by Calculated Risk on 12/15/2014 02:20:00 PM

Monday, December 15, 2014

A Comment on Oil Prices

Recently there has been a dramatic decline in oil prices. This has led to some wild and confusing articles. As an example, Barry Ritholtz excerpted from an article that started: "Most observers thought the Organization of Petroleum Exporting Countries (OPEC) would cut its production to protect its members’ incomes and slash frackers’ profits."

That is wrong. If OPEC cut production, that would help the frackers (not hurt them). And most analysts I know didn't except OPEC to cut production.

For example, from Professor Hamilton on Oct 19th: How will Saudi Arabia respond to lower oil prices?

Oil prices (along with prices of many other commodities) have fallen dramatically since last summer. Some observers are waiting to see if Saudi Arabia responds with significant cutbacks in production. I say, don’t hold your breath.So it was no surprise that OPEC didn't cut production.

...

[In October] I discussed the three main factors in the recent fall in oil prices: (1) signs of a return of Libyan production to historical levels, (2) surging production from the U.S., and (3) growing indications of weakness in the world economy.

As far as Libya is concerned, the politics on the ground remain quite unsettled. It makes sense to wait and see if anticipated production gains are really going to hold before anybody makes major adjustments.

In terms of surging U.S. production, the key question is how low the price can get before significant numbers of U.S. producers decide to pull out. If world economic growth indeed slows, and if most of the frackers are willing to keep going strong ... trying to maintain the price ... could be a losing bet for the Saudis. They’d be giving up their own revenue just in order to keep the money flowing into ever-growing operations in Texas and North Dakota.

...

And as for worries of another global economic downturn, so far they are only that– worries. If and when we see a downturn materialize, then I would expect to see the Saudis cut back production.

But until then it’s primarily a question of responding to surging output of U.S. tight oil. My guess is that Saudi Arabia would lower prices rather than cut production as long as that’s the name of the game.

emphasis added

And the speculation that oil producers are trying to hurt Iran, Russia, or terrorists ... that is also incorrect.

The reason prices have fallen sharply is supply and demand. It is important to remember that the short term supply and demand curves for oil are very steep.

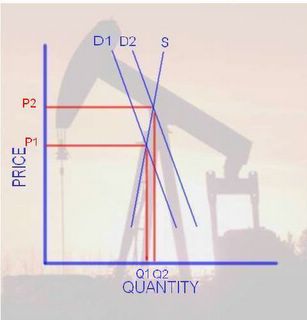

If there is little unused capacity, it takes time for more oil production to become available since this involves huge capital intensive projects. And, in the short term, demand is fairly inelastic over a wide range of prices; for the most part people stay with their routines and keep their same vehicle. With two steep curves (supply and demand) we get the following:

Click on graph for larger image.

Click on graph for larger image.This is a graph I post in 2005. Back in 2005, I pointed out that with a small increase in Demand (from D1 to D2), we would see a small increase in Quantity (Q1 to Q2), but a large change in Price (from P1 to P2). Also a large price increase would also occur if we had a small decrease in supply such as a disruption to production, transport or refining.

And the opposite is also true. A relatively small decrease in demand or increase in supply (fracking) could cause a significant decline in prices. Especially now with OPEC's diminished role (since cutting production helps other producers).

In the long run, supply and demand will adjust to price changes. But if someone asks why prices have fallen so sharply recently, the answer is "supply and demand" and that the short term supply and demand curves are steep for oil.

NAHB: Builder Confidence decreased to 57 in December

by Calculated Risk on 12/15/2014 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 57 in December, down from 58 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Drops One Point in December

Following a four-point uptick last month, builder confidence in the market for newly built single-family homes fell one point in December to a level of 57 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“Members in many markets across the country have seen their businesses improve over the course of the year, and we expect builders to remain confident in 2015,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del.

“After a sluggish start to 2014, the HMI has stabilized in the mid-to-high 50s index level trend for the past six months, which is consistent with our assessment that we are in a slow march back to normal,” said NAHB Chief Economist David Crowe. “As we head into 2015, the housing market should continue to recover at a steady, gradual pace.”

...

Two of the three HMI components posted slight losses in December. The index gauging current sales conditions fell one point to 61, while the index measuring expectations for future sales dropped a single point to 65 and the index gauging traffic of prospective buyers held steady at 45.

Looking at the three-month moving averages for regional HMI scores, the West rose by four points to 62 and the Northeast edged up one point to 45, while the Midwest registered a three-point loss to 54 and the South dropped two points to 60.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 59.

Fed: Industrial Production increased 1.3% in November

by Calculated Risk on 12/15/2014 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 1.3 percent in November after edging up in October; output is now reported to have risen at a faster pace over the period from June through October than previously published. In November, manufacturing output increased 1.1 percent, with widespread gains among industries. The rise in factory output was well above its average monthly pace of 0.3 percent over the previous five months and was its largest gain since February. In November, the output of utilities jumped 5.1 percent, as weather that was colder than usual for the month boosted demand for heating. The index for mining decreased 0.1 percent. At 106.7 percent of its 2007 average, total industrial production in November was 5.2 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.8 percentage point in November to 80.1 percent, a rate equal to its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 13.2 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 80.1% is is at the average from 1972 to 2012 and near the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 1.3% in November to 106.7. This is 27.4% above the recession low, and 5.9% above the pre-recession peak.

This was a strong report - with upward revisions to prior months - and well above expectations.

NY Fed: Empire State Manufacturing Survey indicates "activity declined for New York manufacturers" in December

by Calculated Risk on 12/15/2014 08:36:00 AM

From the NY Fed: Empire State Manufacturing Survey

The December 2014 Empire State Manufacturing Survey indicates that business activity declined for New York manufacturers. The headline general business conditions index dropped fourteen points to -3.6, its first negative reading in nearly two years. The new orders index also fell into negative territory, tumbling eleven points to -2.0, and the shipments index fell to -0.2. Labor market conditions were mixed, with the index for number of employees holding steady at 8.3, while the average workweek index declined to -11.5. ...This is the first of the regional surveys for December. The general business conditions index was well below the consensus forecast of a reading of 12.0, and indicates contraction in December for the first time in two years.

...

Indexes assessing the six-month outlook were generally lower this month, but nevertheless conveyed considerable optimism about future business activity. The index for future general business conditions fell nine points to 38.6—still a fairly high figure by historical standards. emphasis added

Sunday, December 14, 2014

Monday: Industrial Production, NY Fed Mfg Survey, Homebuilder Survey

by Calculated Risk on 12/14/2014 07:27:00 PM

From the WSJ: Fed Likely to Stare Down Oil-Price Drop

Falling oil prices are a boost to the U.S. consumer. But lower prices also are putting downward pressure on already low inflation, potentially moving the nation further away from the Fed’s objective of 2% annual increases in consumer prices.For inflation, the Fed will watch core measures of inflation and inflation expectations - and ignore the decline in headline inflation. As far as the economic strength, the Fed will remain patient.

If Ms. Yellen and her colleagues put more weight on the looming inflation drop, they will hold off on interest-rate increases, which are expected by mid-2015. If they put more weight on underlying economic strength, they will proceed as planned, or even accelerate their move.

The signs so far are that the Fed will proceed as planned.

Monday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of 12.0, up from 10.2 in November (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 79.4%.

• At 10:00 AM, the December NAHB homebuilder survey. The consensus is for a reading of 59, up from 58 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekend:

• Schedule for Week of December 14th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down 3 and DOW futures are down 13 (fair value).

Oil prices were down sharply over the last week with WTI futures at $56.90 per barrel and Brent at $60.69 per barrel. A year ago, WTI was at $97, and Brent was at $112 - so prices are down 41% and 46% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.56 per gallon (down almost 70 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

FOMC Preview: Focus on Press Conference, Probably Remove "Considerable Time", Shorter Statement

by Calculated Risk on 12/14/2014 11:00:00 AM

On Friday I posted FOMC previews from Goldman Sachs, Merrill Lynch and Nomura economists. Here is what I expect on Wednesday:

• The key focus will be on Fed Chair Janet Yellen's press conference and the FOMC projections.

• There will be some wording changes (see below) and the FOMC statement will probably be a little shorter. In October, the word count declined to 707 words, from 895 in September. Last year, in December 2013, the statement had 867 words. Ten years ago, in December 2004, the statement had only 316 words!

• On the projections, I expect GDP to be revised up slightly for 2014 (to around 2.3%), for the unemployment rate to be revised down to 5.8% for Q4, for inflation to be revised down - and for core inflation to be mostly unchanged. The key will be changes to the projections for 2015 and beyond.

• Possible wording changes include:

1) some change to the "considerable time" phrase, possibly emphasizing the FOMC will be patient before raising rates.

2) some concern about less inflation, perhaps changing the word "diminished" in the phrase "the likelihood of inflation running persistently below 2 percent has diminished somewhat since early this year" to "increased recently". Note: Earlier this year, when inflation picked up a little, Yellen said: "The CPI index has been a bit on the high side, but I think the data that we’re seeing is noisy." So the FOMC might remain patient on inflation again - and Fed Chair Yellen will address this in the press conference.

Note: I don't expect any change to this key sentence: "The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run."

For fun: the over/under on the word count is probably around 700 words, and I'll take the under!

Saturday, December 13, 2014

Schedule for Week of December 14th

by Calculated Risk on 12/13/2014 01:11:00 PM

The key economic report this week is November housing starts on Tuesday.

For manufacturing, the November Industrial Production and Capacity Utilization report, and the December NY Fed (Empire State), Philly Fed, and Kansas City Fed surveys, will be released this week.

For prices, CPI will be released on Wednesday.

The FOMC meets on Tuesday and Wednesday.

8:30 AM: NY Fed Empire Manufacturing Survey for December. The consensus is for a reading of 12.0, up from 10.2 in November (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November.This graph shows industrial production since 1967.

The consensus is for a 0.7% increase in Industrial Production, and for Capacity Utilization to increase to 79.4%.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 59, up from 58 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

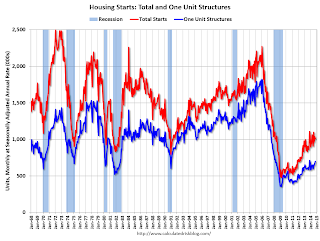

8:30 AM: Housing Starts for November.

8:30 AM: Housing Starts for November. Total housing starts were at 1.009 million (SAAR) in October. Single family starts were at 696 thousand SAAR in October.

The consensus is for total housing starts to increase to 1.038 million (SAAR) in November.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for November. The consensus is for a 0.1% decrease in CPI in October, and for core CPI to increase 0.1%.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to make no change to policy, however the phrase "considerable period" will probably be changed in the statement.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 295 thousand from 294 thousand.

10:00 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 25.0, down from 40.8 last month (above zero indicates expansion).

10:00 AM: Regional and State Employment and Unemployment (Monthly) for November 2014

11:00 AM: the Kansas City Fed manufacturing survey for December.

Unofficial Problem Bank list declines to 406 Institutions

by Calculated Risk on 12/13/2014 08:09:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 12, 2014.

Changes and comments from surferdude808:

As anticipated, there were few changes to the Unofficial Problem Bank List this week. After the removal of one bank, the list count is 406 institutions with assets of $123.9 billion. A year ago, the list held 641 institutions with assets of $219.4 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 406.

The Ohio State Bank, Marion, OH ($85 million) was removed after if found a merger partner. Next week, we anticipate the OCC will provide an update on its enforcement action activities.

Friday, December 12, 2014

Goldman: FOMC Preview

by Calculated Risk on 12/12/2014 07:51:00 PM

Some excerpts from a research note by economists Sven Jari Stehn and David Mericle at Goldman Sachs:

The economic dataflow has been solid since the October FOMC meeting. ... News on inflation, however, has been mixed. On the one hand, actual inflation measures have firmed a bit since October. But, on the other hand, oil prices have continued to decline and market-implied measures of inflation expectations have dropped further.The meeting is next Tuesday and Wednesday.

We expect modest upgrades to Fed officials’ projections and to the description of growth and the labor market in the FOMC statement, while the inflation forecasts are likely to come down a bit. These expectations for the economic projections would suggest that the “dots” remain broadly unchanged.

We expect the FOMC to modify its “considerable time” forward guidance. One possibility would be to state that the committee will be “patient” in raising the funds rate until it is clear that the economy is on the path to achieving the FOMC’s goals. ... Our forecast for updated guidance is a close call, however, as the committee would want to avoid a tightening of financial conditions in light of the mixed inflation news. We would therefore expect the committee to indicate that the change in guidance is not meant to convey an expectation of an earlier liftoff than previously communicated, either in the statement itself or in Chair Yellen’s press conference.

An area of particular interest for the press conference will be any discussion of the post-liftoff guidance, as recent Fed communication has raised the prospect that views might be starting to shift away from the “shallow glide path.” Our forecast remains for the first hike in September 2015, followed by a steeper path of the funds rate than current market pricing.

Hotels: Occupancy Rate Finishing 2014 Strong

by Calculated Risk on 12/12/2014 05:18:00 PM

From HotelNewsNow.com: STR: US results for week ending 6 December

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 30 November through 6 December 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 3.1 percent to 57.1 percent. Average daily rate increased 4.5 percent to finish the week at US$114.73. Revenue per available room for the week was up 7.7 percent to finish at US$65.48.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now in the slow period of the year.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and since mid-June, the occupancy rate has been a little higher than for the same period in 2000.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com