by Calculated Risk on 4/17/2015 04:17:00 PM

Friday, April 17, 2015

Key Measures Show Low Inflation in March

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.6% annualized rate) in March. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for March here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.9% annualized rate) in March. The CPI less food and energy also rose 0.2% (2.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.8%. Core PCE is for February and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 2.6% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 2.8% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is slightly above 2%).

The key question for the Fed is if these key measures will move back towards 2%.

Goldman Sachs: "An Update on Student Loans: A Bigger Headwind but Still Not a Deal Breaker"

by Calculated Risk on 4/17/2015 03:06:00 PM

Some excerpts from interesting analysis by Goldman Sachs economists Alec Phillips and Hui Shan: An Update on Student Loans: A Bigger Headwind but Still Not a Deal Breaker

The upshot is that the student debt burden on young households has increased and it has become a bigger headwind to housing demand compared to a few years ago. That said, we still think the sheer size of the millennials who are currently in their 20s and whose housing consumption should increase sharply in the coming years will support aggregate housing demand.

However, we are skeptical that student loans would pose serious systemic risks even if default rates increased significantly from their already high levels. The main reason is simply that around two-thirds of the outstanding balance of student loans is held directly on the federal government's balance sheet, and most of the remainder is held in the form of asset backed securities that are guaranteed by the federal government, subject to a small first loss (up to 3% of the outstanding balance and accrued interest). ... The bottom line is that the non-guaranteed portion of federal student loan balances plus all non-federal student loans that have not yet been charged off by lenders is probably not much greater than $100 billion and could be as low as $20 billion.

Of slightly greater concern is the fact that student loan debt is in many ways senior to other forms of consumer debt. For example, student loans cannot generally be discharged in bankruptcy, and borrowers in default can face wage garnishments and reduced tax refunds, among other remedies. In theory, this makes it more likely that a borrower's limited income would be used to repay student loan debt rather than to service mortgage or other consumer debt. This could, in theory, increase the default rate on non-student debt during the next economic downturn.

That said, recent policy changes alleviate this concern somewhat. Income-based repayment programs, which limit required monthly payments to a manageable percentage of borrowers' income and, in some cases, allow remaining debt to be forgiven, should reduce the competition between debt service on student loans and other debt. The Obama Administration has recently expanded eligibility for these programs.

Overall, after updating our prior analysis on student loans we come away with the view that increased student debt levels, and particularly the concentration of higher levels of debt among some borrowers, could create some headwinds for consumers, but that the risk of an acute financial disruption caused by student loan defaults is low.

Lawler: Texas Employment Declines (Housing Impact)

by Calculated Risk on 4/17/2015 11:58:00 AM

From housing economist Tom Lawler: Texas: Non-Farm Payoll Employment Fell in March

The Texas Workforce Commission reported that non-farm payroll employment in the Lone Star State declined by 25,400 (or -0.22%) on a seasonally adjust basis in March, the first monthly decline since September 2009 and the largest monthly decline since August 2009. Declines were broad-based from an industry perspective, with mining and logging, construction, manufacturing, and the service-producing sectors all experiencing a monthly dip in employment.

From the end of 2013 to the end of 2014 non-farm payroll employment in Texas increased by 3.6%, easily outpacing the 2.3% growth for the US as a whole.

In 2014 single-family building permits in Texas were up 8.7% from 2013 compared to 1.5% for the US as a whole. In the first two months of 2015 single-family building permits in Texas were up 6.7% from the comparable period of 2014, compared to a YOY gain of 5.6% for the US as a whole.

CR note: As Lawler points out, single family building permits (and housing starts) have increased much faster in Texas than in the U.S. With the slowdown due to lower oil prices, employment is now falling, and building will probably slow.

Preliminary April Consumer Sentiment increases to 95.9

by Calculated Risk on 4/17/2015 10:03:00 AM

BLS: CPI increased 0.2% in March, Core CPI increased 0.2%

by Calculated Risk on 4/17/2015 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in March on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index declined 0.1 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was lower than the consensus forecast of a 0.2% increase for CPI, and at the forecast of a 0.2% increase in core CPI.

The index for all items less food and energy rose 0.2 percent in March, the same increase as in January and February.

emphasis added

Thursday, April 16, 2015

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in March

by Calculated Risk on 4/16/2015 08:59:00 PM

Friday:

• At 8:30 AM ET, the Consumer Price Index for March from the BLS. The consensus is for a 0.3% increase in prices, and a 0.2% increase in core CPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for April). The consensus is for a reading of 93.7, up from 93.0 in March.

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for a few selected cities in March.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase foreclosure as lenders work through the backlog).

Short sales are down in these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Mar-15 | Mar-14 | Mar-15 | Mar-14 | Mar-15 | Mar-14 | Mar-15 | Mar-14 | |

| Las Vegas | 8.3% | 12.9% | 9.3% | 11.7% | 17.6% | 24.6% | 32.4% | 43.1% |

| Reno** | 5.0% | 14.0% | 8.0% | 7.0% | 13.0% | 21.0% | ||

| Phoenix | 3.2% | 5.1% | 4.2% | 6.9% | 7.4% | 11.9% | 27.5% | 33.1% |

| Sacramento | 5.4% | 8.2% | 6.9% | 7.9% | 12.3% | 16.1% | 19.3% | 22.5% |

| Minneapolis | 2.9% | 4.9% | 12.2% | 21.9% | 15.1% | 26.8% | ||

| Mid-Atlantic | 4.7% | 7.7% | 14.0% | 10.9% | 18.8% | 18.5% | 18.2% | 19.9% |

| Orlando | 4.2% | 7.9% | 26.9% | 23.7% | 31.1% | 31.6% | 38.2% | 44.6% |

| Chicago (city) | 21.9% | 28.8% | ||||||

| Hampton Roads | 22.7% | 24.5% | ||||||

| Northeast Florida | 31.0% | 39.1% | ||||||

| Richmond VA | 11.9% | 18.1% | 18.0% | 21.1% | ||||

| Tucson | 32.0% | 33.5% | ||||||

| Toledo | 32.7% | 40.7% | ||||||

| Des Moines | 16.3% | 20.8% | ||||||

| Omaha | 16.1% | 20.3% | ||||||

| Wichita | 23.2% | 32.0% | ||||||

| Pensacola | 33.4% | 35.7% | ||||||

| Memphis* | 15.5% | 18.5% | ||||||

| Springfield IL** | 11.8% | 14.4% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

NMHC: Apartment Market Conditions Tighter in April Survey

by Calculated Risk on 4/16/2015 05:50:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Expand in April NMHC Quarterly Survey

All four indexes landed above the breakeven level of 50 in the April National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions.

“The song remains the same—the apartment markets are not only strong but getting stronger,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Despite occasional predictions to the contrary, markets keep getting tighter. As new construction increases, so do absorptions, indicating the demand for apartments is not yet close to being sated.”

The Market Tightness Index increased by 7 points from last quarter (and by 2 points from a year earlier) to 58. Thirty-one percent of respondents reported tighter conditions than three months ago. This now marks the fifth consecutive quarter where the index indicates overall improving conditions.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates market conditions were tighter over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

Comments on March Housing Starts

by Calculated Risk on 4/16/2015 02:54:00 PM

March was another disappointing month for housing start.

In February, it was easy to blame the weather, especially in the Northeast where starts plunged and then bounced back in March. However, in March, the weakness was more in the South and West (maybe related to oil prices in Texas and the drought in California).

Note: It is also possible that the West Coast port slowdown impacted starts a little in March. The labor situation was resolved in February, and any impact should disappear quickly.

This graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with two weak months, starts are still running about 5% ahead of 2014 through March.

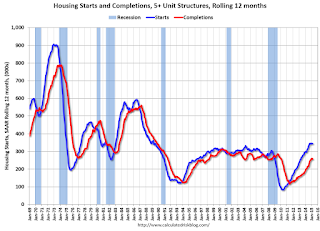

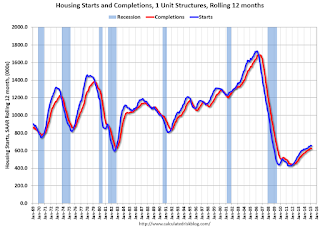

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Philly Fed Manufacturing Survey increased to 7.5 in April

by Calculated Risk on 4/16/2015 11:23:00 AM

Earlier from the Philly Fed: April Manufacturing Survey

Manufacturing activity in the region increased modestly in April, according to firms responding to this month’s Manufacturing Business Outlook Survey. Indicators for general activity and new orders were positive but remained at low readings. Firms reported overall declines in shipments this month, but employment and work hours increased at the reporting firms. Firms reported continued price reductions in April, with indicators for prices of inputs and the firms’ own products remaining negative. The survey’s indicators of future activity suggest a continuation of modest growth in the manufacturing sector over the next six months.This was above the consensus forecast of a reading of 5.0 for April.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from 5.0 in March to 7.5 this month. ...

Firms’ responses suggest some improvement in labor market conditions compared with March. The current employment index increased 8 points, to 11.5, its highest reading in five months.

emphasis added

Earlier this week, the NY Fed reported: April Empire State Manufacturing Survey Indicates Sluggish Conditions

The survey’s headline general business conditions index turned slightly negative for the first time since December, falling 8 points to -1.2 in a sign that the growth in manufacturing had paused. The new orders index—a bellwether of demand for manufactured goods—was also negative, pointing to a modest decline in orders for a second consecutive month. Employment growth slowed, too.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The yellow line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys declined in April, and this suggests a slightly weaker ISM report for April.

Weekly Initial Unemployment Claims increased to 294,000

by Calculated Risk on 4/16/2015 09:30:00 AM

The DOL reported:

In the week ending April 11, the advance figure for seasonally adjusted initial claims was 294,000, an increase of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 281,000 to 282,000. The 4-week moving average was 282,750, an increase of 250 from the previous week's revised average. The previous week's average was revised up by 250 from 282,250 to 282,500.The previous week was revised up by 1,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 282,750.

This was above the consensus forecast of 280,000, and the low level of the 4-week average suggests few layoffs.