by Calculated Risk on 3/12/2015 09:25:00 AM

Thursday, March 12, 2015

Weekly Initial Unemployment Claims decreased to 289,000

Catching up: The DOL reported:

In the week ending March 7, the advance figure for seasonally adjusted initial claims was 289,000, a decrease of 36,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 320,000 to 325,000. The 4-week moving average was 302,250, a decrease of 3,750 from the previous week's revised average. The previous week's average was revised up by 1,250 from 304,750 to 306,000.The previous week was revised up to 325,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 302,250.

This was below the consensus forecast of 300,000, and the low level of the 4-week average suggests few layoffs.

Retail Sales decreased 0.6% in February

by Calculated Risk on 3/12/2015 08:42:00 AM

On a monthly basis, retail sales decreased 0.6% from January to February (seasonally adjusted), and sales were up 1.7% from February 2014. Sales in December were unrevised at a 0.8% decrease.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $437.0 billion, a decrease of 0.6 percent from the previous month, but up 1.7 percent above February 2014. ... The December 2014 to January 2015 percent change was unrevised from -0.8 percent.

Click on graph for larger image.

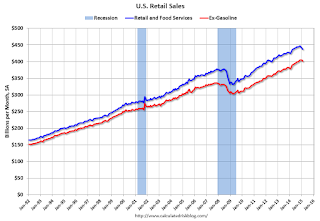

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline decreased 0.8%.

Retail sales ex-autos decreased 0.1%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 5.1% on a YoY basis (1.7% for all retail sales).

Retail and Food service sales ex-gasoline increased by 5.1% on a YoY basis (1.7% for all retail sales).The decrease in February was below consensus expectations of a 0.3% increase. This was a weak report.

Wednesday, March 11, 2015

Thursday: Retail Sales, Flow of Funds, Unemployment Claims

by Calculated Risk on 3/11/2015 08:11:00 PM

Thursday:

• 8:30 AM ET, Retail sales for February will be released. On a monthly basis, retail sales decreased 0.8% from December to January (seasonally adjusted), and sales were up 3.3% from January 2014. The consensus is for retail sales to increase 0.3% in February, and to increase 0.5% ex-autos.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 309 thousand from 320 thousand.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.1% increase in inventories.

• At 12:00 PM, the Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 2:00 PM ET, the Monthly Treasury Budget Statement for February.

Fed Fails Deutsche Bank and Santander Capital Plans, BofA required to Submit New Plan by Q3

by Calculated Risk on 3/11/2015 04:41:00 PM

From the Federal Reserve: Comprehensive Capital Analysis and Review (CCAR)

The Federal Reserve on Wednesday announced it has not objected to the capital plans of 28 bank holding companies participating in the Comprehensive Capital Analysis and Review (CCAR). One institution received a conditional non-objection based on qualitative grounds, and the Federal Reserve objected to two firms' plans on qualitative grounds.From the WSJ: Federal Reserve Rejects 2 Banks’ Capital Plans in Annual ‘Stress Tests’

...

The Federal Reserve did not object to the capital plan of Bank of America Corporation, but is requiring the institution to submit a new capital plan by the end of the third quarter to address certain weaknesses in its capital planning processes. The Federal Reserve objected to the capital plans of Deutsche Bank Trust Corporation and Santander Holdings USA on qualitative concerns.

Twenty-eight of 31 large banks received Federal Reserve approval to return capital to investors on Wednesday but only after some of the biggest Wall Street firms came perilously close to failing the regulator’s annual “stress test.”

A 29th firm, Bank of America Corp. , received conditional approval of its capital plan and can move forward with boosting dividends or stock buybacks, but must resubmit its proposal to address “certain weaknesses” including its ability to measure losses and revenue, the Fed said. ... The Fed rejected the capital plans of two large banks, the U.S. units of Deutsche Bank AG and Banco Santander SA, for “qualitative” deficiencies including ability to model losses and identify risks. ...

Deutsche Bank, which took the stress test for the first time this year, was rejected for “numerous and significant deficiencies” across several areas of the capital planning process including the bank’s ability to identify risks, the Fed said.

Quarterly Services Survey suggests upward revision to Q4 GDP to 2.5%

by Calculated Risk on 3/11/2015 12:14:00 PM

From Reuters: U.S. services data suggest upward revision to Q4 growth

The Commerce Department's quarterly services survey ... showed consumption ... increased at a faster clip than the government had assumed in its second estimate of [GDP].Here is the Q4 Quarterly Services Press Release

Economists said the data suggested fourth-quarter consumer spending could be raised by at least six-tenths of a percentage point to a 4.9 percent annual rate ... the QSS suggested fourth-quarter GDP growth could be raised to a 2.5 percent pace from the 2.2 percent rate reported last month ...

Real Estate Data Resource for Local Area Sales and Inventory

by Calculated Risk on 3/11/2015 10:43:00 AM

Each month I track sales and inventory data for several previous bubble areas (like Las Vegas, Phoenix, Sacramento). These areas are interesting because they had huge prices bubbles, and large price declines - followed by significant investor buying (that is now declining). I also track these areas because the data is available on line.

Housing economist Tom Lawler is tracking a number of other areas, and has been kind enough to share that data with us (focused on distressed sales and cash buying).

If you are looking for data on your own area, you could try the local MLS, or look at the Zillow Research data. In addition to prices, Zillow tracks inventory and sales by metro area and zip code. Scroll down to "Other Metrics" and look at "Home Sales" and "For-sale Inventory" for the last five years.

Caution: Zillow has been expanding their coverage, so use caution when creating a data series based on aggregate data.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/11/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 6, 2015. ...

The Refinance Index decreased 3 percent from the previous week to the lowest level since January 2015. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.01 percent, the highest level since the week ending January 2, 2015, from 3.96 percent, with points increasing to 0.39 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 2% higher than a year ago.

Tuesday, March 10, 2015

Wednesday: Q4 Quarterly Services Report, Banks Comprehensive Capital Analysis

by Calculated Risk on 3/10/2015 07:39:00 PM

From Jon Hilsenrath at the WSJ: Fed Leans Toward Removing ‘Patient’ Promise on Rates

The Federal Reserve is strongly considering removing a barrier to raising short-term interest rates, by dropping its promise to be “patient” before acting.It seems very likely that "patient" will be removed from the statement. This will mean a June rate hike is possible, but not guaranteed.

...

Dropping the patience promise next week doesn’t mean officials are yet set on a rate increase in June. Ms. Yellen has signaled that the inflation backdrop is the key wildcard in the months ahead. Though the job market is improving as the Fed hoped, inflation isn’t moving back toward its 2% objective.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Q4 Quarterly Services Report from the Census Bureau.

• At 4:30 PM, the Federal Reserve will release the Comprehensive Capital Analysis and Review Results (Stress Test)

Phoenix Real Estate in February: Sales Up 9%, Inventory DOWN 8% Year-over-year

by Calculated Risk on 3/10/2015 04:45:00 PM

For the third consecutive month, inventory was down year-over-year in Phoenix. This is a significant change.

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in January were up 9.0% year-over-year. Another change.

2) Cash Sales (frequently investors) were down about 8% to 29.9% of total sales. Non-cash sales were up 18.3% year-over-year.

3) Active inventory is now down 8.4% year-over-year. Note: House prices bottomed in Phoenix in 2011 at about the current level of inventory.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline).

| February Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Feb-2008 | 3,445 | --- | 650 | 18.9% | 57,3051 | --- |

| Feb-2009 | 5,477 | 59.0% | 2,188 | 39.9% | 52,013 | -9.2% |

| Feb-2010 | 6,595 | 20.4% | 2,997 | 45.4% | 42,388 | -18.5% |

| Feb-2011 | 7,171 | 8.7% | 3,776 | 52.7% | 40,666 | -4.1% |

| Feb-2012 | 7,249 | 1.1% | 3,616 | 49.9% | 23,736 | -41.6% |

| Feb-2013 | 6,618 | -8.7% | 3,053 | 46.1% | 21,718 | -8.5% |

| Feb-2014 | 5,476 | -17.3% | 1,939 | 35.4% | 29,899 | 37.7% |

| Feb-2015 | 5,970 | 9.0% | 1,784 | 29.9% | 27,382 | -8.4% |

| 1 February 2008 probably included pending listings | ||||||

FNC: Residential Property Values increased 4.3% year-over-year in January

by Calculated Risk on 3/10/2015 01:38:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their January 2015 index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased 0.3% from December to January (Composite 100 index, not seasonally adjusted).

The 10 city MSA, the 20-MSA and 30-MSA RPIs all decreased . These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in January than in December, with the 100-MSA composite up 4.3% compared to January 2014 (this index was up 5.0% year-over-year in December). In general, for FNC, the YoY increase has been slowing since peaking in March at 9.0%.

The index is still down 19.8% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through January 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the price indexes have been showing a slowdown in price increases.

Note: The January Case-Shiller index will be released on Tuesday, Tuesday, March 31.