by Calculated Risk on 11/29/2014 01:21:00 PM

Saturday, November 29, 2014

Schedule for Week of November 30th

The key report this week is the November employment report on Friday.

Other key reports include the November ISM manufacturing index on Monday, November vehicle sales on Tuesday, the November ISM non-manufacturing index on Wednesday, and the October Trade Deficit on Friday.

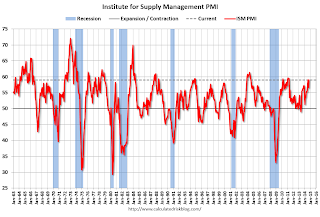

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated solid expansion in October at 59.0%. The employment index was at 55.5%, and the new orders index was at 65.8%.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

8:30 AM: Employment Report for November. The consensus is for an increase of 225,000 non-farm payroll jobs added in November, up from the 214,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to decline to 5.7% in November.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.64 million jobs, and it appears the pace of hiring is increasing. Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.5 billion in October from $43.0 billion in September.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1 decrease in October orders.

3:00 PM: Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $16.3 billion.

Unofficial Problem Bank list declines to 408 Institutions

by Calculated Risk on 11/29/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 28, 2014.

Changes and comments from surferdude808:

This week, the FDIC provided an update on its latest enforcement action activity and updated aggregate figures for their official problem banks. After four additions and seven removals, the Unofficial Problem Bank List holds 408 institutions with assets of $124.7 billion. A year ago, the list held 645 institutions with assets of $221.2 billion. During November, the list count dropped by 14 institutions after four additions, 13 action terminations, four mergers, and one failure. It was the most institutions added in a month since five were added back in October 2013.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now back down to 408. Almost a round trip ...

The FDIC terminated actions against CNLBank, Orlando, FL ($1.3 billion); Chambers Bank, Danville, AR ($773 million); Pine River Valley Bank, Bayfield, CO ($142 million); Hanover Community Bank, Garden City Park, NY ($142 million); Heritage Bank & Trust, Columbia, TN ($102 million); Thayer County Bank, Hebron, NE ($55 million); and Riverland Bank, Jordan, MN ($44 million).

The FDIC issued actions against Noah Bank, Elkins Park, PA ($317 million); Pacific Valley Bank, Salinas, CA ($231 million Ticker: PVBK); Lafayette State Bank, Mayo, FL ($93 million); and Bison State Bank, Bison, KS ($9 million).

The FDIC reported its number of problem banks had fallen for 14 consecutive quarters to 329 institutions with assets of $102 billion. So the difference between the FDIC numbers and the Unofficial number is 79 institutions and $22.7 billion in assets, which is down from a difference of 85 institutions and $30 billion in assets last quarter.

Friday, November 28, 2014

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/28/2014 09:11:00 PM

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change.

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the CoreLogic and NSA Case-Shiller National index since 1987 (both through September). The seasonal pattern was smaller back in the '90s and early '00s, and increased since the bubble burst.

Both indexes were negative seasonally (NSA) in September and will probably stay slightly negative for a few months.

It appears the seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Possible Headline for Next Friday: "Best Year for Employment since the '90s"

by Calculated Risk on 11/28/2014 03:05:00 PM

As of the October BLS report, the economy has added 2.225 million private sector jobs, and 2.285 million total jobs in 2014.

The consensus is the economy will add another 220 thousand jobs in November (215 thousand private sector jobs). If that happens, 2014 will be the best year for private employment since 1999.

Here is a table showing the best years for nonfarm employment growth since 1995. To be the best year since the '90s, the economy needs to add an additional 222 thousand total nonfarm jobs. This could happen in the November report to be released next Friday, December 5th or in the December employment report to be released in early January.

This is happening with only 60 thousand public sector jobs added so far this year. For comparison, there were 186 thousand public sector jobs added in 2005

| Top Years Since 1995 Change in Nonfarm Payrolls per Year (000s) | ||

|---|---|---|

| Year | Total Nonfarm Employment | |

| 1997 | 3,408 | |

| 1999 | 3,177 | |

| 1998 | 3,047 | |

| 1996 | 2,825 | |

| 2005 | 2,506 | |

| 2013 | 2,331 | |

| 20141 | 2,285 | |

| 2012 | 2,236 | |

| 1995 | 2,159 | |

| 1 2014 is through October. | ||

For private employment, to be the best year since the '90s, the economy needs to add an additional 176 thousand private sector jobs (probably happen in the November report).

There is a small chance that 2014 will be the best year since 1998 for private employment. However it would take an additional 491 thousand private sector jobs added in November and December (it would take 505 thousand additional jobs to be the best since 1997). That would be a very strong finish to the year - unlikely, but not impossible.

| Top Years Since 1995 Change in Private Payrolls per Year (000s) | ||

|---|---|---|

| Year | Private Employment | |

| 1997 | 3,213 | |

| 1998 | 2,734 | |

| 1996 | 2,720 | |

| 1999 | 2,716 | |

| 2011 | 2,400 | |

| 2013 | 2,365 | |

| 2005 | 2,320 | |

| 2012 | 2,294 | |

| 20141 | 2,225 | |

| 1995 | 2,081 | |

| 1 2014 is through October. | ||

Right now it seems very likely that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

Hotels: Occupancy Rate Finishing 2014 Strong, Best Year since 2000

by Calculated Risk on 11/28/2014 10:41:00 AM

From HotelNewsNow.com: US hotel results for week ending 22 November

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 16-22 November 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 5.5 percent to 60.7 percent. Average daily rate increased 4.1 percent to finish the week at US$112.52. Revenue per available room for the week was up 9.8 percent to finish at US$68.34.

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Hotels are now heading into the slow period of the year.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and since mid-June, the 4-week average of the occupancy rate has been a little higher than for the same week in 2000.

Right now it looks like 2014 will be the best year since 2000 for hotels. And since it takes some time to plan and build hotels, I expect 2015 will be even better for hotel occupancy.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Thursday, November 27, 2014

Vehicle Sales Forecast: "Strongest November since 2001"

by Calculated Risk on 11/27/2014 08:02:00 PM

The automakers will report November vehicle sales on Tuesday, December 2nd. Sales in October were at 16.35 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales in November might be at or above 17 million SAAR.

Note: There were 25 selling days in November this year compared to 26 last year.

Here are a few forecasts:

From WardsAuto: Forecast: SAAR Could Reach 17 Million for Second Time in Four Months

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 17 million-unit seasonally adjusted annual rate for just the second time since 2006, after crossing that threshold most recently in August, when deliveries equated to a 17.4 million SAAR. The WardsAuto report is calling for 1.29 million light vehicles to be delivered over 25 selling days. The resulting daily sales rate of 51,461 units represents an 8.1% improvement over same-month year-ago (over 26 days) and a 9.1% month-to-month gain on October (27 days), slightly ahead of an average 6% October-November gain over the past three years. The 17 million-unit SAAR would be significantly higher than the 16.3 million recorded year-to-date through October, and would help bring 2014 sales in line with WardsAuto’s full year forecast of 16.4 million units.From J.D. Power: New-Vehicle Retail Sales On Pace for 1.1 Million, the Strongest November Since 2001

New-vehicle retail sales in November 2014 are projected to come in at 1.1 million units, a 5.5 percent increase on a selling-day adjusted basis, compared with November 2013 (November 2014 has one fewer selling day than November 2013).From Kelley Blue Book: New-Vehicle Sales To Rise 2.2 Percent In November On Black Friday Deals, According To Kelley Blue Book

...

“The industry continues to demonstrate strong sales growth, which is exceptional considering that November is currently on pace to record the highest average customer-facing transaction prices ever,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power. [Total forecast 16.5 million SAAR]

In November 2014, new light-vehicle sales, including fleet, are expected to hit 1,270,000 units, up 2.2 percent from November 2013, and down 0.6 percent from October 2014. The seasonally adjusted annual rate (SAAR) for November 2014 is estimated to be 16.8 million, up from 16.2 million in November 2013, and up from 16.3 million in October 2014.From TrueCar: TrueCar Forecasts 17 Million SAAR in November as Early Black Friday Events Prime the Market

TrueCar, Inc. ... forecasts the pace of auto sales in November accelerated to a seasonally adjusted annualized rate ("SAAR") of 17 million new units with the early launch of Black Friday sales campaigns.Another strong month for auto sales, and 2014 should be the best year since 2006.

New light vehicle sales in the U.S. (including fleet) are expected to reach 1,296,700 units for the month, up 4.1 percent from a year ago. On a daily selling rate (DSR) basis, with one less selling day this November, deliveries are expected to rise 8.2 percent. ... Best November since 2001

WTI Crude Oil Falls Below $70

by Calculated Risk on 11/27/2014 12:48:00 PM

From the WSJ: OPEC Leaves Production Target Unchanged

The Organization of the Petroleum Exporting Countries said its 12 members, who collectively pump around one-third of the world’s oil, would comply with its current production ceiling of 30 million barrels a day. That would involve a supply cut of around 300,000 barrels a day based on the cartel’s output in October, according to the group’s own data.

...

The oil producer group’s decision led to a further sharp selloff in major global oil benchmarks, with U.S. markets closed for the Thanksgiving holiday. Brent crude fell about 6% to below $73, a four-year low, while the West Texas Intermediate benchmark was down 3.2% to $71.36 a barrel.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI has fallen over 4% today to $69.40 per barrel, and Brent to $72.97.

Prices are off over 35% from the peak for the year, and if this price decline holds, there should be further declines in gasoline prices over the next couple of weeks. Gasoline futures are down about 10 cents per gallon.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.80 per gallon (down about 45 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Word of the Year

by Calculated Risk on 11/27/2014 11:16:00 AM

Each year since 2003, Merriam-Webster has listed the Words of the Year mostly based on the frequency that each word was looked up that year.

Some years the "words of the year" have been relevant to Calculated Risk, as an example, in 2004 the word of the year was "blog" (CR was started in January 2005 partly because I was wondering what a "blog" was). In 2008, the word of the year was "bailout", and in 2010 the word was "austerity".

For fun, here are a few suggestions for "word of the year" related to the blog since 2004 (I'm sure others will have better suggestions):

2004: Blog (Merriam-Webster)

2005: Bubble. This was the peak year for the housing bubble (activity peaked in 2005, although prices peaked in early 2006). Writing about the housing bubble was the main topic on the blog in 2005.

2006: Bust. This was when the housing bust started.

2007: Subprime or Recession. It was 2007 that "subprime" started to be used by the general public. An alternative would be "recession" since the Great Recession started in December 2007, and a key topic on the blog all year was when the recession would start. Other words could be: delinquency, Alt-A, and NINJA (No income, jobs or asset loans).

2008: Bailout (Merriam-Webster). Three alternatives could be "Financial Crisis", "TARP" and "foreclosure".

2009: Stimulus. An alternative could be "deflation".

2010: Austerity (Merriam-Webster). Unfortunately austerity could be the "word of the year" for several years.

2011: Default. This was the year Congress threatened to default on paying the bills.

2012: Short Sale. This was probably the year that short sales peaked. This was the year house prices bottomed (but I couldn't think of a "word")

2013: Shutdown. In 2013, Congress shut down the government.

2014: Employment. In May 2014, employment surpassed the pre-recession peak, and 2014 will be the best year for employment since the '90s.

2015: Wages (Just being hopeful - maybe 2015 will be the year that real wages start to increase)

Happy Thanksgiving to all!

Wednesday, November 26, 2014

Fannie Mae: Mortgage Serious Delinquency rate declined in October, Lowest since October 2008

by Calculated Risk on 11/26/2014 08:21:00 PM

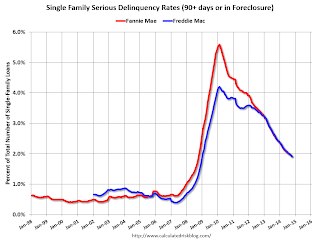

Fannie Mae reported yesterday that the Single-Family Serious Delinquency rate declined in October to 1.92% from 1.96% in September. The serious delinquency rate is down from 2.48% in October 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in October to 1.91% from 1.96% in September. Freddie's rate is down from 2.48% in September 2013, and is at the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.56 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in 2016 - although the rate of decline has slowed recently.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be close to normal in late 2016.

Zillow: Case-Shiller House Price Index year-over-year change expected to slow further in October

by Calculated Risk on 11/26/2014 03:47:00 PM

The Case-Shiller house price indexes for September were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

From Zillow: Oct. 2014 Case-Shiller Prediction: Expect the Slowdown to Continue

The September S&P/Case-Shiller (SPCS) data out [yesterday] showed more slowing in the housing market, with annual growth in the 20-city index falling 0.7 percentage points from August’s pace to 4.9 percent in September. This is the first time annual appreciation for the 20-city index has been below 5 percent since October 2012. The national index was up 4.8 percent on an annual basis in September.So the Case-Shiller index will probably show a lower year-over-year gain in October than in September (4.9% year-over-year for the Composite 20 in September, 4.8% year-over-year for the National Index).

Our current forecast for October SPCS data indicates further slowing, with the annual increase in the 20-City Composite Home Price Index falling to 4.3 percent.

The non-seasonally adjusted (NSA) 20-City index was flat from August to September, and we expect it to decrease 0.4 percent in October. We also expect a monthly decline for the 10-City Composite Index, which is projected to fall 0.4 percent from September to October (NSA).

All forecasts are shown in the table below. These forecasts are based on the September SPCS data release and the October 2014 Zillow Home Value Index (ZHVI), released Nov. 20. Officially, the SPCS Composite Home Price Indices for October will not be released until Tuesday, Dec. 30.

| Zillow October 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | October 2013 | 180.29 | 178.20 | 165.90 | 164.01 |

| Case-Shiller (last month) | September 2014 | 188.68 | 184.84 | 173.72 | 170.19 |

| Zillow Forecast | YoY | 4.2% | 4.2% | 4.3% | 4.3% |

| MoM | -0.4% | 0.2% | -0.4% | 0.2% | |

| Zillow Forecasts1 | 187.9 | 185.4 | 173.0 | 170.8 | |

| Current Post Bubble Low | 146.45 | 149.87 | 134.07 | 137.05 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 28.3% | 23.7% | 29.1% | 24.6% | |

| Bubble Peak | 226.29 | 226.87 | 206.52 | 206.61 | |

| Date of Bubble Peak | Jun-06 | Apr-06 | Jul-06 | Apr-06 | |

| Below Bubble Peak | 17.0% | 18.3% | 16.2% | 17.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||