by Calculated Risk on 2/12/2015 07:14:00 PM

Thursday, February 12, 2015

Report: Foreclosures Increase in January, "Clearing the deck"

Note: Data from other sources suggest most of the loans on these properties were originated almost a decade ago. Still "clearing the deck" after the storm.

From RealtyTrac: U.S. Foreclosure Activity Increases 5 Percent in January Driven By 15-Month High in Bank Repossessions

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for January 2015, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 119,888 U.S. properties in January, an increase of 5 percent from the previous month but still down 4 percent from a year ago.Friday:

The 5 percent monthly increase was driven primarily by a 55 percent monthly jump in bank repossessions (REOs) to a 15-month high. A total of 37,292 U.S. properties were repossessed by lenders in January, up 23 percent from a year ago to the highest monthly total since October 2013.

...

“Due to our ponderous judicial system, most of the options have been exhausted, and the judges are now expediting the process,” said Mike Pappas, CEO and president of the Keyes Company, covering the South Florida market. “The banks recognize the opportunity in this improving market and are aggressively trying to remove these properties from their balance sheets. It is encouraging, after seven years, to see the end near on this dramatic cycle.”

...

“Our agents’ REO and distress business has wound considerably down over the last two years,” said Mark Hughes, Chief Operating Officer at First Team Real Estate, covering the Southern California market. “Despite a bit of an extension to this wind-down process due to delayed actions created by the Homeowner Bill of Rights in 2013, we are preparing that this is really a final push to clear the decks of the a still disproportionate amount of distressed homes and finally bring the market back to a more stability.”

emphasis added

• At 10:00 AM ET, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 98.5, up from 98.1 in January.

Freddie Mac: 30 Year Mortgage Rates increase to 3.69% in Latest Weekly Survey

by Calculated Risk on 2/12/2015 02:10:00 PM

From Freddie Mac today: Mortgage Rates Move Higher on Strong Jobs Report

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher amid a strong employment report. Regardless, fixed-rate mortgages rates still remain near their May 23, 2013 lows. ...

30-year fixed-rate mortgage (FRM) averaged 3.69 percent with an average 0.6 point for the week ending February 12, 2015, up from last week when it averaged 3.59 percent. A year ago at this time, the 30-year FRM averaged 4.28 percent.

15-year FRM this week averaged 2.99 percent with an average 0.6 point, up from last week when it averaged 2.92 percent. A year ago at this time, the 15-year FRM averaged 3.33 percent.

Click on graph for larger image.

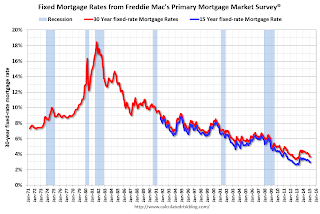

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (34 bps) from the all time low of 3.35% in late 2012, but down from 4.28% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Hotels: Solid Start to 2015

by Calculated Risk on 2/12/2015 11:12:00 AM

From HotelNewsNow.com: US hotel results for week ending 7 February

The U.S. hotel industry recorded positive results in the three key performance metrics during the week of 1-7 February 2015, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 1.9 percent to 57.5 percent. Average daily rate increased 3.5 percent to finish the week at US$113.55. Revenue per available room for the week was up 5.5 percent to finish at US$65.32.

emphasis added

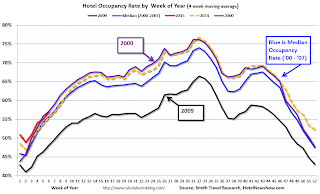

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the slow period of the year, but business travel will pick up soon.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and solidly above 2014.

So far 2015 is at about the same level as 2000 (best year for hotels) - and 2015 will probably be the best year ever for hotels.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Retail Sales decreased 0.8% in January

by Calculated Risk on 2/12/2015 08:40:00 AM

On a monthly basis, retail sales decreased 0.8% from December to January (seasonally adjusted), and sales were up 3.3% from January 2014. Sales in December were unrevised at a 0.9% decrease.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $439.8 billion, a decrease of 0.8 percent from the previous month, but up 3.3 percent above January 2014. ... The November to December 2014 percent change was unrevised from -0.9 percent.

Click on graph for larger image.

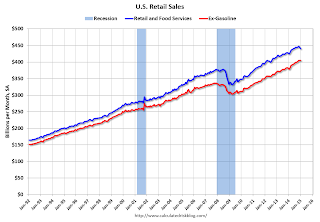

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increased slightly.

Retail sales ex-autos decreased 0.9%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 6.9% on a YoY basis (3.3% for all retail sales).

Retail and Food service sales ex-gasoline increased by 6.9% on a YoY basis (3.3% for all retail sales).The decrease in January was below consensus expectations of a 0.5% decrease. Sales for both November and December were revised up slightly.

Although weaker than expected, after removing the impact of lower gasoline prices, this was an OK report.

Weekly Initial Unemployment Claims increased to 304,000

by Calculated Risk on 2/12/2015 08:30:00 AM

The DOL reported:

In the week ending February 7, the advance figure for seasonally adjusted initial claims was 304,000, an increase of 25,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 278,000 to 279,000. The 4-week moving average was 289,750, a decrease of 3,250 from the previous week's revised average. The previous week's average was revised up by 250 from 292,750 to 293,000.The previous week was revised up to 279,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 289,750.

This was above the consensus forecast of 285,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, February 11, 2015

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 2/11/2015 06:55:00 PM

From Reuters: Euro zone, Greece fail to agree way forward following meeting

We explored a number of issues, one of which was the current program," Jeroen Dijsselbloem, who chaired the meeting, told a news conference in the early hours on Thursday in Brussels.Quote of the day:

"We discussed the possibility of an extension. For some that is clear that is preferred option but we haven't come to that conclusion as yet. We will need a little more time."

“We are not negotiating the bailout; it was cancelled by its own failure.” Greek Prime Minister Alexis TsiprasEarlier I posted some of the details of the failed agreement: Did Austerity in Greece Deliver?

Greece delivered on a primary surplus, but the details on unemployment and GDP show the "program" was the wrong policy. Time to change the policy!

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 278 thousand.

• Also at 8:30 AM, Retail sales for January will be released. The consensus is for retail sales to decrease 0.5% in January, and to decrease 0.5% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for December. The consensus is for a 0.2% increase in inventories.

CNBC: EU and Greece Reach "Agreement in Principle"

by Calculated Risk on 2/11/2015 04:54:00 PM

From CNBC: EU, Greece come to agreement in principle, meetings to continue: Source

Greece has reached an agreement, in principle, with the European Union to stay in an EU bailout program, a source familiar with the matter told CNBC Wednesday.No details.

EIA: Record Oil Inventories, Gasoline Prices expected to average $2.33/gal in 2015

by Calculated Risk on 2/11/2015 01:30:00 PM

Oil prices are down today, with Brent at $55.05 per barrel, and WTI at $49.47. Note: There is less investment now, but current wells are still pumping.

Here is an excerpt from the Weekly Petroleum Status Report

U.S. crude oil refinery inputs averaged about 15.6 million barrels per day during the week ending February 6, 2015, 20,000 barrels per day more than the previous week’s average. Refineries operated at 90.0% of their operable capacity last week. ...

U.S. crude oil imports averaged 7.3 million barrels per day last week, down by 101,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 7.3 million barrels per day, 3.6% below the same four-week period last year. ...

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.9 million barrels from the previous week. At 417.9 million barrels, U.S. crude oil inventories are at the highest level for this time of year in at least the last 80 years.It is difficult to forecast oil and gasoline prices due to world events - and the response of producers to price changes, but currently the EIA expects gasoline prices to average $2.94/gal in 2015 according to the Short Term Energy Outlook released yesterday:

emphasis added

• EIA forecasts that Brent crude oil prices will average $58/bbl in 2015 and $75/bbl in 2016, with 2015 and 2016 annual average West Texas Intermediate (WTI) prices expected to be $3/bbl and $4/bbl, respectively, below Brent. This price outlook is unchanged from last month's forecast. ...Right now gasoline prices are down to around $2.22 per gallon nationally according to the Gasbuddy.com.

• Driven largely by falling crude oil prices, U.S. weekly regular gasoline retail prices averaged $2.04/gallon (gal) on January 26, the lowest since April 6, 2009, before increasing to $2.19/gal on February 9. EIA expects U.S. regular gasoline retail prices, which averaged $3.36/gal in 2014, to average $2.33/gal in 2015. The average household is now expected to spend about $750 less for gasoline in 2015 compared with last year because of lower prices. The projected regular gasoline retail price increases to an average of $2.73/gal in 2016.

emphasis added

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Opinion: Did Germany Fulfill their Promises? Did Austerity in Greece Deliver?

by Calculated Risk on 2/11/2015 10:35:00 AM

Back in 2010, Greece agreed to a number of austerity measures. In general, Greece met their obligations and is currently running a primary surplus.

Greece was told by the IMF, the Germans, and other that this would turn the Greek economy around. Greece clearly needed some austerity, however many of us argued austerity alone would be a disaster for Greece, and for Europe in general.

Below are the forecasts for Greece (IMF) and the actual results (Eurostat).

Clearly austerity alone failed. Sadly European officials like German Finance minister Wolfgang Schauble have not changed their views and apologized to the Greeks.

Here is an actual quote from Schauble in 2013:

"Nobody in Europe sees this contradiction between fiscal policy consolidation and growth,” Schauble said. “We have a growth-friendly process of consolidation, and we have sustainable growth, however you want to word it.”A "growth friendly process"? "Sustainable growth"? Nonsense.

Obviously there is a contradiction between "fiscal policy consolidation and growth". And not everyone is blind to the obvious - some people in Europe see the obvious contradiction (just look at the data for Europe as a whole and Greece in particular).

It is time to stop blaming Greece (they mostly did what they were told), and start blaming the Germans and others for pushing the wrong policies. And give Greece a little relief.

| Greece: Annual GDP, Forecast and Actual1 | ||

|---|---|---|

| Year | Promised | Actual |

| 2009 | -2 | -4.4 |

| 2010 | -4 | -5.4 |

| 2011 | -2.6 | -8.9 |

| 2012 | 1.1 | -6.6 |

| 2013 | 2.1 | -3.9 |

| 2014 | 2.1 | |

| 2015 | 2.7 | |

| 1IMF Forecasts and Eurostat Actual | ||

| Greece: Annual Unemployment Rate, Forecast and Actual1 | ||

|---|---|---|

| Year | Promised | Actual |

| 2009 | 9.4 | 9.6 |

| 2010 | 11.8 | 12.7 |

| 2011 | 14.6 | 17.9 |

| 2012 | 14.8 | 24.5 |

| 2013 | 14.3 | 27.5 |

| 2014 | 14.1 | 26.82 |

| 2015 | 13.4 | |

| 1IMF Forecasts and Eurostat Actual 22014 is Q1, Q2, Q3 average | ||

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 2/11/2015 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 9.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 6, 2015. ...

The Refinance Index decreased 10 percent from the previous week. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.84 percent, the highest level since January 9, 2015, from 3.79 percent, with points increasing to 0.31 from 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

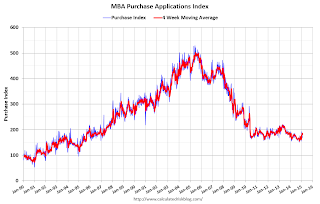

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 1% from a year ago.