by Calculated Risk on 2/14/2015 01:15:00 PM

Saturday, February 14, 2015

Schedule for Week of February 15, 2015

The key economic report this week is January housing starts on Wednesday.

For manufacturing, the January Industrial Production and Capacity Utilization report, and the February NY Fed (Empire State), and Philly Fed surveys, will be released this week.

For prices, PPI will be released on Wednesday.

All US markets are closed in observance of the Presidents' Day holiday.

8:30 AM: NY Fed Empire State Manufacturing Survey for February. The consensus is for a reading of 9.0, down from 10.0 last month (above zero is expansion).

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 58, up from 57 in January. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

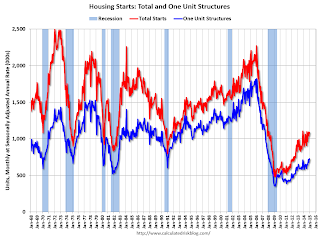

8:30 AM: Housing Starts for January.

8:30 AM: Housing Starts for January. Total housing starts were at 1.089 million (SAAR) in December. Single family starts were at 679 thousand SAAR in December.

The consensus is for total housing starts to decrease to 1.070 million (SAAR) in January.

8:30 AM: The Producer Price Index for January from the BLS. The consensus is for a 0.4% decrease in prices, and a 0.1% increase in core PPI.

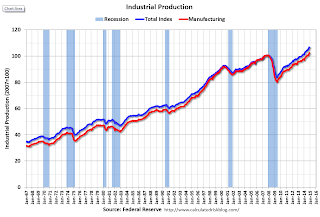

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for January.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.9%.

During the day: The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for Meeting of January 27-28, 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 290 thousand from 304 thousand.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 8.5, up from 6.3 last month (above zero indicates expansion).

No economic releases scheduled.

Unofficial Problem Bank list declines to 386 Institutions

by Calculated Risk on 2/14/2015 08:07:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 14, 2015.

Changes and comments from surferdude808:

A failure today reduced the Unofficial Problem Bank List to 386 institutions with assets of $121.2 billion. A year ago, the list held 586 institutions with assets of $195 billion.

The FDIC shuttered the doors of Capitol City Bank & Trust Company, Atlanta, GA ($276 million) making it the 89th bank headquartered in Georgia to fail since the on-set of the Great Recession. Astonishingly, the FDIC estimates the failure cost at $88.9 million or nearly 33 percent of the bank's assets.

Historically, commercial bank failure are usually around 12¢ on the dollar. Even with a well above average cost percentage, Capitol City Bank & Trust only ranks as the 54th most expensive failure, in cost percentage terms, of the 89 Georgia closures. Moreover, its cost is under the Georgia average failure cost of 34.7 percent of failed bank assets.

Next week, we anticipate the OCC will release an update on its latest enforcement action activities..

Friday, February 13, 2015

Bank Failure #3 in 2015: Capitol City Bank & Trust Company, Atlanta, Georgia

by Calculated Risk on 2/13/2015 06:55:00 PM

Another bank failure in Georgia ...

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of Capitol City Bank & Trust Company, Atlanta, Georgia

As of December 31, 2014, Capitol City Bank & Trust Company had approximately $272.3 million in total assets and $262.7 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $88.9 million. ... Capitol City Bank & Trust Company is the third FDIC-insured institution in the nation to fail this year, and the first in Georgia. The last FDIC-insured institution closed in the state was Eastside Commercial Bank, Conyers, on July 18, 2014.At least we know it is Friday.

By Request: Repeat U.S. Population by Age and Distribution, 1900 through 2060

by Calculated Risk on 2/13/2015 02:34:00 PM

Repeat: Here are animations of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

Also - by request - I've slowed the animation down to 2 seconds per slide (and included a slower distribution animation below).

Note: For distribution, here are the same graphs using a slider (the user can look at individual slides).

There are many interesting points - the Depression baby bust, the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more. What jumps out at me are the improvements in health care. And also that the largest cohorts will all soon be under 40. Heck, in the last frame (2060), any remaining Boomers will be in those small (but growing) 95 to 99, and 100+ cohorts.

Animation updates every two seconds.

Notes: Population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

The second graph is by distribution (updates every 2 seconds).

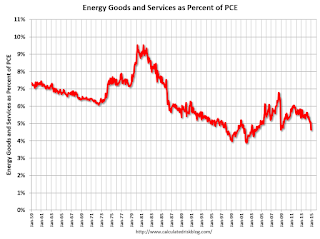

Energy expenditures as a percentage of consumer spending

by Calculated Risk on 2/13/2015 11:14:00 AM

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through December 2014.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

With the recent decline in energy prices, this ratio has declined sharply. Hopefully energy prices are resuming their long term down trend as a percent of PCE.

Preliminary February Consumer Sentiment decreases to 93.6

by Calculated Risk on 2/13/2015 10:04:00 AM

Thursday, February 12, 2015

Report: Foreclosures Increase in January, "Clearing the deck"

by Calculated Risk on 2/12/2015 07:14:00 PM

Note: Data from other sources suggest most of the loans on these properties were originated almost a decade ago. Still "clearing the deck" after the storm.

From RealtyTrac: U.S. Foreclosure Activity Increases 5 Percent in January Driven By 15-Month High in Bank Repossessions

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for January 2015, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 119,888 U.S. properties in January, an increase of 5 percent from the previous month but still down 4 percent from a year ago.Friday:

The 5 percent monthly increase was driven primarily by a 55 percent monthly jump in bank repossessions (REOs) to a 15-month high. A total of 37,292 U.S. properties were repossessed by lenders in January, up 23 percent from a year ago to the highest monthly total since October 2013.

...

“Due to our ponderous judicial system, most of the options have been exhausted, and the judges are now expediting the process,” said Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market. “The banks recognize the opportunity in this improving market and are aggressively trying to remove these properties from their balance sheets. It is encouraging, after seven years, to see the end near on this dramatic cycle.”

...

“Our agents’ REO and distress business has wound considerably down over the last two years,” said Mark Hughes, Chief Operating Officer at First Team Real Estate, covering the Southern California market. “Despite a bit of an extension to this wind-down process due to delayed actions created by the Homeowner Bill of Rights in 2013, we are preparing that this is really a final push to clear the decks of the a still disproportionate amount of distressed homes and finally bring the market back to a more stability.”

emphasis added

• At 10:00 AM ET, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 98.5, up from 98.1 in January.

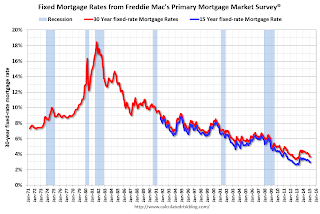

Freddie Mac: 30 Year Mortgage Rates increase to 3.69% in Latest Weekly Survey

by Calculated Risk on 2/12/2015 02:10:00 PM

From Freddie Mac today: Mortgage Rates Move Higher on Strong Jobs Report

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher amid a strong employment report. Regardless, fixed-rate mortgages rates still remain near their May 23, 2013 lows. ...

30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending February 12, 2015, up from last week when it averaged 3.59 percent. A year ago at this time, the 30-year FRM averaged 4.28 percent.

15-year FRM this week averaged 2.99 percent with an average 0.6 point, up from last week when it averaged 2.92 percent. A year ago at this time, the 15-year FRM averaged 3.33 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.28% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Hotels: Solid Start to 2015

by Calculated Risk on 2/12/2015 11:12:00 AM

From HotelNewsNow.com: US hotel results for week ending 7 February

The U.S. hotel industry recorded positive results in the three key performance metrics during the week of 1-7 February 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 1.9 percent to 57.5 percent. Average daily rate increased 3.5 percent to finish the week at US$113.55. Revenue per available room for the week was up 5.5 percent to finish at US$65.32.

emphasis added

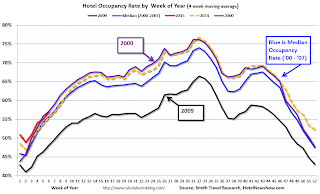

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the slow period of the year, but business travel will pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at about the same level as 2000 (best year for hotels) - and 2015 will probably be the best year ever for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Retail Sales decreased 0.8% in January

by Calculated Risk on 2/12/2015 08:40:00 AM

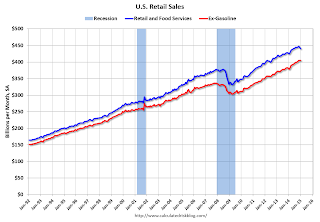

On a monthly basis, retail sales decreased 0.8% from December to January (seasonally adjusted), and sales were up 3.3% from January 2014. Sales in December were unrevised at a 0.9% decrease.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $439.8 billion, a decrease of 0.8 percent from the previous month, but up 3.3 percent above January 2014. ... The November to December 2014 percent change was unrevised from -0.9 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increased slightly.

Retail sales ex-autos decreased 0.9%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 6.9% on a YoY basis (3.3% for all retail sales).

Retail and Food service sales ex-gasoline increased by 6.9% on a YoY basis (3.3% for all retail sales).The decrease in January was below consensus expectations of a 0.5% decrease. Sales for both November and December were revised up slightly.

Although weaker than expected, after removing the impact of lower gasoline prices, this was an OK report.