by Calculated Risk on 5/21/2015 10:10:00 AM

Thursday, May 21, 2015

Existing Home Sales in April: 5.04 million SAAR, Inventory down 0.9% Year-over-year

The NAR reports: Existing-Home Sales Lose Momentum in April

Total existing–home sales, which are completed transactions that include single–family homes, townhomes, condominiums and co–ops, declined 3.3 percent to a seasonally adjusted annual rate of 5.04 million in April from an upwardly revised 5.21 million in March. Despite the monthly decline, sales have increased year–over–year for seven consecutive months and are still 6.1 percent above a year ago. ...

Total housing inventory at the end of April increased 10.0 percent to 2.21 million existing homes available for sale, but is still 0.9 percent below a year ago (2.23 million). Unsold inventory is at a 5.3–month supply at the current sales pace, up from 4.6 months in March.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.04 million SAAR) were 3.3% lower than last month, and were 6.1% above the April 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.21 million in April from 2.01 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.21 million in April from 2.01 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 0.9% year-over-year in April compared to April 2014.

Inventory decreased 0.9% year-over-year in April compared to April 2014. Months of supply was at 5.3 months in April.

This was below expectations of sales of 5.20 million. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increased to 274,000, Lowest 4-Week average in 15 years

by Calculated Risk on 5/21/2015 08:35:00 AM

The DOL reported:

In the week ending May 16, the advance figure for seasonally adjusted initial claims was 274,000, an increase of 10,000 from the previous week's unrevised level of 264,000. The 4-week moving average was 266,250, a decrease of 5,500 from the previous week's unrevised average of 271,750. This is the lowest level for this average since April 15, 2000 when it was 266,250.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 266,250.

This was above the consensus forecast of 270,000, and the low level of the 4-week average suggests few layoffs. This is the lowest 4-week average in 15 years (since April 2000).

Note: If the 4-week average falls to 266,000, it will be the lowest in 40 years!

Wednesday, May 20, 2015

Thursday: Existing Home Sales, Unemployment Claims and More

by Calculated Risk on 5/20/2015 07:27:00 PM

From Jon Hilsenrath at the WSJ: Fed Looks Past June for First Rate Hike

Federal Reserve officials at their April policy meeting said in the most explicit terms yet that they are unlikely to start raising short-term interest rates in June, as seemed possible when 2015 began.Thursday:

Officials have been saying they won’t begin lifting their benchmark federal funds rate from near zero until they see more improvement in the labor market and are confident inflation will rise toward their 2% target. Several of them started the year thinking they might reach that point by midyear.

But by last month, after watching the economy stumble through the winter, many at the April 28-29 meeting were doubtful those criteria for a rate increase would be met, according to minutes of the meeting released Wednesday.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 270 thousand from 264 thousand.

• Also at 8:30 AM, the Chicago Fed National Activity Index for April. This is a composite index of other data.

• At 10:00 AM, the Philly Fed manufacturing survey for May. The consensus is for a reading of 8.0, up from 7.5 last month (above zero indicates expansion).

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for sales of 5.22 million on seasonally adjusted annual rate (SAAR) basis. Sales in March were at a 5.19 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.20 million SAAR.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

• At 1:30 PM, Speech by Fed Vice Chairman Stanley Fischer, Past, Present, and Future Challenges for the Euro Area, At the ECB Forum on Central Banking, Linho Sintra, Portugal

CoreLogic: Southern California April Home Sales up 8.5% Year-over-year

by Calculated Risk on 5/20/2015 04:26:00 PM

From CoreLogic (formerly DataQuick): CoreLogic Reports Southern California Home Sales Rose 8.5 Percent Year over Year in April 2015

A total of 21,708 new and existing houses and condominiums sold in April 2015 in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties, up 9.9 percent month over month from 19,760 sales in March 2015. April 2015 sales also rose by 8.5 percent compared to April 2014 when there were 20,008 sales, marking the second straight month with year-over-year increases. Southern California home sales in April 2015 were the second highest for the month of April since 2006, only behind April 2013 when 21,795 homes sold.The NAR will release existing home sales for April tomorrow at 10:00 AM ET. The consensus is for sales of 5.22 million on seasonally adjusted annual rate (SAAR) basis, up about 10% from April 2014.

Sales activity picked up last month, making it one of the stronger Aprils since the housing bust, though sales remained below average," said Andrew LePage, a data analyst for CoreLogic. "Many buyers still face credit and affordability hurdles, and the inventory of homes for sale remains relatively tight in many markets. New home construction is still well below historically normal levels, too."

...

Real estate-owned (REO) sales represented 4.5 percent of all Southern California home sales in April, down from 5.1 percent of sales in March 2015 and down from 5.2 percent in April 2014.

...

Short sales accounted for 4.4 percent of total sales in April, up from 4 percent in March 2015 and down from 5 percent in April 2014.

emphasis added

FOMC Minutes: June Rate Hike Unlikely

by Calculated Risk on 5/20/2015 02:32:00 PM

From the Fed: Minutes of the Federal Open Market Committee, April 28-29, 2015 . Excerpts:

In their discussion of communications regarding the path of the federal funds rate over the medium term, participants expressed a range of views about when economic conditions were likely to warrant an increase in the target range for the federal funds rate. Participants continued to judge that it would be appropriate to raise the target range for the federal funds rate when they had seen further improvement in the labor market and were reasonably confident that inflation would move back to its 2 percent objective over the medium term. Although participants expressed different views about the likely timing and pace of policy firming, they agreed that the Committee's decision to begin firming would appropriately depend on the incoming data and their implications for the economic outlook. A few anticipated that the information that would accrue by the time of the June meeting would likely indicate sufficient improvement in the economic outlook to lead the Committee to judge that its conditions for beginning policy firming had been met. Many participants, however, thought it unlikely that the data available in June would provide sufficient confirmation that the conditions for raising the target range for the federal funds rate had been satisfied, al-though they generally did not rule out this possibility. Participants discussed the merits of providing an explicit indication, in postmeeting statements released prior to the commencement of policy firming, that the target range for the federal funds rate would likely be raised in the near term. However, most participants felt that the timing of the first increase in the target range for the federal funds rate would appropriately be determined on a meeting-by-meeting basis and would depend on the evolution of economic conditions and the outlook. In keeping with this data-dependent approach, some participants further suggested that the postmeeting statement's description of the economic situation and outlook, and of progress toward the Committee's goals, provided the appropriate means by which the Committee could help the public assess the likely timing of the initial increase in the target range for the federal funds rate.

emphasis added

AIA: Architecture Billings Index declined in April

by Calculated Risk on 5/20/2015 10:08:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Remain Stuck in Winter Slowdown

Riding a stretch of increasing levels of demand for thirteen out of the last fifteen months, the Architecture Billings Index (ABI) dropped in April for the second month this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI score was 48.8, down sharply from a mark of 51.7 in March. This score reflects a decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.1, up from a reading of 58.2 the previous month.

“The fundamentals in the design and construction industry remain very healthy,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The fact that both inquires for new projects and new design contracts continued to accelerate at a healthy pace in April points to strong underlying demand for design activity. However, April would typically be a month where these projects would be in full swing, but a severe winter in many parts of the Northeast and Midwest has apparently delayed progress on projects.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 48.8 in April, down from 51.7 in March. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative for the third consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was mostly positive over the last year, suggesting an increase in CRE investment in 2015.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 5/20/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 15, 2015. ...

The Refinance Index increased 0.3 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier, to the lowest level since April. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 11 percent higher than the same week one year ago.

“Mortgage rates increased last week, and Treasury rates increased to a recent high at mid week before falling at the end of the week. Overall purchase activity fell for the week, along with conventional refinance volume, but government refinance volume increased. The level of purchase applications remained 11 percent higher than the same week last year, but the drop this week may indicate borrowers being wary of the recent run up in mortgage rates,” said Mike Fratantoni, MBA’s Chief Economist.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.04 percent, its highest level since December 2014, from 4.00 percent, with points decreasing to 0.32 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It would take much lower rates - below 3.5% - to see a significant refinance boom this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 11% higher than a year ago.

Tuesday, May 19, 2015

Wednesday: FOMC Minuites, Architecture Billings Index

by Calculated Risk on 5/19/2015 08:01:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Back Near Recent Highs Ahead of Fed

Mortgage rates continued higher at an unsettling pace today, following an exceptionally strong reading on Residential Construction data. This particular report doesn't historically cause a lot of rate volatility, but it comes at a time when markets are considering the Fed's next move and where any strong showing for the economy increases the odds of a rate hike.Wednesday:

Although the Fed Funds Rate doesn't correlate directly with mortgage rates, this particular rate hike (whenever it happens) will be a major symbolic shift away from the 'emergency' rate levels that haven't budged since 2008. As such, rates are likely to move higher across the board at first. Indeed, much of the recent move higher is due to market participants pricing in their expectations for that sort of big-picture shift. The fact that it coincides with a separate potential big-picture shift in European rates markets is only making things worse.

And yet, rates remain in historically good territory today. Additionally, they haven't been seeing nearly the same sort of freakouts that characterized 2013's taper tantrum. After getting down to 3.875% on Friday, the average lender is now back to quoting conventional 30yr fixed rates of 4.0% on top tier scenarios.

emphasis added

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM: the Fed will release the FOMC Minutes for the Meeting of April 28-29, 2015.

Quarterly Housing Starts by Intent

by Calculated Risk on 5/19/2015 04:15:00 PM

In addition to housing starts for April, the Census Bureau also released the Q1 "Started and Completed by Purpose of Construction" report today.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

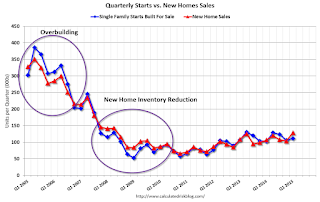

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released today showed there were 112,000 single family starts, built for sale, in Q1 2015, and that was below the 129,000 new homes sold for the same quarter, so inventory decreased in Q1 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting about the same number of homes that they are selling, and the inventory of under construction and completed new home sales is still very low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control.

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 9% compared to Q1 2014.

Single family starts built for sale were up about 9% compared to Q1 2014. Owner built starts were down 4% year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly over the last few years, but was only 1% compared to Q1 2014.

Sacramento Housing in April: Total Sales up 9% Year-over-year

by Calculated Risk on 5/19/2015 01:27:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For some time, not much changed. But over the last 2+ years we've seen some significant changes with a dramatic shift from foreclosures (REO: lender Real Estate Owned) to short sales, and the percentage of total distressed sales declining sharply.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April, 11.9% of all resales were distressed sales. This was down from 12.4% last month, and down from 16.3% in April 2014. Since distressed sales happen year round, but conventional sales decline in December and January, the percent of distressed sales bumps up in the winter (seasonal).

The percentage of REOs was at 6.5%, and the percentage of short sales was 5.5%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 26.0% year-over-year (YoY) in April. In general the YoY increases have been trending down after peaking at close to 100%, however the YoY increase was slightly larger in April than in March.

Cash buyers accounted for 16.4% of all sales (frequently investors).

Total sales were up 8.9% from April 2014, and conventional equity sales were up 14.6% compared to the same month last year.

Summary: This data suggests a healing market with fewer distressed sales, more equity sales, and less investor buying.