by Calculated Risk on 3/06/2015 08:30:00 AM

Friday, March 06, 2015

February Employment Report: 295,000 Jobs, 5.5% Unemployment Rate

From the BLS:

Total nonfarm payroll employment increased by 295,000 in February, and the unemployment rate edged down to 5.5 percent, the U.S. Bureau of Labor Statistics reported today.

...

After revision, the change in total nonfarm payroll employment for December remained at +329,000, and the change for January was revised from +257,000 to +239,000. With these revisions, employment gains in December and January were 18,000 lower than previously reported. Over the past 3 months, job gains have averaged 288,000 per month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 295 thousand in February (private payrolls increased 288 thousand).

Payrolls for December and January were revised down by a combined 18 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In February, the year-over-year change was 3.3 million jobs.

This was the highest year-over-year gain since end of the '90s.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate decreased in February to 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

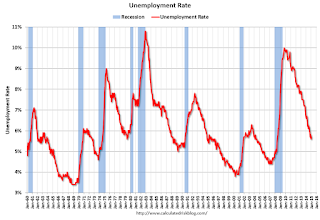

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in February to 5.5%.

This was above expectations of 230,000, and this was another solid report.

I'll have much more later ...

Thursday, March 05, 2015

Friday: Jobs, Trade Deficit

by Calculated Risk on 3/05/2015 06:51:00 PM

Congratulations to my friend, housing economist Tom Lawler, for winning another "Crystal Ball" award (Tom's home price forecasts were the most accurate of their more than 100 expert panelists.). This is Tom's third "Crystal Ball"!

Friday:

• At 8:30 AM ET, the Employment Report for February. The consensus is for an increase of 230,000 non-farm payroll jobs added in February, down from the 257,000 non-farm payroll jobs added in January. The consensus is for the unemployment rate to decline to 5.6% in February from 5.7% in January.

• Also at 8:30 AM, the Trade Balance report for January from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.8 billion in January from $46.6 billion in December.

• At 3:00 PM, Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Hints of real Wage Increases

by Calculated Risk on 3/05/2015 03:04:00 PM

A few thoughts ... it seems this might be the year that we see an increase in real wages. Here are a few signs:

1) The official data suggests we are getting closer to full employment. The unemployment rate (U-3) has fallen to 5.7%, and "quits" are up significantly (voluntary separations). The number of people working part time for economic reasons is still high, but declining (these workers are included in the alternate measure of underemployment, U-6, that has fallen to 11.3% from a high of 17.1%).

2) Several companies have announced increases for their lowest paid employees, including Wal-Mart (to $9 per hour in April, and $10 per hour next year) and T.J. Maxx.

3) More labor issues. There was the West Coast port slowdown (now resolved, with a huge backup of ships waiting to unload), and the ongoing refinery strikes. From the WSJ: U.S. Refiners, Striking Workers Digging In for Protracted Battle

U.S. refiners and striking union workers are digging in for a protracted battle that could last through the spring.

...

Weeks of negotiations the union and refinery owners fell apart in early February. Since then, 6,500 USW workers have walked out of more than a dozen plants. ...

The last nationwide refinery strike was in 1980 and lasted for three months. This year, energy companies have signaled that they are willing for the work stoppage to drag on even longer. The two sides are trying to hammer out a new three-year contract that would be used as a pattern for union employment, wage increases and benefits at refineries and petrochemical plants around the U.S.

Click on graph for larger image.

Click on graph for larger image.Union membership has declined significantly over the last 35 years (less power for labor), but these slowdowns and strikes still suggest some negotiating power for labor (we didn't see many strikes in 2008 when the economy was collapsing).

Last year I wrote that the economic word of the year for 2015 might be "wages", "Just being hopeful", I wrote, "maybe 2015 will be the year that real wages start to increase". All of the above suggests some increase in real wages this year.

Goldman February Payrolls Preview

by Calculated Risk on 3/05/2015 12:10:00 PM

Yesterday I posted a employment preview for February. Here are some excerpts from Goldman Sachs economist David Mericle:

We expect nonfarm payroll job growth of 220k in February, below the consensus forecast of 235k. Labor market indicators were mixed in February, and we expect that the effect of four major snowstorms in the month leading into the February survey week will also weigh on payroll growth. We expect a one-tenth decline in the unemployment rate to 5.6%, reversing the increase seen last month. On average hourly earnings, our baseline expectation is for a 0.2% increase, but we see some upside risk from possible statistical distortions related to the severe snowstorms.

emphasis added

Weekly Initial Unemployment Claims increased to 320,000

by Calculated Risk on 3/05/2015 08:34:00 AM

The DOL reported:

In the week ending February 28, the advance figure for seasonally adjusted initial claims was 320,000, an increase of 7,000 from the previous week's unrevised level of 313,000. The 4-week moving average was 304,750, an increase of 10,250 from the previous week's unrevised average of 294,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 304,750.

This was above the consensus forecast of 300,000, however the low level of the 4-week average suggests few layoffs.

Wednesday, March 04, 2015

Thursday: Unemployment Claims, Stress Test Results

by Calculated Risk on 3/04/2015 07:01:00 PM

From Greg Ip at the WSJ: Janet Yellen, Forecasting Ace

Her forecasts as a Fed official have been strikingly accurate, as the release of 2009 transcripts to the Fed’s deliberations make clear. If she worked on Wall Street, she’d be a “hot hand.” This does not mean as chairwoman she is necessarily right; but it does suggest her forecasts deserve the benefit of the doubt.Yellen has no crystal ball - she just paid close attention to the data and drew the correct conclusions. This is one reason I argued for Yellen as Fed Chair.

...

A Wall Street Journal study of her public comments concluded that she consistently hit the mark more often from 2009 to 2012 than other members of the Federal Open Market Committee.

Transcripts of FOMC meetings in 2009, released Wednesday, reinforce this point. Ms Yellen is repeatedly more gloomy about the outlook, less worried about inflation, and more in favor of forceful monetary stimulus than her colleagues.

Her foresight on inflation is especially noteworthy. Discussing its outlook in January, 2009, she said: “We could see a prolonged period in which inflation falls well below the level consistent with our dual goals of price stability and maximum sustainable employment.” That, of course, is what has happened: inflation has consistently run below the Fed’s 2% target.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for no change in January orders.

• At 4:30 PM, Dodd-Frank Act Stress Test Results

Preview for February Employment Report

by Calculated Risk on 3/04/2015 03:28:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for February. The consensus, according to Bloomberg, is for an increase of 230,000 non-farm payroll jobs in February (with a range of estimates between 200,000 and 252,000), and for the unemployment rate to decline to 5.6%.

The BLS reported 257,000 jobs added in January.

Here is a summary of recent data:

• The ADP employment report showed an increase of 212,000 private sector payroll jobs in February. This was below expectations of 220,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing employment index decreased in February to 51.4%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs declined by 10,000 in February. The ADP report indicated a 3,000 increase for manufacturing jobs in February.

The ISM non-manufacturing employment index decreased in January to 56.4%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 245,000 in February.

Combined, the ISM indexes suggests employment gains of 235,000. This suggests growth close to expectations.

• Initial weekly unemployment claims averaged close to 295,000 in January, down from 298,000 in January. For the BLS reference week (includes the 12th of the month), initial claims were at 282,000; this was down from 308,000 during the reference week in January.

Generally this suggests slightly fewer layoffs, seasonally adjusted, in February compared to January.

• The final February University of Michigan consumer sentiment index decreased to 95.4 from the January reading of 98.1. Sentiment is frequently coincident with changes in the labor market, but this decrease is probably mostly due to an increase in gasoline prices in February.

• Trim Tabs reported that the U.S. economy added between 215,000 and 245,000 jobs in February. This was up from their 190,000 to 220,000 range last month. "TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding".

• Conclusion: There is always some randomness to the employment report, but most indicators suggest an employment number close to the consensus.

Note: Last February, the economy added 188,000 jobs according to the BLS, so anything above 188,000 (including revisions) will increase the year-over-year change (already highest since the '90s).

Fed's Beige Book: Economic Activity Expanded "across most regions", Oil "declined"

by Calculated Risk on 3/04/2015 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of St. Louis and based on information collected on or before February 23, 2015. "

Reports from the twelve Federal Reserve Districts indicate that economic activity continued to expand across most regions and sectors from early January through mid-February. Six Districts noted that the local economy expanded at a moderate pace since the prior reporting period. Activity rose modestly in Philadelphia and Cleveland, while it increased slightly in Kansas City. Dallas noted a similar pace of growth as in the previous period, while Richmond reported that activity slowed from the modest pace seen in the prior period. Boston noted that business contacts were fairly upbeat this period, notwithstanding the severe weather....And on real estate:

Oil and natural gas drilling declined in the Cleveland, Minneapolis, Kansas City, and Dallas Districts. In contrast, the Richmond District reported that natural gas production was unchanged. The number of drilling rigs for oil and natural gas declined sharply in the Cleveland, Minneapolis, and Kansas City Districts. Oil and gas producers in the Cleveland, Kansas City, and Dallas Districts anticipate cuts in capital expenditures during 2015. Coal production was unchanged in both the Cleveland and Richmond Districts, while it increased modestly in the St. Louis District. Both the Cleveland and Richmond Districts reported lower coal prices.

Residential real estate conditions were mixed across the Districts. Home sales and prices increased in most Districts; construction activity was mixed, with some Districts reporting disruptions due to severe weather. Residential sales increased in Boston, Philadelphia, Richmond, St. Louis, Dallas, and San Francisco. Sales fell in Cleveland and Kansas City. Contacts in New York, Philadelphia, and Cleveland partially attributed lower construction to inclement weather conditions. Contacts in Boston noted low levels of inventory due, in part, to inclement weather. Reports noted that low levels of inventory and lack of desirable lots continue to slow the market: Contacts in Boston, Cleveland, Kansas City, and San Francisco cited a lack of available inventory, while contacts in Cleveland and Richmond noted a lack of available lots. Single-family building permits increased in St. Louis and San Francisco. Contacts in Cleveland, Atlanta, Kansas City, and Minneapolis reported flat to declining real estate construction.

Commercial real estate market conditions were stable or improving in most Districts. Commercial vacancy rates declined in Boston, Chicago, St. Louis, and Kansas City. In Dallas, contacts reported that commercial real estate had steadied or slowed since the previous report. The apartment market remained strong in most Districts. Apartment rental rates rose in New York, Chicago, and San Francisco. Contacts in Cleveland noted an increased demand for multifamily housing. Contacts in Dallas noted that apartment demand remains strong. Commercial construction increased in most Districts. Contacts in New York, Richmond, Atlanta, St. Louis, and San Francisco noted stable to strong multifamily construction. Contacts in Chicago reported moderate growth in commercial real estate, driven mainly by industrial buildings. In Boston, contacts noted that speculative construction remains limited due to high construction costs.

emphasis added

Yellen in June 2009: Sluggish Recovery, Low inflation for "few years"

by Calculated Risk on 3/04/2015 10:40:00 AM

The Federal Reserve released the transcripts for the 2009 FOMC meetings today. Here is SF Fed President Janet Yellen in June 2009:

Thank you, Mr. Chairman. At our meeting in late April, we had begun to see hopeful signs of impending economic recovery, and subsequent economic and financial developments have strengthened the view that the economy is bottoming out. Even so, the outlook over the next several years remains disturbing. My modal forecast shows economic growth resuming next quarter, but I expect the recovery to be quite gradual. The output and employment gaps are, at a minimum, quite large, so it will take a long time to regain full employment under current monetary and fiscal policy settings. Although downside risks have diminished, I remain concerned that the recovery is still fragile.Note that Yellen correctly forecast that the recovery was starting (this was June 2009), but that the recovery would be sluggish - not V-shaped - because of the need for "balance sheet repair" (I made the same argument in mid-2009), and that inflation would be low for some time. Many analysts were forecasting a strong recovery (ignoring the reasons for the recessions) and high inflation.

...

And, of course, labor markets continue to deteriorate badly. It’s a sign of how bad things really are that near euphoria broke out with the announcement of 345,000 nonfarm jobs lost in May. The unemployment rate is soaring month by month, and, even worse, it appears to understate the true extent of the deterioration, given the unusually high incidence of permanent, as opposed to temporary, layoffs, and the unprecedented increase in involuntary part-time work. ...

My forecasts for output and employment are similar to the Greenbook’s, so I won’t go into the details. I do want to emphasize that I anticipate a rather sluggish recovery, not the rapid V-shaped recovery we have frequently seen following deep recessions in the past. The process of balance sheet repair that households and financial institutions are undergoing will result in subdued spending for an extended period, and monetary policies here and abroad are not able to play as big a role as usual in promoting recovery because of the constraint of the zero lower bound on short-term interest rates.

... [E]ven under the typical recovery simulation, which has much stronger growth than in the baseline, the unemployment rate remains well above the 5 percent NAIRU by the end of 2011, and inflation hovers around 1 percent. This outcome reflects the large unemployment and GDP gaps estimated for the first quarter. ...

So, to conclude, if the recovery is as slow as the Greenbook and I expect, it will take quite a number of years to get back to potential output. As a result, I expect core inflation to drift lower over the next few years, falling below the 2 percent rate that seems best to me.

ISM Non-Manufacturing Index increased to 56.9% in February

by Calculated Risk on 3/04/2015 10:00:00 AM

The February ISM Non-manufacturing index was at 56.9%, up from 56.7% in January. The employment index increased in February to 56.4%, up from 51.6% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2015 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 61st consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 56.9 percent in February, 0.2 percentage point higher than the January reading of 56.7 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index decreased to 59.4 percent, which is 2.1 percentage points lower than the January reading of 61.5 percent, reflecting growth for the 67th consecutive month at a slower rate. The New Orders Index registered 56.7 percent, 2.8 percentage points lower than the reading of 59.5 percent registered in January. The Employment Index increased 4.8 percentage points to 56.4 percent from the January reading of 51.6 percent and indicates growth for the 12th consecutive month. The Prices Index increased 4.2 percentage points from the January reading of 45.5 percent to 49.7 percent, indicating prices contracted in February for the third consecutive month. According to the NMI®, 14 non-manufacturing industries reported growth in February. Comments from respondents have increased in regards to the affects of the reduction in fuel costs and the impact of the West Coast port labor issues on the continuity of supply. Overall, supply managers feel mostly positive about the direction of the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was close to the consensus forecast of 56.5% and suggests slightly faster expansion in February than in January. Overall this was a solid report.