by Calculated Risk on 4/29/2015 07:00:00 AM

Wednesday, April 29, 2015

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Apps up 21% YoY

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 24, 2015. ...

The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index was unchanged from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 21 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.85 percent from 3.83 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 21% higher than a year ago.

Tuesday, April 28, 2015

Wednesday: GDP, FOMC

by Calculated Risk on 4/28/2015 09:00:00 PM

From Bloomberg: Fed Decision Day Guide: From Cooling Economy to Forward Guidance

Investors will scrutinize changes to the description of the economy for hints on the likely timing of liftoff after policy makers all but ruled out an interest-rate increase at this meeting.Wednesday:

Expectations for the first increase since 2006 have shifted out to September from June as the economy weakened in the first quarter ...

Inflation: Signs that consumer prices are stabilizing following a rebound in oil costs could encourage policy makers to tweak their language on inflation. ...

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2015 (advance estimate). The consensus is that real GDP increased 1.0% annualized in Q1.

• At 10:00 AM, Pending Home Sales Index for March. The consensus is for a 1.0% increase in the index.

• At 2:00 PM, FOMC Meeting Statement. No change to policy is expected.

A Comment on House Prices: Real Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/28/2015 04:37:00 PM

The expected slowdown in year-over-year price increases has occurred. In October 2013, the National index was up 10.9% year-over-year (YoY). In February 2015, the index was up 4.2% YoY. However the YoY change has only declined slightly over the last six months.

Looking forward, I expect the YoY increases for the indexes to move more sideways (as opposed to down). Two points: 1) I don't expect (as some) for the indexes to turn negative YoY (in 2015) , and 2) I think most of the slowdown on a YoY basis is now behind us. This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (36%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 7.6% below the bubble peak. However, in real terms, the National index is still about 21% below the bubble peak.

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to May 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to December 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

In real terms, the National index is back to June 2003 levels, the Composite 20 index is back to March 2003, and the CoreLogic index back to April 2003.

In real terms, house prices are back to 2003 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to March 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to 2003 levels - and maybe moving a little sideways now.

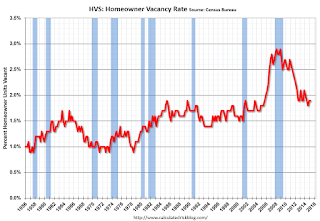

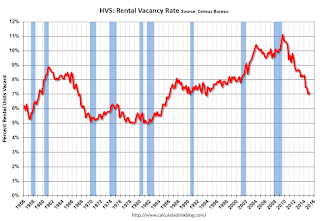

HVS: Q1 2015 Homeownership and Vacancy Rates

by Calculated Risk on 4/28/2015 01:45:00 PM

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2015.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 63.7% in Q1, from 64.0% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate is probably close to a bottom.

Are these homes becoming rentals?

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

I think the Reis quarterly survey (large apartment owners only in selected cities) is a much better measure of the rental vacancy rate.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Richmond Fed: "Manufacturing Sector Activity Remained Soft"

by Calculated Risk on 4/28/2015 10:22:00 AM

From the Richmond Fed: Manufacturing Sector Activity Remained Soft; Employment and Wages Grew Mildly

Overall, manufacturing conditions remained soft in April. The composite index for manufacturing moved to a reading of −3 following last month's reading of −8. The index for shipments and the index for new orders gained seven points in April, although both indicators finished at only −6.This is the last of the regional surveys for April. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Manufacturing employment edged up a point this month, with the index ending at 7. The average workweek lengthened, moving the index up eight points to end at 4. The average wage index added one point to end at 9.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

It seems likely the ISM index will be weak again, and could even show contraction for April. The ISM Manufacturing Index for April will be released on Friday, May 1st, and the consensus is for an increase to 52.0 from 51.5 in March.

Case-Shiller: National House Price Index increased 4.2% year-over-year in February

by Calculated Risk on 4/28/2015 09:17:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Widespread Gains in Home Prices for February According to the S&P/Case-Shiller Home Price Indices

Data released for February 2015 show that home prices continued their rise across the country over the last 12 months. ... Both the 10-City and 20-City Composites saw larger year-over-year increases in February compared to January. The 10-City Composite gained 4.8% year-over-year, up from 4.3% in January. The 20-City Composite gained 5.0% year-over-year, compared to a 4.5% increase in January. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.2% annual gain in February 2015, weaker than the 4.4% increase in January 2015.

...

The National Index rebounded in February, reporting a 0.1% change for the month. Both the 10- and 20-City Composites reported significant month-over-month increases of 0.5%, their largest increase since July 2014. Of the sixteen cities that reported increases, San Francisco and Denver led all cities in February with increases of 2.0%and 1.4%. Cleveland reported the largest drop as prices fell 1.0%. Las Vegas and Boston reported declines of -0.3% and -0.2% respectively.

...

“Home prices continue to rise and outpace both inflation and wage gains,” said David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The S&P/Case-Shiller National Index has seen 34 consecutive months with positive year-over-year gains; all 20 cities have shown year-over-year gains every month since the end of 2012. While prices are certainly rebounding, only two cities – Denver and Dallas – have surpassed their housing boom peaks. Nationally, prices are almost 10% below the high set in July 2006. Las Vegas fell 61.7% peak to trough and has the farthest to go to set a new high; it is 41.5% below its high. If a complete recovery means new highs all around, we’re not there yet.

“A better sense of where home prices are can be seen by starting in January 2000, before the housing boom accelerated, and looking at real or inflation adjusted numbers. Based on the S&P/Case-Shiller National Home Price Index, prices rose 66.8% before adjusting for inflation from January 2000 to February 2015; adjusted for inflation, this is 27.9% or a 1.7% annual rate. The highest price gain over the last 15 years was in Los Angeles with a 4.3% real annual rate; the lowest was Detroit with a -3.6% real annual rate. While nationally, prices are recovering, new construction of single family homes remains very weak despite low vacancy rates among both renters and owner-occupied homes.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 15.2% from the peak, and up 0.9% in February (SA).

The Composite 20 index is off 14.1% from the peak, and up 0.9% (SA) in February.

The National index is off 7.6% from the peak, and up 0.4% (SA) in February. The National index is up 24.3% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.8% compared to February 2014.

The Composite 20 SA is up 5.0% year-over-year..

The National index SA is up 4.2% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in February seasonally adjusted. (Prices increased in 16 of the 20 cities NSA) Prices in Las Vegas are off 41.1% from the peak, and prices in Denver and Dallas are at new highs (SA).

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 50% above January 2000 (44% nominal gain in 14 years).

These are nominal prices, and real prices (adjusted for inflation) are up about 38% since January 2000 - so the increase in Phoenix from January 2000 until now is about 10% above the change in overall prices due to inflation.

Two cities - Denver (up 64% since Jan 2000) and Dallas (up 47% since Jan 2000) - are above the bubble highs (a few other Case-Shiller Comp 20 city are close - Boston and, Charlotte). Detroit prices are still below the January 2000 level.

This was below the consensus forecast for a 4.6% YoY increase for the National index. I'll have more on house prices later.

Monday, April 27, 2015

Tuesday: Case-Shiller House Prices

by Calculated Risk on 4/27/2015 09:34:00 PM

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices. The consensus is for a 4.6% year-over-year increase in the National Index for February. The Zillow forecast is for the National Index to increase 4.5% year-over-year in February, and for prices to increase 0.5% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for April.

• Also at 10:00 AM, Conference Board's consumer confidence index for April. The consensus is for the index to increase to 102.5 from 101.3.

• Also at 10:00 AM, the Q1 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track with other measures (like the decennial Census and the ACS).

Freddie Mac: Mortgage Serious Delinquency rate declined in March

by Calculated Risk on 4/27/2015 06:21:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in March to 1.73%, down from 1.81% in February. Freddie's rate is down from 2.20% in March 2014, and the rate in March was the lowest level since December 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for March in a few days.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.47 percentage points over the last year - and the rate of improvement has slowed recently - but at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

So even though distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Merrill Lynch: FOMC Preview

by Calculated Risk on 4/27/2015 04:40:00 PM

The FOMC meeting starts tomorrow and the statement will be released Wednesday at 2:00 PM ET. No change in policy is expected.

Here is a preview from Merrill Lynch:

At the March FOMC meeting, the Fed took any policy changes in April off the table. We don’t expect similar language about June policy at the April meeting. We do expect a more somber description of recent activity. This dovish shift in the nearterm view should translate into significantly lower odds of a June rate hike in our view. But any market participants who seek an explicit signal that June also is off the table are likely to be disappointed: the FOMC will want to maintain as much policy flexibility as possible. Fed officials also should stay optimistic about reaching their dual mandate objectives over time. The minutes, released in three weeks’ time, are once again likely to be more informative about the state of the Fed debate.

Without a press conference or updated projections in April, the FOMC statement will be the focus. The main change is likely to be an acknowledgment of the broadly weaker data for consumption, manufacturing and the labor market in recent months. The Committee may suggest temporary factors (i.e., weather and the West Coast port shutdown) account for much of the 1Q slowdown and thus leave the mediumterm outlook unchanged. Meanwhile, the recent firming of core inflation measures may give the FOMC more confidence that downside inflation risks — which rose in the March SEP — have faded. As such, we look for no significant changes in the inflation outlook, although we continue to believe the Fed is under-estimating the persistence of global disinflationary forces.

The March statement dropped “patient,” which had been generally interpreted to mean no rate hikes for the current and subsequent meeting, in order to have more flexibility for setting policy at the June meeting and beyond. To make certain the markets didn’t misinterpret the change in guidance as a sign of imminent liftoff, the FOMC stated that an April rate hike remained “unlikely” and that dropping “patient” did not mean the FOMC had decided on the timing of liftoff. As these clarifications are no longer needed, we expect they will be dropped. The statement may add that the Fed anticipates a “gradual” normalization process, to complement existing language that economic conditions may warrant lower-than-normal policy rates for some time. We expect no changes to the reinvestment program.

Vehicle Sales Forecasts: Best April in "13 Years"

by Calculated Risk on 4/27/2015 01:11:00 PM

The automakers will report April vehicle sales on Friday, May 1st. Sales in March were at 17.05 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales will be strong in April too. April sales (SA) will probably be the best since 2005.

Note: There were 26 selling days in April, the same as last year. Here are a couple of forecasts:

From WardsAuto: Forecast: April Daily Sales to Reach 13-Year High

A WardsAuto forecast calls for U.S. automakers to deliver 1.474 million light vehicles this month.From J.D. Power: New-Vehicle Sales in April Strongest for the Month in a Decade

The forecasted daily sales rate of 56,706 over 26 days represents a 6.7% improvement from like-2014 (also 26 days) and would mark the industry’s best April, on a daily basis, since 2002, as well as the highest April sales volume since 2000.

...

The report puts the seasonally adjusted annual rate of sales for the month at 16.8 million units, down from March’s 17.1 million SAAR, but some 800,000 units above year-ago and slightly ahead of the 16.8 million first-quarter SAAR.

Total light-vehicle sales are projected to reach 1,463,700, a 5 percent increase compared with April 2014 and the highest level for the month since April 2005 when 1,500,624 new vehicles were sold. [Total forecast 16.6 million SAAR]Another strong month for auto sales.