by Calculated Risk on 3/18/2015 02:00:00 PM

Wednesday, March 18, 2015

FOMC Statement: No "Patient", "Growth has moderated"

Dropped "patient", "economic growth has moderated", unlikely to hike rates in April.

FOMC Statement:

Information received since the Federal Open Market Committee met in January suggests that economic growth has moderated somewhat. Labor market conditions have improved further, with strong job gains and a lower unemployment rate. A range of labor market indicators suggests that underutilization of labor resources continues to diminish. Household spending is rising moderately; declines in energy prices have boosted household purchasing power. Business fixed investment is advancing, while the recovery in the housing sector remains slow and export growth has weakened. Inflation has declined further below the Committee's longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of energy price declines and other factors dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. Consistent with its previous statement, the Committee judges that an increase in the target range for the federal funds rate remains unlikely at the April FOMC meeting. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term. This change in the forward guidance does not indicate that the Committee has decided on the timing of the initial increase in the target range.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

emphasis added

LA area Port Traffic Declined Sharply in February due to Labor Issues

by Calculated Risk on 3/18/2015 11:55:00 AM

Note: LA area ports were impacted by labor negotiations that were settled on February 21st.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report for February since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.3% compared to the rolling 12 months ending in January. Outbound traffic was down 1.4% compared to 12 months ending in January.

Inbound traffic had been increasing, and outbound traffic had been mostly moving sideways or slightly down. The recent downturn was due to labor issues.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Imports were down 18% year-over-year in February, exports were down 17% year-over-year.

The labor issues are now resolved - the ships are rapidly disappearing from the outer harbor - and I expect port traffic will be at record levels for March (catching up).

AIA: Architecture Billings Index increases slightly in February

by Calculated Risk on 3/18/2015 09:54:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Improves in February

After its first negative score in ten months, the Architecture Billings Index (ABI) showed a nominal increase in design activity in February, and has been positive ten out of the past twelve months. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the February ABI score was 50.4, up slightly from a mark of 49.9 in January. This score reflects a minor increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 56.6, down from a reading of 58.7 the previous month.

“The health of the institutional market has been the key factor for positive business conditions for the design and construction industry in recent months, and it is encouraging to see that sector remain on solid footing,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, we’re seeing some slowing in the other major construction sectors. Design billings for residential projects had its first negative month in over three years, and commercial design billings have seen only modest growth in recent years.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.4 in February, up from 49.9 in January. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential was negative for the first time in over three years - and might be indicating a slowdown for apartments. (just one month)

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was mostly positive over the last year, suggesting an increase in CRE investment in 2015.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/18/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 13, 2015. ...

The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.99 percent from 4.01 percent, with points increasing to 0.40 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 1% higher than a year ago.

Tuesday, March 17, 2015

Wednesday: Fed Day!

by Calculated Risk on 3/17/2015 08:57:00 PM

From Jon Hilsenrath at the WSJ: Fed to Markets: No More Promises

Ahead of their policy meeting that ends Wednesday, Fed officials have signaled they want to drop the latest iteration in a succession of low-rate promises—a line in their policy statement pledging to be “patient” before deciding to raise rates.Wednesday:

The move could be a test for investors. In theory, less-clear-cut interest-rate guidance from the Fed should lead to more volatility in financial markets. That’s because investors will be left less certain about a key variable in every asset-valuation model: the cost of funds.

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day: the AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Meeting Announcement. The FOMC is expected to make no change to policy, however the word "patient" will probably be removed from the statement opening the possibility of a rate hike as early as June.

• At 2:00 PM, the FOMC Forecasts. This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

DataQuick: Southern California February Home Sales down 3% Year-over-year

by Calculated Risk on 3/17/2015 05:24:00 PM

From DataQuick: Southern California Home Sales Dip Year Over Year Again; Median Price Edges Higher

CoreLogic® ... today released its February 2015 Southern California housing market report, which shows the number of homes sold rose slightly from January but hit the lowest level for a February in seven years. ... A total of 13,650 new and existing houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in February 2015. That was up 0.7 percent month over month from 13,560 sales in January 2015, and down 2.7 percent year over year from 14,027 sales in February 2014, according to CoreLogic DataQuick data.A couple of key points: 1) the percent of distress sales usually increases in the winter months, because traditional sales fall off sharply - so it is important to look at the year-over-year change in distressed sales (down to 12.1% from 15.7% a year ago), and 2) we might see more upward price pressure unless inventory increases.

"This feels a lot like early 2014, with home sales off to a slow start as many would-be home buyers struggle with inventory constraints, credit hurdles and reduced affordability," said Andrew LePage, data analyst for CoreLogic DataQuick. "And just like a year ago, one of the big questions hanging over the market is whether we'll see a sizeable jump in inventory this spring and summer. A nearly three-year stretch of price appreciation has given many more owners enough equity to sell their homes and buy another. Recent job growth has helped fuel housing demand and if that’s met with only a modest rise in the supply of homes for sale it will put upward pressure on prices. Of course, the direction of mortgage rates, among other factors, will also play a role in determining how the housing market shapes up this year."

...

Foreclosure resales represented 6.0 percent of the resale market in February. That was up from a revised 5.7 percent in January 2015 and down from 6.7 percent in February 2014. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009. Foreclosure resales are purchased homes that have been previously foreclosed upon in the prior 12 months.

Short sales made up an estimated 6.1 percent of resales in February, down from a revised 6.6 in January 2015 and down from 9.0 percent in February 2014. Short sales are transactions in which the sale price fell short of what was owed on the property.

emphasis added

Comments on February Housing Starts

by Calculated Risk on 3/17/2015 02:24:00 PM

As always, we we shouldn't let one month of data influence us too much. For February it appears housing starts were impacted by the weather, especially in the Northeast.

Here is a table showing starts in the four Census Bureau regions. Starts in the Northeast were down 46% year-over-year:

| Housing Starts (000) | |||

|---|---|---|---|

| Feb-15 | Feb-14 | YoY Change | |

| Northeast | 47 | 87 | -46.0% |

| Midwest | 97 | 122 | -20.5% |

| South | 514 | 502 | 2.4% |

| West | 239 | 217 | 10.1% |

| Total | 897 | 928 | -3.3% |

However, even if starts had increased year-over-year in February at the rate in the South and the West, housing starts would still have been below expectations. So overall this was a disappointing report.

Note: It is also possible that the West Coast port slowdown impacted starts a little. The labor situation was resolved in February, so any impact should disappear quickly.

Click on graph for larger image.

Click on graph for larger image.This graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with the weak February, starts are running 8.4% ahead of 2014 through February.

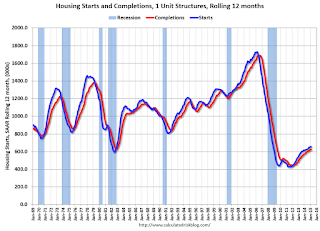

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions.

The blue line is for multifamily starts and the red line is for multifamily completions. The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

BLS: Twenty-four States had Unemployment Rate Decreases in January

by Calculated Risk on 3/17/2015 10:55:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

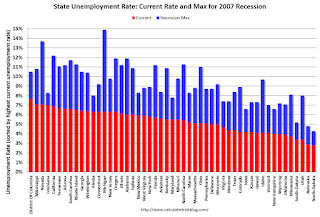

Regional and state unemployment rates were little changed in January. Twenty-four states had unemployment rate decreases from December, 8 states had increases, and 18 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

North Dakota had the lowest jobless rate in January, 2.8 percent. Mississippi and Nevada had the highest unemployment rates among the states, 7.1 percent each.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. Mississippi and Nevada, at 7.1%, had the highest state unemployment rate although D.C was higher.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 8% (light blue); Three states and D.C. are still at or above 7% (dark blue).

CoreLogic: "1.2 Million US Borrowers Regained Equity in 2014, 5.4 Million Properties Remain in Negative Equity"

by Calculated Risk on 3/17/2015 09:38:00 AM

From CoreLogic: CoreLogic Reports 1.2 Million US Borrowers Regained Equity in 2014

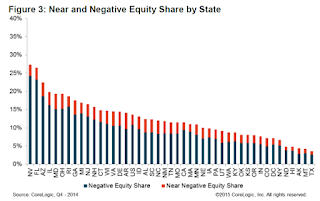

CoreLogic ... today released new analysis showing 1.2 million borrowers regained equity in 2014, bringing the total number of mortgaged residential properties with equity at the end of Q4 2014 to approximately 44.5 million or 89 percent of all mortgaged properties. Nationwide, borrower equity increased year over year by $656 billion in Q4 2014. The CoreLogic analysis also indicates approximately 172,000 U.S. homes slipped into negative equity in the fourth quarter of 2014 from the third quarter 2014, increasing the total number of mortgaged residential properties with negative equity to 5.4 million, or 10.8 percent of all mortgaged properties. This compares to 5.2 million homes, or 10.4 percent, that were reported with negative equity in Q3 2014, a quarter-over-quarter increase of 3.3 percent. Compared to 6.6 million homes, or 13.4 percent, reported for Q4 2013, the number of underwater homes has decreased year over year by 1.2 million or 18.9 percent.

... Of the 49.9 million residential properties with a mortgage, approximately 10 million, or 20 percent, have less than 20-percent equity (referred to as “under-equitied”) and 1.4 million of those have less than 5-percent equity (referred to as near-negative equity). Borrowers who are “under-equitied” “under-equitied” may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Borrowers with near negative equity are considered at risk of moving into negative equity if home prices fall. In contrast, if home prices rose by as little as 5 percent, an additional 1 million homeowners now in negative equity would regain equity. ...

“The share of homeowners that had negative equity increased slightly in the fourth quarter of 2014, reflecting the typical weakness in home values during the final quarter of the year,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Our CoreLogic HPI dipped 0.7 percent from September to December, and the percent of owners 'underwater' increased to 10.8 percent. However, from December-to-December, the CoreLogic index was up 4.8 percent, and the negative equity share fell by 2.6 percentage points.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the break down of negative equity by state. Note: Data not available for some states. From CoreLogic:

"Nevada had the highest percentage of mortgaged properties in negative equity at 24.2 percent; followed by Florida (23.2 percent); Arizona (18.7 percent); Illinois (16.2 percent) and Rhode Island (15.8 percent). These top five states combined account for 31.7 percent of negative equity in the United States."

Note: The share of negative equity is still very high in Nevada and Florida, but down from a year ago (Q4 2013) when the negative equity share in Nevada was at 30.4 percent, and at 28.1 percent in Florida.

The second graph shows the distribution of home equity in Q4 compared to Q3 2014. Close to 4% of residential properties have 25% or more negative equity.

The second graph shows the distribution of home equity in Q4 compared to Q3 2014. Close to 4% of residential properties have 25% or more negative equity.In Q4 2013, there were 6.6 million properties with negative equity - now there are 5.4 million. A significant change.

Housing Starts decreased sharply to 897 thousand Annual Rate in February

by Calculated Risk on 3/17/2015 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 897,000. This is 17.0 percent below the revised January estimate of 1,081,000 and is 3.3 percent (±12.5%)* below the February 2014 rate of 928,000.

Single-family housing starts in February were at a rate of 593,000; this is 14.9 percent (±10.0%) below the revised January figure of 697,000. The February rate for units in buildings with five units or more was 297,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,092,000. This is 3.0 percent above the revised January rate of 1,060,000 and is 7.7 percent above the February 2014 estimate of 1,014,000.

Single-family authorizations in February were at a rate of 620,000; this is 6.2 percent (±0.9%) below the revised January figure of 661,000. Authorizations of units in buildings with five units or more were at a rate of 445,000 in February.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased sharply in February. Multi-family starts are down 10% year-over-year.

Single-family starts (blue) decreased in February and are up slightly year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),This was well below expectations of 1.040 million starts in February, although starts in January were revised up. Overall this was a weak report, although permits were decent (an indicator for March), and a large portion of the weakness was in the volatile multi-family sector. I'll have more later ...