by Calculated Risk on 2/25/2015 03:16:00 PM

Wednesday, February 25, 2015

Comments on New Home Sales

Earlier: New Home Sales at 481,000 Annual Rate in January, Highest January since 2008

Here is an updated table of new home sales since 2000 and the change from the previous year, including the revisions for the last few months. Sales in 2014 were only up 1.9% from 2013.

| New Home Sales (000s) | ||

|---|---|---|

| Year | Sales | Change |

| 2000 | 877 | -0.3% |

| 2001 | 908 | 3.5% |

| 2002 | 973 | 7.2% |

| 2003 | 1,086 | 11.6% |

| 2004 | 1,203 | 10.8% |

| 2005 | 1,283 | 6.7% |

| 2006 | 1,051 | -18.1% |

| 2007 | 776 | -26.2% |

| 2008 | 485 | -37.5% |

| 2009 | 375 | -22.7% |

| 2010 | 323 | -13.9% |

| 2011 | 306 | -5.3% |

| 2012 | 368 | 20.3% |

| 2013 | 429 | 16.6% |

| 2014 | 437 | 1.9% |

There are two ways to look at 2014: 1) sales were below expectations, or 2) this just means more growth over the next several years! Both are correct, and what matters now is the present (sales are picking up), and the future (still bright).

It is important not to be influenced too much by one month of data, but if sales averaged the January rate in 2015 of 481 thousand - just moved sideways - then sales for 2015 would be up 10.1% over 2014.

Based on the low level of sales, more lots coming available, changing builder designs and demographics, I expect sales to increase over the next several years.

As I noted last month, it is important to remember that demographics is a slow moving - but unstoppable - force!

It was over four years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. One major reason for that optimism was demographics - a large cohort was moving into the renting age group.

Now demographics are slowly becoming more favorable for home buying.

Click on graph for larger image.

Click on graph for larger image.This graph shows the longer term trend for several key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph is from 1990 to 2060 (all data from BLS: 1990 to 2013 is actual, 2014 to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts - and new home sales - to continue to increase in coming years.

There are several reasons to expect a return to double digit (or close) new home sales growth in 2015: Builders bringing lower priced homes on the market, more finished lots available, looser credit and demographics (as discussed above). The housing recovery is ongoing.

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through January 2015. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through January 2015. This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to mostly move sideways (distressed sales will continue to decline and be offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Black Knight: Mortgage Delinquencies Declined in January

by Calculated Risk on 2/25/2015 12:46:00 PM

According to Black Knight's First Look report for January, the percent of loans delinquent decreased 1% in January compared to December, and declined 11% year-over-year.

The percent of loans in the foreclosure process declined slightly in January and were down about 31% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.56% in January, down from 5.64% in December. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined slightly in January and remained at 1.61%.

The number of delinquent properties, but not in foreclosure, is down 327,000 properties year-over-year, and the number of properties in the foreclosure process is down 360,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for February in March.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2015 | Dec 2014 | Jan 2014 | Jan 2013 | |

| Delinquent | 5.56% | 5.64% | 6.27% | 7.03% |

| In Foreclosure | 1.61% | 1.61% | 2.35% | 3.41% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,701,000 | 1,736,000 | 1,851,000 | 1,974,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,112,000 | 1,132,000 | 1,289,000 | 1,531,000 |

| Number of properties in foreclosure pre-sale inventory: | 815,000 | 820,000 | 1,175,000 | 1,703,000 |

| Total Properties | 3,628,000 | 3,688,000 | 4,315,000 | 5,208,000 |

New Home Sales at 481,000 Annual Rate in January, Highest January since 2008

by Calculated Risk on 2/25/2015 10:00:00 AM

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 481 thousand.

November sales were revised up from 431 thousand to 446 thousand, and December sales were revised up from 481 thousand to 482 thousand.

"Sales of new single-family houses in January 2015 were at a seasonally adjusted annual rate of 481,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.2 percent below the revised December rate of 482,000, but is 5.3 percent above the January 2014 estimate of 457,000."

Click on graph for larger image.

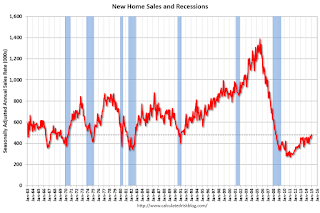

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are barely above the bottom for previous recessions.

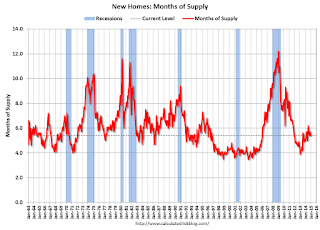

The second graph shows New Home Months of Supply.

The months of supply was unchanged in January at 5.4 months.

The months of supply was unchanged in January at 5.4 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of January was 218,000. This represents a supply of 5.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In January 2015 (red column), 36 thousand new homes were sold (NSA). Last year 33 thousand homes were sold in January. This is the highest for January since 2008.

The high for January was 92 thousand in 2005, and the low for January was 21 thousand in 2011.

This was above expectations of 471,000 sales in January, and is a decent start to 2015. I'll have more later today.

MBA: Purchase Mortgage Applications Increase, Refinance Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 2/25/2015 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 20, 2015. This week’s results include an adjustment to account for the Presidents’ Day holiday. ...

The Refinance Index decreased 8 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.99 percent from 3.93 percent, with points decreasing to 0.33 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

2015 will probably see more refinance activity than in 2014, but not a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down 2% from a year ago.

Tuesday, February 24, 2015

Wednesday: New Home Sales, Yellen

by Calculated Risk on 2/24/2015 08:26:00 PM

The following paragraph from Fed Chair Janet Yellen's testimony today seems to suggest "patient" will be dropped from the FOMC statement at the March 17-18 meeting. Sentence by sentence:

The FOMC's assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings.That just repeated the current understanding. If the FOMC wants to have the option to raise rates in June, they would most likely drop "patient" from the statement in March (June is the second meeting after March).

If economic conditions continue to improve, as the Committee anticipates, the Committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis. Before then, the Committee will change its forward guidance.Yes, the FOMC needs to drop "patient" before they move to a meeting-by-meeting basis.

However, it is important to emphasize that a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings.This was the clarification today. Although "patient" probably means no hike for at least two meetings, dropping "patient" does not mean a rate hike is guaranteed two meetings later - just that a hike may be considered based on incoming data (employment and inflation).

Right now I expect the FOMC to drop patient at the next meeting.

Wednesday:

• At 7:00 AM ET, Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for January from the Census Bureau. The consensus is for a decrease in sales to 471 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 481 thousand in December.

• Also at 10:00 AM, Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C. (Report will be a repeat, plus Q&A).

Lawler on Toll Brothers and Other Builders: Maybe Points to Strong New Home Sales in January

by Calculated Risk on 2/24/2015 04:27:00 PM

From housing economist Tom Lawler: Toll Brothers: Net Orders Up 16% YOY in Latest Quarter; “Traditional” Net Orders Up 20.7%; Ex the West, Net Orders Down

Toll Brothers, the self-described “nation’s leading builder of luxury homes,” reported that net home orders in the quarter ended January 31, 2015 totaled 1,063, up 16.0% from the disappointed orders in the comparable quarter of 2014. Net orders per community were up 3.5% from a year earlier. Net orders in the company’s “traditional” home building operations totaled 1,044, up 20.7% from the comparable quarter of 2014. Home deliveries last quarter totaled 1,091, up 17.6% from the comparable quarter of 2014, at an average sales price of $782,300, up 12.8% from a year earlier. “Traditional” home delivers totaled 1,091, up 17.5% from the comparable quarter of 2014, at an average sales price of $714,900, up 2.8% from a year earlier. The company’s order backlog at the end of January was 3,651, down 0.4% from last January, at an average order price of $750,000, up 2.5% from a year earlier. The backlog for traditional building at the end of January was 3,536, up 2.9% from last January, at an average sales price of $732,000, up 4.5% from a year earlier.

Compared to a year ago Toll’s traditional net orders were down in every region save the West (Arizona, California, Colorado, Nevada, and Washington), as shown in the table below. Part of the YOY gain in the West reflected orders from lots and communities in California obtained from the acquisition of Shapell Industries, which closed last February. That acquisition included 5,219 lots in Northern and Southern California, 4,122 of which were not finished as of 8/31/2013. When asked whether the strong YOY growth in net orders in the West reflected orders associated with the Shappell acquisition or from “core” strength in the region, a company official said “it was both.” The fact that Toll’s net order (and settlement) price in the West was down from a year ago, however, suggested that a “good chunk” of the YOY order gain in the West was related to the Shapell acquisition (Shapell’s average sales price had been lower than Toll’s) – especially given management’s discussion of “pricing power” in many California markets.

| Net Home Orders | Average Net Order Price | |||||

|---|---|---|---|---|---|---|

| Qtr. Ended: | 1/31/2015 | 1/31/2014 | % Chg. | 1/31/2015 | 1/31/2014 | % Chg. |

| North | 177 | 181 | -2.2% | $625,100 | $652,900 | -4.3% |

| Mid-Atlantic | 224 | 263 | -14.8% | $659,500 | $623,100 | 5.8% |

| South | 199 | 222 | -10.4% | $850,700 | $758,100 | 12.2% |

| West | 444 | 199 | 123.1% | $905,100 | $944,100 | -4.1% |

| Traditional | 1044 | 865 | 20.7% | $794,000 | $737,800 | 7.6% |

| City Living | 19 | 51 | -62.7% | $2,301,900 | $1,245,700 | 84.8% |

| Total | 1063 | 916 | 16.0% | $821,500 | $766,100 | 7.2% |

On the “pricing power” front, while on the December conference call officials focused on the reduction in pricing power across many of its markets, today officials seemed a touch more optimistic – although comments with vague, save that in Northern California, Southern California, the New York City area, and certain parts of Florida pricing power appeared to have improved.

Officials also said since the start of the current quarter (February 1), signed contracts were running about 13% higher than the comparable period of 2014.

And Some News from Other Builders Points to Strong New Home Sales in January (maybe)

In significantly older news but related to early 2015 home sales, KB Home reported (on February 11) that net home orders from December 1, 2014 through February 6, 2015 totaled 1,499, up 24.8% from the comparable period of a year earlier. At the beginning of its current fiscal quarter (which runs from December 1, 2014 through February 28, 2015) the company had 227 communities for sale, up 19% from a year earlier. Quarter-to-date net order value over this period was up 25.5% from the comparable year-earlier period, implying a YOY gain in net order price of about 1%.

KB Home released these preliminary quarter-to-date order numbers in conjunction with the commencement of a public offerening of $250 million in senior notes.

Meanwhile, in anticipation of management’s meetings with investors at a conference this week, Meritage Homes reported that net home orders in January totaled 606, up 48% from last January. Meritage said that net orders per community were up 24% YOY.

While it is dangerous to attempt to translate reported net orders from builders to Census’ estimates for new home sales – even when one has a lot of builder reports – my “gut” tells me that Census’ report on new home sales for January will beat “consensus.”

CR Note: New Home sales for January will be released tomorrow morning at 10:00 AM ET. The consensus is for a decrease in sales to 471 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 481 thousand in December.

FDIC: Fewer Problem banks, Residential REO Declines in Q4

by Calculated Risk on 2/24/2015 03:41:00 PM

The FDIC released the Quarterly Banking Profile for Q4 today.

The banking industry continued to improve at the end of the year. Although total industry earnings declined as a result of significant litigation expenses at a few large institutions and a continued decline in mortgage-related income, a majority of banks reported higher operating revenues and improved earnings from the previous year. In addition, banks made loans at a faster pace, asset quality improved, and the number of banks on the problem list declined to the lowest level in six years.

...

[F]ourth quarter net income was 36.9 billion dollars, down 7.3 percent from the prior year. The principal reasons for the decline were a 4.4 billion dollar increase in litigation expenses concentrated at a few large institutions and a 1.6 billion dollar decline in mortgage-related noninterest income.

emphasis added

Click on graph for larger image.

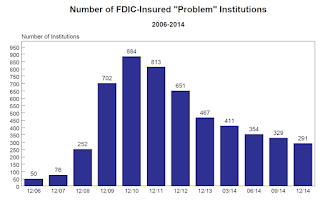

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks quarterly for 2014, and year end prior to 2014):

The number of banks on the problem list fell to the lowest level since the third quarter of 2008. There were 291 banks on the problem list at the end of 2014, less than one-third of the 888 problem banks at the peak in March 2011. Total assets of banks on the problem list fell to 87 billion dollars.

This is the first time problem bank assets have been below 100 billion dollars since March 2008.

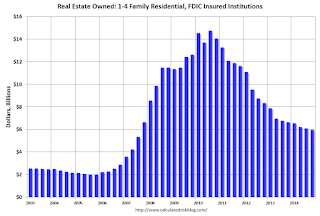

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $6.10 billion in Q3 2014 to $5.98 billion in Q4. This is the lowest level of REOs since Q3 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $6.10 billion in Q3 2014 to $5.98 billion in Q4. This is the lowest level of REOs since Q3 2007.This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

A Comment on House Prices: Real Prices and Price-to-Rent Ratio in December

by Calculated Risk on 2/24/2015 12:22:00 PM

First, S&P's David Blitzer said this morning "The housing recovery is faltering." I disagree with that wording. The level of housing starts and new home sales are still historically weak, but are clearly recovering - and I expect the housing recovery to continue (not "falter").

Second, the expected slowdown in year-over-year price increases has occurred. In October 2013, the National index was up 10.9% year-over-year (YoY). In December 2014, the index was up 4.6% YoY. The YoY change has held steady for the last four months.

Looking forward, I expect the YoY increases for the indexes to move more sideways (as opposed to down). Two points: 1) I don't expect (as some) for the indexes to turn negative YoY (in 2015) , and 2) I think most of the slowdown on a YoY basis is now behind us. This slowdown in price increases was expected by several key analysts, and I think it was good news for housing and the economy.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

It has been almost ten years since the bubble peak. In the Case-Shiller release this morning, the National Index was reported as being 8.4% below the bubble peak. However, in real terms, the National index is still about 22% below the bubble peak.

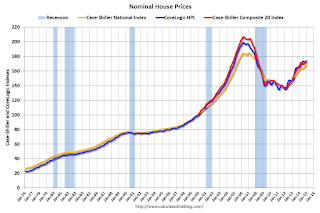

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to May 2005 levels, and the Case-Shiller Composite 20 Index (SA) is back to December 2004 levels, and the CoreLogic index (NSA) is back to February 2005.

Real House Prices

In real terms, the National index is back to April 2003 levels, the Composite 20 index is back to November 2002, and the CoreLogic index back to March 2003.

In real terms, house prices are back to early '00s levels.

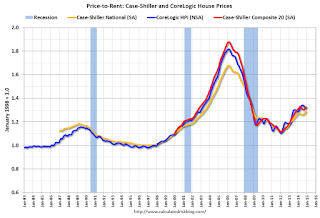

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to May 2003 levels, the Composite 20 index is back to December 2002 levels, and the CoreLogic index is back to March 2003.

In real terms, and as a price-to-rent ratio, prices are mostly back to early 2000 levels - and maybe moving a little sideways now.

Yellen: Semiannual Monetary Policy Report to the Congress

by Calculated Risk on 2/24/2015 10:00:00 AM

Federal Reserve Chair Janet Yellen testimony "Semiannual Monetary Policy Report to the Congress" Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C. (starts at 10 AM ET):

The FOMC's assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings. If economic conditions continue to improve, as the Committee anticipates, the Committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis. Before then, the Committee will change its forward guidance. However, it is important to emphasize that a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings. Instead the modification should be understood as reflecting the Committee's judgment that conditions have improved to the point where it will soon be the case that a change in the target range could be warranted at any meeting. Provided that labor market conditions continue to improve and further improvement is expected, the Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when, on the basis of incoming data, the Committee is reasonably confident that inflation will move back over the medium term toward our 2 percent objective.Here is the C-Span Link

It continues to be the FOMC's assessment that even after employment and inflation are near levels consistent with our dual mandate, economic conditions may, for some time, warrant keeping the federal funds rate below levels the Committee views as normal in the longer run. It is possible, for example, that it may be necessary for the federal funds rate to run temporarily below its normal longer-run level because the residual effects of the financial crisis may continue to weigh on economic activity. As such factors continue to dissipate, we would expect the federal funds rate to move toward its longer-run normal level. In response to unforeseen developments, the Committee will adjust the target range for the federal funds rate to best promote the achievement of maximum employment and 2 percent inflation.

emphasis added

Here is the Bloomberg TV link.

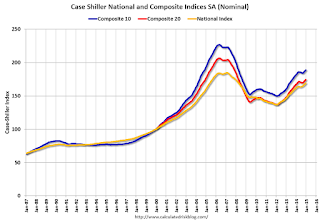

Case-Shiller: National House Price Index increased 4.6% year-over-year in December

by Calculated Risk on 2/24/2015 09:05:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3 month average of October, November and December prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices Grew at Twice the Rate of Inflation in 2014 According to the S&P/Case-Shiller Home Price Indices

Data released today for December 2014 shows a slight uptick in home prices across the country. Nine cities reported monthly increases in prices ... Both the 10-City and 20-City Composites saw year-over-year increases in December compared to November. The 10-City Composite gained 4.3% year-over-year, up from 4.2% in November. The 20-City Composite gained 4.5% year-over-year, compared to a 4.3% increase in November. The S&P/Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, recorded a 4.6% annual gain in December 2014 versus 4.7% in November.

...

The National index was slightly negative in December, while both composite Indices were positive. Both the 10- and 20-City Composites reported slight increases of 0.1%, while the National Index posted a -0.1% change for the month. Miami and Denver led all cities in December with increases of 0.7% and 0.5% respectively. Chicago and Cleveland offset those gains by reporting decreases of -0.9% and -0.5% respectively.

...

“The housing recovery is faltering. While prices and sales of existing homes are close to normal, construction and new home sales remain weak. Before the current business cycle, any time housing starts were at their current level of about one million at annual rates, the economy was in a recession” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The softness in housing is despite favorable conditions elsewhere in the economy: strong job growth, a declining unemployment rate, continued low interest rates and positive consumer confidence.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 16.7% from the peak, and up 0.8% in December (SA).

The Composite 20 index is off 15.6% from the peak, and up 0.9% (SA) in December.

The National index is off 8.4% from the peak, and up 0.7% (SA) in December. The National index is up 23.7% from the post-bubble low set in Dec 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to December 2013.

The Composite 20 SA is up 4.5% year-over-year..

The National index SA is up 4.6% year-over-year.

Prices increased (SA) in all 20 of the 20 Case-Shiller cities in December seasonally adjusted. (Prices increased in 9 of the 20 cities NSA) Prices in Las Vegas are off 41.6% from the peak, and prices in Denver and Dallas are at new highs (SA).

This was close to the consensus forecast for a 4.7% YoY increase for the National index. I'll have more on house prices later.