by Calculated Risk on 12/05/2014 01:29:00 PM

Friday, December 05, 2014

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

By request, here is an update on an earlier post through the November employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 2 | 4,7171 |

| 122 months into 2nd term: 10,290 pace. | |

1Currently Obama's 2nd term is on pace to be the 2nd best ever - only trailing Clinton's 1st term.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Twenty months into Mr. Obama's second term, there are now 6,715,000 more private sector jobs than when he initially took office.

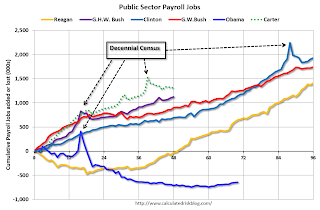

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 646,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 2 | 671 |

| 122 months into 2nd term, 146 pace | |

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is if the public sector layoffs have ended. The cutbacks are clearly over at the state and local levels, and it appears cutbacks at the Federal level have slowed. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Trade Deficit mostly unchanged in October at $43.4 Billion

by Calculated Risk on 12/05/2014 11:43:00 AM

Earlier the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.4 billion in October, down $0.2 billion from $43.6 billion in September, revised. October exports were $197.5 billion, $2.3 billion more than September exports. October imports were $241.0 billion, $2.1 billion more than September imports.The trade deficit was larger than the consensus forecast of $41.5 billion.

The first graph shows the monthly U.S. exports and imports in dollars through October 2014.

Click on graph for larger image.

Click on graph for larger image.Both imports and exports increased in October.

Exports are 19% above the pre-recession peak and up 2% compared to October 2013; imports are 4% above the pre-recession peak, and up about 3% compared to October 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through October.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $88.47 in October, down from $92.54 in September, and down from $99.96 in October 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts, but oil prices will really decline over the next several reports!

The trade deficit with China increased to $32.5 billion in October, from $28.7 billion in October 2013. The deficit with China is a large portion of the overall deficit.

Employment Report Comments: Best Year for Employment since the '90s

by Calculated Risk on 12/05/2014 09:44:00 AM

Earlier: November Employment Report: 321,000 Jobs, 5.8% Unemployment Rate

Last month I posted a possible list of economic words for the year since I started this blog. This included "bubble", "subprime", "bailout" and more. For 2014 I suggested "employment", and for 2015 I'm hoping for "wages". 2014 has definitely been about jobs!

This was a strong employment report with 321,000 jobs added, and job gains for September and October were revised up. This was the tenth consecutive month over 200,000, and an all time record 50th consecutive month of job gains.

As always we shouldn't read too much into one month of data, but at the current pace (through November), the economy will add 2.89 million jobs this year (2.80 million private sector jobs). This is the best year since 1999 (and, for private employment, this might be the best year since 1997).

A few other positives: U-6 declined to 11.4% (an alternative measure for labor underutilization) and was at the lowest level since 2008, the number of part time workers for economic reasons declined (lowest since October 2008), and the number of long term unemployed declined to the lowest level since January 2009.

And there might even be an early hint of wage growth, from the BLS: "Average hourly earnings for all employees on private nonfarm payrolls rose by 9 cents to $24.66 in November. Over the year, average hourly earnings have risen by 2.1 percent. In November, average hourly earnings of private-sector production and nonsupervisory employees increased by 4 cents to $20.74."

With the unemployment rate at 5.8%, there is still little upward pressure on wages. Hopefully wage growth will pick up as the unemployment rate falls over the next couple of years.

A few more numbers:

Total employment increased 321,000 from October to November and is now 1.7 million above the previous peak. Total employment is up 10.4 million from the employment recession low.

Private payroll employment increased 314,000 from October to November, and private employment is now 2.1 million above the previous peak. Private employment is up 10.9 million from the recession low.

Through the first eleven months of 2014, the economy has added 2,650,000 payroll jobs - up from 2,247,000 added during the same period in 2013. My expectation at the beginning of the year was the economy would add between 2.4 and 2.7 million payroll jobs this year - I was a little low!

Year-over-year Change in Employment

In November, the year-over-year change was 2.73 million jobs, and it appears the pace of hiring is increasing.

It seems very likely that 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

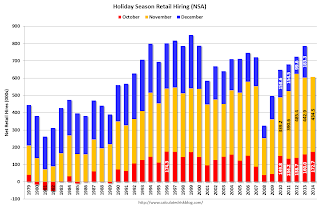

Seasonal Retail Hiring

According to the BLS employment report, retailers hired seasonal workers in November at a solid pace, although slightly lower than in 2012.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

This graph really shows the collapse in retail hiring in 2008. Since then seasonal hiring has increased back close to more normal levels. Note: I expect the long term trend will be down with more and more internet holiday shopping.

This suggests retailers are reasonably optimistic about the holiday season. Note: There is a decent correlation between October seasonal retail hiring and holiday retail sales.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in November at 80.8%, and the 25 to 54 employment population ratio was unchanged at 76.9%. As the recovery continues, I expect the participation rate for this group to increase a little - although the participation rate has been trending down for this group since the late '90s.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 6.9 million, changed little in November.The number of persons working part time for economic reasons decreased in November to 6.850 million from 7.027 million in October. This suggests slack still in the labor market. These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 11.4% in November from 11.5% in October.

This is the lowest level for U-6 since September 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.815 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.916 in October. This is trending down, but is still very high.

This is the lowest level for long term unemployed since January 2009.

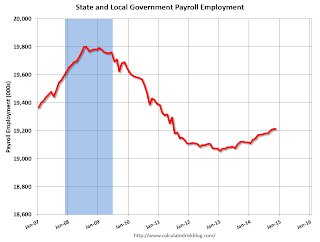

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In November 2014, state and local governments added 2,000 jobs. State and local government employment is now up 157,000 from the bottom, but still 587,000 below the peak.

Clearly state and local employment is now increasing. And Federal government layoffs have slowed (payroll increased by 5 thousand in November), but Federal employment is still down 17,000 for the year.

November Employment Report: 321,000 Jobs, 5.8% Unemployment Rate

by Calculated Risk on 12/05/2014 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 321,000 in November, and the unemployment rate was unchanged at 5.8 percent, the U.S. Bureau of Labor Statistics reported today.

...

The change in total nonfarm payroll employment for September was revised from +256,000 to +271,000, and the change for October was revised from +214,000 to +243,000. With these revisions, employment gains in September and October combined were 44,000 more than previously reported.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes).

Ten consecutive months over 200 thousand.

Employment is now up 2.73 million year-over-year.

Total employment is now 1.7 million above the pre-recession peak.

The second graph shows the employment population ratio and the participation rate.

The second graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate was unchanged in November at 62.8%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio was unchanged at 59.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

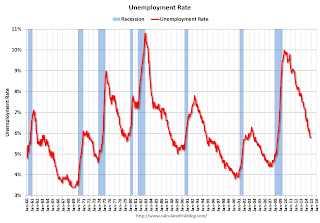

The third graph shows the unemployment rate.

The third graph shows the unemployment rate. The unemployment rate was unchanged in November at 5.8%.

This was well above expectations, and with the upward revisions to prior months, this was a strong report. Party like it's 1999!

I'll have much more later ...

Thursday, December 04, 2014

Friday: Employment, Trade Deficit

by Calculated Risk on 12/04/2014 06:33:00 PM

A few employment previews:

From me: Preview: Employment Report for November (reviewing the numbers for the month)

From Tim Duy on the employment report and the Fed Ahead of the November Employment Report

As I have said before, predicting the monthly nonfarm payroll change is a fool's errand, yet an errand we all undertake. I would pick 235k with an upside risk. More important is what happens to wage growth. I expect that to pick up over the next six months, but would be surprised to see any large gain this month.From Andy Kierz at Business Insider: It Could Take Months Before We Find Out Friday's Jobs Report Was Great

One big factor that could weigh on the jobs number is the recent tendency for revisions to the November payroll numbers to be quite a bit larger than for other months ... Sheperdson points out that "over the past five years, the median revision between the first estimate for November and the third, published two months later, is a hefty 71K. The median for the other 11 months of the year is just +23K."The seasonal factor for November might have been skewed by the huge job losses in 2008 and early 2009, and that might be less of a factor now. But it will take some time to know!

If that trend continues, we could see the November jobs number increase by tens of thousands in the later revisions early next year.

Friday:

• At 8:30 AM ET, the Employment Report for November. The consensus is for an increase of 230,000 non-farm payroll jobs added in November, up from the 214,000 non-farm payroll jobs added in October. The consensus is for the unemployment rate to be unchanged at 5.8% in November.

• Also at 8:30 AM, the Trade Balance report for October from the Census Bureau. The consensus is for the U.S. trade deficit to be at $41.5 billion in October from $43.0 billion in September.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1 decrease in October orders.

• At 3:00 PM, Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $16.3 billion.

Mortgage Rates decline to 3.89%, No Significant Increase in Refinance Activity Expected

by Calculated Risk on 12/04/2014 01:27:00 PM

A few months ago, there was some discussion of a possible "refi boom" due to falling mortgage rates. I argued then that that was unlikely.

Mortgage rates have fallen further, but rates are still far above the level required for a significant increase in refinance activity.

This morning Freddie Mac reported: Mortgage Rates Lower Across the Board

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates down from the previous week. At 3.89 percent, the average 30-year fixed-rate mortgage is at its lowest level since the week of May 30, 2013.

Click on graph for larger image.

This graph shows the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey® compared to the MBA refinance index.

The refinance index dropped sharply last year when mortgage rates increased. Historically refinance activity picks up significantly when mortgage rates fall about 50 bps from a recent level.

Many borrowers who took out mortgages last year can refinance now - but that is a small number of total borrowers. For a significant increase in refinance activity, rates would have to fall below the late 2012 lows (on a monthly basis, 30 year mortgage rates were at 3.35% in the PMMS in November and December 2012.

Based on the relationship between the 30 year mortgage rate and 10-year Treasury yields, the 10-year Treasury yield would probably have to decline to 1.5% or lower for a significant refinance boom (in the near future). With the 10-year yield currently at 2.27%, I don't expect a significant increase in refinance activity any time soon.

Black Knight October Mortgage Monitor: "8% of mortgages, 4 million borrowers in negative equity"

by Calculated Risk on 12/04/2014 09:47:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for October today. According to BKFS, 5.44% of mortgages were delinquent in October, down from 5.67% in September. BKFS reported that 1.69% of mortgages were in the foreclosure process, down from 2.54% in October 2013.

This gives a total of 7.13% delinquent or in foreclosure. It breaks down as:

• 1,658,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,101,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 858,000 loans in foreclosure process.

For a total of 3,617,000 loans delinquent or in foreclosure in October. This is down from 4,427,000 in October 2013.

This table from Black Knight is a comparison of 2005 to 2014 originations by Credit Score and LTV. Black Knight notes:

Borrowers with credit scores of 740 and up make up 55 percent of 2014 refinance originations, compared to just 29 percent in 2005It is not surprising that the recent vintages of mortgage loan are the best performing ever!

On the other hand, in 2005, 21 percent of refinance originations were to credit scores below 640; today that number is just 8 percent

Today’s purchase market is even more clearly separated; 56 percent of purchase originations were to credit scores of 740 and above, while just 2 percent went to borrowers with scores below 640

This graph shows the percent of loans in negative equity grouped by CLTV.

This graph shows the percent of loans in negative equity grouped by CLTV.From Black Knight:

Over the past two and a half years, there has been a sustained and continual improvement in negative equity, from 33.5 percent of borrowers being underwater in January 2012 to less than eight percent todayThe good news is there are few borrowers with CLTV at or above 150%. The bad news is - for most of these borrowers - the only way out is foreclosure (or a short sale).

Only 1.2 percent of active mortgages have current CLTVs of 150 percent or higher, down from 9.5 percent in January of 2012 (the bottom of the market in terms of national home prices)

While the overall share of underwater mortgages continues to decline, delinquency rates are increasing among the remaining negative equity mortgages

For the severely underwater – 150 percent or higher current CLTVs – over three out of every four borrowers (77 percent) are delinquent

There is much more in the mortgage monitor.

Weekly Initial Unemployment Claims decreased to 297,000

by Calculated Risk on 12/04/2014 08:34:00 AM

The DOL reported:

In the week ending November 29, the advance figure for seasonally adjusted initial claims was 297,000, a decrease of 17,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 313,000 to 314,000. The 4-week moving average was 299,000, an increase of 4,750 from the previous week's revised average. The previous week's average was revised up by 250 from 294,000 to 294,250.The previous week was revised up to 314,000

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 299,000.

This was close to the consensus forecast of 300,000, and the level suggests few layoffs.

Wednesday, December 03, 2014

Thursday: Unemployment Claims

by Calculated Risk on 12/03/2014 07:52:00 PM

From the WSJ: Saudi Arabia Sees Oil Prices Stabilizing Around $60 a Barrel

OPEC’s biggest oil producer, Saudi Arabia, now believes oil prices could stabilize at around $60 a barrel, a level both it and other Gulf producers believe they could withstand, according to people familiar with the situation.Another $10 per barrel decline would be good for the economy!

The shift in Saudi thinking suggests the de facto leader of the Organization of the Petroleum Exporting Countries won’t push for supply cuts in the near-term, even if oil prices fall further. Brent crude dropped 62 cents a barrel to $69.92 on Wednesday.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

Preview: Employment Report for November

by Calculated Risk on 12/03/2014 04:00:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for November. The consensus, according to Bloomberg, is for an increase of 230,000 non-farm payroll jobs in November (with a range of estimates between 140,000 and 275,000), and for the unemployment rate to be unchanged at 5.8%.

The BLS reported 214,000 jobs added in October.

Here is a summary of recent data:

• The ADP employment report showed an increase of 208,000 private sector payroll jobs in November. This was below expectations of 226,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing employment index decreased in November to 54.9%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 7,000 in November. The ADP report indicated a 11,000 increase for manufacturing jobs in November.

The ISM non-manufacturing employment index decreased in November to 56.7%. A historical correlation (linear) between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 253,000 in November.

Combined, the ISM indexes suggests employment gains of 260,000. This suggests growth above expectations.

• Initial weekly unemployment claims averaged close to 294,000 in November, up from 287,000 in October. For the BLS reference week (includes the 12th of the month), initial claims were at 292,000; this was up from 284,000 during the reference week in October.

Generally this suggests about the same low level of layoffs in November as in September and October.

• The final November Reuters / University of Michigan consumer sentiment index increased to 88.8 from the October reading of 86.9. This was the highest level in more than seven years. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like sharply lower gasoline prices.

• On small business hiring: The small business index from Intuit showed a 30,000 increase in small business employment in November (up from 15,000 in October):

Small business added 30,000 new people to its base of 20.5 million employees.• Trim Tabs reported:

"Small businesses are not just hiring, they are also paying employees more and asking them to work longer hours. All of these figures are seasonally adjusted, so this is not influenced by just holiday activity," said Susan Woodward, the economist who works with Intuit to create the Small Business Employment and Revenue Indexes.

Hourly employees worked 20 minutes longer in November than they did in October, a sharp rise, and the fraction of hourly workers working full–time rose by 0.2 percent for the month. The hiring rate rose to 5.8 percent for the month, the highest since January 2009.

Compensation per employee, which includes business owners, rose $9 for the month, or 0.34 percent, to $33,305 per year.

TrimTabs Investment Research estimates that the U.S. economy added 306,000 jobs in November, little changed from 314,000 jobs in October.• Conclusion: Below is a table showing several employment indicators and the initial BLS report (the first column is the revised employment). A few key points:

“Hiring kicked into higher gear just in time for the holiday shopping season,” said David Santschi, Chief Executive Officer of TrimTabs. “Job growth in the past two months was the highest since May 2010, when census-related hiring skewed the data.” ... TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding

1) All but one of the revisions this year have been up (average about 22,000).

2) Unfortunately none of the indicators below is very good at predicting the initial BLS employment report.

3) In general it looks like this should be another 200+ month (based on ADP, ISM, unemployment claims, and small business hiring).

There is always some randomness to the employment report. The consensus forecast is pretty strong, but I'll take the over again (above 230,000).

| Employment Indicators (000s) | ||||||

|---|---|---|---|---|---|---|

| BLS Revised | BLS Initial | ADP Initial | ISM | Weekly Claims Reference Week1 | Intuit Small Business | |

| Jan | 144 | 113 | 175 | 236 | 329 | 10 |

| Feb | 222 | 175 | 139 | -6 | 334 | 0 |

| Mar | 203 | 192 | 191 | 153 | 323 | 0 |

| Apr | 304 | 288 | 220 | NA | 320 | 25 |

| May | 229 | 217 | 179 | 130 | 327 | 35 |

| Jun | 267 | 288 | 281 | NA | 314 | 20 |

| Jul | 243 | 209 | 218 | NA | 303 | 15 |

| Aug | 203 | 142 | 204 | 285 | 299 | 0 |

| Sep | 256 | 248 | 213 | NA | 281 | 10 |

| Oct | 214 | 230 | 340 | 284 | 15 | |

| Nov | Friday | 208 | 260 | 282 | 30 | |

| 1Lower is better for Unemployment Claims | ||||||