by Calculated Risk on 3/06/2015 11:59:00 AM

Friday, March 06, 2015

Trade Deficit decreased in January to $41.8 Billion

Earlier the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $41.8 billion in January, down $3.8 billion from $45.6 billion in December, revised. January exports were $189.4 billion, down $5.6 billion from December. January imports were $231.2 billion, down $9.4 billion from December.The trade deficit was at the consensus forecast of $41.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through January 2015.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in January (some impact of West Coast port slowdown).

Exports are 14% above the pre-recession peak and down 2% compared to January 204; imports are at the pre-recession peak, and unchanged compared to January 2014.

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $58.96 in January, down from $73.64 in December, and down from $90.21 in January 2014. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts.

The trade deficit with China increased to $28.6 billion in January, from $27.8 billion in January 2013. The deficit with China is a large portion of the overall deficit.

The decrease in the trade deficit was due to a lower volume and lower price of oil imports (volatile month-to-month), and a slightly larger deficit with the Euro Area ($8.0 billion in Jan 2015 compared to $7.2 billion in Jan 2014).

Employment Report Comments and Graphs

by Calculated Risk on 3/06/2015 09:45:00 AM

Earlier: February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

This was a very solid employment report with 295,000 jobs added, although job gains for January were revised down 18,000.

Unfortunately there was little good news on wage growth, from the BLS: "In February, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $24.78. Over the year, average hourly earnings have risen by 2.0 percent."

However I expect real wages to increase this year.

A few more numbers: Total employment increased 295,000 from January to February and is now 2.8 million above the previous peak. Total employment is up 11.5 million from the employment recession low.

Private payroll employment increased 288,000 from January to February, and private employment is now 3.2 million above the previous peak. Private employment is up 12.0 million from the recession low.

In February, the year-over-year change was 3.3 million jobs. This was the highest year-over-year gain since March '00.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in February to 81.0%, and the 25 to 54 employment population ratio increased to 77.3%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth has been running close to 2% since 2010 and will probably pick up a little this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in February at 6.6 million. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in February to 6.635 million from 6.810 million in January. This is the lowest level since September 2008. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.0% in February from 11.3% in January. This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.709 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.800 in January. This is trending down, but is still very high.

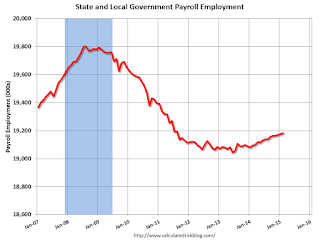

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In February 2015, state and local governments added 7,000 jobs. State and local government employment is now up 138,000 from the bottom, but still 620,000 below the peak.

State and local employment is now generally increasing. And Federal government layoffs have slowed (Federal payrolls were unchanged in February).

Overall this was a very solid employment report.

February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

by Calculated Risk on 3/06/2015 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 295,000 in February, and the unemployment rate edged down to 5.5 percent, the U.S. Bureau of Labor Statistics reported today.

...

After revision, the change in total nonfarm payroll employment for December remained at +329,000, and the change for January was revised from +257,000 to +239,000. With these revisions, employment gains in December and January were 18,000 lower than previously reported. Over the past 3 months, job gains have averaged 288,000 per month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 295 thousand in February (private payrolls increased 288 thousand).

Payrolls for December and January were revised down by a combined 18 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 3.3 million jobs.

This was the highest year-over-year gain since end of the '90s.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate decreased in February to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 5.5%.

This was above expectations of 230,000, and this was another solid report.

I'll have much more later ...

Thursday, March 05, 2015

Friday: Jobs, Trade Deficit

by Calculated Risk on 3/05/2015 06:51:00 PM

Congratulations to my friend, housing economist Tom Lawler, for winning another "Crystal Ball" award (Tom's home price forecasts were the most accurate of their more than 100 expert panelists.). This is Tom's third "Crystal Ball"!

Friday:

• At 8:30 AM ET, the Employment Report for February. The consensus is for an increase of 230,000 non-farm payroll jobs added in February, down from the 257,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to decline to 5.6% in February from 5.7% in January.

• Also at 8:30 AM, the Trade Balance report for January from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.8 billion in January from $46.6 billion in December.

• At 3:00 PM, Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Hints of real Wage Increases

by Calculated Risk on 3/05/2015 03:04:00 PM

A few thoughts ... it seems this might be the year that we see an increase in real wages. Here are a few signs:

1) The official data suggests we are getting closer to full employment. The unemployment rate (U-3) has fallen to 5.7%, and "quits" are up significantly (voluntary separations). The number of people working part time for economic reasons is still high, but declining (these workers are included in the alternate measure of underemployment, U-6, that has fallen to 11.3% from a high of 17.1%).

2) Several companies have announced increases for their lowest paid employees, including Wal-Mart (to $9 per hour in April, and $10 per hour next year) and T.J. Maxx.

3) More labor issues. There was the West Coast port slowdown (now resolved, with a huge backup of ships waiting to unload), and the ongoing refinery strikes. From the WSJ: U.S. Refiners, Striking Workers Digging In for Protracted Battle

U.S. refiners and striking union workers are digging in for a protracted battle that could last through the spring.

...

Weeks of negotiations the union and refinery owners fell apart in early February. Since then, 6,500 USW workers have walked out of more than a dozen plants. ...

The last nationwide refinery strike was in 1980 and lasted for three months. This year, energy companies have signaled that they are willing for the work stoppage to drag on even longer. The two sides are trying to hammer out a new three-year contract that would be used as a pattern for union employment, wage increases and benefits at refineries and petrochemical plants around the U.S.

Click on graph for larger image.

Click on graph for larger image.Union membership has declined significantly over the last 35 years (less power for labor), but these slowdowns and strikes still suggest some negotiating power for labor (we didn't see many strikes in 2008 when the economy was collapsing).

Last year I wrote that the economic word of the year for 2015 might be "wages", "Just being hopeful", I wrote, "maybe 2015 will be the year that real wages start to increase". All of the above suggests some increase in real wages this year.

Goldman February Payrolls Preview

by Calculated Risk on 3/05/2015 12:10:00 PM

Yesterday I posted a employment preview for February. Here are some excerpts from Goldman Sachs economist David Mericle:

We expect nonfarm payroll job growth of 220k in February, below the consensus forecast of 235k. Labor market indicators were mixed in February, and we expect that the effect of four major snowstorms in the month leading into the February survey week will also weigh on payroll growth. We expect a one-tenth decline in the unemployment rate to 5.6%, reversing the increase seen last month. On average hourly earnings, our baseline expectation is for a 0.2% increase, but we see some upside risk from possible statistical distortions related to the severe snowstorms.

emphasis added

Weekly Initial Unemployment Claims increased to 320,000

by Calculated Risk on 3/05/2015 08:34:00 AM

The DOL reported:

In the week ending February 28, the advance figure for seasonally adjusted initial claims was 320,000, an increase of 7,000 from the previous week's unrevised level of 313,000. The 4-week moving average was 304,750, an increase of 10,250 from the previous week's unrevised average of 294,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 304,750.

This was above the consensus forecast of 300,000, however the low level of the 4-week average suggests few layoffs.

Wednesday, March 04, 2015

Thursday: Unemployment Claims, Stress Test Results

by Calculated Risk on 3/04/2015 07:01:00 PM

From Greg Ip at the WSJ: Janet Yellen, Forecasting Ace

Her forecasts as a Fed official have been strikingly accurate, as the release of 2009 transcripts to the Fed’s deliberations make clear. If she worked on Wall Street, she’d be a “hot hand.” This does not mean as chairwoman she is necessarily right; but it does suggest her forecasts deserve the benefit of the doubt.Yellen has no crystal ball - she just paid close attention to the data and drew the correct conclusions. This is one reason I argued for Yellen as Fed Chair.

...

A Wall Street Journal study of her public comments concluded that she consistently hit the mark more often from 2009 to 2012 than other members of the Federal Open Market Committee.

Transcripts of FOMC meetings in 2009, released Wednesday, reinforce this point. Ms Yellen is repeatedly more gloomy about the outlook, less worried about inflation, and more in favor of forceful monetary stimulus than her colleagues.

Her foresight on inflation is especially noteworthy. Discussing its outlook in January, 2009, she said: “We could see a prolonged period in which inflation falls well below the level consistent with our dual goals of price stability and maximum sustainable employment.” That, of course, is what has happened: inflation has consistently run below the Fed’s 2% target.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for no change in January orders.

• At 4:30 PM, Dodd-Frank Act Stress Test Results

Preview for February Employment Report

by Calculated Risk on 3/04/2015 03:28:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus, according to Bloomberg, is for an increase of 230,000 non-farm payroll jobs in February (with a range of estimates between 200,000 and 252,000), and for the unemployment rate to decline to 5.6%.

The BLS reported 257,000 jobs added in January.

Here is a summary of recent data:

• The ADP employment report showed an increase of 212,000 private sector payroll jobs in February. This was below expectations of 220,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing employment index decreased in February to 51.4%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs declined by 10,000 in February. The ADP report indicated a 3,000 increase for manufacturing jobs in February.

The ISM non-manufacturing employment index decreased in January to 56.4%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 245,000 in February.

Combined, the ISM indexes suggests employment gains of 235,000. This suggests growth close to expectations.

• Initial weekly unemployment claims averaged close to 295,000 in January, down from 298,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 282,000; this was down from 308,000 during the reference week in January.

Generally this suggests slightly fewer layoffs, seasonally adjusted, in February compared to January.

• The final February University of Michigan consumer sentiment index decreased to 95.4 from the January reading of 98.1. Sentiment is frequently coincident with changes in the labor market, but this decrease is probably mostly due to an increase in gasoline prices in February.

• Trim Tabs reported that the U.S. economy added between 215,000 and 245,000 jobs in February. This was up from their 190,000 to 220,000 range last month. "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding".

• Conclusion: There is always some randomness to the employment report, but most indicators suggest an employment number close to the consensus.

Note: Last February, the economy added 188,000 jobs according to the BLS, so anything above 188,000 (including revisions) will increase the year-over-year change (already highest since the '90s).

Fed's Beige Book: Economic Activity Expanded "across most regions", Oil "declined"

by Calculated Risk on 3/04/2015 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of St. Louis and based on information collected on or before February 23, 2015. "

Reports from the twelve Federal Reserve Districts indicate that economic activity continued to expand across most regions and sectors from early January through mid-February. Six Districts noted that the local economy expanded at a moderate pace since the prior reporting period. Activity rose modestly in Philadelphia and Cleveland, while it increased slightly in Kansas City. Dallas noted a similar pace of growth as in the previous period, while Richmond reported that activity slowed from the modest pace seen in the prior period. Boston noted that business contacts were fairly upbeat this period, notwithstanding the severe weather....And on real estate:

Oil and natural gas drilling declined in the Cleveland, Minneapolis, Kansas City, and Dallas Districts. In contrast, the Richmond District reported that natural gas production was unchanged. The number of drilling rigs for oil and natural gas declined sharply in the Cleveland, Minneapolis, and Kansas City Districts. Oil and gas producers in the Cleveland, Kansas City, and Dallas Districts anticipate cuts in capital expenditures during 2015. Coal production was unchanged in both the Cleveland and Richmond Districts, while it increased modestly in the St. Louis District. Both the Cleveland and Richmond Districts reported lower coal prices.

Residential real estate conditions were mixed across the Districts. Home sales and prices increased in most Districts; construction activity was mixed, with some Districts reporting disruptions due to severe weather. Residential sales increased in Boston, Philadelphia, Richmond, St. Louis, Dallas, and San Francisco. Sales fell in Cleveland and Kansas City. Contacts in New York, Philadelphia, and Cleveland partially attributed lower construction to inclement weather conditions. Contacts in Boston noted low levels of inventory due, in part, to inclement weather. Reports noted that low levels of inventory and lack of desirable lots continue to slow the market: Contacts in Boston, Cleveland, Kansas City, and San Francisco cited a lack of available inventory, while contacts in Cleveland and Richmond noted a lack of available lots. Single-family building permits increased in St. Louis and San Francisco. Contacts in Cleveland, Atlanta, Kansas City, and Minneapolis reported flat to declining real estate construction.

Commercial real estate market conditions were stable or improving in most Districts. Commercial vacancy rates declined in Boston, Chicago, St. Louis, and Kansas City. In Dallas, contacts reported that commercial real estate had steadied or slowed since the previous report. The apartment market remained strong in most Districts. Apartment rental rates rose in New York, Chicago, and San Francisco. Contacts in Cleveland noted an increased demand for multifamily housing. Contacts in Dallas noted that apartment demand remains strong. Commercial construction increased in most Districts. Contacts in New York, Richmond, Atlanta, St. Louis, and San Francisco noted stable to strong multifamily construction. Contacts in Chicago reported moderate growth in commercial real estate, driven mainly by industrial buildings. In Boston, contacts noted that speculative construction remains limited due to high construction costs.

emphasis added