by Calculated Risk on 11/12/2014 08:04:00 PM

Wednesday, November 12, 2014

Thursday: Job Openings, Unemployment Claims

From Nick Timiraos as the WSJ: Elevated Level of Part-Time Employment: Post-Recession Norm?

The unemployment rate has fallen sharply over the past year, but that improvement is masking a still-bleak picture for millions of workers who say they can’t find full-time jobs.Every month I post a graph of those working part time for economic reasons. Here is the October graph:

...

The situation of these so-called involuntary part-time workers—those who would prefer to work more than 34 hours a week—has economists puzzling over whether a higher level of part-time employment might be a permanent legacy of the great recession. If so, it could force more workers to choose between underemployment or working multiple jobs to make ends meet, leading to less income growth and weaker discretionary spending.

From the BLS report:

From the BLS report:The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was about unchanged in October at 7.0 million.The number of persons working part time for economic reasons decreased in October to 7.027 million from 7.103 million in September.

Although this is still very high, it is important to note that "normal" is probably in the 4 to 5 million range.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 275 thousand from 278 thousand.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for September from the BLS. Note that the recent employment report was for October. Jobs openings increased in August to 4.835 million from 4.605 million in July. The number of job openings (yellow) were up 23% year-over-year. Quits were up 5% year-over-year.

• At 2:00 PM, the Monthly Treasury Budget Statement for October.

Lawler: Beazer Results and Q3 Builder Summary Table

by Calculated Risk on 11/12/2014 04:18:00 PM

From housing economist Tom Lawler: Beazer Homes: Net Orders Down a Bit, Double-Digit Drop in Net Orders/Community; 2014 Unit Sales “Disappointing” Though Home Prices Increased More Than “Expected”

Beazer Homes reported that net home orders in the quarter ended September 30, 2014 totaled 1,173, down 1.3% from the comparable quarter of 2013. Net orders per community last quarter were down about 11% from a year ago. Home deliveries last quarter totaled 1,695, up 2.3% from the comparable quarter of 2013, at an average sales price of $294,500, up 12.2% from a year ago. The company’s order backlog at the end of September was 1,690, down 10.7% from last September. The company owned or controlled 28,127 lots at the end of September, up 0.4% from last September and up 16.5% from two years ago.

Company officials described housing demand as “uneven” in 2014, but on average felt that demand was “disappointing,” and the company sold fewer houses than it had “expected.” Officials also said, however, that its average sales price increased by more than “expected,” but strangely officials did not link the higher prices with lower sales.

For the latest quarter officials described July sales as “so-so,” August sales as “awesome,” and September sales as “not so good.”

For FY 2015 (Beazer’s FY ends on September 30), Beazer expects “mid-teens” growth in its net orders and its community count, and an average sales price “nearing” $320,000. The ASP was $284,800 for FY 2014 and $294,500 for the latest quarter. Officials implied that this surprisingly high ASP expectation would come mainly from regional and product mix. Most analysts were skeptical that the company could achieve that high a sales price AND grow orders at a mid-teens pace.

Here are some summary stats for nine builders reporting results for the quarter ending September 30th.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 09/14 | 09/13 | % Chg | 09/14 | 09/13 | % Chg | 09/14 | 09/13 | % Chg |

| D.R. Horton | 7,135 | 5,160 | 38.3% | 8,612 | 6,866 | 25.4% | $279,099 | 262,453 | 6.3% |

| PulteGroup | 3,779 | 3,781 | -0.1% | 4,646 | 4,817 | -3.5% | $334,000 | 310,000 | 7.7% |

| NVR | 2,936 | 2,381 | 23.3% | 3,236 | 3,342 | -3.2% | $366,200 | 349,200 | 4.9% |

| The Ryland Group | 1,707 | 1,592 | 7.2% | 2,018 | 1,883 | 7.2% | $331,000 | 298,000 | 11.1% |

| Beazer Homes | 1,173 | 1,192 | -1.6% | 1,695 | 1,657 | 2.3% | $295,400 | 263,200 | 12.2% |

| Standard Pacific | 1,154 | 1,110 | 4.0% | 1,250 | 1,217 | 2.7% | $483,000 | 420,000 | 15.0% |

| Meritage Homes | 1,500 | 1,300 | 15.4% | 1,522 | 1,418 | 7.3% | $358,000 | 341,000 | 5.0% |

| MDC Holdings | 1,081 | 924 | 17.0% | 1,093 | 1,257 | -13.0% | $370,600 | 345,000 | 7.4% |

| M/I Homes | 892 | 869 | 2.6% | 985 | 937 | 5.1% | $320,000 | 284,000 | 12.7% |

| Total | 21,357 | 18,309 | 16.6% | 25,057 | 23,394 | 7.1% | $326,373 | $305,805 | 6.7% |

Net orders per community of these nine builders combined were up about 7.4% from a year ago. Acquisitions of other builds probably added about 1.6 percentage points to the YOY growth in net orders for the group. The order backlog for these builders at the end of September totaled 37,643, up 9.5% from last September.

Here is a chart comparing Census’ estimate for new SF home sales with net orders from these nine large builders (indexed: 2010 = 100)

Click on graph for larger image.

Click on graph for larger image.Builders report net orders as gross orders in a quarter less sales cancellations in a quarter. Census defines “home sales” as gross contract signings less contract signings on homes on which a previously signed contract had been cancelled. There also appears to be a timing difference between when a builder recognizes an order and the date of a contract signing in Census’ Survey of Construction.

DataQuick: October Southern California Home Sales Dip To Three-Year Low

by Calculated Risk on 11/12/2014 01:50:00 PM

From DataQuick: Southern California Home Sales Dip To Three-Year Low; Smaller Year-Over-Year Gain for Median Sale Price

Southland homes sold at the slowest pace for the month of October in three years as sales to investors and cash buyers continued to run well below October 2013 levels. ... A total of 19,271 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in October 2014. That was down 0.4 percent from 19,348 sales in September, and down 4.4 percent from 20,150 sales in October 2013, according to CoreLogic DataQuick data.The NAR is scheduled to release existing home sales for October on Thursday, November 20th.

Last month’s sales decline from September was not unusual. On average, Southern California sales have fallen 0.3 percent between September and October since 1988, when CoreLogic DataQuick data begin. ...

"It was another sub-par month for Southern California home sales. We've yet to see traditional buyers fill the void left by the drop-off in investor and cash buyers, which began in spring last year,” said Andrew LePage, data analyst for CoreLogic DataQuick. “Of course, there are multiple reasons for this year's lackluster sales. New-home transactions are still running at about half their normal level. The resale market is hampered by constrained inventory in many areas, in part because some people who want to put their homes up for sale still haven't regained enough equity to purchase their next home. Then there are the would-be buyers who continue to struggle with affordability and mortgage availability, if not uncertainty over their employment or the direction of the housing market."

...

Foreclosure resales represented 4.8 percent of the Southern California resale market in October. That was up insignificantly from 4.7 percent the prior month and down from 6.3 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009. Foreclosure resales are homes foreclosed on in the prior 12 months.

Short sales made up an estimated 5.9 percent of resales last month. That was down from 6.1 percent the prior month and down from 10.8 percent a year earlier. Short sales are transactions where the sale price fell short of what was owed on the property.

emphasis added

EIA Forecast: Gasoline Prices expected to average $2.94/gal in 2015

by Calculated Risk on 11/12/2014 12:32:00 PM

It is difficult to forecast oil and gasoline prices due to world events - and the response of producers to price changes, but currently the EIA expects gasoline prices to average $2.94/gal in 2015 according to the Short Term Energy Outlook released today:

• North Sea Brent crude oil spot prices fell from $95/barrel (bbl) on October 1 to $84/bbl at the end of the month. The causes included weakening outlooks for global economic and oil demand growth, the return to the market of previously disrupted Libyan crude oil production, and continued growth in U.S. tight oil production. Brent crude oil spot prices averaged $87/bbl in October, the first month Brent prices have averaged below $90/bbl since November 2010. EIA projects that Brent crude oil prices will average $83/bbl in 2015, $18/bbl lower than forecast in last month's STEO. There is significant uncertainty over the crude oil price forecast because of the range of potential supply responses from the Organization of the Petroleum Exporting Countries (OPEC), particularly Saudi Arabia, and U.S. tight oil producers to the new lower oil price environment. ...Lower gasoline prices are a positive for the economy. Right now gasoline prices are down to around $2.92 per gallon nationally according to the Gasbuddy.com.

• Driven largely by falling crude oil prices, U.S. weekly regular gasoline retail prices averaged $2.99/gallon (gal) on November 3, the lowest level since December 20, 2010. U.S. regular gasoline retail prices are projected to continue to decline for the remainder of the year to an average of $2.80/gal in December, $0.33/gal lower than in last month's STEO. EIA expects U.S. regular gasoline retail prices, which averaged $3.51/gal in 2013, to average $3.39/gal in 2014 and $2.94/gal in 2015.

emphasis added

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

NFIB: Small Business Optimism Index Increases in October

by Calculated Risk on 11/12/2014 09:38:00 AM

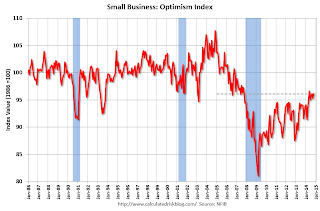

From the National Federation of Independent Business (NFIB): More owners plan to make capital expenditures, expect sales to increase

The NFIB Small Business Optimism Index crept back to its August level of 96.1 with a gain of 0.8 points led by a modest increase in the net percent of owners who plan to increase capital spending and more who expect higher sales in the next 3 months. ...And in another positive sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 12, down from 17 last year - and "taxes" at 21 and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Job creation plans improved a point to a seasonally adjusted net 10 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 96.1 in October from 95.3 in September.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.

MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

by Calculated Risk on 11/12/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 7, 2014. ...

The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.19 percent from 4.17 percent, with points increasing to 0.26 from 0.22 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 71% from the levels in May 2013.

Even with the recent slight small increase in activity - as people who purchased in the last year or so refinance - refinance activity is very low this year and 2014 will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 11% from a year ago.

Tuesday, November 11, 2014

Wednesday: Small Business Optimism

by Calculated Risk on 11/11/2014 06:29:00 PM

From the LA Times: West Coast port slowdown raises fears of dockworker strike or lockout

A six-year agreement covering nearly 20,000 dockworkers at 29 West Coast ports expired July 1. The sides have been negotiating since May. In 2002, amid talks for a previous contract, employers accused the union of go-slow tactics, then locked out dockworkers for 10 days, shutting down ports along the West Coast.Most of the holiday related goods have already arrived, but a shutdown could have a short term impact on the economy.

Some businesses are worried that ports could be shut down again. ... During a shutdown ... some workers — including 20,000 dockworkers — would sit idle and not collect a paycheck.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 7:30 AM, the NFIB Small Business Optimism Index for October.

• At 10:00 AM, the Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.2% increase in inventories.

Lawler on D.R. Horton: Net Orders Jump as Increased Incentives Continued; Expects Big Increase in Unit Sales, Flat Home Prices Next Year

by Calculated Risk on 11/11/2014 01:41:00 PM

From housing economist Tom Lawler: D.R. Horton: Net Orders Jump as Increased Incentives Continued; Expects Big Increase in Unit Sales, Flat Home Prices Next Year

D.R. Horton reported that net home orders in the quarter ended September 30, 2014 totaled 7,135, up 38.3% from the comparable quarter of 2013. Net orders per community were up about 25% from a year ago. ... Home deliveries totaled 8,612 last quarter, up 25.4% from the comparable quarter of 2013, at an average sales price of $279,099, up 6.3% from a year ago. The company’s order backlog at the end of September was 9,888, up 20.5% from last September, at an average order price of $289,118, up 7.3% from a year ago.

On the net order front, orders were up the most in the company’s “East” division (YOY up 93%), which included orders from the housing inventory acquired from Crown Communities and where there are a “disproportionate” number of Express home communities (the relatively new product line for entry-level buyers, as most Express communities are in the Carolinas and Texas).

With respect to the YOY increase in the average price of homes closed last quarter (6.3%), company officials said that the average size of home closed last quarter was up 4% from a year earlier, while the average sales price per square foot was up just a little.

Company officials said that incentives last quarter were little changed from the previous quarter, implying that they were up significantly from a year ago. In order to increase the pace of absorptions, Horton increased significantly its sales incentive starting this spring, to what officials called “more normal long-term levels” from the “much lower than normal” levels of the past few years.

Horton said that at the end of September it owned or controlled 183,500 lots, up 1.4% from a year earlier but up 62.8% from September 2011. From the latter part of 2011 through the first half of 2013 Horton acquired a huge land/lot position, which “positioned” the company well for a housing recovery but which also has “pushed” the company to drive more home sales with more aggressive pricing than most of its competitors.

While a company official characterized overall housing demand as “relatively stable,” the company’s “broad geographic footprint and diversified product offerings across our three brands,” combined with its “sizable inventories of homes and finished lots” and more aggressive pricing, enabled Horton to achieve the highest market share in the company’s history.

For the fiscal year ending September 30, 2014 Horton home closings totaled 28,670 at an average sales price of about $272,200. The company said that in FY 2015 it “expects” home closings to be 34,500 to 37,500 (an increase of 20-30%), at an average sales price that is expected to be “little changed” from FY 2014.

CR Note: Below is a table of annual fiscal year sales (via Lawler). The increase in 2010 was related to the ill-conceived housing tax credit. Note that D.R. Horton increased sales 19% this fiscal year, even though total new home sales were only up a little.

Two key points: Incentives are up significantly (back to "normal" according to Horton) and prices are mostly flat.

| Horton: Homes Closed during Fiscal Year Ending September 30 | ||

|---|---|---|

| Fiscal Year | Sales | YoY % Change |

| 2001 | 21,371 | --- |

| 2002 | 29,761 | 39.3% |

| 2003 | 35,934 | 20.7% |

| 2004 | 43,567 | 21.2% |

| 2005 | 51,172 | 17.5% |

| 2006 | 53,099 | 3.8% |

| 2007 | 41,370 | -22.1% |

| 2008 | 26,396 | -36.2% |

| 2009 | 16,703 | -36.7% |

| 2010 | 20,875 | 25.0% |

| 2011 | 16,695 | -20.0% |

| 2012 | 18,890 | 13.1% |

| 2013 | 24,155 | 27.9% |

| 2014 | 28,670 | 18.7% |

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 11/11/2014 11:12:00 AM

By request, a few more employment graphs that I haven't posted in a few months ...

Here are the previous posts on the employment report:

• October Employment Report: 214,000 Jobs, 5.8% Unemployment Rate

• Comments: Solid Employment Report, Seasonal Retail Hiring at Record Level

• Employment: Party Like It's 1999!

• Update: Prime Working-Age Population Growing Again

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 1.9% of the labor force - the lowest since January 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 663 thousand.

The BLS diffusion index for total private employment was at 62.3 in October, up from 60.4 in September.

The BLS diffusion index for total private employment was at 62.3 in October, up from 60.4 in September.For manufacturing, the diffusion index increased to 58.6, up from 53.1 in September.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in October.

Housing Update: It Appears Inventory build is Slowing in Previous Distressed Markets

by Calculated Risk on 11/11/2014 08:11:00 AM

Note: This is an update to an earlier post.

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And at the beginning of this year I argued house price increases would slow in 2014 because of the increase in inventory.

I don't have a crystal ball, but watching inventory helps understand the housing market. If inventory kept increasing rapidly in certain markets, then we would eventually see price declines. However it now appears the inventory build is slowing in some former distressed markets.

The table below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento. Inventory declined sharply through early 2013, and then inventory started increasing sharply year-over-year. It now appears the inventory build is slowing in these markets - and might even flatten or decline year-over-year soon in Las Vegas and Phoenix.

This makes sense. Prices increased rapidly in these markets in 2012 and 2013 (bouncing off the bottom with low inventory). Higher prices attracted more people to list their homes. But now that prices have flattened out - and there is plenty of inventory - potential sellers aren't as motivated to list their homes. Unlike following the housing bubble, most of these potential sellers probably don't need to sell, so listings will not grow to the moon!

I still expect overall nationwide inventory to continue to increase, but this is something to watch.

| Year-over-year Change in Active Inventory | |||

|---|---|---|---|

| Month | Las Vegas | Phoenix | Sacramento |

| Jan-13 | -58.3% | -11.7% | -61.1% |

| Feb-13 | -53.4% | -8.5% | -51.1% |

| Mar-13 | -42.1% | -5.2% | -37.8% |

| Apr-13 | -24.1% | -4.9% | -10.3% |

| May-13 | -13.2% | -2.1% | 5.3% |

| Jun-13 | 3.7% | -1.6% | 18.3% |

| Jul-13 | 9.0% | -1.6% | 54.3% |

| Aug-13 | 41.1% | 2.4% | 46.8% |

| Sep-13 | 60.5% | 7.8% | 77.3% |

| Oct-13 | 73.4% | 15.7% | 93.2% |

| Nov-13 | 77.4% | 15.2% | 56.8% |

| Dec-13 | 78.6% | 20.9% | 44.2% |

| Jan-14 | 96.2% | 29.6% | 96.3% |

| Feb-14 | 107.3% | 37.7% | 87.8% |

| Mar-14 | 127.9% | 45.5% | 71.2% |

| Apr-14 | 103.1% | 48.8% | 46.3% |

| May-14 | 100.6% | 47.4% | 83.7% |

| Jun-14 | 86.2% | 43.1% | 91.0% |

| Jul-14 | 55.2% | 35.1% | 68.0% |

| Aug-14 | 38.8% | 21.9% | 60.6% |

| Sep-14 | 29.5% | 13.2% | 50.9% |

| Oct-14 | 8.3% | 5.7% | 29.1% |