by Calculated Risk on 5/13/2015 12:04:00 PM

Wednesday, May 13, 2015

Las Vegas: Record Visitor Traffic in 2014, Same pace in 2015

Another update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2014.

We only have data through March, but visitor traffic is slightly below the 2014 pace so far.

However convention attendance is only returning slowly. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Through March, visitor traffic in 2015 is running 0.3% below 2014.

Convention traffic is up about 2% from last year, and is still way below the pre-recession peak. In general, the gamblers are back - and the conventions are slowly returning.

It seemed like there were many housing related conventions during the housing bubble, so it may be some time before convention attendance hits a new high.

Retail Sales unchanged in April

by Calculated Risk on 5/13/2015 08:41:00 AM

On a monthly basis, retail sales were unchanged from March to April (seasonally adjusted), and sales were up 0.9% from April 2014.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $436.8 billion, virtually unchanged from the previous month, but 0.9 percent above April 2014. ... The February 2015 to March 2015 percent change was revised from +0.9 percent to +1.1 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were unchanged.

Retail sales ex-autos increased 0.1%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.6% on a YoY basis (0.9% for all retail sales).

Retail and Food service sales ex-gasoline increased by 3.6% on a YoY basis (0.9% for all retail sales).The increase in April was below consensus expectations of a 0.2% increase, however March was revised up.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 5/13/2015 07:00:00 AM

From the MBA: As Rates Climb, Refinance Applications Continue to Drop

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 8, 2015. ...

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.2 percent from one week earlier. The unadjusted Purchase Index increased 0.1 percent compared with the previous week and was 12 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.00 percent, its highest level since March 2015, from 3.93 percent, with points increasing to 0.36 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It would take much lower rates - below 3.5% - to see a significant refinance boom this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 12% higher than a year ago.

Tuesday, May 12, 2015

Wednesday: Retail Sales

by Calculated Risk on 5/12/2015 10:26:00 PM

From the WSJ: Don’t Expect Cheap Gasoline to Fuel Retail Sales

The slump in crude oil had, as of February, led to pump-price savings estimated at over $100 billion annually for American households. But tepid retail-sales data from December through February left forecasters scratching their heads about consumers’ failure to spend much of it.Wednesday:

Back in November, year-over-year growth in retail sales was running at 4.7%. It had slipped to 1.26% by March. Even stripping out gas-station sales, it had slowed to 4% from 5.8% over the same period.

There are two likely explanations: the weather and the fact spending is sticky.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, the Retail sales for April will be released. The consensus is for retail sales to increase 0.2% in April, and to increase 0.5% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.2% increase in inventories.

Mortgage News Daily: Mortgage Rates at 2015 Highs, Average Lender at 4%

by Calculated Risk on 5/12/2015 05:32:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Keep Pushing 2015 Highs

Mortgage rates moved disconcertingly higher again today, despite the fact that underlying market levels actually improved during the day. Guaranteeing rates in such a volatile environment is expensive for lenders. The result is yet another high for 2015. The average lender is quoting conventional 30yr fixed rates of 4.0% on top tier scenarios. Just a few short weeks ago, the average rate was 3.625%. That makes this the most abrupt move higher in roughly 2 years, with the last notable example being the mid-2013 'taper tantrum.'Here is a table from Mortgage News Daily:

NY Fed: Household Debt increased slightly in Q1 2015

by Calculated Risk on 5/12/2015 01:11:00 PM

Here is the Q1 report: Household Debt and Credit Report.

From the NY Fed: Delinquencies, Foreclosures and Bankruptcies Improve as Household Debt Stays Flat

The Federal Reserve Bank of New York’s Household Debt and Credit Report revealed that aggregate household debt balances were largely flat in the first quarter of 2015. As of the end of March, total household indebtedness was $11.85 trillion, a $24 billion, or 0.2 percent, increase during the first quarter of this year. The report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

The slowdown in growth can be attributed to a negligible uptick in mortgage balances, which are the largest component of household debt. Mortgage balances stood at $8.17 trillion in the first quarter. Additionally, balances on home equity lines of credit (HELOC), which were $510 billion at the end of fourth quarter, 2014, were unchanged in the first quarter of this year.

Non-housing debt balances increased by 0.7 percent from the end of last year, largely due to increases in student loans ($32 billion) and auto loans ($13 billion). These gains were partially offset by a $16 billion decline in credit card balances.

Measures on delinquencies, foreclosures and bankruptcies all improved in the first quarter. The percentage of outstanding debt in some stage of delinquency fell to 5.7 percent from 6.0 percent in the fourth quarter of 2014, with continuing improvements in mortgages. About 112,000 individuals had a new foreclosure notation added to their credit reports in the first quarter of this year, the lowest total since at least 1999. Four percent fewer consumers had a bankruptcy notation added to their credit reports, bringing the quarterly total to its lowest point since early 2006.

“Tight standards on mortgage lending are reflected in both sluggish growth in housing debt as well as substantial reductions in mortgage delinquency and defaults,“ said Andrew Haughwout, senior vice president and economist at the New York Fed.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased slightly in Q1. Household debt peaked in 2008, and bottomed in Q2 2013.

The recent increase in debt suggests households (in the aggregate) deleveraging is over.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased to 5.7% in Q1, from 6.0% in Q4.

There are a number of credit graphs at the NY Fed site.

BLS: Jobs Openings at 5.0 million in March, Up 19% Year-over-year

by Calculated Risk on 5/12/2015 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 5.0 million job openings on the last business day of March, little changed from 5.1 million in February, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 5.1 million in March and separations were little changed at 5.0 million....The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.8 million quits in March, little changed from February.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in March to 4.994 million from 5.144 million in February.

The number of job openings (yellow) are up 19% year-over-year compared to March 2014.

Quits are up 14% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report. It is a good sign that job openings are around 5 million, and that quits are increasing solidly year-over-year.

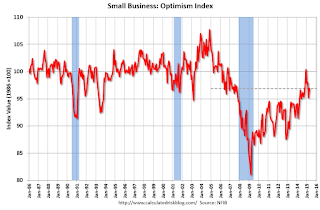

NFIB: Small Business Optimism Index increased in April

by Calculated Risk on 5/12/2015 09:06:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Rises, But Future Sales Cloud Outlook

The Small Business Optimism Index increased 1.7 points from March to 96.9, this in spite of a quarter of virtually no economic growth. Unfortunately, the Index remained below the January reading. Nine of the 10 Index components gained, only real sales expectations were weaker. But this still leaves the Index below its historical average, oscillating between 95 and 98 but never breaking out except for December, when the Index just tipped past 100, only to fall again.More good news: Only 11 percent of companies reported "poor sales" as the most important problem, down from 16% a year ago, and a recession high of 34%.

...

Small businesses posted another decent month of job creation. Those that hired were more aggressive than those reducing employment, producing an average increase of 0.14 workers per firm, continuing a string of solid readings for 2015. ... Twenty-seven percent of all owners reported job openings they could not fill in the current period, up 3 points from March. A net 11 percent plan to create new jobs, up 1 point and a solid reading.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.9 in April from 95.2 in March.

Monday, May 11, 2015

Tuesday: Job Openings, Q1 Household Debt and Credit Report

by Calculated Risk on 5/11/2015 09:27:00 PM

A couple of posts on consumers ...

From Professor Hamilton at Econbrowser: Energy prices and consumer spending

Whatever the explanation, the facts seem to be that, unlike what we usually observed historically, consumers have been using much of the gains from lower energy prices to bolster their saving rather than using it to increase spending on other goods and services.And from Dr. Altig at Macroblog: All Eyes on the Consumer

... the "fundamentals" suggest the four-month annualized growth of consumer spending should have been in excess of 4 percent, as opposed to the approximately 1.5 percent we actually saw. That is a story we don't expect to persist, and our current view of the year is that first-quarter consumer spending results are not indicative of future performance.My sense is the increase in consumer spending will be larger in Q2.

Consumers are, of course, a forward-looking bunch, and it is possible the recent weak spending reflects a looming reality not captured by the simple model described above. But our forecast for now is that consumers will move to the fundamentals, and not vice versa.

Tuesday:

• At 9:00 AM ET, NFIB Small Business Optimism Index for April.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for March from the BLS. Jobs openings increased in February to 5.133 million from 4.965 million in January. This was the highest level for job openings since January 2001. The number of job openings (yellow) were up 23% year-over-year, and Quits were up 10% year-over-year.

• At 11:00 AM, the The New York Fed will release their Q1 2015 Household Debt and Credit Report

Research: Natural Rate of Unemployment under 5% and Falling

by Calculated Risk on 5/11/2015 05:32:00 PM

From the Chicago Fed: Changing labor force composition and the natural rate of unemployment Excerpts:

We estimate our baseline natural rate of unemployment as of 2014:Q4 to be 4.9% —0.5 percentage points lower than the CBO’s estimate of the short-run natural rate. We project this rate to fall by about 0.06 percentage points per year through the end of the decade, reaching 4.5% at the end of 2020—0.7 percentage points below the CBO’s estimate.

Two broad assumptions underlie these simple calculations. First, demographics and educational attainment are fundamental determinants of unemployment, and thus, changes in them over time should drive overall levels of aggregate unemployment. Second, the unemployment rate was at its natural rate in late 2005. Both of these assumptions seem plausible, but neither is completely unassailable. ...

...

While great progress has been made over the past few years, significant labor market slack remains. We estimate the natural rate at or below 5%, at least half of a percentage point below its actual level as of March 2015. This estimate of slack, in combination with labor market measures such as LFP and involuntary part-time workers, may help explain why wage inflation and price inflation remain so low. Moreover, we estimate that absent major new developments, demographic and educational changes will persist, potentially reducing the trend unemployment rate to around 4.4% to 4.8% by 2020.