by Calculated Risk on 6/03/2015 03:15:00 PM

Wednesday, June 03, 2015

Preview: Employment Report for May

Another month, another employment report ...

On Friday at 8:30 AM ET, the BLS will release the employment report for May. The consensus, according to Bloomberg, is for an increase of 220,000 non-farm payroll jobs in May (with a range of estimates between 190,000 and 289,000), and for the unemployment rate to be unchanged at 5.4%.

The BLS reported 223,000 jobs added in April.

Here is a summary of recent data:

• The ADP employment report showed an increase of 201,000 private sector payroll jobs in May. This was at expectations of 200,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth at expectations.

• The ISM manufacturing employment index increased in May to 51.7%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 10,000 in May. The ADP report indicated a 5,000 decrease for manufacturing jobs.

The ISM non-manufacturing employment index decreased in May to 56.7%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 215,000 in May.

Combined, the ISM indexes suggests employment gains of 205,000. This suggests employment growth slightly below expectations.

• Initial weekly unemployment claims averaged close to 271,000 in May, down from 284,000 in April - and the lowest monthly average since early 2001. For the BLS reference week (includes the 12th of the month), initial claims were at 275,000; down from 296,000 during the reference week in April.

This suggests a lower level of layoffs in May compared to the previous months.

• The final May University of Michigan consumer sentiment index decreased to 90.0 from the April reading of 95.9. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a 25,000 increase in small business employment in May, up from 15,000 in March. From Intuit: Small Businesses Employment Shows Sharp Growth in May

Small business employment rose by 25,000 jobs in May, an increase of 0.13 percent, or an annual rate of 1.6 percent. The hiring rate also continued to rise, showing the fastest increase since the hiring rate began growing for small businesses in July 2009. Hourly employees worked an average of 41 minutes longer than in April.• Trim Tabs reported that the U.S. economy added 273,000 jobs in May. From TrimTabs:

“Looking back to January 2004, we see only seven months when the change in hours worked was larger than 25 minutes. This is a sign that small businesses are working hard to meet increased demands – and get work done,” said Susan Woodward, the economist who works with Intuit to produce the Small Business Employment and Revenue Indexes.

“Another sign of stronger small business activity is the hiring rate, which rose at nearly twice the rate of any other month since beginning to rise in September 2009. The hiring rate always exceeds the employment increase because hiring reflects replacing workers who leave, as well as added workers,” Woodward said

TrimTabs Investment Research estimates that the U.S. economy added 273,000 jobs in May, the eleventh consecutive month that employment growth exceeded 200,000 jobs.• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. However it looks like this should be another 200+ month (based on ADP, ISM, unemployment claims, and small business hiring). There is always some randomness to the employment report, but my guess is something close to the consensus this month.

“While the Bureau of Economic Analysis’ latest GDP growth estimate has Wall Street worried about a slowdown, our figures paint a different picture,” said David Santschi, chief executive officer of TrimTabs. “Real-time tax data indicates employment growth remains solid.”

TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding.

Fed's Beige Book: Economic Activity Expanded, Respondents "generally optimistic"

by Calculated Risk on 6/03/2015 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Dallas based on information collected on or before May 22, 2015"

Reports from the twelve Federal Reserve Districts suggest overall economic activity expanded during the reporting period from early April to late May. Activity in the Richmond, Chicago, Minneapolis, and San Francisco Districts was characterized as growing at a moderate pace, while the New York, Philadelphia, and St. Louis Districts cited modest growth. Contacts in the Boston District reported mixed conditions, and the Cleveland and Kansas City Districts indicated a slight pace of expansion. Compared to the previous report, the pace of growth slowed slightly in the Dallas District but held steady in the Atlanta District. Outlooks among respondents were generally optimistic, with growth expected to continue at a modest to moderate pace in several districts. ...And on real estate:

Manufacturing activity generally held steady or increased over the reporting period, except for in the Dallas District where it was slightly weaker and in the Kansas City District where it fell markedly.

Residential real estate activity and construction expanded in most districts since the prior report, and outlooks were largely positive. Homes sales rose strongly in the Minneapolis District on a year-over-year basis, while more modest to moderate gains were reported by all of the remaining districts, except for Philadelphia where builders reported mixed conditions for new home sales and brokers noted slightly slower existing-home sales in April on a year-over-year basis. ... Residential construction was flat to up during the reporting period, although a few districts reported a slower pace of homebuilding activity due to financing and capacity constraints and severe weather.

Commercial real estate leasing and construction activity improved in most districts, and outlooks were optimistic.

emphasis added

ISM Non-Manufacturing Index decreased to 55.7% in May

by Calculated Risk on 6/03/2015 10:04:00 AM

The May ISM Non-manufacturing index was at 55.7%, down from 57.8% in April. The employment index decreased in May to 55.3%, down from 56.7% in April. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: May 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in May for the 64th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.7 percent in May, 2.1 percentage points lower than the April reading of 57.8 percent. This represents continued growth in the non-manufacturing sector although at a slower rate. The Non-Manufacturing Business Activity Index decreased to 59.5 percent, which is 2.1 percentage points lower than the April reading of 61.6 percent, reflecting growth for the 70th consecutive month at a slower rate. The New Orders Index registered 57.9 percent, 1.3 percentage points lower than the reading of 59.2 percent registered in April. The Employment Index decreased 1.4 percentage points to 55.3 percent from the April reading of 56.7 percent and indicates growth for the 15th consecutive month. The Prices Index increased 5.8 percentage points from the April reading of 50.1 percent to 55.9 percent, indicating prices increased in May for the third consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in May. Overall there has been a slight slowing in the rate of growth for the non-manufacturing sector. Respondents’ comments are mostly positive about business conditions and indicate economic growth will continue."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 57.2% and suggests slower expansion in May than in April. Overall this was a decent report.

Trade Deficit declined in April to $40.9 Billion

by Calculated Risk on 6/03/2015 08:46:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $40.9 billion in April, down $9.7 billion from $50.6 billion in March, revised. April exports were $189.9 billion, $1.9 billion more than March exports. April imports were $230.8 billion, $7.8 billion less than March imports.The trade deficit was smaller than the consensus forecast of $43.9 billion.

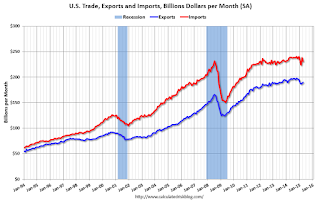

The first graph shows the monthly U.S. exports and imports in dollars through April 2015.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in April. Note: Imports surged in March due to the resolution of the West Coast port slowdown and the unloading of waiting ships, so a decrease in imports was expected in April.

Exports are 14% above the pre-recession peak and down 3% compared to April 2014; imports are at the pre-recession peak, and down 3% compared to April 2014.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings over last few months due to port slowdown.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products (wild swings over last few months due to port slowdown.Oil imports averaged $46.52 in April, up slightly from $46.47 in March, and down from $95.00 in April 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

The trade deficit with China decreased to $26.5 billion in April, from $27.3 billion in April 2014. The deficit with China is a large portion of the overall deficit.

ADP: Private Employment increased 201,000 in May

by Calculated Risk on 6/03/2015 08:18:00 AM

Private sector employment increased by 201,000 jobs from April to May according to the May ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was at the consensus forecast for 200,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 9,000 jobs in May, after adding just 1,000 in April. The construction industry had another good month in May adding 27,000 jobs, up from 24,000 last month. Meanwhile, manufacturing lost 5,000 jobs in May, after losing 8,000 in April.

Service-providing employment rose by 192,000 jobs in May, a strong rise from 164,000 in April. The ADP National Employment Report indicates that professional/business services contributed 28,000 jobs in May, down from April’s 35,000. Trade/transportation/utilities grew by 56,000, up from April’s 41,000. The 12,000 new jobs added in financial activities is double last month’s 6,000.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market posted a solid gain in May. Employment growth remains near the average of the past couple of years. At the current pace of job growth the economy will be back to full employment by this time next year. The only blemishes are the decline in mining jobs due to the collapse in oil prices and the decline in manufacturing due to the strong dollar.”

The BLS report for May will be released on Friday and the consensus is for 220,000 non-farm payroll jobs added in May.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up 14% YoY

by Calculated Risk on 6/03/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 29, 2015. This week’s results include an adjustment to account for the Memorial Day holiday. ...

The Refinance Index decreased 12 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 14 percent compared with the previous week and was 14 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.02 percent from 4.07 percent, with points decreasing to 0.33 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It would take much lower rates - below 3.5% - to see a significant refinance boom this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 14% higher than a year ago.

Tuesday, June 02, 2015

Wednesday: Trade Deficit, ADP Employment, ISM Non-Mfg Index, Beige Book

by Calculated Risk on 6/02/2015 08:43:00 PM

This made me chuckle today ... "If the last seven years have taught investors anything, it’s to focus on the negatives and never change your mind." Josh Brown

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in May, up from 169,000 in April.

• At 8:30 AM, Trade Balance report for April from the Census Bureau. The consensus is for the U.S. trade deficit to be at $43.9 billion in April from $51.4 billion in March. Note: The trade deficit increased sharply in March after the West Coast port slowdown was resolved in February. The deficit should decline significantly in April.

• At 10:00 AM, the ISM non-Manufacturing Index for April. The consensus is for index to decrease to 57.2 from 57.8 in April.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Hatzius: September rate hike "sensible in the base case ", "but less than optimal on risk management grounds"

by Calculated Risk on 6/02/2015 05:32:00 PM

A few excerpts from a research piece by Goldman Sachs chief economist Jan Hatzius: A September Hike: Sensible in the Base Case, Premature on Risk Management Grounds

The monetary policy path in the March "dot plot", which implies rate hikes starting at the September FOMC meeting, is consistent with the implications of a Taylor 1999 rule with a focus on broad labor market slack. To us, this looks like sensible policy in the FOMC's base case for the economy (which is broadly similar to our own at this point).

Nevertheless, we think the risk management case for delaying the first hike until 2016 remains persuasive. There is substantial uncertainty around the economic outlook, the equilibrium funds rate, and the true amount of labor market slack. This uncertainty has asymmetric effects on optimal monetary policy, and generally favors waiting.

Meanwhile, we are unconvinced by the main risk management arguments that are typically deployed in favor of an earlier liftoff than implied by the baseline economic scenario, which include financial stability concerns, worries about "falling behind the curve", and a desire to test the machinery of exit.

For now, our forecast remains that the FOMC will hike rates at the September FOMC meeting. But our discussion today reinforces our existing view that this remains a close call.

U.S. Light Vehicle Sales increased to 17.8 million annual rate in May

by Calculated Risk on 6/02/2015 03:00:00 PM

Based on an AutoData estimate, light vehicle sales were at a 17.9 million SAAR in May. That is up 6.2% from May 2014, and up 7.3% from the 16.5 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 17.79 million SAAR from AutoData).

This was above the consensus forecast of 17.0 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was above the consensus forecast, and the strongest sales pace since July 2005. It appears 2015 will be the best year for light vehicle sales since 2001.

Preliminary May Vehicle Sales at 17.7 million SAAR: Best sales rate since 2005, On pace for Best Year since 2001

by Calculated Risk on 6/02/2015 12:14:00 PM

From WardsAuto: May 2015 U.S. LV Sales Thread: May SAAR Should Top 17 Million

May WardsAuto report forecasted LV sales for May at 1.6 million units, equating to a SAAR of nearly 17.5 million units. Wtih 6 of the Top 7 automakers reporting sales are trending at 1.63 million units, equating to a SAAR slightly above 17.7 million units.From the WSJ: Auto Makers Posted Stronger-Than-Expected U.S. Sales in May

emphasis added

Several top auto makers logged stronger-than-expected U.S. vehicle sales in May, adding to the industry’s momentum this year.I'll post a graph in a few hours (after all of the results have been reported), but sales were well above the consensus forecast of 17.0 million for May.

...

The results came despite one less selling day compared with last May, which was expected to result in slight year-over-year declines for most major manufacturers.

Still, the U.S. auto industry is on its way to delivering 17 million new vehicles this year—a level unseen since 2001.