by Calculated Risk on 11/04/2014 08:43:00 AM

Tuesday, November 04, 2014

Trade Deficit increased in September to $43.0 Billion

Earlier the Department of Commerce reported:

[T]otal September exports of $195.6 billion and imports of $238.6 billion resulted in a goods and services deficit of $43.0 billion, up from $40.0 billion in August, revised. September exports were $3.0 billion less than August exports of $198.6 billion. September imports were $0.1 billion more than August imports of $238.6 billion.The trade deficit was larger than the consensus forecast of $40.7 billion and the trade deficit was revised down slightly for August.

The first graph shows the monthly U.S. exports and imports in dollars through September 2014.

Click on graph for larger image.

Click on graph for larger image.Imports increased slightly and exports decreased in August.

Exports are 18% above the pre-recession peak and up 3% compared to September 2013; imports are 3% above the pre-recession peak, and up about 3% compared to September 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $92.54 in September, down from $96.32 in August, and down from $102.00 in September 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012. Oil prices will really decline in the October and November reports!

The trade deficit with China increased to $35.6 billion in September, from $30.6 billion in September 2013. The deficit with China is almost all of the overall deficit.

Monday, November 03, 2014

Tuesday: Trade Deficit

by Calculated Risk on 11/03/2014 09:00:00 PM

Two weeks ago, Professor James Hamilton wrote: How will Saudi Arabia respond to lower oil prices? (read entire piece!). Hamilton wrote:

it’s primarily a question of responding to surging output of U.S. tight oil. My guess is that Saudi Arabia would lower prices rather than cut production ...And today from the WSJ: Oil Skids as Saudis Adjust Prices

U.S. oil prices tumbled to a fresh two-year low Monday on news that Saudi Arabia cut its selling price for oil to the U.S., suggesting that the kingdom is trying to compete with U.S. shale oil.Bloomberg shows WTI down to $78.24 a barrel, and Brent down to $84.78. So gasoline prices should continue to decline (currently $2.96 per gallon national average).

Tuesday:

• At 8:30 AM ET, the Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to be at $40.7 billion in September from $40.1 billion in August.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is for a 0.7 decrease in September orders.

Fed Survey: Banks "eased standards for construction and land development loans"

by Calculated Risk on 11/03/2014 05:12:00 PM

From the Federal Reserve: The October 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the October survey results indicated that only a modest net fraction of banks eased their standards for commercial and industrial (C&I) loans to firms of all sizes, but generally larger net fractions of banks eased each of the pricing terms listed in the survey and some non-price terms. Banks also reported having eased standards for construction and land development loans, a category of commercial real estate (CRE) loans included in the survey. On the demand side, modest net fractions of banks reported stronger demand for C&I loans to larger firms; similar net fractions experienced stronger demand for all three categories of CRE loans covered in the survey.

...

Regarding loans to households, some large banks reported having eased standards on closed-end mortgage loans, but respondents generally indicated little change in standards and terms for other types of loans to households. Reported changes in loan demand were mixed. Moderate net fractions of banks reported stronger demand for auto loans and weaker demand for nontraditional closed-end mortgage loans. Demand for other types of loans to households was about unchanged at most banks.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph). Multifamily is seeing slightly tighter standards for the second consecutive quarter.

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE.

Banks are seeing a pickup in demand for all categories of CRE.This suggests (along with the Architecture Billing Index) that we will see a further increase in commercial real estate development.

U.S. Light Vehicle Sales unchanged at 16.35 million annual rate in October

by Calculated Risk on 11/03/2014 02:30:00 PM

Based on an WardsAuto estimate, light vehicle sales were at a 16.35 million SAAR in October. That is up 7% from October 2013, and unchanged from the 16.34 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 16.35 million SAAR from WardsAuto).

This was below the consensus forecast of 16.6 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was the sixth consecutive month with a sales rate over 16 million.

Construction Spending decreased 0.4% in September

by Calculated Risk on 11/03/2014 11:29:00 AM

Earlier the Census Bureau reported that overall construction spending decreased in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2014 was estimated at a seasonally adjusted annual rate of $950.9 billion, 0.4 percent below the revised August estimate of $955.2 billion.. The September figure is 2.9 percent (±2.1%) above the September 2013 estimate of $924.2 billion.Both private and public spending decreased in September:

Spending on private construction was at a seasonally adjusted annual rate of $680.0 billion, 0.1 percent below the revised August estimate of $680.8 billion. Residential construction was at a seasonally adjusted annual rate of $349.1 billion in September, 0.4 percent above the revised August estimate of $347.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $331.0 billion in September, 0.6 percent below the revised August estimate of $333.0 billion. ...Note: Non-residential for offices and hotels is increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In September, the estimated seasonally adjusted annual rate of public construction spending was $270.9 billion, 1.3 percent below the revised August estimate of $274.4 billion.

emphasis added

As an example, construction spending for lodging is up 15% year-over-year, whereas spending for power (includes oil and gas) construction is down 11% since peaking in May.

Click on graph for larger image.

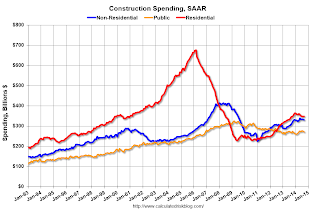

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has declined recently and is 48% below the peak in early 2006 - but up 53% from the post-bubble low.

Non-residential spending is 20% below the peak in January 2008, and up about 47% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and about 4% above the post-recession low.

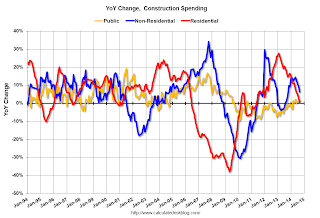

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 1%. Non-residential spending is up 6% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup, and public spending has probably hit bottom after several years of austerity.

This was a weak report - well below the consensus forecast of a 0.6% increase - and there were also downward revisions to spending in July and August.

ISM Manufacturing index increases to 59.0 in October

by Calculated Risk on 11/03/2014 10:04:00 AM

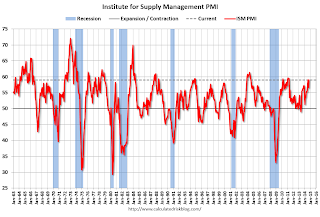

The ISM manufacturing index suggests faster expansion in October than in September. The PMI was at 59.0% in October, up from 56.6% in September. The employment index was at 55.5%, up from 54.6% in September, and the new orders index was at 65.8%, up from 60.0%.

From the Institute for Supply Management: October 2014 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in October for the 17th consecutive month, and the overall economy grew for the 65th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The October PMI® registered 59 percent, an increase of 2.4 percentage points from September’s reading of 56.6 percent, indicating continued expansion in manufacturing. The New Orders Index registered 65.8 percent, an increase of 5.8 percentage points from the 60 percent reading in September, indicating growth in new orders for the 17th consecutive month. The Production Index registered 64.8 percent, 0.2 percentage point above the September reading of 64.6 percent. The Employment Index grew for the 16th consecutive month, registering 55.5 percent, an increase of 0.9 percentage point above the September reading of 54.6 percent. Inventories of raw materials registered 52.5 percent, an increase of 1 percentage point from the September reading of 51.5 percent, indicating growth in inventories for the third consecutive month. Comments from the panel generally cite positive business conditions, with growth in demand and production volumes."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 56.0%, and indicates solid expansion in October.

Black Knight releases Mortgage Monitor for September

by Calculated Risk on 11/03/2014 08:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for September today. According to BKFS, 5.67% of mortgages were delinquent in September, down from 5.90% in August. BKFS reported that 1.76% of mortgages were in the foreclosure process, down from 2.63% in September 2013.

This gives a total of 7.43% delinquent or in foreclosure. It breaks down as:

• 1,760,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,118,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 893,000 loans in foreclosure process.

For a total of 3,711,000 loans delinquent or in foreclosure in September. This is down from 4,593,000 in September 2013.

Click on graph for larger image.

This graph shows the percent of borrowers and the amount of equity. Black Knight notes: "Only 8 percent of borrowers remain “underwater” on their mortgages, down from a level of 33 percent at the end of 2011, and to the lowest point since 2007"

More from Black Knight:

“Before the most recent reductions in the average 30-year mortgage interest rate, approximately six million borrowers met broad-based ‘refinancibility’ criteria,” said Barnes. “These criteria assume loan-to-value ratios of 80 percent or below, good credit, non-delinquent loan status and current interest rates high enough that borrowers have an incentive to refinance. In light of where rates are today, and looking at borrowers with current notes at 4.5 percent and above, that population has now swelled to 7.4 million – almost a 25 percent increase. This is a relatively conservative assessment though, as those with current rates of 4.25 to 4.5 percent could arguably benefit from refinancing as well. That group adds another 1.7 million borrowers to the population.There is much more in the mortgage monitor.

“On a related note, we also examined how the equity situation in America has changed since we last looked. Due in no small part to 28 consecutive months of home price appreciation since 2012, we’ve seen the share of borrowers with negative equity drop down to just below eight percent as of July, down from a level of 33 percent at the end of 2011, and to its lowest point since 2007. An additional 8.5 percent of borrowers are in ‘near-negative equity’ positions, with less than 10 percent equity in their homes. However, more than half of all borrowers have 30 percent or more equity, a level not seen in nearly eight years.”

Sunday, November 02, 2014

Monday: ISM Mfg, Auto Sales, Construction Spending

by Calculated Risk on 11/02/2014 08:30:00 PM

From the SacBee: Sacramento gas prices under $3 per gallon are part of nationwide trend

AAA reported that the average gas price nationally dropped by 33 cents in October, reaching $2.99 on Saturday. That was the first time in four years that the national average dropped below $3.Nice!

Monday:

• Early, Black Knight Mortgage Monitor report for September.

• All day, Light vehicle sales for October. The consensus is for light vehicle sales to increase to 16.6 million SAAR in October from 16.3 million in September (Seasonally Adjusted Annual Rate).

• At 10:00 AM ET, the ISM Manufacturing Index for October. The consensus is for a decrease to 56.0 from 56.6 in September. The ISM manufacturing index indicated expansion in September at 56.6%. The employment index was at 54.6%, and the new orders index was at 60.0%.

• Also at 10:00 AM, Construction Spending for September. The consensus is for a 0.6% increase in construction spending.

Weekend:

• Schedule for Week of November 2nd

• Retail: October Seasonal Hiring vs. Holiday Retail Sales

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down slightly and DOW futures are also down slightly (fair value).

Oil prices were down over the last week with WTI futures at $80.54 per barrel and Brent at $85.86 per barrel. A year ago, WTI was at $96, and Brent was at $107 - so prices are down close to 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.98 per gallon (down almost 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Retail: October Seasonal Hiring vs. Holiday Retail Sales

by Calculated Risk on 11/02/2014 11:17:00 AM

Every year I track seasonal retail hiring for hints about holiday retail sales.

At the bottom of this post is a graph showing the correlation between October seasonal hiring and holiday retail sales.

First, here is the NRF forecast for this year: Optimism Shines as National Retail Federation Forecasts Holiday Sales to Increase 4.1

[T]he National Retail Federation ... expects sales in November and December (excluding autos, gas and restaurant sales) to increase a healthy 4.1 percent to $616.9 billion, higher than 2013’s actual 3.1 percent increase during that same time frame.Note: NRF defines retail sales as including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

According to NRF, retailers are expected to hire between 725,000 and 800,000 seasonal workers this holiday season, potentially more than they actually hired during the 2013 holiday season (768,000). Seasonal employment in 2013 increased 14 percent over the previous holiday season.

Here is a graph of retail hiring for previous years based on the BLS employment report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired about 786 thousand seasonal workers last year (using BLS data, Not Seasonally Adjusted), and 160 thousand seasonal workers last October.

The following scatter graph is for the years 1993 through 2013 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.70 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants. Note: The NRF is just looking at November and December.

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.70 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants. Note: The NRF is just looking at November and December.When the October employment report is released this coming Friday, I'll be looking at seasonal retail hiring for hints if retailers expect a strong holiday season.

Saturday, November 01, 2014

Fannie Mae: Mortgage Serious Delinquency rate declined in September, Lowest since October 2008

by Calculated Risk on 11/01/2014 06:46:00 PM

Fannie Mae reported yesterday that the Single-Family Serious Delinquency rate declined in September to 1.96% from 1.99% in August. The serious delinquency rate is down from 2.55% in September 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in September to 1.96% from 1.98% in August. Freddie's rate is down from 2.58% in September 2013, and is at the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.59 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in 2016 - although the rate of decline has slowed recently.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be close to normal in late 2016.