by Calculated Risk on 7/13/2015 05:56:00 PM

Monday, July 13, 2015

Tuesday: Retail Sales

The verdict is almost unanimous. The Greek deal is bad for Greece, bad for Germany and bad for Europe. Everyone loses.

It appears the negotiations became personal - and destructive. Europe was Schäuble'd.

From the WSJ: Third Time’s the Charm? Little Optimism Over New Greece Bailout

The plan repeats the central features of the previous bailouts in 2010 and 2012. In return for loans, Greece’s creditors—other eurozone governments and the International Monetary Fund—want to see stringent fiscal retrenchment as well as market-oriented overhauls of Greece’s economy.The definition of insanity: "doing the same thing over and over again and expecting different results." (attributed to Einstein).

...

Although heavy austerity greatly reduced Greece’s budget deficit, the economic collapse meant that its ratio of debt to gross domestic product—an indicator of solvency—rose even higher. ...

Critics including many economists and some policy makers have leveled a string of criticisms at Greece’s earlier bailouts. Among the most common charges: The scale and pace of fiscal austerity proved to be an overdose that Greece’s sclerotic economy and unstable political system couldn’t cope with. Forecasts for growth, tax revenues and privatization revenues were overly optimistic.

Tuesday:

• At 8:30 AM ET, Retail sales for June will be released. The consensus is for retail sales to increase 0.3% in June, and to increase 0.6% ex-autos.

• At 9:00 AM, NFIB Small Business Optimism Index for June.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.2% increase in inventories.

The Shrinking Deficit

by Calculated Risk on 7/13/2015 02:37:00 PM

From the WSJ: U.S. Annual Budget Deficit Remains Near 7-Year Low in June

The U.S. reported a $52 billion surplus in June, a month in which the government in recent decades has typically generated a surplus on account of corporate and individual taxes collected at month’s end.The most recent CBO projection was for the fiscal 2015 budget deficit to be 2.7% of GDP. Right now it looks like fiscal 2015 will be closer to 2.4% (a significant change).

The monthly surplus brought the budget deficit over the past 12 months to $431 billion, down nearly 20% from a year earlier.

...

Meanwhile, Congress has yet to raise the federal debt limit. The Treasury has been using emergency measures since mid-March to avoid breaching the ceiling.

The Treasury hasn’t said how long it might be able to do that, but budget analysts have said the emergency measures could last until November or December.

Zillow Forecast: Expect Case-Shiller National House Price Index up 4.0% year-over-year change in May

by Calculated Risk on 7/13/2015 11:59:00 AM

The Case-Shiller house price indexes for April were released two weeks ago. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Case-Shiller Expected to Continue Recent Leveling-Off Trend in May

The April S&P/Case-Shiller (SPCS) data published [2 weeks ago] showed home prices continuing to rise slightly less than 5 percent annually for both the 10- and 20-city indices, and slightly more than 4 percent annually for the national index. April marks the eighth consecutive month in which the national home price index has appreciated at a less than 5 percent annual appreciation rate (seasonally adjusted).So the year-over-year change in for May Case-Shiller National index will be about the same as in the April report.

In April, the 10-city index appreciated at an annual rate of 4.6 percent, compared to 4.9 percent for the 20-City Index (SA). The non-seasonally adjusted (NSA) 10-City Index was up 1 percent month-over-month, while the 20-City index rose 1.1 percent (NSA) from March to April. We expect the change from April to May to show increases of more than 1 percent (NSA) for both the 10- and 20-city indices.

All Case-Shiller forecasts are shown in the table below. ... Officially, the SPCS Composite Home Price Indices for May will not be released until Tuesday, July 28.

| Zillow Case-Shiller Forecast | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller Composite 10 | Case-Shiller Composite 20 | Case-Shiller National | ||||

| NSA | SA | NSA | SA | NSA | SA | |

| April Actual YoY | 4.6% | 4.6% | 4.9% | 4.9% | 4.2% | 4.2% |

| May Forecast YoY | 4.7% | 4.7% | 5.0% | 5.0% | 4.0% | 4.0% |

| May Forecast MoM | 1.1% | 0.2% | 1.2% | 0.3% | 1.0% | 0.0% |

Greek Deal

by Calculated Risk on 7/13/2015 10:08:00 AM

From the WSJ: Eurozone Leaders Reach Unanimous Agreement on Greece

Eurozone leaders said Monday morning that they would give Greece up to €86 billion ($96 billion) in fresh bailout loans as long as the government of Prime Minister Alexis Tsipras manages to implement a round of punishing austerity measures in the coming days.From the Financial Times: Eurozone leaders reach deal on Greece

The beatings will continue until morale improves.

Sunday, July 12, 2015

Sunday Night Futures: Uncertainty in Europe

by Calculated Risk on 7/12/2015 08:29:00 PM

After some absurd demands from Germany, it appears there might be some movement towards a deal with Greece tonight. But maybe not ... crazy.

Monday:

• At 2:00 PM ET, the Monthly Treasury Budget Statement for June.

Weekend:

• Schedule for Week of July 12, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 11 and DOW futures are down 87 (fair value).

Oil prices were down over the last week with WTI futures at $52.13 per barrel and Brent at $58.00 per barrel. A year ago, WTI was at $102, and Brent was at $105 - so prices are down almost 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.77 per gallon (down about $0.85 per gallon from a year ago).

Greece Update: No Deal ... Yet

by Calculated Risk on 7/12/2015 11:43:00 AM

From the Financial Times: France and Germany split over bid to break Greece deadlock

While Paris is backing Greek plans for a deal, Berlin is leading a group of sceptical countries that insist that Athens first passes significant reform laws in the next few days before negotiations can begin on a new rescue programme.From the WSJ: Greek Deal Prospects Slim as Eurozone Leaders Convene

excerpt with permission

Finance ministers from the currency area convened earlier in the day, and discussed a draft statement that contains a “timeout” for Greece from the eurozone as a potential option, two European officials said Sunday. The statement, which may still change, will form the basis for crisis talks of eurozone leaders later Sunday, these officials said.Too funny. Offered "debt resturcturing" if Grexit? It is called bankruptcy.

The statement says that “in case no agreement [on a new bailout program] could be reached, Greece should be offered swift negotiations on a timeout from the euro area, with possible debt restructuring,” one official said. The sentence is still in brackets, indicating that it doesn’t have the backing of all 19 eurozone countries.

However, French President François Hollande later said, “There is no temporary Grexit. There is only Grexit or not Grexit.”

From Bloomberg: Tsipras Calls for Honest Compromise With EU Struggling to Trust

“The situation is extremely difficult if you consider the economic situation in Greece and the worsening in the last few months, but what has been lost also in terms of trust and reliability,” German Chancellor Angela Merkel told reporters as she arrived.

Saturday, July 11, 2015

Schedule for Week of July 12, 2015

by Calculated Risk on 7/11/2015 08:11:00 AM

The key economic reports this week are June Housing Starts on Friday, and June Retail sales on Tuesday.

For manufacturing, the June Industrial Production and Capacity Utilization report, and the July NY Fed (Empire State) and Philly Fed surveys, will be released this week.

For prices, CPI will be released on Friday, and PPI on Wednesday.

Fed Chair Janet Yellen will present the Semiannual Monetary Policy Report to the Congress on Wednesday and Thursday.

2:00 PM ET: The Monthly Treasury Budget Statement for June.

8:30 AM ET: Retail sales for June will be released.

8:30 AM ET: Retail sales for June will be released.This graph shows retail sales since 1992 through May 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were up 1.2% from April to May (seasonally adjusted), and sales were up 2.7% from May 2014.

The consensus is for retail sales to increase 0.3% in June, and to increase 0.6% ex-autos.

9:00 AM: NFIB Small Business Optimism Index for June.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.2% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.1% increase in core PPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for July. The consensus is for a reading of 3.5, up from -2.0 last month (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.1%.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Financial Services, U.S. House of Representatives

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 282 thousand from 297 thousand.

10:00 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 11.5, down from 15.2 last month (above zero indicates expansion).

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 59, unchanged from 59 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core CPI.

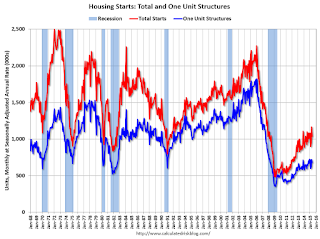

8:30 AM: Housing Starts for June.

8:30 AM: Housing Starts for June. Total housing starts decreased to 1.036 million (SAAR) in May. Single family starts decreased to 680 thousand SAAR in May.

The consensus is for total housing starts to increase to 1.125 million (SAAR) in June.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 96.2, up from 96.1 in June.

Friday, July 10, 2015

Hotels: On Pace for Record Occupancy in 2015

by Calculated Risk on 7/10/2015 06:15:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 4 July

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 28 June through 4 July 2015, according to data from STR, Inc.For the same week in 2009, ADR (average daily rate) was $95.16 and RevPAR (Revenue per available room) was $54.94. ADR is up 25% since June 2009, and RevPAR is up almost 50%!

In year-over-year measurements, the industry’s occupancy increased 3.6 percent to 68.3 percent. Average daily rate for the week was up 6.2 percent to US$119.20. Revenue per available room increased 10.1 percent to finish the week at US$81.45.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate will be high during the summer travel season.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and this year will probably be the best year ever for hotels.

The summer season will probably be strong with lower gasoline prices.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Sacramento Housing in June: Sales up 22%, Inventory down 10% YoY

by Calculated Risk on 7/10/2015 03:08:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But over the last 3 years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In June, total sales were up 21.7% from June 2014, and conventional equity sales were up 25.4% compared to the same month last year.

In June, 10.7% of all resales were distressed sales. This was up from 9.8% last month, and down from 13.3% in June 2014.

The percentage of REOs was at 4.8% in June, and the percentage of short sales was 5.8%. Note: It has been some time since there were more short sales than REO sales in a given month.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 10.0% year-over-year (YoY) in June. This was the second consecutive monthly YoY decrease in inventory in Sacramento (a big change).

Cash buyers accounted for 16.0% of all sales (frequently investors).

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.

Fed Chair Yellen: Expect to raise the federal funds rate later this year

by Calculated Risk on 7/10/2015 12:34:00 PM

From Fed Chair Janet Yellen: Recent Developments and the Outlook for the Economy Excerpt:

My own outlook for the economy and inflation is broadly consistent with the central tendency of the projections submitted by FOMC participants at the time of our June meeting. Based on my outlook, I expect that it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy. But I want to emphasize that the course of the economy and inflation remains highly uncertain, and unanticipated developments could delay or accelerate this first step. We will be watching carefully to see if there is continued improvement in labor market conditions, and we will need to be reasonably confident that inflation will move back to 2 percent in the next few years.

Let me also stress that this initial increase in the federal funds rate, whenever it occurs, will by itself have only a very small effect on the overall level of monetary accommodation provided by the Federal Reserve. Because there are some factors, which I mentioned earlier, that continue to restrain the economic expansion, I currently anticipate that the appropriate pace of normalization will be gradual, and that monetary policy will need to be highly supportive of economic activity for quite some time. The projections of most of my FOMC colleagues indicate that they have similar expectations for the likely path of the federal funds rate. But, again, both the course of the economy and inflation are uncertain. If progress toward our employment and inflation goals is more rapid than expected, it may be appropriate to remove monetary policy accommodation more quickly. However, if progress toward our goals is slower than anticipated, then the Committee may move more slowly in normalizing policy.

emphasis added