by Calculated Risk on 12/10/2014 07:01:00 AM

Wednesday, December 10, 2014

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 5, 2014. ...

The Refinance Index increased 13 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.11 percent from 4.08 percent, with points remaining unchanged from 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

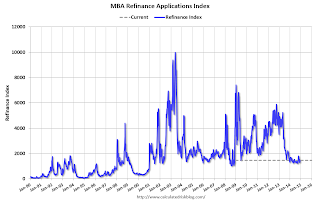

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 72% from the levels in May 2013.

Even with the general decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. As I've noted before - rates would have to decline significantly for there to be a large refinance boom.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 4% from a year ago.

Tuesday, December 09, 2014

Wednesday: Q3 Quarterly Services Report

by Calculated Risk on 12/09/2014 06:44:00 PM

From the WSJ: Drop in Inflation Gauge May Complicate Outlook for Interest Rates

An inflation gauge closely watched by Federal Reserve officials has fallen to the lowest level since the financial crisis, potentially complicating the interest-rate outlook as investors brace for a likely Fed rate increase as soon as mid-2015.With the unemployment rate still elevated, inflation below target, and inflation expectations falling, I expect the Fed will be patient.

The five-year forward five-year inflation breakeven rate hit 2.0185% this month, the lowest since Dec. 31, 2008, according to the latest data provided by Rabobank.

Wednesday:

• At 7:00 AM ET, Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Q3 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for November.

Las Vegas Real Estate in November: YoY Non-contingent Inventory up 20%, Distressed Sales and Cash Buying down YoY

by Calculated Risk on 12/09/2014 03:31:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports local home prices bounce back, while housing sales and supply slip

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in November was 2,483, down from 2,861 in October and down from 2,694 one year ago. At the current pace, [GLVAR President Heidi] Kasama said Southern Nevada has about a four-month supply of available properties. REALTORS® consider a six-month supply to be a balanced market.There are several key trends that we've been following:

...

GLVAR said 31.9 percent of all local properties sold in November were purchased with cash. That’s down from 35.1 percent in October and well short of the February 2013 peak of 59.5 percent, suggesting that fewer investors have been buying homes in Southern Nevada.

...

For roughly two years, GLVAR has reported fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in November, when 9.6 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 10.6 percent in October. Another 8.7 percent of all November sales were bank-owned properties, down from 8.9 percent in October.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in November was 13,421, down 7.0 percent from 14,430 in October and down 5.8 percent from one year ago. GLVAR tracked a total of 3,529 condos and townhomes listed for sale on its MLS in November, down 3.4 percent from 3,653 in October and down 2.6 percent from November 2013.

By the end of November, GLVAR reported 8,195 single-family homes listed without any sort of offer. That’s down 7.7 percent from 8,880 such homes listed in October, but up 20.0 percent from one year ago. For condos and townhomes, the 2,458 properties listed without offers in November represented a 3.5 percent decrease from 2,548 such properties listed in October, but a 12.1 percent increase from one year ago.

emphasis added

1) Overall sales were down 7.8% year-over-year.

2) However conventional (equity, not distressed) sales were up about 5% year-over-year. In November 2013, only 72.0% of all sales were conventional equity. This year, in November 2014, 81.7% were equity sales. Note: In November 2012, only 48.1% were equity!

3) The percent of cash sales has declined year-over-year from 43.7% in November 2013 to 31.9% in November 2014. (investor buying appears to be declining).

4) Non-contingent inventory is up 20.0% year-over-year. The table below shows the year-over-year change for non-contingent inventory in Las Vegas. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It appears the inventory build is slowing (an important change in many areas).

| Las Vegas: Year-over-year Change in Non-contingent Inventory | |

|---|---|

| Month | YoY |

| Jan-13 | -58.3% |

| Feb-13 | -53.4% |

| Mar-13 | -42.1% |

| Apr-13 | -24.1% |

| May-13 | -13.2% |

| Jun-13 | 3.7% |

| Jul-13 | 9.0% |

| Aug-13 | 41.1% |

| Sep-13 | 60.5% |

| Oct-13 | 73.4% |

| Nov-13 | 77.4% |

| Dec-13 | 78.6% |

| Jan-14 | 96.2% |

| Feb-14 | 107.3% |

| Mar-14 | 127.9% |

| Apr-14 | 103.1% |

| May-14 | 100.6% |

| Jun-14 | 86.2% |

| Jul-14 | 55.2% |

| Aug-14 | 38.8% |

| Sep-14 | 29.5% |

| Oct-14 | 25.6% |

| Nov-14 | 20.0% |

Trulia: Asking House Prices up 7.4% year-over-year in November

by Calculated Risk on 12/09/2014 12:41:00 PM

From Trulia chief economist Jed Kolko: Housing’s Millennial Mismatch

Nationwide, asking prices on for-sale homes jumped 1.5% month-over-month in November, seasonally adjusted — a surprisingly large increase. Future months will tell whether this was a blip or the beginning of a sustained climb. Year-over-year, asking prices rose 7.4%, down from the 10.3% year-over-year increase in November 2013. Asking prices rose year-over-year in 98 of the 100 largest U.S. metros — everywhere but Little Rock and New Haven.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and although year-over-year price increases had been slowing, the year-over-year change increased in November.

Four of the 10 metros where asking prices rose most year-over-year were in Florida. These Sunshine State markets have older populations, and they all have a lower share of millennials than the national average of 21% and a higher share of baby boomers than the average of 24%. In fact, only one of the 10 markets with the largest price increases in November has a higher share of millennials than the national average—and only slightly (Las Vegas, at 22%).

Rents continued to climb. Nationwide, rents rose 6.1% year-over-year in November. Still, rent gains have cooled since August in 14 of the 25 largest rental markets, including the Northern California markets of San Francisco, Oakland, and Sacramento.

emphasis added

The month-to-month increase suggests further house price increases over the next few months on a seasonally adjusted basis.

There is much more in the article.

BLS: Jobs Openings at 4.8 million in October, Up 21% Year-over-year

by Calculated Risk on 12/09/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.8 million job openings on the last business day of October, little changed from 4.7 million in September, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits was unchanged at 2.7 million in October, maintaining the prior month’s increase.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for October, the most recent employment report was for November.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in October to 4.834 million from 4.685 million in September.

The number of job openings (yellow) are up 21% year-over-year compared to October 2013.

Quits are up 12% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is a very positive report. It is a good sign that job openings are over 4 million for the ninth consecutive month (almost to 5 million), and that quits are increasing year-over-year.

NFIB: Small Business Optimism Index Increases in November

by Calculated Risk on 12/09/2014 08:15:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Perks Up in December

The NFIB Small Business Optimism Index jumped up 2.0 points to 98.1, just a tick lower than its historical average before the Great Recession. ...And in another positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 12, down from 15 last year - and "taxes" at 23 and "regulations" at 22 are the top problems (taxes are usually reported as the top problem during good times - there always has to be a "top problem"!).

Fifty-seven percent reported outlays, 1 point better than October. The percent of owners planning capital outlays in the next 3 to 6 months fell 1 point to 25, a strong reading ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 98.1 in November from 96.1 in October.

Monday, December 08, 2014

Tuesday: Job Openings, Small Business Optimism

by Calculated Risk on 12/08/2014 06:37:00 PM

From Jon Hilsenrath at the WSJ: Fed Aims to Signal Shift on Low Rates

Federal Reserve officials are seriously considering an important shift in tone at their policy meeting next week: dropping an assurance that short-term interest rates will stay near zero for a “considerable time” as they look more confidently toward rate increases around the middle of next year.The FOMC statement (and press conference) will be released next week, Wednesday, December 17th.

Senior officials have hinted lately that they’re looking at dropping this closely watched interest-rate signal, which many market participants take as a sign rates won’t go up for at least six months.

Tuesday:

• At 7:30 AM ET, NFIB Small Business Optimism Index for November.

• At 10:00 AM, Job Openings and Labor Turnover Survey for October from the BLS. Jobs openings decreased in September to 4.735 million from 4.853 million in August. The number of job openings (yellow) were up 20% year-over-year compared to September 2013, and Quits were up 16% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for October. The consensus is for a 0.2% increase in inventories.

•During the day: Trulia Price Rent Monitors for November. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

FNC: More Long Term Home Owners selling in 2014

by Calculated Risk on 12/08/2014 04:06:00 PM

FNC released an interesting report today: Larger Homes Show Faster Appreciation than Smaller Homes Over the Past Decade

According to FNC, in 2004, about half of existing home sales were homes held 5 years of less. In 2014, only about one-fourth of home sales were held 5 years or less.

And in 2004, just 10% of home sales were held for more than 15 years. In 2014, that has doubled (more long term owners are selling now).

From FNC on the composition of existing home sales:

• A 10-year comparison of ownership duration on existing-home sales reveals a significant decline in the turnovers of homes held for short periods.

• 2004: 11.9% held for 18 months or less & 18.1% between 18-36 months• Rising share of homes held for longer periods:

• 2014: 5.8% held for 18 months or less & 7.6% between 18-36 months

• 2004: 5.7% for 12-15 years & 10.0% above 15 years• Median ownership duration currently stands at eight years, double the number from the pre-2009 periods.

• 2014: 9.6% for 12-15 years & 19.3% above 15 years

Click on graph for larger image.

Click on graph for larger image.This graph from FNC shows existing home sales by duration of ownership for 2004 and 2014.

Fewer flippers - and more long term owners selling.

Phoenix Real Estate in November: Sales down 4%, Cash Sales down Sharply, Inventory up only 3%

by Calculated Risk on 12/08/2014 12:40:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying. These key markets hopefully show us changes in trends for sales and inventory.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in November were down 3.8% year-over-year.

2) Cash Sales (frequently investors) were down about 20% to 28.0% of total sales. Non-cash sales were up 5.0% year-over-year.

3) Active inventory is now up 2.5% year-over-year - and at about the same level as in November 2011 (in 2011 house prices bottomed in Phoenix). Note: This is the smallest year-over-year inventory increase this year, so the inventory build may be slowing.

More inventory (a theme this year) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow ...

According to Case-Shiller, Phoenix house prices bottomed in August 2011 (mostly flat for all of 2011), and then increased 23% in 2012, and another 15% in 2013. Those large increases were probably due to investor buying, low inventory and some bounce back from the steep price declines in 2007 through 2010. Now, with more inventory, price increases have flattened out in 2014.

As an example, the Phoenix Case-Shiller index through September shows prices up less than 1% in 2014, and the Zillow index shows Phoenix prices up 3% over the last year.

| November Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Nov-08 | 4,417 | --- | 1,217 | 27.6% | 56,2271 | --- |

| Nov-09 | 7,494 | 69.7% | 2,572 | 34.3% | 40,372 | -28.2% |

| Nov-10 | 6,789 | -9.4% | 2,966 | 43.7% | 45,353 | 12.3% |

| Nov-11 | 7,147 | 5.3% | 3,245 | 45.4% | 26,798 | -40.9% |

| Nov-12 | 6,810 | -4.7% | 2,945 | 43.2% | 23,232 | -13.3% |

| Nov-13 | 5,181 | -23.9% | 1,761 | 34.0% | 26,762 | 15.2% |

| Nov-14 | 4,986 | -3.8% | 1,396 | 28.0% | 27,426 | 2.5% |

| 1 November 2008 probably includes pending listings | ||||||

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 12/08/2014 10:38:00 AM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• November Employment Report: 321,000 Jobs, 5.8% Unemployment Rate

• Employment Report Comments: Best Year for Employment since the '90s

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 1.8% of the labor force - the lowest since January 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 677 thousand.

The BLS diffusion index for total private employment was at 69.7 in November, up from 63.8 in October.

The BLS diffusion index for total private employment was at 69.7 in November, up from 63.8 in October.For manufacturing, the diffusion index was at 63.0, down from 64.2 in October.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good, close to 70 is great. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in November - another good sign.