by Calculated Risk on 7/21/2015 02:59:00 PM

Tuesday, July 21, 2015

Existing Home Sales: Lawler vs. the Consensus

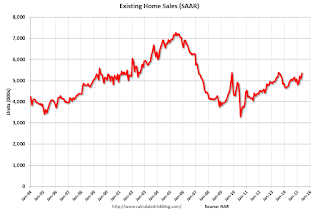

The NAR will report June Existing Home Sales tomorrow, Wednesday, July 22nd at 10:00 AM.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.40 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.45 million on a seasonally adjusted annual rate (SAAR) basis, up from 5.35 million SAAR in May.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 5 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last five years, the consensus average miss was 145 thousand with a standard deviation of 155 thousand. Lawler's average miss was 67 thousand with a standard deviation of 47 thousand.

Note: Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | --- |

| 1NAR initially reported before revisions. | |||

DOT: Vehicle Miles Driven increased 2.7% year-over-year in May, Rolling 12 Months at All Time High

by Calculated Risk on 7/21/2015 11:59:00 AM

People are driving more!

The Department of Transportation (DOT) reported:

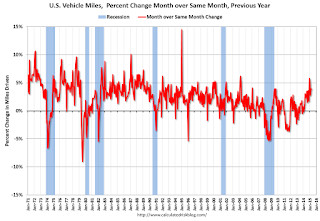

Travel on all roads and streets changed by 2.7% (7.3 billion vehicle miles) for May 2015 as compared with May 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 275.1 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for May 2015 is 262.1 billion miles, a 3.4% (8.7 billion vehicle miles) increase over May 2014. It also represents a 0.2% change (0.6 billion vehicle miles) compared with April 2015.

The rolling 12 month total is moving up, after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

The second graph shows the year-over-year change from the same month in the previous year.

In May 2015, gasoline averaged of $2.80 per gallon according to the EIA. That was down significantly from May 2014 when prices averaged $3.75 per gallon.

In May 2015, gasoline averaged of $2.80 per gallon according to the EIA. That was down significantly from May 2014 when prices averaged $3.75 per gallon. Gasoline prices aren't the only factor - demographics is also key. However, with lower gasoline prices, miles driven - on a rolling 12 month basis - is at a new high.

BLS: Twenty-One States had Unemployment Rate Decreases in June

by Calculated Risk on 7/21/2015 10:13:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in June. Twenty-one states and the District of Columbia had unemployment rate decreases from May, 12 states had increases, and 17 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nebraska had the lowest jobless rate in June, 2.6 percent. West Virginia had the highest rate, 7.4 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. West Virginia, at 7.4%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Only one state (West Virginia) and D.C. are still at or above 7% (dark blue).

Monday, July 20, 2015

WSJ: "Bidding Wars Return to Home Market"

by Calculated Risk on 7/20/2015 05:27:00 PM

From Kris Hudson at the WSJ: Bidding Wars Return to Home Market

Bidding wars, a hallmark of last decade’s housing boom, are making a comeback in a number of metro areas across the U.S. But while the earlier wars reflected enthusiasm fueled by easy-money mortgages, the current froth stems from a market short of homes for sale.There are number of reasons inventory is still low, even with higher prices. People shouldn't overlook the obvious impact of investor buying on inventory. Three years ago I wrote:

The reasons for the scant supply are myriad, including a much-slower-than-expected recovery in home construction. Yet an equally significant problem is that millions of people aren’t listing their homes for sale because they suspect they can’t qualify for a new mortgage, can’t afford the costs associated with a sale or fear that they won’t prevail in the scrum for the few houses available.

At the end of May, there were 2.3 million existing U.S. homes for sale, enough supply to last 5.1 months at the current sales pace. That is below the six to seven months of supply that the National Association of Realtors says is needed for a balanced market.

But in more than one-third of the 300 largest metropolitan areas tracked by Realtor.com, homes listed for sale in June had been on the market for a median of less than two months. A low median figure indicates rapid turnover in inventory as demand for homes exceeds supply.

One key is the substantial increase in investor owned single family homes. These are not "flippers", but cash flow investors - and these investors will not sell just because prices have risen a few percent (I've talked with some of these investors, and they many are making 8% to 12% cash-on-cash after expenses - and they have no intention of selling in the near term). Economist Tom Lawler discussed this back in February, and concluded that a significant "share of the decline in the share of homes for sale reflects the acquisition of SF (and condo) properties by investors as multi-year rental properties".Investor buying has slowed, and there has even been some selective selling:

Blackstone Group LP’s Invitation Homes, after spending more than $9 billion in a U.S. property-buying spree, is starting to sell some houses as it shifts focus from rapid expansion to fine-tuning its holdings.So maybe we will see a little more inventory.

The housing landlord has agreed to sell about 1,300 Atlanta-area residences that don’t fit its strategy, which targets communities with higher rents and quality schools, according to Chief Executive Officer John Bartling. The transaction would be the biggest bulk sale for the 3-year-old company, the largest U.S. owner of single-family homes.

Tuesday:

• At 10:00 AM ET, the Federal Reserve will release the Annual revision for Industrial Production and Capacity Utilization

• Also at 10:00 AM, Regional and State Employment and Unemployment for June.

A comment on Interest Only Mortgage Loans

by Calculated Risk on 7/20/2015 02:07:00 PM

Some people incorrectly blame "subprime" for the financial crisis. Others blame interest only loans. Neither are toxic if underwritten correctly.

From Diana Olick at CNBC: Interest-only mortgages: They're baaack

They were the villains of the housing crash. Federal regulators called them toxic. Now interest-only mortgages are making a comeback, but these are not the loans of yesteryear or yester-housing booms.There were several problems with mortgage lending in the mid-2000s. There was widespread use of subprime and Alt-A loans with risk layering. Risk layering might have included qualifying at a teaser rate, 100%+ loan-to-value financing, negative amortizing loans, interest only, and/or, self-underwritten loans - so-called stated income loans.

"I think it's opening the door back to responsible lending, giving people choices," said Mat Ishbia, president and CEO of Michigan-based United Wholesale Mortgage, the second-largest lender through brokers in the nation.

The company announced Monday it is now offering interest-only loans through brokers, with significant safeguards. Borrowers must put 20 percent down, ensuring that they have the "skin in the game" that so many did not during the heady days of the housing boom. They must have at least a 720 FICO credit score, which is well above average, and they must qualify on what the payments will be once they're adjusted higher, not at the starter rate.

A subprime or interest only loan, underwritten properly, is a reasonable mortgage product (such as described in the article). However if the lender starts layering risk, then the product could be dangerous.

If you want to understand Subprime and Alt-A, here are two great posts from my former co-blogger Tanta:

What Is "Subprime"?

Reflections on Alt-A

CoreLogic: Southern California June Home Sales up 18% Year-over-year

by Calculated Risk on 7/20/2015 11:27:00 AM

From the LA Times: Southern California home sales soar in June; prices climb 5.7%

On Thursday, fresh evidence of that trend emerged in a report from CoreLogic. Home sales posted a sizable 18.1% pop in June from a year earlier ...The NAR will release existing home sales for June on Wednesday at 10:00 AM ET. The consensus is for sales of 5.40 million on seasonally adjusted annual rate (SAAR) basis, up about 8% from June 2014.

The sales increase, the largest in nearly three years, put the number of sales just 9.6% below average, CoreLogic said. A year ago, sales were nearly 24% below average.

Notably, it appears more families are entering the market as the economy improves. Although still elevated in comparison to long-term averages, the share of absentee buyers — mostly investors — slid to 21.1%, the lowest percentage since April 2010, CoreLogic said.

...

Leslie Appleton-Young, chief economist for the California Assn. of Realtors, cautioned that the market still has too few homes for sale and that prices have risen to a point where many can't afford a house.

Unless that changes, sales are unlikely to reach levels in line with historical norms, she said.

“I am not saying the housing market isn't robust,” she said. “I think housing affordability is a big issue...."

emphasis added

LA area Port Traffic: Weakness in June

by Calculated Risk on 7/20/2015 09:57:00 AM

Note: There were some large swings in LA area port traffic earlier this year due to labor issues that were settled on February 21st. Port traffic surged in March as the waiting ships were unloaded (the trade deficit increased in March too), and port traffic declined in April. Perhaps traffic in June is closer to normal.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.4% compared to the rolling 12 months ending in May. Outbound traffic was down 0.9% compared to 12 months ending in May.

The recent downturn in exports might be due to the strong dollar and weakness in China.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down 5% year-over-year in June; exports were down 10% year-over-year.

The labor issues are now resolved, and the distortions from the labor issues are behind us. This data suggests a slightly larger trade deficit with Asia in June.

Sunday, July 19, 2015

Sunday Night Futures

by Calculated Risk on 7/19/2015 09:11:00 PM

First, a reminder of what Professor Tim Duy wrote earlier this year:

I tend agree that the net impact [from the decline in oil prices] will be positive, but note that the negative impacts will be fairly concentrated and easy for the media to sensationalize, while the positive impacts will be fairly dispersed. We all know what is going to happen to rig counts, high-yield energy debt, and the economies of North Dakota and at least parts of Texas. "Kablooey," I think, is the technical term. Easy media fodder. Much more difficult to see the positive impact spread across the real incomes of millions of households, with particularly solid gains at the lower ends of the income distribution. This will be most likely revealed in the aggregate data and be much less newsworthy.I added to Duy's observation by noting that the negative impacts would happen quicker than the positive impacts, but lower oil prices would still be an overall positive for 2015.

emphasis added

Now from Justin Lahart at the WSJ: Cheap Oil Should Fuel Economy at Last

It looks like better days [in oil producing states] are in the offing. Federal Reserve data released last week showed that the sharp downdraft in drilling activity eased in June. And after falling by more half in the first six months of the year, Baker Hughes ’s weekly count of U.S. oil rigs has just leveled out.Weekend:

Layoff announcements in the energy sector have also fallen back lately. And Goldman’s Mr. Pandl calculates that, adjusting for seasonal swings, initial claims for unemployment insurance in the five states above have also cooled off.

So at the least, the drag from oil on the economy should diminish in the months ahead, putting U.S. growth on a better footing in the second half of the year. What’s more, consumers may start spending more of the money they have been saving at the pump.

• Schedule for Week of July 19, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are flat and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $50.78 per barrel and Brent at $56.99 per barrel. A year ago, WTI was at $103, and Brent was at $106 - so prices are down about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.76 per gallon (down about $0.82 per gallon from a year ago).

EIA: West Coast Gasoline Prices "likely to remain elevated until later this summer"

by Calculated Risk on 7/19/2015 11:38:00 AM

An interesting article from the EIA: California gasoline prices rise further as lengthier supply chain is strained. A few excerpts:

West Coast spot prices for conventional gasoline increased sharply last week, while falling slightly on the Gulf Coast and remaining flat on the East Coast. The Los Angeles, California, spot price for conventional gasoline increased nearly 90 cents per gallon (cents/gal) between July 6 and July 13, while San Francisco, California, and Portland, Oregon prices increased 24 cents/gal and 5 cents/gal, respectively (Figure 1). This most recent price rise results from a delay in receipts of waterborne imports of gasoline blending components and a decrease in total motor gasoline inventories within an already constrained supply chain.

Click on graph for larger image.

Click on graph for larger image.West Coast spot gasoline prices typically trade at a premium to prices in other regions of the country because of the region's unique product specifications and relative isolation from other domestic and international markets. As a result, West Coast gasoline markets are primarily supplied by in-region production, and prices react more quickly and strongly during times of local supply shortages. The West Coast gasoline spot price differential has been higher than usual for the past several months following a series of supply disruptions caused by an unplanned refinery outage in February and additional refinery outages in April. Also, West Coast gasoline demand is up 4% in the first four months of 2015 compared with the same time last year, putting additional pressure on the supply chain.

...

Other periods of price spikes have occurred in California, most notably in 2008, 2009, and 2012, that were similar in duration and magnitude to the current situation. By early June of this year, the other refineries were back in operation so only the Torrance refinery remains down. Prices will likely stabilize again when imports and inventories increase, but are likely to remain elevated until the repairs to the Torrance refinery are completed later this summer.

Saturday, July 18, 2015

Schedule for Week of July 19, 2015

by Calculated Risk on 7/18/2015 08:22:00 AM

The key reports this week are June New Home sales on Friday, and June Existing Home Sales on Wednesday.

No economic releases scheduled.

10:00 AM ET: Regional and State Employment and Unemployment for June.

10:00 AM: The Federal Reserve will release the Annual revision for Industrial Production and Capacity Utilization

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for May 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 5.40 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 5.35 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.45 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 279 thousand from 281 thousand.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

11:00 AM: the Kansas City Fed manufacturing survey for July.

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the April sales rate.

The consensus is for an increase in sales to 550 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 546 thousand in May.