourly earnings for private employees rose by 0.24% m-o-m in July, bouncing back from the weak flat reading in June. Last, we expect the unemployment rate to remain unchanged at 5.3% as the drop in labor force participation in June appeared anomalous and could show some rebound in July.Friday:

• At 8:30 AM ET, the Employment Report for July. The consensus is for an increase of 212,000 non-farm payroll jobs added in July, down from the 223,000 non-farm payroll jobs added in June. The consensus is for the unemployment rate to be unchanged at 5.3%.

• At 3:00 PM, Consumer Credit for June from the Federal Reserve. The consensus is for an increase of $17.4 billion in credit.

Payroll Employment and Seasonal Factors

by Calculated Risk on 8/06/2015 03:10:00 PM

The seasonal adjustment for July is a little tricky, so this might be a good time to review the seasonal pattern for employment.

Even in the best of years there are a significant number of jobs lost in the months of January and July. In 1994, when the economy added almost 3.9 million jobs, there were 2.25 million lost in January 1994 Not Seasonally Adjusted (NSA), and almost 1 million payroll jobs lost in July of that year (NSA).

Last year, in July 2014, 1.11 million total jobs were lost (NSA), however all of the decline in non-farm payrolls NSA was from the public sector (teacher layoffs). Usually those teachers return to the payrolls in September and early October. Since this happens every year, the BLS applies a seasonal adjustment before reporting the headline number.

Although there were 1.11 million jobs lost in July 2014 (NSA), after the seasonal adjustment, the BLS reported 209 thousand non-farm jobs were added (SA) .

For the private sector, there are always a large number of jobs lost in January (retailers and others cutting jobs) and some jobs lost in September (summer hires let go).

This graph shows the seasonal pattern since 2002 for both total non-farm jobs and private sector only payroll jobs. Notice the large spike down every January.

Also notice the second large spike down every July for public sector jobs (teachers).

In July 2014, there are about 1.3 million teacher jobs lost (NSA), and that was seasonally adjusted to a 5 thousand job gain. This will be something to check in the jobs report tomorrow.

The key point is this series needs a seasonal adjustment, but the adjustment can be tricky.