by Calculated Risk on 3/20/2015 06:15:00 PM

Friday, March 20, 2015

30 Year Mortgage Rates decline to March Lows

From Matthew Graham at Mortgage News Daily: Mortgage Rates End Week at March Lows

Mortgage rates moved modestly lower on average today after doing an admirable job of holding their ground amid weaker market conditions yesterday. That weakness was largely the result of a technical correction to the immense strength seen after Wednesday's Fed Announcement and Press Conference. The following two days have essentially legitimized that strength as something other than a temporary knee jerk reaction.Note: rates are still above the level required for a significant increase in refinance activity. Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

...

Most lenders are now quoting a conventional 30yr fixed rate of 3.75% for top tier scenarios. There's more consensus on that one rate than normal. Many lenders that had been at 3.875% are just barely into the 3.75% territory after this week's gains, but underlying market levels are quite strong enough and haven't been maintained long enough for too many lenders to make the foray down to 3.625%.

Based on the relationship between the 30 year mortgage rate and 10-year Treasury yields, the 10-year Treasury yield would probably have to decline to 1.5% or lower for a significant refinance boom (in the near future). With the 10-year yield currently at 1.93%, I don't expect a significant increase in refinance activity.

Here is a table from Mortgage News Daily:

Zillow: Negative Equity Rate unchanged in Q4 2014

by Calculated Risk on 3/20/2015 01:30:00 PM

From Zillow: Even as Home Values Rise, Negative Equity Rate Flattens

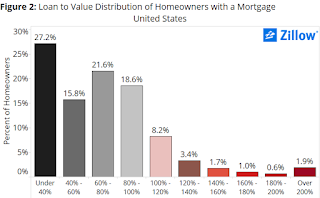

In the fourth quarter of 2014, the U.S. negative equity rate – the percentage of all homeowners with a mortgage that are underwater, owing more on their home than it is worth – stood at 16.9 percent, unchanged from the third quarter. Negative equity had fallen quarter-over-quarter for ten straight quarters, or two-and-a-half years, prior to flattening out between Q3 and Q4 of last year.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q4 2014.

While this may not seem very notable (after all, overall negative equity didn’t go up, merely flattened out), this represents a major turning point in the housing market. The days in which rapid and fairly uniform home value appreciation contributed to steep drops in negative equity are behind us, and a new normal has arrived. Negative equity, while it may still fall in fits and spurts, is decidedly here to stay, and will impact the market for years to come.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Nationally, of the homeowners who are underwater, around half are only underwater by 20 percent or less, which is to say they are close to escaping negative equity. (Figure 2) On the other hand, 1.9 percent of all owners with a mortgage remain deeply underwater, owing at least twice what their home is worth. Of the largest metro areas, markets with above average rates of deeply underwater homeowners include Las Vegas (3.8 percent), Chicago (3.8 percent), Atlanta (3.5 percent), Detroit (3.3 percent) and Miami (2.8 percent)Almost half of the borrowers with negative equity have a LTV of 100% to 120% (8.2% in Q4 2014). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or their loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for ten years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 5.2% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic released their Q4 2014 negative equity earlier this week. For Q4, CoreLogic reported there were 5.4 million properties with negative equity, up slightly from Q3.

Campbell Survey: "Strong spring home buying season"

by Calculated Risk on 3/20/2015 11:47:00 AM

Here is a survey I follow.

From Campbell Surveys: Spring Home Buying Season Expected To Be Strong, Particularly for First-Time Homebuyers, According to HousingPulse Survey (no link)

Trends in homebuyer traffic along with rising demand from first-time homebuyers point toward a strong spring home buying season, according to the latest Campbell/Inside Mortgage Finance HousingPulse Tracking Survey.We will see soon.

“Both the data and comments from real-estate agents support expectations for a strong spring/summer buyer season,” said Tom Popik, research director for Campbell Surveys.

The Homebuyer Traffic Diffusion Indexes for first-time homebuyers and current homeowners hit levels in February above those seen a year ago. Traffic was strongest from first-time homebuyers, with a traffic diffusion index of 61.4 in February compared with 56.8 in February 2014. Any reading on the index above 50 indicates increasing traffic.

DataQuick: California Bay Area February Home Sales Decline

by Calculated Risk on 3/20/2015 09:06:00 AM

From DataQuick: Bay Area February Home Sales Decline; Smaller Gain for Median Sale Price

The number of homes sold was slightly lower than in January and was the lowest for the month of February in seven years. ... A total of 4,376 new and existing houses and condos sold in the nine-county Bay Area in February 2015. That was down 1.1 percent month over month from 4,423 sales in January 2015 and down 10.9 percent year over year from 4,911 sales in February 2014, according to CoreLogic DataQuick data.

...

“February is always a bit odd from a numbers standpoint. March should provide a better view of emerging trends this year,” said Andrew LePage, CoreLogic DataQuick data analyst. “That said, it is easy to see that supply is still constrained."

...

Foreclosure resales accounted for 4.5 percent of all resales in February, up from a revised 4.4 percent in January 2015 and down from 5.0 percent in February 2014. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is about 10 percent. Foreclosure resales are purchased homes that have been previously foreclosed upon in the prior 12 months.

Short sales accounted for an estimated 4.8 percent of Bay Area resales in February, down from a revised 5.2 percent in January 2015 and down from 6.3 percent in February 2014. Short sales are transactions in which the sale price fell short of what was owed on the property.

emphasis added

Thursday, March 19, 2015

Freddie Mac: 30 Year Mortgage Rates decrease to 3.78% in Latest Weekly Survey

by Calculated Risk on 3/19/2015 07:01:00 PM

From Freddie Mac today: Mortgage Rates Move Down as We Head Into Spring

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving down across the board. The average 30-year fixed mortgage rate continues its run below 4 percent -- a good sign for the spring homebuying season. ...

30-year fixed-rate mortgage (FRM) averaged 3.78 percent with an average 0.6 point for the week ending March 19, 2015, down from last week when it averaged 3.86 percent. A year ago at this time, the 30-year FRM averaged 4.32 percent.

15-year FRM this week averaged 3.06 percent with an average 0.6 point, down from last week when it averaged 3.10 percent. A year ago at this time, the 15-year FRM averaged 3.32 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (43 bps) from the all time low of 3.35% in late 2012, but down from 4.32% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Lawler on Lennar: Orders Up Despite Weather; Margins Down a Bit on Diminished Pricing Power; and Confusion on Houston

by Calculated Risk on 3/19/2015 03:18:00 PM

From housing economist Tom Lawler:

Lennar Corporation, the nation’s second largest homebuilder, reported that net home orders in the quarter ended February 28, 2015 totaled 5,287, up 18.4% from the comparable quarter of 2014. The average net order price was $346,000, up 5.8% from a year ago. Home deliveries totaled 4,302, up 19.2% from the comparable quarter of 2015, at an average sales price of $326,000, up 2.5% from a year earlier. The company’s order backlog at the end of February was 6,817, up 20.4% from last February, at an average order price of $352,000, up 2.9% from a year ago.

In Lennar’s press release the company’s CEO was quoted as saying that “(d)espite severe weather conditions which contraction production and sales in parts of the country, the housing market continued its strong and steady recover. Early signals from this year’s spring selling season indicate that the housing market is improving, and disappointing single-family starts and permits numbers should rebound shortly.”

The company said that its homebuilding gross margin last quarter was down slightly from a year earlier but was consistent with the company’s guidance from earlier this year, with the decline coming from a combination of rising labor and material costs and a moderation in pricing power.

A few conference call questions focused on Houston, and company officials seemed moderately “upbeat” but created a bit of confusion. Noting a 7.1% YOY decline in net home orders in Houston in the latest quarter, one analyst asked about what was behind this decline, and how the Houston market was holding up. A company official responded that the Houston market was still seeing “good traffic,” but that some buyers were being a “bit more caution” about “pulling the trigger.” The official also noted that the company, in balancing “price versus pace,” was focused more on margin in Houston, and did not “chase prices down.” Near the end of the call another analyst, noting this statement, asked for some clarification, and a company official said that some “smaller and less-capitalized” builders, some selling in “outlying” areas, had cut prices in response to “headlines,” but that Lennar had not. Lennar’s average order price in Houston last quarter was unchanged from a year ago.

And some other data from Houston:

Flipping to “macro” numbers, single-family permits in the Houston MSA through January showed no signs of slowing. January SF permits were up 11% from the previous January, and permits over the three-month period ending in January were 14.4% from the comparable three-month period of a year earlier.

On the MLS front, the Houston Association of Realtors reported that single-family home sales by realtors in the Houston area totaled 4,521 in February, down 5.8% from last February’s pace. The HAR also reported that total property listings were up 0.7% from a year earlier, the first YOY increase in several years, and that listings in February were up 8.4% in December. While inventory levels remained at historically low levels relative to sales last month, the unusually high jump over the last two months is worth noting.

Right now it appears as if home sales are starting to soften in the Houston market, while based on building permits construction was still increasing through the beginning of this year. Given the likely negative impact of the plunge in oil prices on Houston’s economy (it won’t be as bad as in the 1980’s, but it will be negative), and it would appear that (1) there may be some “excess” building going on; and (2) that suggests coming downward pressure on home prices.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in February

by Calculated Risk on 3/19/2015 12:37:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in February.

Thanks to Tom for sharing this with all of us!

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase foreclosure as lenders work through the backlog).

Short sales are down in these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Feb-15 | Feb-14 | Feb-15 | Feb-14 | Feb-15 | Feb-14 | Feb-15 | Feb-14 | |

| Las Vegas | 9.3% | 14.0% | 9.7% | 12.0% | 19.0% | 26.0% | 37.4% | 46.8% |

| Reno** | 7.0% | 13.0% | 7.0% | 7.0% | 14.0% | 20.0% | ||

| Phoenix | 4.4% | 5.3% | 5.8% | 8.3% | 10.1% | 13.7% | 29.9% | 35.4% |

| Sacramento | 6.3% | 12.4% | 8.6% | 7.0% | 14.9% | 19.4% | 19.8% | 26.5% |

| Minneapolis | 2.7% | 5.0% | 15.3% | 25.3% | 18.1% | 30.3% | ||

| Mid-Atlantic | 5.3% | 7.7% | 15.1% | 10.9% | 20.4% | 18.6% | 21.2% | 21.4% |

| Orlando | 5.3% | 9.4% | 27.0% | 23.8% | 32.3% | 33.2% | 42.2% | 42.2% |

| Bay Area CA* | 4.8% | 6.3% | 4.5% | 5.0% | 9.3% | 11.3% | 26.7% | 28.4% |

| So. California* | 6.1% | 9.0% | 6.1% | 6.7% | 12.2% | 15.7% | 28.0% | 31.0% |

| Chicago (city) | 29.9% | 40.0% | ||||||

| Hampton Roads | 22.6% | 30.7% | ||||||

| Northeast Florida | 37.6% | 44.5% | ||||||

| Tucson | 33.7% | 37.0% | ||||||

| Des Moines | 21.3% | 23.3% | ||||||

| Georgia*** | 27.1% | 35.3% | ||||||

| Omaha | 19.6% | 25.6% | ||||||

| Pensacola | 36.7% | 41.8% | ||||||

| Knoxville | 23.9% | 27.4% | ||||||

| Richmond VA | 13.9% | 22.2% | 21.5% | 22.2% | ||||

| Springfield IL** | 15.3% | 18.3% | 21.4% | N/A | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Philly Fed Manufacturing Survey declines to 5.0 in March

by Calculated Risk on 3/19/2015 10:08:00 AM

From the Philly Fed: March Manufacturing Survey

Manufacturing activity in the region increased at a modest pace in March, according to firms responding to this month’s Manufacturing Business Outlook Survey. The survey’s current indicators for general activity and new orders were positive and remained near their low readings in February.This was below the consensus forecast of a reading of 7.0 for March.

...

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, at 5.0, was virtually unchanged from its reading of 5.2 in February ...

Although the current employment index, at just 3.5, was virtually unchanged from last month, the index remains well below its average reading of about 14 over the second half of last year. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The light blue line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February. Note: Areas with oil production (Texas and some in Kansas City region), have been especially weak.

The average of the Empire State and Philly Fed surveys declined in March, and this suggests a slightly weaker ISM report for March.

Weekly Initial Unemployment Claims increased to 291,000

by Calculated Risk on 3/19/2015 08:33:00 AM

The DOL reported:

In the week ending March 14, the advance figure for seasonally adjusted initial claims was 291,000, an increase of 1,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 289,000 to 290,000. The 4-week moving average was 304,750, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 302,250 to 302,500.The previous week was revised up to 290,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 304,750.

This was slightly below the consensus forecast of 293,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, March 18, 2015

Thursday: Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 3/18/2015 07:01:00 PM

From Tim Duy: Yellen Strikes a Dovish Tone

The FOMC concluded its two-day meeting today, and the results were largely as I had anticipated. The Fed took note of the recent data, downgrading the pace of activity from "solid" to "moderated." They continue to expect inflation weakness to be transitory. The risks to the outlook are balanced. And "patient" was dropped; April is still off the table for a rate hike, but data dependence rules from that point on.Thursday:

Growth, inflation and unemployment forecasts all came down. Especially important was the decrease in longer-run unemployment projections. The Fed's estimates of NAIRU are falling, something almost impossible to avoid given the stickiness of wage growth in the face of falling unemployment. The forecast changes yielded a downward revision to the Fed's interest rate projections. In addition, the strong dollar was clearly on the Fed's mind. Federal Reserve Chair Janet Yellen often referred to the dollar and its impact on growth in the press conference, much more than I expected.

...

Bottom Line: Yellen does it again - she moves the Fed both closer to and further from the first rate hike of this cycle. By moving toward the markets on the path of rate hikes, the Fed acknowledges that they are eager to let this recovery run on. Moreover, they proved that they are in fact data dependent by moving policy in the direction of the data. Overall, Yellen has managed the transition away from what the Fed came to see as excessive forward guidance just about as well as could be expected.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 289 thousand.

• At 10:00 AM, the Philly Fed manufacturing survey for February. The consensus is for a reading of 7.0, up from 5.2 last month (above zero indicates expansion).