by Calculated Risk on 5/26/2015 02:29:00 PM

Tuesday, May 26, 2015

Real Prices and Price-to-Rent Ratio in March

The expected slowdown in year-over-year price increases has occurred. In October 2013, the National index was up 10.9% year-over-year (YoY). In March 2015, the index was up 4.1% YoY. However the YoY change has only declined slightly over the last six months.

As I've noted before, I think most of the slowdown on a YoY basis is now behind us (I don't expect price to go negative this year). This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $274,000 today adjusted for inflation (37%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.6% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to June 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to February 2005 levels, and the CoreLogic index (NSA) is back to March 2005.

Real House Prices

In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to May 2003, and the CoreLogic index back to July 2003.

In real terms, house prices are back to 2003 levels.

Note: CPI less Shelter is down 1.5% year-over-year, so this is pushing up real prices.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to March 2003 levels, and the CoreLogic index is back to June 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and the price-to-rent ratio maybe moving a little sideways now.

Comments on New Home Sales

by Calculated Risk on 5/26/2015 11:32:00 AM

The new home sales report for April was above expectations at 517 thousand on a seasonally adjusted annual rate basis (SAAR).

Earlier: New Home Sales increased to 517,000 Annual Rate in April

The Census Bureau reported that new home sales this year, through April, were 179,000, Not seasonally adjusted (NSA). That is up 23.7% from 145,000 during the same period of 2014 (NSA). That is a solid first four months!

Sales were up 26.1% year-over-year in April, but that was an easy comparison.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will probably be strong through July (the first seven months were especially weak in 2014), however I expect the year-over-year increases to slow later this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increased to 517,000 Annual Rate in April

by Calculated Risk on 5/26/2015 10:16:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 517 thousand.

The previous three months were revised up by a total of 5 thousand (SA).

"Sales of new single-family houses in April 2015 were at a seasonally adjusted annual rate of 517,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.8 percent above the revised March rate of 484,000 and is 26.1 percent above the April 2014 estimate of 410,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottoms for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply decreased in April to 4.8 months.

The months of supply decreased in April to 4.8 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of April was 205,000. This represents a supply of 4.8 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2015 (red column), 49 thousand new homes were sold (NSA). Last year 39 thousand homes were sold in April. This is the highest for April since 2008.

The high for April was 116 thousand in 2005, and the low for April was 30 thousand in 2011.

This was above expectations of 509,000 sales in April, and this is still a solid start for 2015. I'll have more later today.

Case-Shiller: National House Price Index increased 4.1% year-over-year in March

by Calculated Risk on 5/26/2015 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Accelerate, Led by San Francisco and Denver According to the S&P/Case-Shiller Home Price Indices

Data released today for March 2015 show that home prices continued their rise across the country over the last 12 months. ... Both the 10-City and 20-City Composites saw year-over-year increases in March. The 10-City Composite gained 4.7% year-over-year, while the 20-City Composite gained 5.0% year-over-year. The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.1% annual gain in March 2015 versus a 4.2% increase in February 2015.

...

The National index increased again in March with a 0.8% increase for the month. Both the 10- and 20-City Composites increased significantly, reporting 0.8% and 0.9% month-over-month increases, respectively. Of the 19 cities reporting increases, San Francisco led all cities with an increase of 3.0%. Seattle followed next with a reported increase of 2.3%. Cleveland reported an increase of 0.4%, its first positive month-over-month increase since August 2014. New York was the only city to report a negative month-over-month change with a -0.1% decrease for March 2015.

...

“Home prices have enjoyed year-over-year gains for 35 consecutive months,” says David M. Blitzer, Managing Director & Chairman of the Index Committee for S&P Dow Jones Indices. “The pattern of consistent gains is national and seen across all 20 cities covered by the S&P/Case-Shiller Home Price Indices. The longest run of gains is in Detroit at 45 months, the shortest is New York with 27 months. However, the pace has moderated in the last year; from August 2013 to February 2014, the national index gained more than 10% year-over-year, compared to 4.1% in this release.

“Given the long stretch of strong reports, it is no surprise that people are asking if we’re in a new home price bubble. The only way you can be sure of a bubble is looking back after it’s over. The average 12 month rise in inflation adjusted home prices since 1975 is about 1.0% per year compared to the current 4.1% pace, arguing for a bubble. However, the annual rate of increase halved in the last year, as shown in the first chart. Home prices are currently rising more quickly than either per capita personal income (3.1%) or wages (2.2%), narrowing the pool of future home-buyers. All of this suggests that some future moderation in home prices gains is likely. Moreover, consumer debt levels seem to be manageable. I would describe this as a rebound in home prices, not bubble and not a reason to be fearful.”

emphasis added

Click on graph for larger image.

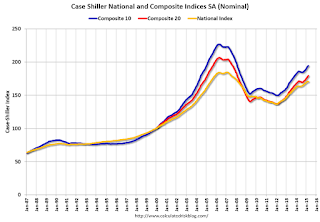

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 14.2% from the peak, and up 0.9% in March (SA).

The Composite 20 index is off 13.1% from the peak, and up 0.9% (SA) in March.

The National index is off 7.6% from the peak, and up 0.1% (SA) in March. The National index is up 24.7% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to March 2014.

The Composite 20 SA is up 5.0% year-over-year..

The National index SA is up 4.1% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in March seasonally adjusted. (Prices increased in 19 of the 20 cities NSA) Prices in Las Vegas are off 40.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 50% above January 2000 (50% nominal gain in 15 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 40% since January 2000 - so the increase in Phoenix from January 2000 until now is about 10% above the change in overall prices due to inflation.

Two cities - Denver (up 65% since Jan 2000) and Dallas (up 48% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston and, Charlotte). Detroit prices are still below the January 2000 level.

This was close to the consensus forecast. I'll have more on house prices later.

Monday, May 25, 2015

Tuesday: New Home Sales, Case-Shiller House Prices, Durable Goods and More

by Calculated Risk on 5/25/2015 08:13:00 PM

From Bloomberg: What Would Happen If Greece Doesn’t Pay the IMF: Q&A

Q: What will the IMF do?From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 3 and DOW futures are down 20 (fair value).

A: A missed payment date starts the clock ticking. Two weeks after the initial due date and a cable from Washington urging immediate payment, the fund sends another cable stressing the “seriousness of the failure to meet obligations” and again urges prompt settlement. Two weeks after that, the managing director informs the Executive Board that an obligation is overdue. For Greece, that’s when the serious consequences kick in. These are known as cross-default and cross-acceleration.

Tuesday:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

• At 9:00 AM, the FHFA House Price Index for March 2015. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 9:00 AM, the S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March prices. The consensus is for a 4.6% year-over-year increase in the Comp 20 index for March.

• At 10:00 AM, New Home Sales for April from the Census Bureau. The consensus is for an increase in sales to 509 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 481 thousand in March.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May.

• At 10:30 AM, Dallas Fed Manufacturing Survey for May.

Gasoline Prices: Down a Dollar from last year on Memorial Day

by Calculated Risk on 5/25/2015 10:11:00 AM

According to Gasbuddy.com (see graph at bottom), gasoline prices are down to a national average of $2.75 per gallon. One year ago for the week of Memorial Day, prices were at $3.75 per gallon, and for the same week two years ago prices were $3.70 per gallon.

Ten years ago, price were at $2.17 per gallon, and fifteen years ago at $1.57.

| Memorial Day | Weekly Average Gasoline Price |

|---|---|

| 29-May-00 | $1.57 |

| 28-May-01 | $1.74 |

| 27-May-02 | $1.43 |

| 26-May-03 | $1.53 |

| 31-May-04 | $2.10 |

| 30-May-05 | $2.17 |

| 29-May-06 | $2.94 |

| 28-May-07 | $3.25 |

| 26-May-08 | $3.99 |

| 25-May-09 | $2.49 |

| 31-May-10 | $2.84 |

| 30-May-11 | $3.90 |

| 28-May-12 | $3.73 |

| 27-May-13 | $3.70 |

| 26-May-14 | $3.75 |

| 25-May-15 | $2.75 |

According to Bloomberg, WTI oil is at $59.40 per barrel, and Brent is at $65.37 per barrel. Last year on Memorial Day, Brent was at $110.01 per barrel, and two years ago Brent was at $103.77.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Sunday, May 24, 2015

Hotels: RevPAR up almost 50% since 2009

by Calculated Risk on 5/24/2015 10:01:00 PM

Revenue per available room (RevPAR) is now at $85.50. In May 2009, RevPAR had fallen to $58.39. So, RevPAR is up 46.9% over the last 6 years - and the occupancy rate will probably be at a new record high this year. A great year for hotels!

From HotelNewsNow.com: STR: US hotel results for week ending 16 May

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 10-16 May 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year measurements, the industry’s occupancy increased 0.5 percent to 70.3 percent. Average daily rate increased 5.2 percent to finish the week at US$122.10. Revenue per available room for the week was up 5.7 percent to finish at US$85.80.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above last year.

Right now 2015 is even above 2000 (best year for hotels) - and 2015 will probably be the best year on record for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Report: Greece will not make June IMF Payment

by Calculated Risk on 5/24/2015 11:30:00 AM

From the WSJ: Greece Won’t Meet IMF Repayments in June, Interior Minister Says

Greece said Sunday that it won’t have the money it is due to repay to the International Monetary Fund next month unless it strikes a deal with international creditors over further rescue funding.

Interior Minister Nikos Voutsis told privately owned television station Mega that Greece is scheduled to repay €1.6 billion ($1.76 billion) to the IMF between June 5-19, but the payments cannot be met.

“This money will not be given,” he said. “It does not exist.”

Saturday, May 23, 2015

Schedule for Week of May 24, 2015

by Calculated Risk on 5/23/2015 08:31:00 AM

The key reports this week are April New Home sales on Tuesday, the 2nd estimate of Q1 GDP on Friday, and March Case-Shiller house prices on Tuesday.

For manufacturing, the May Richmond and Dallas Fed surveys will be released this week.

All US markets will be closed in observance of Memorial Day.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.6% decrease in durable goods orders.

9:00 AM: FHFA House Price Index for March 2015. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March prices.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the February 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 4.6% year-over-year increase in the Comp 20 index for March. The Zillow forecast is for the National Index to increase 4.2% year-over-year in March, and for prices to increase 1.0% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for April from the Census Bureau.

10:00 AM: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for an increase in sales to 509 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 481 thousand in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

10:30 AM: Dallas Fed Manufacturing Survey for May.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Regional and State Employment and Unemployment (Monthly), April 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 274 thousand.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.8% increase in the index.

8:30 AM: Gross Domestic Product, 1st quarter 2015 (second estimate). The consensus is that real GDP decreased 0.9% annualized in Q1, revised down from the 0.2% advance estimate.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 53.0, up from 52.3 in April.

10:00 AM: University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 90.0, up from the preliminary reading of 88.6, and down from the April reading of 95.9.

Friday, May 22, 2015

ATA Trucking Index decreased 3% in April

by Calculated Risk on 5/22/2015 04:01:00 PM

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Fell 3% in April

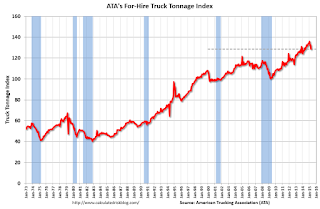

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index fell 3% in April, following a revised gain of 0.4% during the previous month. In April, the index equaled 128.6 (2000=100), which was the lowest level since April 2014. The all-time high is 135.8, reached in January 2015.

Compared with April 2014, the SA index increased just 1%, which was well below the 4.2% gain in March and the smallest year-over-year gain since February 2013. ...

“Like most economic indicators, truck tonnage was soft in April,” said ATA Chief Economist Bob Costello. “Unless tonnage snaps back in May and June, GDP growth will likely be suppressed in the second quarter.”

Costello added that truck tonnage is off 5.3% from the high in January.

“The next couple of months will be telling for both truck freight and the broader economy. Any significant jump from the first quarter is looking more doubtful,” he said.

Trucking serves as a barometer of the U.S. economy, representing 68.8% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled just under 10 billion tons of freight in 2014. Motor carriers collected $700.4 billion, or 80.3% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up only 1.0% year-over-year.