by Calculated Risk on 12/03/2014 07:52:00 PM

Wednesday, December 03, 2014

Thursday: Unemployment Claims

From the WSJ: Saudi Arabia Sees Oil Prices Stabilizing Around $60 a Barrel

OPEC’s biggest oil producer, Saudi Arabia, now believes oil prices could stabilize at around $60 a barrel, a level both it and other Gulf producers believe they could withstand, according to people familiar with the situation.Another $10 per barrel decline would be good for the economy!

The shift in Saudi thinking suggests the de facto leader of the Organization of the Petroleum Exporting Countries won’t push for supply cuts in the near-term, even if oil prices fall further. Brent crude dropped 62 cents a barrel to $69.92 on Wednesday.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

Preview: Employment Report for November

by Calculated Risk on 12/03/2014 04:00:00 PM

Friday at 8:30 AM ET, the BLS will release the employment report for November. The consensus, according to Bloomberg, is for an increase of 230,000 non-farm payroll jobs in November (with a range of estimates between 140,000 and 275,000), and for the unemployment rate to be unchanged at 5.8%.

The BLS reported 214,000 jobs added in October.

Here is a summary of recent data:

• The ADP employment report showed an increase of 208,000 private sector payroll jobs in November. This was below expectations of 226,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly below expectations.

• The ISM manufacturing employment index decreased in November to 54.9%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 7,000 in November. The ADP report indicated a 11,000 increase for manufacturing jobs in November.

The ISM non-manufacturing employment index decreased in November to 56.7%. A historical correlation (linear) between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 253,000 in November.

Combined, the ISM indexes suggests employment gains of 260,000. This suggests growth above expectations.

• Initial weekly unemployment claims averaged close to 294,000 in November, up from 287,000 in October. For the BLS reference week (includes the 12th of the month), initial claims were at 292,000; this was up from 284,000 during the reference week in October.

Generally this suggests about the same low level of layoffs in November as in September and October.

• The final November Reuters / University of Michigan consumer sentiment index increased to 88.8 from the October reading of 86.9. This was the highest level in more than seven years. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like sharply lower gasoline prices.

• On small business hiring: The small business index from Intuit showed a 30,000 increase in small business employment in November (up from 15,000 in October):

Small business added 30,000 new people to its base of 20.5 million employees.• Trim Tabs reported:

"Small businesses are not just hiring, they are also paying employees more and asking them to work longer hours. All of these figures are seasonally adjusted, so this is not influenced by just holiday activity," said Susan Woodward, the economist who works with Intuit to create the Small Business Employment and Revenue Indexes.

Hourly employees worked 20 minutes longer in November than they did in October, a sharp rise, and the fraction of hourly workers working full–time rose by 0.2 percent for the month. The hiring rate rose to 5.8 percent for the month, the highest since January 2009.

Compensation per employee, which includes business owners, rose $9 for the month, or 0.34 percent, to $33,305 per year.

TrimTabs Investment Research estimates that the U.S. economy added 306,000 jobs in November, little changed from 314,000 jobs in October.• Conclusion: Below is a table showing several employment indicators and the initial BLS report (the first column is the revised employment). A few key points:

“Hiring kicked into higher gear just in time for the holiday shopping season,” said David Santschi, Chief Executive Officer of TrimTabs. “Job growth in the past two months was the highest since May 2010, when census-related hiring skewed the data.” ... TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 141 million U.S. workers subject to withholding

1) All but one of the revisions this year have been up (average about 22,000).

2) Unfortunately none of the indicators below is very good at predicting the initial BLS employment report.

3) In general it looks like this should be another 200+ month (based on ADP, ISM, unemployment claims, and small business hiring).

There is always some randomness to the employment report. The consensus forecast is pretty strong, but I'll take the over again (above 230,000).

| Employment Indicators (000s) | ||||||

|---|---|---|---|---|---|---|

| BLS Revised | BLS Initial | ADP Initial | ISM | Weekly Claims Reference Week1 | Intuit Small Business | |

| Jan | 144 | 113 | 175 | 236 | 329 | 10 |

| Feb | 222 | 175 | 139 | -6 | 334 | 0 |

| Mar | 203 | 192 | 191 | 153 | 323 | 0 |

| Apr | 304 | 288 | 220 | NA | 320 | 25 |

| May | 229 | 217 | 179 | 130 | 327 | 35 |

| Jun | 267 | 288 | 281 | NA | 314 | 20 |

| Jul | 243 | 209 | 218 | NA | 303 | 15 |

| Aug | 203 | 142 | 204 | 285 | 299 | 0 |

| Sep | 256 | 248 | 213 | NA | 281 | 10 |

| Oct | 214 | 230 | 340 | 284 | 15 | |

| Nov | Friday | 208 | 260 | 282 | 30 | |

| 1Lower is better for Unemployment Claims | ||||||

Fed's Beige Book: Economic Activity "continued to expand"

by Calculated Risk on 12/03/2014 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Chicago and based on information collected on or before November 24, 2014."

Reports from the twelve Federal Reserve Districts suggest that national economic activity continued to expand in October and November. A number of Districts also noted that contacts remained optimistic about the outlook for future economic activity. Consumer spending continued to advance in most Districts, and reports on tourism were mostly positive. Employment gains were widespread across Districts, and Districts reporting on business spending generally noted some improvement. Demand for nonfinancial services generally increased. Manufacturing activity strengthened in most Districts. Construction and real estate activity expanded overall, but at a pace that varied by sector and by District.And on real estate:

Construction and real estate activity expanded overall in October and November, but saw a fair amount of variation across sectors and regions. Residential construction increased on balance across the Districts and multifamily construction remained stronger than single-family construction in a number of Districts. Reports on residential real estate activity were mixed. About half of the Districts reported an increase in home sales. Many Districts indicated that sales in the multifamily sector were stronger than sales in the single-family sector. Home prices were little changed in most Districts, although prices increased in the Richmond, Atlanta, Dallas, and San Francisco Districts. Nonresidential construction rose in most Districts. Construction of office space was relatively strong in some large urban areas, such as New York City and Philadelphia. Industrial construction was particularly strong in the Cleveland, Chicago, and Dallas Districts. Commercial real estate activity also increased in many Districts, with declining vacancies and rising rents for office space; especially strong activity was noted in the central business districts of some large urban areas. Vacancies for commercial and industrial space also dropped in several Districts.Residential real estate is "mixed', however nonresidential is picking up. Overall fairly positive.

emphasis added

ISM Non-Manufacturing Index increased to 59.3% in November

by Calculated Risk on 12/03/2014 10:00:00 AM

The November ISM Non-manufacturing index was at 59.3%, up from 57.1% in October. The employment index decreased in November to 56.7%, down from 59.6% in October. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2014 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 58th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 59.3 percent in November, 2.2 percentage points higher than the October reading of 57.1 percent. This represents continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased to 64.4 percent, which is 4.4 percentage points higher than the October reading of 60 percent, reflecting growth for the 64th consecutive month at a faster rate. The New Orders Index registered 61.4 percent, 2.3 percentage points higher than the reading of 59.1 percent registered in October. The Employment Index decreased 2.9 percentage points to 56.7 percent from the October reading of 59.6 percent and indicates growth for the ninth consecutive month. The Prices Index increased 2.3 percentage points from the October reading of 52.1 percent to 54.4 percent, indicating prices increased at a faster rate in November when compared to October. According to the NMI®, 14 non-manufacturing industries reported growth in November. Comments from the majority of respondents indicate that business conditions are on track for continued growth. The respondents have also stated that there is some strain on capacity due to the month-over-month increase in activity."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 57.7% and suggests faster expansion in November than in October. A solid report.

ADP: Private Employment increased 208,000 in November

by Calculated Risk on 12/03/2014 08:15:00 AM

– Private sector employment increased by 208,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 226,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Steady as she goes in the job market. Monthly job gains remain consistently over 200,000. At this pace the unemployment rate will drop by half a percentage point per annum. The tightening in the job market will soon prompt acceleration in wage growth.”

The BLS report for November will be released on Friday.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 12/03/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 28, 2014. This week’s results included an adjustment for the Thanksgiving holiday. ...

The Refinance Index decreased 13 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.08 percent, the lowest level since May 2013, from 4.15 percent, with points increasing to 0.28 from 0.25 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 75% from the levels in May 2013.

Even with a decline in mortgage rates, refinance activity is very low this year and 2014 will be the lowest since year 2000. As I've noted before - rates would have to decline significantly for there to be a large refinance boom.

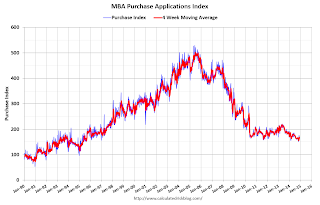

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 4% from a year ago.

Tuesday, December 02, 2014

Wednesday: ISM Non-Mfg Index, ADP Employment, Beige Book

by Calculated Risk on 12/02/2014 07:09:00 PM

Looking ahead to Friday, if net non-farm job growth (November plus revisions) is 222 thousand or more, than 2014 will be the best year for employment since the '90s.

For the private sector, the magic number is 176 thousand to pass 2011 and be the best year since the '90s (seems very likely).

Right now the consensus is for 235 thousand non-farm payroll jobs according to MarketWatch.

Get ready to party like it's 1999!

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

• At 10:00 AM, the ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

U.S. Light Vehicle Sales increase to 17.1 million annual rate in November

by Calculated Risk on 12/02/2014 02:44:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 17.08 million SAAR in November. That is up 5.5% from November 2013, and up 4.5% from the 16.35 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 17.08 million SAAR from WardsAuto).

This was above the consensus forecast of 16.5 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was another strong month for vehicle sales - the second month with 17 million SAAR this year - and the seventh consecutive month with a sales rate over 16 million.

Update: More 2015 Housing Forecasts

by Calculated Risk on 12/02/2014 12:39:00 PM

A few more updates ...

Update 12/5/2014 more from Zillow: 2015: A Big Year for Buyers

Update 12/2/2014 added CoreLogic.

Update 11/26/2014 for Merrill Lynch (minor downward revisions) and Fannie Mae (Noveber update, no changes)

Update 11/24/2014: I've added Metrostudy's forecast.

Update: I've added the MBA and Goldman Sachs forecasts. Also Wells Fargo updated their forecast (slight changes).

Towards the end of each year I collect some housing forecasts for the following year, and it looks like most analysts are optimistic for 2015.

Here is a summary of forecasts for 2014. In 2014, new home sales will be around 440 thousand, and total housing starts will be close to 1 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high).

In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Note: Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays were the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2015.

From Fannie Mae: Housing Forecast: November 2014

From NAHB: Single-Family Production Poised to Take Off in 2015

I don't have Moody's Analytics' forecast, but Mark Zandi, chief economist at Moody's Analytics said today "that single-family starts could be closing in on 1 million units by the end of 2015 and multifamily production could go as high as 500,000 units." That seems too high.

I haven't worked up a forecast yet for 2015.

| Housing Forecasts for 2015 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| Chapman U | 1,056 | 2.4% | ||

| CoreLogic | 498 | 743 | 1,124 | 5.2%5 |

| Fannie Mae | 523 | 783 | 1,170 | 4.9%2 |

| Goldman Sachs | 521 | 1,166 | 3.1% | |

| Merrill Lynch | 530 | 1,175 | 3.7% | |

| Metrostudy | 515 | 730 | 1,100 | 3.9%4 |

| MBA | 503 | 728 | 1,108 | 3.0%2 |

| NAHB | 547 | 802 | 1,158 | |

| NAR | 620 | 1,300 | 4%3 | |

| Wells Fargo | 530 | 770 | 1,160 | 3.3% |

| Zillow | 501 | 1,113 | 2.5%4 | |

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Home price 4Zillow Home Value Index, Oct 2014 to Oct 2015 5CoreLogic HPI | ||||

Construction Spending increased 1.1% in October

by Calculated Risk on 12/02/2014 10:03:00 AM

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2014 was estimated at a seasonally adjusted annual rate of $971.0 billion, 1.1 percent above the revised September estimate of $960.3 billion.Both private and public spending increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $692.4 billion, 0.6 percent above the revised September estimate of $688.0 billion. Residential construction was at a seasonally adjusted annual rate of $353.8 billion in October, 1.3 percent above the revised September estimate of $349.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $338.6 billion in October, 0.1 percent below the revised September estimate of $338.9 billion. ...Note: Non-residential for offices and hotels is increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In October, the estimated seasonally adjusted annual rate of public construction spending was $278.6 billion, 2.3 percent above the revised September estimate of $272.3 billion.

emphasis added

As an example, construction spending for lodging is up 16% year-over-year, whereas spending for power (includes oil and gas) construction is declining since peaking in May.

Click on graph for larger image.

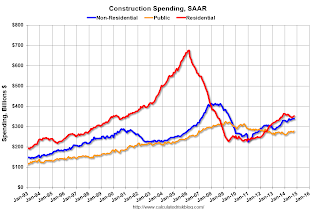

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 48% below the peak in early 2006 - but up 55% from the post-bubble low.

Non-residential spending is 18% below the peak in January 2008, and up about 50% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and about 7% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 2%. Non-residential spending is up 6% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was a strong report - well above the consensus forecast of a 0.5% increase - and there were also upward revisions to spending in August and September.