by Calculated Risk on 5/09/2015 10:01:00 AM

Saturday, May 09, 2015

Schedule for Week of May 10, 2015

The key economic report this week is April Retail sales on Wednesday.

For manufacturing, the April Industrial Production and Capacity Utilization report, and the May NY Fed (Empire State) survey will be released this week.

At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

9:00 AM: NFIB Small Business Optimism Index for April.

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in February to 5.133 million from 4.965 million in January. This was the highest level for job openings since January 2001.

The number of job openings (yellow) were up 23% year-over-year, and Quits were up 10% year-over-year.

11:00 AM: The New York Fed will release their Q1 2015 Household Debt and Credit Report

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for April will be released.

8:30 AM ET: Retail sales for April will be released.This graph shows retail sales since 1992 through March 2015. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.9% from February to March (seasonally adjusted), and sales were up 1.3% from March 2014.

The consensus is for retail sales to increase 0.2% in April, and to increase 0.5% ex-autos.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.2% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 276 thousand from 265 thousand.

8:30 AM ET: The Producer Price Index for April from the BLS. The consensus is for a 0.2% increase in prices, and a 0.1% increase in core PPI.

8:30 AM: NY Fed Empire State Manufacturing Survey for May. The consensus is for a reading of 5.0, up from -1.2 last month (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for April.This graph shows industrial production since 1967.

The consensus is for no change in Industrial Production, and for Capacity Utilization to be unchanged at 78.4%.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 95.8, down from 95.9 in April.

Friday, May 08, 2015

Bank Failure Friday Returns: 5th Failure in 2015

by Calculated Risk on 5/08/2015 06:35:00 PM

From the FDIC: Republic Bank of Chicago, Oak Brook, Illinois, Assumes All of the Deposits of Edgebrook Bank, Chicago, Illinois

As of March 31, 2015, Edgebrook Bank had approximately $90.0 million in total assets and $90.0 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $16.8 million. Compared to other alternatives, ... Edgebrook Bank is the fifth FDIC-insured institution in the nation to fail this year, and the second in Illinois. The last FDIC-insured institution closed in the state was Highland Community Bank, Chicago, on January 23, 2015.This is the first bank closing since February, and it looks like failures might be in single digits this year (lowest since 2007 when 3 banks failed). Last year 18 banks were closed by regulators.

Lawler: More Builder Results (updated table)

by Calculated Risk on 5/08/2015 04:36:00 PM

Housing economist Tom Lawler sent me this updated table of builder results for Q1.

For these nine builders, net orders were up 20.3% year-over-year. Although cancellations are handled differently, this is about the same year-over-year increase for Q1 as for New Home sales as reported by the Census Bureau.

The average closing price is only up slightly this year following a sharp increase in 2014.

From Tom Lawler:

Below is a table with some summary statistics for nine large publicly-traded home builders for the first calendar quarter of 2015. While results varied across builders, the general themes were significantly higher unit sales, but lower home building margins, relative to the comparable quarter of 2014.

Net orders per community for these combined nine builders combined were up 13.2% YOY, and their combined order backlog at the end of March was up 14.8% from last March.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 3/15 | 3/14 | % Chg | 3/15 | 3/14 | % Chg | 3/15 | 3/14 | % Chg |

| D.R. Horton | 11,135 | 8,569 | 29.9% | 8,243 | 6,194 | 33.1% | $281,305 | 271,230 | 3.7% |

| PulteGroup | 5,139 | 4,863 | 5.7% | 3,365 | 3,436 | -2.1% | $323,000 | 317,000 | 1.9% |

| NVR | 3,926 | 3,325 | 18.1% | 2,534 | 2,211 | 14.6% | $371,000 | 361,400 | 2.7% |

| The Ryland Group | 2,389 | 2,186 | 9.3% | 1,463 | 1,470 | -0.5% | $343,000 | 327,000 | 4.9% |

| Beazer Homes | 1,698 | 1,390 | 22.2% | 936 | 977 | -4.2% | $305,800 | 272,400 | 12.3% |

| Standard Pacific | 1,571 | 1,311 | 19.8% | 972 | 995 | -2.3% | $528,000 | 483,000 | 9.3% |

| Meritage Homes | 1,979 | 1,525 | 29.8% | 1,335 | 1,109 | 20.4% | $387,000 | 366,000 | 5.7% |

| MDC Holdings | 1,593 | 1,236 | 28.9% | 909 | 873 | 4.1% | $414,800 | 364,900 | 13.7% |

| M/I Homes | 1,108 | 982 | 12.8% | 717 | 732 | -2.0% | $325,000 | 299,000 | 8.7% |

| Total | 30,538 | 25,387 | 20.3% | 20,474 | 17,997 | 13.8% | $330,848 | $318,886 | 3.8% |

Fannie and Freddie: REO inventory declined in Q1, Down 30% Year-over-year

by Calculated Risk on 5/08/2015 02:31:00 PM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

From Fannie Mae:

We continue to experience disproportionately higher credit losses and serious delinquency rates from single-family loans originated in 2005 through 2008 than from loans originated in other years. Single-family loans originated in 2005 through 2008 constituted 12% of our single-family book of business as of March 31, 2015 but constituted 59% of our seriously delinquent loans as of March 31, 2015 and drove 67% of our credit losses in the first quarter of 2015.From Freddie Mac:

emphasis added

Our single-family REO acquisitions in the first quarter of 2015 were highest in Florida, Illinois, Ohio, and Michigan, which collectively represented 38% of total single-family REO acquisitions during that period, based on the number of properties, and comprised 38% of our total single-family REO property inventory at March 31, 2015.Fannie and Freddie are still working through the backlog of loans made during the housing bubble, mostly in judicial foreclosure states.

Our REO acquisition activity is disproportionately high for certain types of loans, including loans with certain higher-risk characteristics. For example, the percentage of interest-only and Alt-A loans in our single-family credit guarantee portfolio, based on UPB, was approximately 2% and 3%, respectively, at March 31, 2015. The percentage of our REO acquisitions in the first quarter of 2015 that had been financed by either of these loan types represented approximately 20% of our total REO acquisitions, based on loan amount prior to acquisition. In addition, loans from our 2005-2008 Legacy single-family book comprised approximately 71% of our REO acquisition activity during the first quarter of 2015.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q1 for both Fannie and Freddie, and combined inventory is down 30% year-over-year. For Freddie, this is the lowest level of REO since Q2 2008. For Fannie, this is the lowest level since Q3 2009.

Short term delinquencies are at normal levels, but there are still a fairly large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

Employment Report Comments and Graphs

by Calculated Risk on 5/08/2015 11:52:00 AM

Earlier: April Employment Report: 223,000 Jobs, 5.4% Unemployment Rate

This was a decent employment report with 223,000 jobs added, but February and March were revised down by a combined 39,000 jobs.

However there is still limited wage growth, from the BLS: "In April, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.87. Over the past 12 months, average hourly earnings have increased by 2.2 percent." Weekly hours were unchanged.

A few more numbers: Total employment increased 223,000 from March to April and is now 3.0 million above the previous peak. Total employment is up 11.7 million from the employment recession low.

Private payroll employment increased 213,000 from March to April, and private employment is now 3.5 million above the previous peak. Private employment is up 12.3 million from the recession low.

In April, the year-over-year change was just under 3.0 million jobs.

Overall this is another positive month ... and moving in the right direction!

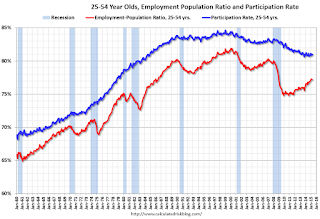

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate increased in April to 81.0%, and the 25 to 54 employment population ratio was unchanged at 77.2%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

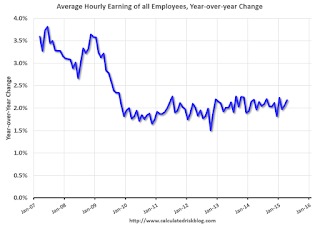

Average Hourly Earnings

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased slightly to 2.2%, however wages were revised down for February and March. Wages will probably pick up a little this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 6.6 million in April, but is down by 880,000 from a year earlier. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in April to 6.58 million from 6.70 million in March. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 10.8% in April from 10.9% in March. This is the lowest level for U-6 since August 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.525 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.563 million in March.

This is trending down - and is at the lowest level since November 2008 - but is still very high.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In April 2015, state and local governments added 8,000 jobs (after losing 8,000 in March). State and local government employment is now up 132,000 from the bottom, but still 626,000 below the peak.

State and local employment is now generally increasing - slowly. And Federal government layoffs have slowed (Federal payrolls added 2,000 jobs in April, and Federal employment is unchanged year-to-date).

This was a decent employment report for April (not great, but not terrible). The year-over-year employment gains are still solid.

April Employment Report: 223,000 Jobs, 5.4% Unemployment Rate

by Calculated Risk on 5/08/2015 08:35:00 AM

From the BLS:

Total nonfarm payroll employment increased by 223,000 in April, and the unemployment rate was essentially unchanged at 5.4 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, health care, and construction. Mining employment continued to decline.

...

The change in total nonfarm payroll employment for February was revised from +264,000 to +266,000, and the change for March was revised from +126,000 to +85,000. With these revisions, employment gains in February and March combined were 39,000 lower than previously reported.

emphasis added

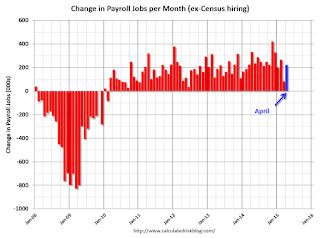

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 223 thousand in April (private payrolls increased 213 thousand).

Payrolls for February and March were revised down by a combined 39 thousand.

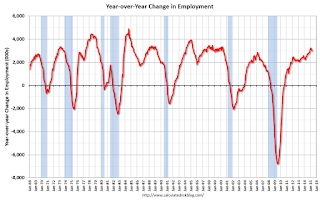

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was just under 3.0 million jobs.

This is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate increased in April to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was declined in April to 5.4%.

This was at expectations of 220,000, however there March was revised down ... still a decent report.

I'll have much more later ...

Thursday, May 07, 2015

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 5/07/2015 07:42:00 PM

Here is the employment preview I posted earlier: Preview: Employment Report for April

Goldman Sachs is forecasting 230,000 jobs added, and for the unemployment rate to decline to 5.4%.

Merrill Lynch is forecasting 235,000 jobs added in April, and the unemployment rate declining to 5.4%.

Nomura is forecasting 210,000 jobs, a 0.28% increase in wages month-to-month, and a 5.4% unemployment rate.

Friday:

• At 8:30 AM ET, the Employment Report for April. The consensus is for an increase of 220,000 non-farm payroll jobs added in April, up from the 126,000 non-farm payroll jobs added in March. The consensus is for the unemployment rate to decline to 5.4%.

Phoenix Real Estate in April: Sales Up 9.3%, Inventory DOWN 13% Year-over-year

by Calculated Risk on 5/07/2015 05:31:00 PM

For the fifth consecutive month, inventory was down year-over-year in Phoenix. This is a significant change from last year.

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in April were up 9.3% year-over-year.

2) Cash Sales (frequently investors) were down to 25.3% of total sales.

3) Active inventory is now down 13.2% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline).

| April Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash | Percent Cash | Inventory | YoY Change | |

| Apr-08 | 4,8751 | --- | 986 | 20.2% | 55,7261 | --- |

| Apr-09 | 8,564 | 75.7% | 3,464 | 40.4% | 44,165 | -20.7% |

| Apr-10 | 9,261 | 8.1% | 3,641 | 39.3% | 41,756 | -5.5% |

| Apr-11 | 9,328 | 0.7% | 4,489 | 48.1% | 34,515 | -17.3% |

| Apr-12 | 8,438 | -9.5% | 4,013 | 47.6% | 21,125 | -38.8% |

| Apr-13 | 8,744 | 3.6% | 3,670 | 42.0% | 20,083 | -4.9% |

| Apr-14 | 7,656 | -12.4% | 2,469 | 32.2% | 29,889 | 48.8% |

| Apr-15 | 8,368 | 9.3% | 2,120 | 25.3% | 25,950 | -13.2% |

| 1 April 2008 does not include manufactured homes, ~100 more | ||||||

Goldman Sachs April Employment Preview

by Calculated Risk on 5/07/2015 03:15:00 PM

Yesterday I discussed several indicators: Preview: Employment Report for April

Some excerpts from a research piece by Goldman Sachs economist David Mericle:

We expect nonfarm payroll job growth of 230k in April ... We expect the unemployment rate to decline by one-tenth to 5.4% and average hourly earnings to rise 0.2%.

...

Based on our method for estimating the payrolls effect of deviations in weather conditions from seasonal norms, we expect that warmer temperatures should be a substantial positive factor for April payrolls. The weeks leading into the March reference week were much colder than usual, while the weeks leading into the April reference period were quite a bit warmer than usual. Furthermore, the change in employment in both the construction and leisure and hospitality industries was about 30k below trend in March.

...

We also see some upside risk to our baseline forecast from a calendar effect. There were five rather than four weeks between the reference weeks for the March and April payrolls surveys this year. While the relevant history is limited and the BLS's seasonal adjustment procedure does attempt to control for the four-versus-five week effect, we have found that five-week Aprils tend to see above-trend payroll growth. Moreover, we have found that this calendar effect is not fully captured by other employment-related data. We expect an unusually large and positive calendar effect this month.

Part II: Demographics are Now Improving, Projections

by Calculated Risk on 5/07/2015 01:15:00 PM

Yesterday I pointed out that a blog post on demographics at the Financial Times would make more sense if it had been written a decade ago.

A decade ago it was obvious that demographics would be a drag on the economy. Even without the financial crisis, we would have expected a slowdown in growth.

But now the prime working age population is growing again, and we can expect growth to pick up over the next decade.

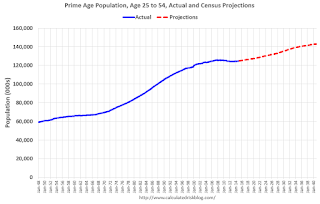

Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through March 2015 - with projections from the Census Bureau through 2040.

In the '80s, the prime working age population was growing 2% or more per year. Over the last 10 years (March 2005 through March 2015), the prime working age population was mostly unchanged (up less than 1% for the decade).

That is key reason that growth has slowed (see Demographics and GDP: 2% is the new 4%). Add the residual effects of the financial crisis to the drag from demographics - and the last decade was no surprise.

Going forward, the prime working age population will grow at a 0.5% to 1.0% annual rate (Census projections). This isn't the 2%+ per year of the 1980s, but it is still decent growth.

Demographics are now improving in the U.S..