by Calculated Risk on 6/05/2015 05:21:00 PM

Friday, June 05, 2015

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

By request, here is an update on an earlier post through the April employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -844 |

| GW Bush 2 | 381 |

| Obama 1 | 2,018 |

| Obama 2 | 6,3221 |

| 128 months into 2nd term: 10,838 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 844,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 463,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 2,018,000 more private sector jobs at the end of Mr. Obama's first term. Twenty eight months into Mr. Obama's second term, there are now 8,340,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 638,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -702 |

| Obama 2 | 641 |

| 128 months into 2nd term, 110 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

For the public sector, the cutbacks are clearly over at the state and local levels, and it appears cutbacks at the Federal level might also be over. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Here is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the third best for total job creation.

Note: Only 64 thousand public sector jobs have been added during the first twenty eight months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is less than 8% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,885 | 692 | 11,577 |

| 2 | Clinton 2 | 10,070 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 6,322 | 64 | 6,386 | |

| Pace2 | 10,838 | 110 | 10,948 | |

| 128 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The second table shows the jobs need per month for Obama's 2nd term to be in the top three presidential terms.

| Average Jobs needed per month (000s) for Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 228 | 260 | ||

| #2 | 187 | 246 | ||

| #3 | 152 | 220 | ||

Hotels: On Pace for Record Occupancy in 2015, New Construction Increasing

by Calculated Risk on 6/05/2015 01:41:00 PM

From HotelNewsNow.com: STR: US results for week ending 30 May

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 24-30 May 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year measurements, the industry’s occupancy increased 2.2 percent to 63.5 percent. Average daily rate increased 4.7 percent to finish the week at US$114.73. Revenue per available room for the week was up 7.0 percent to finish at US$72.83.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above last year.

Right now 2015 is slightly above 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels.

This strong occupancy and RevPAR performance is why investment in hotels has started picking up. In the recent construction spending report, spending on hotels was up 20% year-over-year.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

May Employment Report Comments and Graphs

by Calculated Risk on 6/05/2015 10:01:00 AM

Earlier: May Employment Report: 280,000 Jobs, 5.5% Unemployment Rate

This was a solid employment report with 280,000 jobs added, and March and April were revised up by a combined 32,000 jobs.

There was even some hints of wage growth, from the BLS: "In May, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $24.96. Over the year, average hourly earnings have risen by 2.3 percent." Weekly hours were unchanged.

A few more numbers: Total employment increased 280,000 from April to May and is now 3.3 million above the previous peak. Total employment is up 12.0 million from the employment recession low.

Private payroll employment increased 262,000 from April to May, and private employment is now 3.8 million above the previous peak. Private employment is up 12.6 million from the recession low.

In May, the year-over-year change was just under 3.1 million jobs.

Overall this was a very positive report.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in May at 81.0%, and the 25 to 54 employment population ratio was unchanged at 77.2%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased 2.3% YoY, and the pace is increasing. Wages will probably pick up a little more this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged at 6.7 million in May and has shown little movement in recent months. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons increased in May to 6.65 million from 6.58 million in April. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that was unchanged at 10.8% in May.

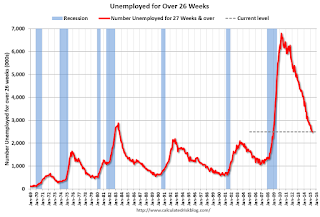

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.502 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.525 million in April.

This is trending down - and is at the lowest level since November 2008 - but is still very high.

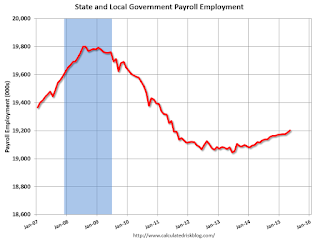

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In May 2015, state and local governments added 15,000 jobs. State and local government employment is now up 160,000 from the bottom, but still 598,000 below the peak.

State and local employment is now generally increasing - slowly. And Federal government layoffs appear to have ended (Federal payrolls added 3,000 jobs in May, and Federal employment is up 6,000 year-to-date).

This was a solid employment report for May.

May Employment Report: 280,000 Jobs, 5.5% Unemployment Rate

by Calculated Risk on 6/05/2015 08:42:00 AM

From the BLS:

Total nonfarm payroll employment increased by 280,000 in May, and the unemployment rate was essentially unchanged at 5.5 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, leisure and hospitality, and health care. Mining employment continued to decline.

...

The change in total nonfarm payroll employment for March was revised from +85,000 to +119,000, and the change for April was revised from +223,000 to +221,000. With these revisions, employment gains in March and April combined were 32,000 more than previously reported.

...

In May, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $24.96. Over the year, average hourly earnings have risen by 2.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 280 thousand in May (private payrolls increased 262 thousand).

Payrolls for March and April were revised up by a combined 32 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In May, the year-over-year change was almost 3.1 million jobs.

This is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate increased in May to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio increased to 59.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in May to 5.5%.

This was above expectations of 220,000 jobs, and combined revisions were up ... a strong report.

I'll have much more later ...

Thursday, June 04, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 6/04/2015 08:00:00 PM

Here is the employment preview I posted earlier: Preview: Employment Report for May

And some comments on various employment indicators: Public and Private Employment Data

Goldman Sachs is forecasting 210,000 jobs added, and for the unemployment rate to be unchanged at 5.4%.

Merrill Lynch is forecasting 220,000 jobs added in May, and the unemployment rate at 5.4%, and 0.3% mom increase hourly earnings

Nomura is forecasting 190,000 jobs, a 0.28% increase in wages mom, and a 5.4% unemployment rate.

Friday:

• At 8:30 AM ET, the Employment Report for May. The consensus is for an increase of 220,000 non-farm payroll jobs added in May, up from the 213,000 non-farm payroll jobs added in April. The consensus is for the unemployment rate be unchanged at 5.4%.

• At 3:00 PM, Consumer Credit for April from the Federal Reserve. The consensus is for an increase of $16.0 billion in credit.

Lawler: Characteristics Homes Built in 2014; Construction of “Moderately-Sized” SF Homes Remained Low in 2014.

by Calculated Risk on 6/04/2015 04:21:00 PM

From Housing economist Tom Lawler:

Earlier this week the Census Bureau released its annual report on the Characteristics of New Housing Units Completed/Sold for 2014. The report, based on data collected from the Survey of Construction, includes (among a lot of other things) estimates for the number of housing units completed or sold by square feet of floor area, number of bath rooms, and number of bedrooms. On the single-family home front, one of the most striking statistics for the last few years (including 2014) is the incredibly small number of moderately-sized (and priced) homes built. Here is a table from the report showing the number of single-family homes completed by square feet of floor area from 1999 to 2014.

Compared to 2000, the number of single-family homes completed in 2014 was down by 50%. The number of homes completed in 2014 with square footage below 1,800 was down by a staggering 70%, while the number of homes completed with square footage of 4,000 or more last year was unchanged from 2000! And the number of single family homes completed with square footage below 1,800 last year showed no increase from 2013’s record low.

| Square Feet of Floor Area in New Single-Family Houses Completed1 | |||||||

|---|---|---|---|---|---|---|---|

| (Components may not add to totals because of rounding) | |||||||

| Number of houses (in thousands) by square feet | |||||||

| Year | Total | Under 1,400 | 1,400 to 1,799 | 1,800 to 2,399 | 2,400 to 2,999 | 3,000 to 3,999 | 4,000 or more |

| 1999 | 1,270 | 197 | 276 | 370 | 211 | 157 | 59 |

| 2000 | 1,242 | 178 | 268 | 363 | 208 | 158 | 66 |

| 2001 | 1,256 | 167 | 261 | 359 | 222 | 172 | 75 |

| 2002 | 1,325 | 172 | 283 | 375 | 240 | 180 | 76 |

| 2003 | 1,386 | 179 | 279 | 401 | 251 | 199 | 77 |

| 2004 | 1,532 | 186 | 311 | 433 | 291 | 219 | 92 |

| 2005 | 1,636 | 165 | 317 | 467 | 306 | 262 | 119 |

| 2006 | 1,654 | 164 | 312 | 452 | 326 | 263 | 137 |

| 2007 | 1,218 | 120 | 220 | 335 | 227 | 202 | 115 |

| 2008 | 819 | 104 | 146 | 219 | 138 | 127 | 84 |

| 2009 | 520 | 66 | 106 | 139 | 89 | 72 | 48 |

| 2010 | 496 | 66 | 96 | 135 | 87 | 75 | 37 |

| 2011 | 447 | 57 | 84 | 111 | 79 | 76 | 40 |

| 2012 | 483 | 53 | 83 | 126 | 93 | 88 | 40 |

| 2013 | 569 | 46 | 89 | 154 | 115 | 110 | 56 |

| 2014 | 620 | 48 | 87 | 162 | 131 | 127 | 66 |

| 1Includes houses built for rent, not shown separately | |||||||

Below is a longer-run chart showing the median square footage of single-family homes completed. (I can’t show a longer-run chart by similar square-footage ranges, as Census changed its ranges.)

During most of the 1970’s and the first half of the 1980’s, over half of new single-family homes completed had square footage at or below 1,600.

During most of the 1970’s and the first half of the 1980’s, over half of new single-family homes completed had square footage at or below 1,600. While the de minimus production of moderately sized and priced new single-family home production over the past few years almost certainly reflects extremely low purchase volumes from entry-level buyers, there is some debate regarding how much of this weak production/sales reflects weak demand, and how much reflects “supply” issues (e.g., an inability of many builders in many markets to produce small, moderately-priced homes at high enough profit margins to make it worth there while.)

Those looking for an eventual rebound in single-family housing production to more “normal” unit levels should realize that such a rebound is extremely unlikely without a major increase in the production of smaller, more moderately priced homes.

Public and Private Employment Data

by Calculated Risk on 6/04/2015 02:19:00 PM

Some readers have wondered about the accuracy of the monthly BLS employment report. The report is based on a survey of households, and reports from businesses - for differences see: Household vs. Establishment Series - and the establishment report is benchmarked annually to state unemployment insurance tax reports.

On a monthly basis, the establishment report may have a large margin of error, but - with the annual benchmarks - the report should track payroll employment very well over time.

Another public source of employment related data is the initial and continuing weekly unemployment reports. The initial weekly unemployment claims report shows unemployment claims are near all time lows.

The good news is private sources of employment data are suggesting similar gains in employment (for those who doubt the accuracy of government data).

The most followed private source is from ADP. However, ADP makes some adjustment based on data from the BLS report and from the Philadelphia Federal Reserve’s Aruoba-Diebold-Scotti Business Conditions Index. So this isn't entirely independent series.

Another private source is the ISM surveys of manufacturing and non-manufacturing companies. Although these surveys are based on the number of companies hiring (or laying off workers), the index has tracked changes in private BLS employment over time.

For small business, the Intuit index is very useful - and the NFIB monthly surveys also provides information on hiring. From NFIB: Small Business Hiring Strong for 5th Consecutive Month

“May continued to show solid, but not spectacular hiring, continuing the trend of previous months in 2015. For the second time this year, a high of 29 percent had openings they couldn’t fill; a high we hadn’t seen since April 2006. This is a strong indication that the unemployment rate will decline further.Other sources of private data include:

“Small employers are starting to feel the economy picking up and they are working hard to meet this demand."

• TrimTabs (based on analysis of daily income tax deposits)

• The Conference Board's labor differential (a spread between the share of households reporting jobs are plentiful versus hard to get).

• The Chicago PMI (a regional survey).

• The Challenger, Gray & Christmas report on planned layoffs. From Reuters today: US job cuts plunged 33% to 41,034 in May: Challenger

Job cuts announced by U.S.-based companies declined sharply in May as the energy sector took another pause following successive rounds of big payroll reductions.There are other sources too. The bottom line is all of the data - both private and public - is telling a similar story on employment.

Employers laid off 33 percent fewer workers in May from the previous month, global outsourcing firm Challenger, Gray & Christmas reported Thursday. Companies announced 41,034 cuts in the last four weeks, compared with 61,582 in April.

NFP: Goldman Sachs, Nomura May Employment Previews

by Calculated Risk on 6/04/2015 10:42:00 AM

Yesterday I discussed several indicators: Preview: Employment Report for May

Some excerpts from a research piece by Goldman Sachs economist Kris Dawsey:

We forecast a 210k gain in nonfarm payrolls in May, a bit below consensus of 226k and down slightly from April's pace of increase. ... the trend in payroll job growth seems to have softened a bit since reaching a high-water mark in late-2014 / early-2015.And from economists at Nomura:

...

We expect the unemployment rate to remain unchanged at 5.4%. ...

Average hourly earnings (AHE) for all employees will probably increase 0.3%, in our view. As we have noted in the past, the monthly earnings estimates appear to be influenced by calendar effects. The smaller number of working days in May, combined with relatively late timing of the survey reference week within the month, would historically be consistent with a firm AHE print. Including base effects, we think that the year-on-year change in all-employee AHE is likely to remain stable at 2.2% (with upside risk), while year-on-year growth in production and nonsupervisory AHE will probably rise one-tenth to 2.0%.

[W]e forecast a 185k increase in private payrolls, with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 190k. ... We forecast that average hourly earnings for private employees rose by 0.28% m-o-m in May, indicative of our expectation for a gradual pickup in wage growth as a result of the tightening labor market and a rebound after a slight 0.1% increase in April. Last, we expect the household survey to show that the unemployment rate remained unchanged at 5.4%.

Weekly Initial Unemployment Claims decreased to 276,000

by Calculated Risk on 6/04/2015 08:34:00 AM

The DOL reported:

In the week ending May 30, the advance figure for seasonally adjusted initial claims was 276,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 282,000 to 284,000. The 4-week moving average was 274,750, an increase of 2,750 from the previous week's revised average. The previous week's average was revised up by 500 from 271,500 to 272,000.The previous week was revised to 284,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 274,750.

This was at the consensus forecast of 276,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, June 03, 2015

Mortgage Rates increase to 4.1%

by Calculated Risk on 6/03/2015 07:18:00 PM

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 276 thousand from 282 thousand.

• Also at 8:30 AM, Productivity and Costs for Q1. The consensus is for a 6.0% increase in unit labor costs.

From Matthew Graham: MBS RECAP: The Real Drama is in Europe, but Little to do with Greece

If you missed it, or are otherwise looking for a recap on why bond markets got crushed today, here it is. Nothing materially changed from that update, and that's no surprise considering the source of the drama was Europe.Here is a table of mortgage rates from Mortgage News Daily:

For those of you who don't click links, suffice it to say that the European Central Bank is not the Federal Reserve. ...

It's actually not too complicated. Europe fought tooth and nail for several years to roll out a QE program. They finally launched it in early 2015 and specified the amount and timing. When markets began speculating that the amount might be less or the timing might be cut short, the head of the European Central Bank provided reassurance that the timing and amounts were predetermined. And now today, he said they weren't. It's really that simple.

For the sake of perspective, he did say that the European economy requires the full program for the full amount of time (Sep 2016). The problem is that he also said that the program could end early if there was a sustained adjustment toward inflation targets. Jeez... To reiterate some of my incredulity from this morning, this is dirty pool. The Fed has been widely criticized, to be sure, but I couldn't imagine the backlash if they pulled a similar move with one of our QE iterations that had a predetermined amount of bond-buying.

It's a surefire way to cause chaos. And that's exactly what it did. German Bunds sold off 20bps today (vs 10bps in US Treasuries).