by Calculated Risk on 5/30/2015 08:41:00 AM

Saturday, May 30, 2015

Schedule for Week of May 31, 2015

The key report this week is the May employment report on Friday.

Other key indicators include the April Personal Income and Outlays report on Thursday, May ISM manufacturing index on Friday, May vehicle sales on Friday, April Trade Deficit on Tuesday, and the May ISM non-manufacturing index also on Tuesday.

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for an increase to 51.8 from 51.5 in April.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 51.5% in April. The employment index was at 48.3%, and the new orders index was at 53.5%.

10:00 AM: Construction Spending for April. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 17.0 million SAAR in May from 16.5 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 17.0 million SAAR in May from 16.5 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is a 0.1% decrease in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 200,000 payroll jobs added in May, up from 169,000 in April.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through March. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.9 billion in April from $51.4 billion in March. Note: The trade deficit increased sharply in March after the West Coast port slowdown was resolved in February. The deficit should decline significantly in April.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for index to decrease to 57.2 from 57.8 in April.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 276 thousand from 282 thousand.

8:30 AM: Productivity and Costs for Q1. The consensus is for a 6.0% increase in unit labor costs.

8:30 AM: Employment Report for May. The consensus is for an increase of 220,000 non-farm payroll jobs added in May, up from the 213,000 non-farm payroll jobs added in April.

The consensus is for the unemployment rate be unchanged at 5.4%.

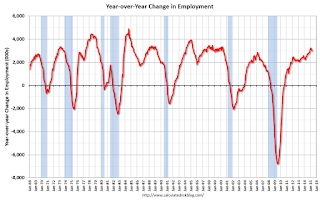

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was just under 3.0 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for March from the Federal Reserve. The consensus is for an increase of $16.0 billion in credit.

Friday, May 29, 2015

Restaurant Performance Index increased in April

by Calculated Risk on 5/29/2015 07:10:00 PM

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Posts Moderate Gain in April

Driven by stronger same-stores sales and customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) posted a moderate gain in April. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.7 in April, up 0.5 percent from a level of 102.2 in March. In addition, April represented the 26th consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

"While individual indicators experienced some choppiness in recent months, the overall RPI stood above the 102 level for seven consecutive months,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “This was driven by consistent majorities of restaurant operators reporting positive same-store sales as well as an optimistic outlook for sales growth in the months ahead.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.7 in April, up from 102.2 in March. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is another solid reading.

Fannie Mae: Mortgage Serious Delinquency rate declined in April, Lowest since September 2008

by Calculated Risk on 5/29/2015 04:10:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in April to 1.73% from 1.78% in March. The serious delinquency rate is down from 2.13% in April 2014, and this is the lowest level since September 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier week, Freddie Mac reported that the Single-Family serious delinquency rate was declined in April to 1.66%. Freddie's rate is down from 2.15% in April 2014, and is at the lowest level since November 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.40 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will close to 1% in late 2016.

The "normal" serious delinquency rate is under 1%, so maybe serious delinquencies will be close to normal at the end of 2016. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Business Executives are NOT experts in Economics

by Calculated Risk on 5/29/2015 02:53:00 PM

Excuse this pet peeve, but for some reason, when a business executive is interviewed on CNBC (and elsewhere), they are asked about economics in addition to their assumed areas of expertise. News flash: Business executives are NOT experts in economics (This should be called the "Jack Welch rule").

An example today: Richard Kovacevich, former chairman and CEO at Wells Fargo was on CNBC today, and said:

"We should be growing at 3 percent, given the difficulty of this last recession," he told CNBC's "Squawk Box." "We always get a higher and faster recovery from a tough recession, and this is the slowest ever, and I think it's the policies that are coming out of Washington DC that are causing this."Wrong.

Imagine an economy with an unchanging labor force, and no innovation (everyone just does things they way they've always been done). How much should GDP grow? Zero.

Now imagine a second economy with a labor force growing 5% per year, no resource constraints, a short learning curve, and no innovation. How much should GDP grow? About 5% per year.

That is why I wrote Demographics and GDP: 2% is the new 4% earlier this year.

Two lessons: 1) Experts in one field are not necessarily experts in another, and 2) demographics matter - and right now 2% is the new 4%.

Philly Fed: State Coincident Indexes increased in 40 states in April

by Calculated Risk on 5/29/2015 12:51:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2015. In the past month, the indexes increased in 40 states, decreased in six, and remained stable in four, for a one-month diffusion index of 68. Over the past three months, the indexes increased in 45 states, decreased in three, and remained stable in two, for a three-month diffusion index of 84.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In April, 43 states had increasing activity (including minor increases).

It appears we are seeing weakness in several oil producing states including Alaska, North Dakota and Oklahoma. It wouldn't be surprising if Texas and other oil producing states also turned red sometime this year.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again. Note: Blue added for Red/Green issues.

Final May Consumer Sentiment at 90.7, Chicago PMI declines Sharply

by Calculated Risk on 5/29/2015 10:03:00 AM

Click on graph for larger image.

The final University of Michigan consumer sentiment index for May was at 90.7, up from the preliminary reading of 88.6, and down from 95.9 in April.

This was close to the consensus forecast of 90.0.

Chicago PMI May 2015: Chicago Business Barometer Back into Contraction in May

The Barometer fell 6.1 points to 46.2 in May from 52.3 in April. All five components of the Barometer weakened with three dropping by more than 10% and all of them now below the 50 breakeven mark.This was well below the consensus forecast of 53.0.

April’s positive move had suggested that the first quarter slowdown was transitory and had been impacted by the cold snap and port strikes. May’s weakness points to a more fundamental slowdown with the Barometer running only slightly above February’s 5½-year low of 45.8.

...

Chief Economist of MNI Indicators Philip Uglow said, “We had thought that the April bounce was consistent with a partial return to normal following the weather and port related slowdown in the first quarter. The latest data for May, however, suggest that this was a false dawn and that sluggish activity has carried through to the second quarter.”

emphasis added

Q1 GDP Revised Down to -0.7% Annual Rate

by Calculated Risk on 5/29/2015 08:37:00 AM

From the BEA: Gross Domestic Product: First Quarter 2015 (Second Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- decreased at an annual rate of 0.7 percent in the first quarter of 2015, according to the "second" estimate released by the Bureau of Economic Analysis. ...Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 1.9% to 1.8%. Residential investment was revised up from 1.3% to 5.0%.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, real GDP increased 0.2 percent. With the second estimate for the first quarter, imports increased more and private inventory investment increased less than previously estimated ...

emphasis added

Net exports was revised down, private inventory investment was revised down, and government was revised down (from -0.8% to -1.1%).

Thursday, May 28, 2015

Friday: Ugly GDP, Chicago PMI, Consumer Sentiment

by Calculated Risk on 5/28/2015 06:52:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Microscopically Lower

Mortgage rates barely budged today. Those that budged moved almost imperceptibly lower from yesterday's latest rate sheets. In general, there was simply very little movement in underlying markets and lenders' rate sheets matched the tone. [Rates at 4.0%]Friday:

Ironically, Freddie Mac's weekly rate survey results came out this morning indicating higher rates. Keep in mind that the Freddie survey receives most of it's responses early in the week and then reports on Thursday mornings. That means that any changes in rates over the intervening days are not captured in the data. In the current case, it's not that rates have moved significantly lower in the past few days, but more to do with the fact that last week's Freddie survey didn't capture the brunt of the rise in rates that occurred on Tuesday.

emphasis added

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2015 (second estimate). The consensus is that real GDP decreased 0.9% annualized in Q1, revised down from the 0.2% advance estimate.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 53.0, up from 52.3 in April.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 90.0, up from the preliminary reading of 88.6, and down from the April reading of 95.9.

Vehicle Sales Forecasts for May: Over 17 Million Annual Rate

by Calculated Risk on 5/28/2015 03:04:00 PM

The automakers will report May vehicle sales on Tuesday, June 2nd. Sales in April were at 16.5 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales will be strong in May too.

Note: There were 26 selling days in May, one less than in May 2014. Here are a few forecasts:

From Edmunds.com: Nearly 1.6 Million New Cars Sold in May Push Seasonally Adjusted Annual Rate (SAAR) to Impressive 17.4 Million, says Edmunds.com

Edmunds.com ... forecasts that 1,591,221 new cars and trucks will be sold in the U.S. in May for an estimated Seasonally Adjusted Annual Rate (SAAR) of 17.4 million.From J.D. Power: New-Vehicle Retail Sales SAAR in May to Hit 14.1M Units, Highest Level So Far in 2015

Total light-vehicle sales in May 2015 are projected to reach 1,591,100, a 3 percent increase on a selling day adjusted basis compared with May 2014. [Total forecast 17.3 million SAAR]From Kelley Blue Book: New-Car Sales to Reach 17.3 Million SAAR in May 2015, According to Kelley Blue Book

New-vehicle sales are expected to decline 1 percent year-over-year to a total of 1.59 million units in May 2015, resulting in an estimated 17.3 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...Another strong month for auto sales. Good times!

...

"May sales will reach the highest total year-to-date, and could remain the highest until December of this year," said Alec Gutierrez, senior analyst for Kelley Blue Book. "While we expect an overall decline in volume versus last year, the difference is the result of one fewer sales day from May 2014, and total SAAR will reflect year-over-year improvement."

Freddie Mac: Mortgage Serious Delinquency rate declined in April

by Calculated Risk on 5/28/2015 01:02:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in April to 1.66%, down from 1.73% in March. Freddie's rate is down from 2.15% in April 2014, and the rate in March was the lowest level since November 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for April in a few days.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.49 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).