by Calculated Risk on 3/11/2015 10:43:00 AM

Wednesday, March 11, 2015

Real Estate Data Resource for Local Area Sales and Inventory

Each month I track sales and inventory data for several previous bubble areas (like Las Vegas, Phoenix, Sacramento). These areas are interesting because they had huge prices bubbles, and large price declines - followed by significant investor buying (that is now declining). I also track these areas because the data is available on line.

Housing economist Tom Lawler is tracking a number of other areas, and has been kind enough to share that data with us (focused on distressed sales and cash buying).

If you are looking for data on your own area, you could try the local MLS, or look at the Zillow Research data. In addition to prices, Zillow tracks inventory and sales by metro area and zip code. Scroll down to "Other Metrics" and look at "Home Sales" and "For-sale Inventory" for the last five years.

Caution: Zillow has been expanding their coverage, so use caution when creating a data series based on aggregate data.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/11/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 6, 2015. ...

The Refinance Index decreased 3 percent from the previous week to the lowest level since January 2015. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.01 percent, the highest level since the week ending January 2, 2015, from 3.96 percent, with points increasing to 0.39 from 0.30 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see a little more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 2% higher than a year ago.

Tuesday, March 10, 2015

Wednesday: Q4 Quarterly Services Report, Banks Comprehensive Capital Analysis

by Calculated Risk on 3/10/2015 07:39:00 PM

From Jon Hilsenrath at the WSJ: Fed Leans Toward Removing ‘Patient’ Promise on Rates

The Federal Reserve is strongly considering removing a barrier to raising short-term interest rates, by dropping its promise to be “patient” before acting.It seems very likely that "patient" will be removed from the statement. This will mean a June rate hike is possible, but not guaranteed.

...

Dropping the patience promise next week doesn’t mean officials are yet set on a rate increase in June. Ms. Yellen has signaled that the inflation backdrop is the key wildcard in the months ahead. Though the job market is improving as the Fed hoped, inflation isn’t moving back toward its 2% objective.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, the Q4 Quarterly Services Report from the Census Bureau.

• At 4:30 PM, the Federal Reserve will release the Comprehensive Capital Analysis and Review Results (Stress Test)

Phoenix Real Estate in February: Sales Up 9%, Inventory DOWN 8% Year-over-year

by Calculated Risk on 3/10/2015 04:45:00 PM

For the third consecutive month, inventory was down year-over-year in Phoenix. This is a significant change.

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in January were up 9.0% year-over-year. Another change.

2) Cash Sales (frequently investors) were down about 8% to 29.9% of total sales. Non-cash sales were up 18.3% year-over-year.

3) Active inventory is now down 8.4% year-over-year. Note: House prices bottomed in Phoenix in 2011 at about the current level of inventory.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow.

Now, with falling inventory, prices might increase a little faster in 2015 (something to watch if inventory continues to decline).

| February Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Feb-2008 | 3,445 | --- | 650 | 18.9% | 57,3051 | --- |

| Feb-2009 | 5,477 | 59.0% | 2,188 | 39.9% | 52,013 | -9.2% |

| Feb-2010 | 6,595 | 20.4% | 2,997 | 45.4% | 42,388 | -18.5% |

| Feb-2011 | 7,171 | 8.7% | 3,776 | 52.7% | 40,666 | -4.1% |

| Feb-2012 | 7,249 | 1.1% | 3,616 | 49.9% | 23,736 | -41.6% |

| Feb-2013 | 6,618 | -8.7% | 3,053 | 46.1% | 21,718 | -8.5% |

| Feb-2014 | 5,476 | -17.3% | 1,939 | 35.4% | 29,899 | 37.7% |

| Feb-2015 | 5,970 | 9.0% | 1,784 | 29.9% | 27,382 | -8.4% |

| 1 February 2008 probably included pending listings | ||||||

FNC: Residential Property Values increased 4.3% year-over-year in January

by Calculated Risk on 3/10/2015 01:38:00 PM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their January 2015 index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased 0.3% from December to January (Composite 100 index, not seasonally adjusted).

The 10 city MSA, the 20-MSA and 30-MSA RPIs all decreased . These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in January than in December, with the 100-MSA composite up 4.3% compared to January 2014 (this index was up 5.0% year-over-year in December). In general, for FNC, the YoY increase has been slowing since peaking in March at 9.0%.

The index is still down 19.8% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through January 2015. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Most of the price indexes have been showing a slowdown in price increases.

Note: The January Case-Shiller index will be released on Tuesday, Tuesday, March 31.

Las Vegas Real Estate in February: Sales Decline 2.6%, Non-contingent Inventory up 16% YoY

by Calculated Risk on 3/10/2015 11:24:00 AM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR report points to steady housing market, prices still up about 8 percent for year

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in February was 2,452, up from 2,239 in January, but down from 2,518 one year ago. At this sales pace, Lynam said Southern Nevada continues to have roughly a four-month supply of available homes, while a six-month supply is considered to be a balanced market.There are several key trends that we've been following:

...

GLVAR is tracking a two-year trend of fewer distressed sales and more traditional sales, where lenders are not controlling the transaction. In February, 9.3 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 9.7 percent in January and from 14 percent one year ago. Another 9.7 percent of February sales were bank-owned, up from 9.4 percent in January, but down from 12 percent last year.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in February was 13,188, up 4.1 percent from 12,666 in January, but down 3.2 percent from one year ago. GLVAR tracked a total of 3,558 condos, high-rise condos and townhomes listed for sale on its MLS in February, up 3.8 percent from 3,429 in January, but down 0.1 percent from February 2014.

By the end of February, GLVAR reported 7,313 single-family homes listed without any sort of offer. That’s down 0.9 percent from January, but up 15.8 percent from one year ago. For condos and townhomes, the 2,425 properties listed without offers in February represented a 4.2 percent increase from January and a 9.6 percent increase from one year ago.

emphasis added

1) Overall sales were down 2.6% year-over-year.

2) However conventional (equity, not distressed) sales were up 6.6% year-over-year. In February 2014, only 74.0% of all sales were conventional equity. In February 2015, 81.0% were standard equity sales. Note: In February 2013 (two years ago), only 51.9% were equity! A significant change.

3) The percent of cash sales has declined year-over-year from 46.8% in February 2014 to 37.4% in February 2015. (investor buying appears to be declining).

4) Non-contingent inventory is up 15.8% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing - but still ongoing.

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

| Dec-14 | 18.0% |

| Jan-15 | 12.9% |

| Feb-15 | 15.8% |

BLS: Jobs Openings at 5.0 million in January, Up 28% Year-over-year

by Calculated Risk on 3/10/2015 10:10:00 AM

From the BLS: Job Openings and Labor Turnover Summary

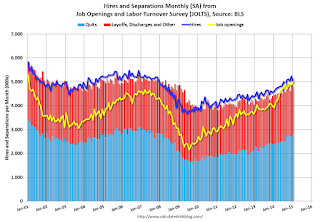

There were 5.0 million job openings on the last business day of January, little changed from 4.9 million in December, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... There were 2.8 million quits in January, little changed from December.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 4.998 million from 4.877 million in December.

The number of job openings (yellow) are up 28% year-over-year compared to January 2014.

Quits are up 17% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another very positive report. It is a good sign that job openings are at 5 million, and that quits are increasing significantly year-over-year.

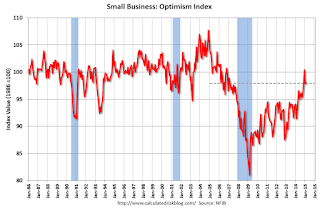

NFIB: Small Business Optimism Index Increased slightly in February

by Calculated Risk on 3/10/2015 09:04:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Rises Despite Falling Sales Trends

The NFIB Small Business Optimism Survey for February rose 0.1 points to 98.0 a solid result despite some unfavorable conditions.

“In spite of slow economic activity and awful weather in a lot of the country, small business owners are finding reasons to hire and spend which is great news. Of the ten components, owners reporting hard-to-fill job openings was the largest gain increasing three points to a 29 percent which is a nine year high.

“Large firms have been powering the economic recovery since the Great Recession, but that may be shifting to the small business sector. February’s data suggests there are fundamental domestic economic currents leading business owners to add workers and these should bubble up in the official statistics and support stronger growth in domestic output.” ...

...

Fourteen percent cited the availability of qualified labor as their top business problem, the highest since September 2007. The job openings figure is one of the highest in 40 years and this suggests that labor markets are tightening and that there will be more pressure on compensation in the coming months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.0 in February from 97.9 in January.

Monday, March 09, 2015

Tuesday: Job Openings, Small Business Survey

by Calculated Risk on 3/09/2015 07:06:00 PM

On mortgage rates from Matthew Graham at Mortgage News Daily: Mortgage Rates Recover Tiny Portion of Friday's Losses

Mortgage rates managed to recover only some of Friday's heavy losses. The most prevalent conventional 30yr rate for top tier scenarios remains at its new perch of 4.0%, though a few lenders remain at 3.875%.CR Note: The Ten Year yield decreased to 2.20% today from 2.24% on Friday.

Tuesday:

• 7:30 AM ET, NFIB Small Business Optimism Index for February.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS. Jobs openings increased in December to 5.028 million from 4.847 million in November. The number of job openings were up 28% year-over-year, and Quits were up 12% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for January. The consensus is for a 0.1% decrease in inventories.

Why the Prime Labor Force Participation Rate has Declined

by Calculated Risk on 3/09/2015 02:38:00 PM

Complaining about the decline in the overall labor force participation rate is the last refuge of scoundrels. A significant decline in the participation rate was expected based on demographics (there is an ongoing debate about how much is due to demographics, and how much of the decline is cyclical - however, as I've pointed out many time, a careful analysis suggests most of the decline is due to demographics).

But what about the decline in the prime working age labor force participation rate?

Each month I post the following graph of the participation rate and employment-population rate for prime working age (25 to 54 years old) workers.

In the earlier period the participation rate for this group was trending up as women joined the labor force. Starting in the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in February to 81.0%, and the 25 to 54 employment population ratio increased to 77.3%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

A couple of key points:

1) Analyzing and forecasting the labor force participation requires looking at a number of factors. Everyone is aware that there is a large cohort has moved into the 50 to 70 age group, and that that has pushing down the overall participation rate. Another large cohort has been moving into the 16 to 24 year old age group - and many in this cohort are staying in school (a long term trend that has accelerated recently) - and that is another key factor in the decline in the overall participation rate.

2) But there are other long term trends. One of these trends is for a decline in the participation rate for prime working age men (25 to 54 years old). For some reasons, see: Possible Reasons for the Decline in Prime-Working Age Men Labor Force Participation and on demographics from researchers at the Atlanta Fed: "Reasons for the Decline in Prime-Age Labor Force Participation"

First, here is a graph of the participation rate by 5 year age groups for the years 2000, 2005, 2010, and 2015.

1) the participation rate for the "prime working age" (25 to 54) is fairly flat (the six highest participation rates).

2) However, the lowest participation rate is for the 50 to 54 age group.

3) And notice that the participation rate for EACH prime age group was declining BEFORE the recession. (Dark blue is January 2000, and light blue is January 2005).

Everyone is aware that there large cohorts moving into retirement - and a large cohort in the 20 to 24 age group - but there has also been in a shift in the prime working age groups.

Since the lowest prime participation is for the 50 to 54 age group (the second lowest is for the 25 to 29 age group), lets focus on those two groups. The 50 to 54 age group is the red line (now the largest percentage of the prime working age) and the 25 to 29 age group is the blue line (now the second largest percentage). Just these shifts in prime demographics would lead to a somewhat lower prime working age participation rate. Overall, the impact of this shift is small compared to long term trends.

Lets focus on just one age group and just for men to look at the long term trend.

This fourth graph shows the 40 to 44 year old men participation rate since 1976 (note the scale doesn't start at zero to better show the change).

There is a clear downward trend, and a researcher looking at this trend in the year 2000 might have predicted the 40 to 44 year old men participation rate would about the level as today (see trend line).

Clearly there are other factors than "economic weakness" causing this downward trend. I listed some reasons a few months ago, and new research from Pew Research suggests stay-at-home dads is one of the reasons: Growing Number of Dads Home with the Kids

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

Clearly there is a downward trend for all 5 year age groups. When arguing about the decline in the prime participation rate, we need to take these long term trends into account.

The bottom line is that the participation rate was declining for prime working age workers before the recession, there the key is understand and adjusting for the long term trend..

Here is a look at the participation rate of women in the prime working age groups over time.

Note: This is a rolling 12 month average to remove noise (data is NSA), and the scale doesn't start at zero to show the change.

For women, the participation rate increased significantly until the late 90s, and then started declining slowly. This is a more complicated story than for men, and that is why I used prime working age men to show the gradual downward decline in participation that has been happening for decades (and is not just recent economic weakness).

The bottom line is that the participation rate was declining for prime working age workers before the recession, there are several reasons for this decline (not just recent "economic weakness") and the prime working age participation rate is probably close to expected without the recession.