by Calculated Risk on 2/02/2015 02:11:00 PM

Monday, February 02, 2015

Q4 2014 GDP Details on Residential and Commercial Real Estate

The BEA has released the underlying details for the Q4 advance GDP report today.

Investment in single family structures is now back to being the top category for residential investment (see first graph). Home improvement was the top category for twenty consecutive quarters following the housing bust ... but now investment in single family structures has been back on top for the last 5 quarters.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

The first graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

Investment in single family structures was $202 billion (SAAR) (over 1.1% of GDP).

Investment in home improvement was at a $178 billion Seasonally Adjusted Annual Rate (SAAR) in Q4 (just over 1.0% of GDP).

Investment in offices is down about 44% from the recent peak (as a percent of GDP) and increasing from a very low level - and is still below the lows for previous recessions (as percent of GDP). With the high office vacancy rate, office investment will only increase slowly.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 59% from the peak. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 63%. With the hotel occupancy rate near record levels, it is likely that hotel investment will probably continue to increase.

These graphs show investment is generally increasing, but from a very low level.

Construction Spending increased 0.4% in December

by Calculated Risk on 2/02/2015 11:07:00 AM

The Census Bureau reported that overall construction spending increased in December:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during December 2014 was estimated at a seasonally adjusted annual rate of $982.1 billion, 0.4 percent above the revised November estimate of $978.6 billion. The December figure is 2.2 percent above the December 2013 estimate of $961.2 billion. ... The value of construction in 2014 was $961.4 billion, 5.6 percent above the $910.8 billion spent in 2013.Both private and public spending increased in December:

Spending on private construction was at a seasonally adjusted annual rate of $698.6 billion, 0.1 percent above the revised November estimate of $698.2 billion. ...Note: Non-residential for offices and hotels is increasing, but spending for oil and gas is generally declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In December, the estimated seasonally adjusted annual rate of public construction spending was $283.5 billion, 1.1 percent above the revised November estimate of $280.4 billion.

emphasis added

As an example, construction spending for lodging is up 18% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 8% year-over-year (and will fall further in the coming months).

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 48% below the peak in early 2006 - but up 53% from the post-bubble low.

Non-residential spending is 16% below the peak in January 2008, and up about 55% from the recent low.

Public construction spending is now 13% below the peak in March 2009 and about 9% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is down 4%. Non-residential spending is up 5% year-over-year. Public spending is up 7% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was below the consensus forecast of a 0.6% increase, however there were some minor upward revisions to spending in October and November.

ISM Manufacturing index declined to 53.5 in January

by Calculated Risk on 2/02/2015 10:00:00 AM

The ISM manufacturing index suggests slower expansion in January than in December. The PMI was at 53.5% in January, down from 55.1% in December. The employment index was at 54.1%, down from 56.0% in December, and the new orders index was at 52.9%, down from 57.8%.

From the Institute for Supply Management: January 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in January for the 20th consecutive month, and the overall economy grew for the 68th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The January PMI® registered 53.5 percent, a decrease of 1.6 percentage points from December’s seasonally adjusted reading of 55.1 percent. The New Orders Index registered 52.9 percent, a decrease of 4.9 percentage points from the seasonally adjusted reading of 57.8 percent in December. The Production Index registered 56.5 percent, 1.2 percentage points below the seasonally adjusted December reading of 57.7 percent. The Employment Index registered 54.1 percent, a decrease of 1.9 percentage points below the seasonally adjusted December reading of 56 percent. Inventories of raw materials registered 51 percent, an increase of 5.5 percentage points above the December reading of 45.5 percent. The Prices Index registered 35 percent, down 3.5 percentage points from the December reading of 38.5 percent, indicating lower raw materials prices in January relative to December. Comments from the panel indicate that most industries, but not all, are experiencing strong demand as 2015 kicks off. The West Coast dock slowdown continues to be a problem, negatively impacting both exports and imports as well as inventories.""

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 54.5%, but still indicates expansion in January.

BEA: Personal Income increased 0.3% in December, Core PCE prices up 1.3% year-over-year

by Calculated Risk on 2/02/2015 08:30:00 AM

The BEA released the Personal Income and Outlays report for December:

Personal income increased $41.3 billion, or 0.3 percent ... in December, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $40.0 billion, or 0.3 percent.A key point is that the PCE price index was only up 0.7% year-over-year (1.3% for core PCE). This is way below the Fed's 2% target.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.1 percent in December, in contrast to an increase of 0.7 percent in November. ... The price index for PCE decreased 0.2 percent in December, the same decrease as in November. The PCE price index, excluding food and energy, increased less than 0.1percent in December; the price index increased less than 0.1 percent in November.

The December price index for PCE increased 0.7 percent from December a year ago. The December PCE price index, excluding food and energy, increased 1.3 percent from December a year ago.

...

Personal saving -- DPI less personal outlays -- was $643.2 billion in December, compared with $568.2 billion in November. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 4.9 percent in December, compared with 4.3 percent in November.

Black Knight Mortgage Monitor

by Calculated Risk on 2/02/2015 07:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for December today. According to BKFS, 5.64% of mortgages were delinquent in December, down from 6.08% in November. BKFS reported that 1.61% of mortgages were in the foreclosure process, down from 2.48% in December 2013.

This gives a total of 7.25% delinquent or in foreclosure. It breaks down as:

• 1,736,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,132,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 820,000 loans in foreclosure process.

For a total of 3,688,000 loans delinquent or in foreclosure in December. This is down from 4,488,000 in December 2013.

There is much more in the mortgage monitor.

Sunday, February 01, 2015

Monday: Personal Income and Outlays, ISM Mfg, Construction Spending

by Calculated Risk on 2/01/2015 08:01:00 PM

Monday:

• At 8:30 AM ET, Personal Income and Outlays for December. The consensus is for a 0.2% increase in personal income, and for a 0.2% decrease in personal spending. And for the Core PCE price index to be unchanged.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for a decrease to 54.5 from 55.5 in December. The ISM manufacturing index indicated expansion in December at 55.5%. The employment index was at 56.8%, and the new orders index was at 57.3%

• At 10:00 AM, Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

Weekend:

• Schedule for Week of February 1, 2015

• Demographics and GDP: 2% is the new 4%

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 24 and DOW futures are down 225 (fair value).

Oil prices were up over the last week with WTI futures at $48.24 per barrel and Brent at $52.99 per barrel. A year ago, WTI was at $99, and Brent was at $109 - so prices are down about 50% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.05 per gallon (down about $1.20 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demographics and GDP: 2% is the new 4%

by Calculated Risk on 2/01/2015 08:11:00 AM

For amusement, I checked out the WSJ opinion page comments on the Q4 GDP report. As usual, the WSJ opinion is pure politics - but it does bring up an excellent point (that the WSJ conveniently ignores).

First, from the WSJ opinion page:

The fourth quarter report means that growth for all of 2014 clocked in at 2.4%, which is the best since 2.5% in 2010. It also means another year, an astonishing ninth in a row, in which the economy did not grow by 3%.This period of low growth isn't "astonishing". First, usually following a recession, there is a brief period of above average growth - but not this time due to the financial crisis and need for households to deleverage. So we didn't see a strong bounce back (sluggish growth was predict on the blog for the first years of the recovery).

And overall, we should have been expecting slower growth this decade due to demographics - even without the housing bubble-bust and financial crisis (that the WSJ opinion page missed).

One simple way to look at the change in GDP is as the change in the labor force, times the change in productivity. If the labor force is growing quickly, GDP will be higher with the same gains in productivity. And the opposite is true.

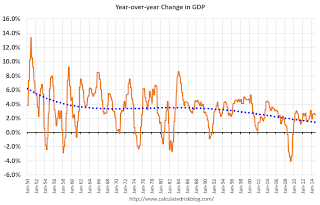

So here is a graph of the year-over-year change in the labor force since 1950 (data from the BLS).

Click on graph for larger image

Click on graph for larger imageThe data is noisy - because of changes in population controls and the business cycle - but the pattern is clear as indicated by the dashed red trend line. The labor force has been growing slowly recently after declining for some time.

We could also look at just the prime working age population - I've pointed out before the that prime working age population has just started growing again after declining for a few years (see Prime Working-Age Population Growing Again)

Now here is a look at GDP for the same period.

The GDP data (year-over-year quarterly) is also noisy, and the dashed blue line shows the trend.

The GDP data (year-over-year quarterly) is also noisy, and the dashed blue line shows the trend. GDP was high in the early 50s - and early-to-mid 60s because of government spending (Korean and Vietnam wars). As in example, in 1951, national defense added added 6.5 percentage points to GDP. Of course we don't want another war ...

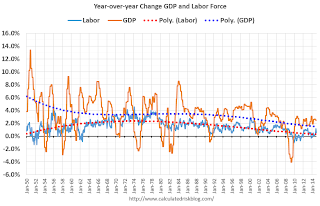

Now lets put the two graphs together.

It isn't a surprise. Other than the early period with a boost from government spending, the growth in GDP has been tracking the growth in the labor force pretty well. The difference in growth between the dashed blue and red lines is due to gains in productivity.

It isn't a surprise. Other than the early period with a boost from government spending, the growth in GDP has been tracking the growth in the labor force pretty well. The difference in growth between the dashed blue and red lines is due to gains in productivity.The good news is that will change going forward (prime working age population will grow faster next decade). The bad news is the political hacks will continue to ignore demographics.

Right now, due to demographics, 2% GDP growth is the new 4%.

Saturday, January 31, 2015

Schedule for Week of February 1, 2015

by Calculated Risk on 1/31/2015 01:11:00 PM

The key report this week is the January employment report on Friday.

Other key reports include the January ISM manufacturing index on Monday, January vehicle sales on Tuesday, the ISM non-manufacturing index on Wednesday, and the December Trade Deficit on Thursday.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.2% increase in personal income, and for a 0.2% decrease in personal spending. And for the Core PCE price index to be unchanged.

10:00 AM: ISM Manufacturing Index for January. The consensus is for a decrease to 54.5 from 55.5 in December.

10:00 AM: ISM Manufacturing Index for January. The consensus is for a decrease to 54.5 from 55.5 in December.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in December at 55.5%. The employment index was at 56.8%, and the new orders index was at 57.3%

10:00 AM: Construction Spending for December. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 16.6 million SAAR in January from 16.8 million in December (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 16.6 million SAAR in January from 16.8 million in December (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 2.0 decrease in December orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in January, down from 241,000 in December.

10:00 AM: ISM non-Manufacturing Index for January. The consensus is for a reading of 56.5, up from 56.2 in December. Note: Above 50 indicates expansion.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 265 thousand.

8:30 AM: Trade Balance report for December from the Census Bureau.

8:30 AM: Trade Balance report for December from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $38.0 billion in December from $39.0 billion in November.

8:30 AM: Employment Report for January. The consensus is for an increase of 230,000 non-farm payroll jobs added in January, down from the 252,000 non-farm payroll jobs added in December.

The consensus is for the unemployment rate to be unchanged at 5.6% in January from 5.6% the previous month.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In December, the year-over-year change was 2.95 million jobs, and that should increase further in January.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

Notes: The annual benchmark revision will be released with the January report. The preliminary estimate was an additional 7,000 jobs as of March 2014.

Also, the new population controls will be used in the Current Population Survey (CPS) estimation process. It is important to note that "household survey data for January 2015 will not be directly comparable with data for December 2014 or earlier periods". Someone better alert Rick Santelli at CNBC!

3:00 PM: Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Unofficial Problem Bank list declines to 388 Institutions

by Calculated Risk on 1/31/2015 08:05:00 AM

UPDATE: The Federal Reserve announced the termination of the enforcement action for Pacific Mercantile Bancorp, Costa Mesa, California; Pacific Mercantile Bank, Costa Mesa, California on Nov 20, 2014. The bank has been removed from the "unofficial list".

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Jan 30, 2015.

Changes and comments from surferdude808:

As expected, the FDIC released an update on its enforcement action activities through December 2014 that contributed to all of the changes to the Unofficial Problem Bank List this week. In all, there were five removals and three additions that leave the list at 388 institutions with assets of $122.5 billion. A year ago, the list held 590 institutions with assets of $195.4 billion. When the weekly was list was first published back on August 7, 2009 it had 389 institutions, so this is the first time a subsequent list held fewer institutions than its inception. There are still 53 institutions from the original list that still remain on it.CR Note: As Surfer Dude noted, the list has come full circle (back to number when we started)!

FDIC terminated actions against Signature Bank of Arkansas, Fayetteville, AR ($492 million); Village Bank, Saint Francis, MN ($176 million); Golden Eagle Community Bank, Woodstock, IL ($136 million); The Wilmington Savings Bank, Wilmington, OH ($127 million); and VistaBank, Aiken, SC ($107 million).

FDIC issued new actions against Seaway Bank and Trust Company, Chicago, IL ($522 million); International Bank, Raton, NM ($292 million); and Sage Bank, Lowell, MA ($208 million).

Next week will likely see fewer changes to the list.

Friday, January 30, 2015

Restaurant Performance Index shows Expansion in December

by Calculated Risk on 1/30/2015 05:47:00 PM

I think restaurants are happy with lower gasoline prices (except, I hear, McDonald's) ...

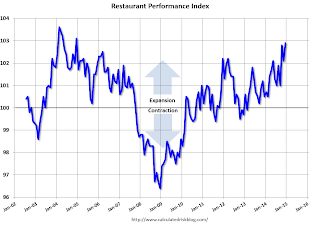

Here is a minor indicator I follow from the National Restaurant Association: Restaurant Performance Index Finished the Year on a Positive Note

Driven by positive sales and traffic and an uptick in capital expenditures, the National Restaurant Association’s Restaurant Performance Index (RPI) finished 2014 with a solid gain. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 102.9 in December, up 0.8 percent from its November level of 102.1. In addition, December marked the 22nd consecutive month in which the RPI stood above 100, which signifies expansion in the index of key industry indicators.

“Growth in the RPI was driven by the current situation indicators in December, with a solid majority of restaurant operators reporting higher same-store sales and customer traffic levels,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, six in 10 operators reported making a capital expenditure during the fourth quarter, with a similar proportion planning for capital spending in the first half of 2015.”

“Overall, the RPI posted three consecutive months above 102 for the first time since the first quarter of 2006, which puts the industry on a positive track heading into 2015,” Riehle added.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index increased to 102.9 in December, down from 102.1 in November. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month. This is a very solid reading - and it is likely restaurants are benefiting from lower gasoline prices.