by Calculated Risk on 6/10/2015 07:52:00 PM

Wednesday, June 10, 2015

Thursday: Retail Sales, Unemployment Claims, Q1 Flow of Funds

From the Financial Times: Anxious Greeks pull money from banks amid fears of capital controls

“Last month the amounts being moved by individual depositors were noticeably smaller, between €200,000 and €100,000. We’re getting to the bottom of the barrel,” [said an Athens-based banking analyst], estimating Greeks had stashed about €5bn under mattresses and floorboards since January.By the time they impose capital controls, all of the money will be gone.

except with permission

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 276 thousand from 275 thousand.

• Also at 8:30 AM, Retail sales for May will be released. The consensus is for retail sales to increase 1.3% in May, and to increase 0.8% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for April. The consensus is for a 0.2% increase in inventories.

• At 12:00 PM, Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

The Shrinking Deficit

by Calculated Risk on 6/10/2015 02:36:00 PM

From the WSJ: U.S. Annual Budget Deficit Falls Near Seven-Year Low

Over the past 12 months, the budget deficit has narrowed to $412 billion, down from $460 billion in April and $491 billion a year earlier. That marks the lowest 12-month deficit since August 2008.The most recent CBO projection was for the fiscal 2015 budget deficit to be 2.7% of GDP. Right now it looks like fiscal 2015 will be closer to 2.4% (a significant change).

...

The brighter budget outlook means the deficit could fall below projections made by analysts just a few months ago. The Congressional Budget Office forecast in March that the federal deficit would rise to $486 billion this year, from $485 billion last year.

Meanwhile, Congress has yet to raise the federal debt limit. The Treasury has been using emergency measures since mid-March to avoid breaching the ceiling.

The Treasury hasn’t yet said how long it might be able to do that, but the CBO estimated in March that those measures should last until October or November.

Quarterly Services Survey suggests upward revision to Q1 GDP

by Calculated Risk on 6/10/2015 11:18:00 AM

From Reuters: U.S. services data suggest upward revision to Q1 GDP

The Commerce Department's quarterly services survey ... showed consumption, including healthcare spending, increased at a faster clip than the government had assumed in its second estimate of gross domestic product published last month.Here is the Q1 Quarterly Services Press Release

JPMorgan said the data suggested first-quarter consumer spending could be bumped up ... together with revisions for construction spending, trade and wholesale inventory data, suggests first-quarter GDP could be revised to show it contracting at a 0.2 percent rate instead of the 0.7 percent pace of decline the government reported last month.

FNC: Residential Property Values increased 5.3% year-over-year in April

by Calculated Risk on 6/10/2015 10:01:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their April 2015 index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 1.2% from March to April (Composite 100 index, not seasonally adjusted).

The 10 city MSA increased 1.7% in April, and the 20-MSA and 30-MSA RPIs both increased 1.6% and 1.4% respectively. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was higher in April than in March, with the 100-MSA composite up 5.3% compared to April 2014.

The index is still down 17.5% from the peak in 2006 (not inflation adjusted).

This graph shows the year-over-year change based on the FNC index (four composites) through April 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the other indexes are also showing the year-over-year change mostly steady at around 5% for the last several months.

Note: The March Case-Shiller index will be released on Tuesday, June 30th.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Index up 15% YoY

by Calculated Risk on 6/10/2015 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 8.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 5, 2015. The previous week’s results included an adjustment for the Memorial Day holiday. ...

The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 10 percent from one week earlier. The unadjusted Purchase Index increased 20 percent compared with the previous week and was 15 percent higher than the same week one year ago.

“Mortgage application volume rebounded strongly in the week following the Memorial Day holiday, indicating that the holiday had a larger impact on business activity than originally assumed. Comparing volume over the past two weeks, purchase activity is up over 6 percent, while refinance activity is down 5 percent. Strong job gains in May and initial signs of wage growth are supporting the purchase market,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.17 percent, its highest level since November 2014, from 4.02 percent, with points increasing to 0.38 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

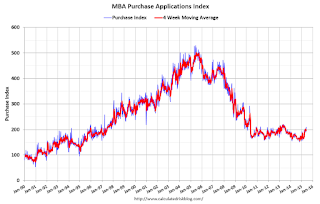

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The increase this week was probably related to the holiday adjustment. With higher rates, refinance activity should decline.

2014 was the lowest year for refinance activity since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 15% higher than a year ago.

Tuesday, June 09, 2015

Wednesday: Q1 Quarterly Services Report

by Calculated Risk on 6/09/2015 07:30:00 PM

Mortgage rates are still down year-over-year, but it is getting close.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Right Back to 2015 Highs

Mortgage rates bounced back up to the highest levels of 2015 today. ...Wednesday:

Most lenders remain at 4.125% for conventional 30yr fixed quotes on top tier scenarios, but an increasing number of them moved up to 4.25% today.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Q1 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for May.

CoreLogic: "Number of Loans in Foreclosure Lowest Since 2007"

by Calculated Risk on 6/09/2015 04:37:00 PM

From CoreLogic: Number of Loans in Foreclosure Lowest Since November 2007

CoreLogic reported today that the national foreclosure inventory fell by 24.9 percent year over year in April 2015 to approximately 521,000 homes, or 1.4 percent of all homes with a mortgage. This marks 42 months of consecutive year-over-year declines ... Also in April 2015, the 12-month sum of completed foreclosures continued to decline, dropping by 19.8 percent to 538,000 since April 2014. The seriously delinquent inventory fell to 1.4 million loans, a 22.1-percent year-over-year decline.

Click on graph for larger image.

Click on graph for larger image.The report today was for April. Here is a map from the March report that shows foreclosure inventory by state.

Some key "bubble" states - like Arizona and California - have mostly recovered.

Several judicial foreclosure states - like New Jersey and Florida - are still struggling.

From CoreLogic today:

Judicial foreclosure states, on average, continued to have higher foreclosure rates than non-judicial states, averaging 2.3 percent and 0.7 percent, respectively, in April 2015. The foreclosure rate for judicial states peaked in February 2012 at 5.4 percent, while non-judicial states experienced peak foreclosure rates in January 2011. As of April 2015, 42 percent of outstanding mortgages were in judicial states, but 70 percent of total loans in foreclosure were in those states.

Las Vegas Real Estate in May: Sales Decreased 2.5% YoY

by Calculated Risk on 6/09/2015 12:31:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports steady home sales and prices with tight housing supply

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in May was 3,363, down from 3,450 one year ago. Compared to May 2014, 2.6 percent fewer homes and 2.2 percent fewer condos and townhomes sold this May.There are several key trends that we've been following:

...

GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. In May, 7.3 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 7.9 percent one year ago. Another 8.0 percent of May sales were bank-owned, down 9.1 percent from one year ago.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in May was 13,569, down 0.5 percent from one year ago. GLVAR tracked a total of 3,470 condos, high-rise condos and townhomes listed for sale on its MLS in May, down 4.8 percent from one year ago.

By the end of May, GLVAR reported 7,133 single-family homes listed without any sort of offer. That’s up 7.8 percent from one year ago. For condos and townhomes, the 2,268 properties listed without offers in May represented a 0.4 percent increase from one year ago.

emphasis added

1) Overall sales were down 2.5% year-over-year.

2) Conventional (equity, not distressed) sales were unchanged year-over-year. In May 2014, 83.0% of all sales were conventional equity. In May 2015, 84.7% were standard equity sales. Note: In May 2013 (two years ago), only 57.9% were equity! There was a significant change from 2013 to 2014.

3) The percent of cash sales has declined year-over-year from 40.2% in May 2014 to 29.1% in May 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 7.8% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

| Mar-15 | 12.2% |

| Apr-15 | 7.6% |

| May-15 | 7.8% |

BLS: Jobs Openings increased to 5.4 million in April, Highest on Record

by Calculated Risk on 6/09/2015 10:07:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings rose to 5.4 million on the last business day of April, the highest since the series began in December 2000, the U.S. Bureau of Labor Statistics reported today. The number of hires was little changed at 5.0 million in April and the number of separations was little changed at 4.9 million. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.7 million quits in April, little changed from March.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in April to 5.376 million from 5.109 million in March.

The number of job openings (yellow) are up 22% year-over-year compared to April 2014.

Quits are up 11% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report. It is a good sign that job openings are over 5 million - at an all time high, and that quits are increasing solidly year-over-year.

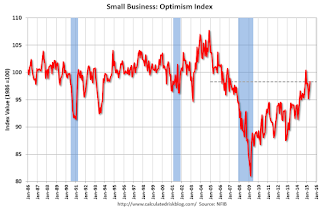

NFIB: Small Business Optimism Index increased in May

by Calculated Risk on 6/09/2015 09:07:00 AM

From the National Federation of Independent Business (NFIB): Small business optimism level is finally back to a normal level

The Index of Small Business Optimism increased 1.4 points to 98.3 ... May is the best reading since the 100.4 December reading but nothing to write home about. The 42 year average is 98.0 ... Eight of the 10 Index components posted improvements.

...

Small businesses posted another decent month of job creation in May, a string of 5 solid months of job creation. On balance, owners added a net 0.13 workers per firm over the past few months.... Twenty-nine percent of all owners reported job openings they could not fill in the current period, up 2 points, revisiting the February reading, and the highest reading since April 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.3 in May from 96.9 in April.